Openly

Founded Year

2017Stage

Debt | AliveTotal Raised

$430.77MLast Raised

$70M | 5 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+80 points in the past 30 days

About Openly

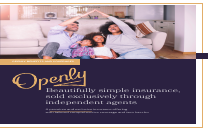

Openly is a home insurance provider focusing on high-value homeowners insurance. The company offers customizable coverage and is sold exclusively through independent agents. Openly uses technology to streamline the quoting process. It was founded in 2017 and is based in Boston, Massachusetts.

Loading...

Openly's Product Videos

ESPs containing Openly

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

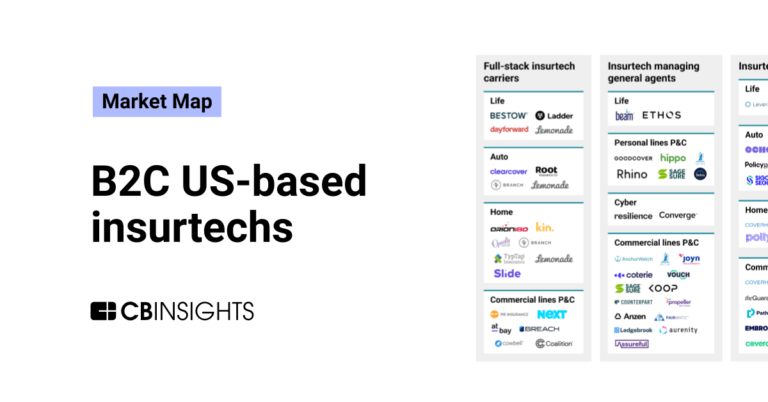

The insurtech managing general agents — personal lines property & casualty market comprises insurtech managing general agents (MGAs) that provide personal lines property & casualty (P&C) insurance. These lines of business may include (but are not limited to) automotive, homeowners, renters, and travel. Also included in this market are insurtech managing general underwriters (MGUs) and other insurt…

Openly named as Highflier among 15 other companies, including Hippo, SageSure, and Honey Insurance.

Openly's Products & Differentiators

Openly Homeowners Insurnace

H05 insurance product

Loading...

Research containing Openly

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Openly in 3 CB Insights research briefs, most recently on May 8, 2025.

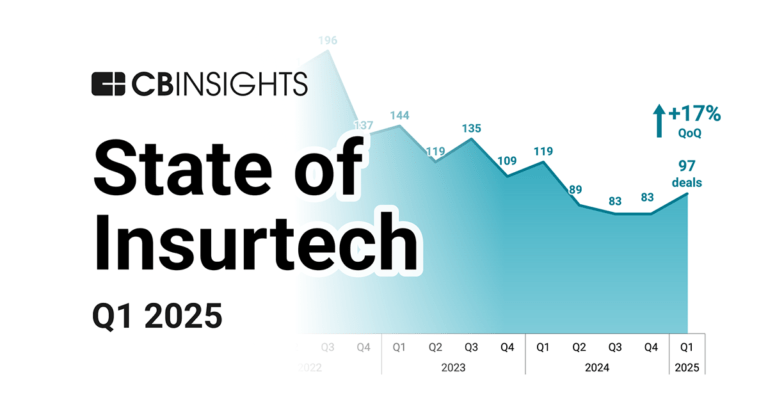

May 8, 2025 report

State of Insurtech Q1’25 Report

Feb 23, 2024

The B2C US insurtech market map

Feb 9, 2024 report

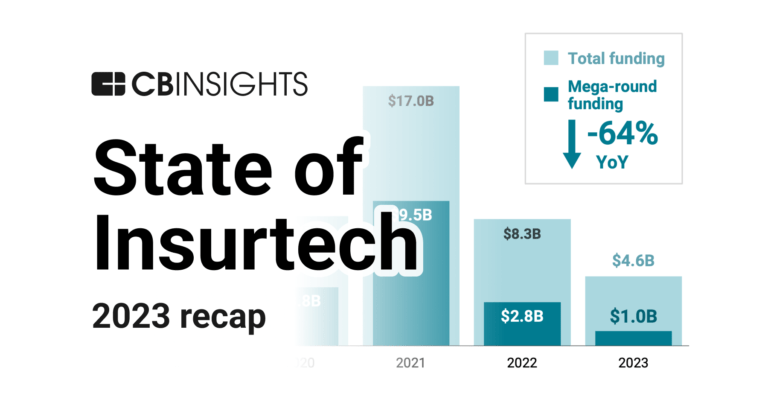

State of Insurtech 2023 ReportExpert Collections containing Openly

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Openly is included in 3 Expert Collections, including Real Estate Tech.

Real Estate Tech

2,494 items

Startups in the space cover the residential and commercial real estate space. Categories include buying, selling and investing in real estate (iBuyers, marketplaces, investment/crowdfunding platforms), and property management, insurance, mortgage, construction, and more.

Insurtech

4,553 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Latest Openly News

Jun 19, 2025

Enjoy complimentary access to top ideas and insights — selected by our editors. The top ten global insurtech equity deals for the first three months of 2025 were valued at more than $5.1 billion, according to publicly-available numbers, and brought in over $812 million for firms across the world. Quantexa, the decision engine provider with offices in the United Kingdom, New York and beyond, closed out its Series F round on March 4 to bring in $175 million or roughly 22% of the funding obtained in the top ten deals. Earlier in the year, firms like Openly and Instabase that are based in the United States closed their funding rounds, each bringing in more than $100 million from investors like Eden Global Partners, the Qatar Investment Authority, Clocktower Technology Ventures and more. The smallest round in the top ten was the South African insurance firm Naked's $37 million Series B funding campaign. View the full list below. Rank

Openly Frequently Asked Questions (FAQ)

When was Openly founded?

Openly was founded in 2017.

Where is Openly's headquarters?

Openly's headquarters is located at 131 Dartmouth Street, Boston.

What is Openly's latest funding round?

Openly's latest funding round is Debt.

How much did Openly raise?

Openly raised a total of $430.77M.

Who are the investors of Openly?

Investors of Openly include Clocktower Technology Ventures, Obvious Ventures, PJC, Advance Venture Partners, Eden Global Partners and 14 more.

Who are Openly's competitors?

Competitors of Openly include Slide Insurance, Sixfold, Kin, Branch, Hippo and 7 more.

What products does Openly offer?

Openly's products include Openly Homeowners Insurnace.

Who are Openly's customers?

Customers of Openly include Iroquois , Goosehead Insurance, Agentero, Reliance Risk and Guaranteed Rate.

Loading...

Compare Openly to Competitors

TypTap is an insurance group that provides homeowners insurance and utilizes technology within the insurance sector. The company offers a quoting platform and pre-underwriting technology. TypTap serves the residential insurance market. It was founded in 2016 and is based in Ocala, Florida.

Branch is an insurance company that provides home and auto insurance. The company offers insurance solutions with options for bundling and coverage types. Branch serves individuals and families seeking insurance policies. It was founded in 2017 and is based in Columbus, Ohio.

Kin provides affordable home insurance solutions within the insurance industry. The company offers a range of products, including homeowners, mobile homes, condos, flood, landlord, and hurricane insurance, all designed to protect customers' properties and interests in the event of disasters or other damages. Kin's insurance products are tailored to meet the needs of homeowners and property investors, offering customizable policies and direct purchasing options to keep costs down. Kin was formerly known as Bright Policy. It was founded in 2016 and is based in Chicago, Illinois.

CSAA Insurance Group provides insurance services within the auto and home insurance sectors. The company offers various insurance products, including policies for automobiles and homes, as well as services such as claims assistance and policy management. CSAA Insurance Group serves individual consumers seeking personal insurance coverage. It was founded in 1914 and is based in Walnut Creek, California.

Next Generation Insurance develops digital insurance distribution platforms within the insurance industry. The company provides services including insurance for college students, distribution solutions for insurance companies, and vendor credential verification services. Next Generation Insurance serves the higher education sector and the insurance industry. It is based in Boston, Massachusetts.

Surround Insurance focuses on providing insurance services in the financial sector. The company offers a range of insurance products, including auto insurance, non-owner auto insurance, renters insurance, and coverage for biking and walking. The company's services are designed to cater to the needs of modern consumers, particularly those in their 20s and 30s, offering fast, simple, and personalized insurance solutions. It was founded in 2018 and is based in Cambridge, Massachusetts.

Loading...