OneCard

Founded Year

2019Stage

Bridge | AliveTotal Raised

$263.52MValuation

$0000Last Raised

$25.5M | 7 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+153 points in the past 30 days

About OneCard

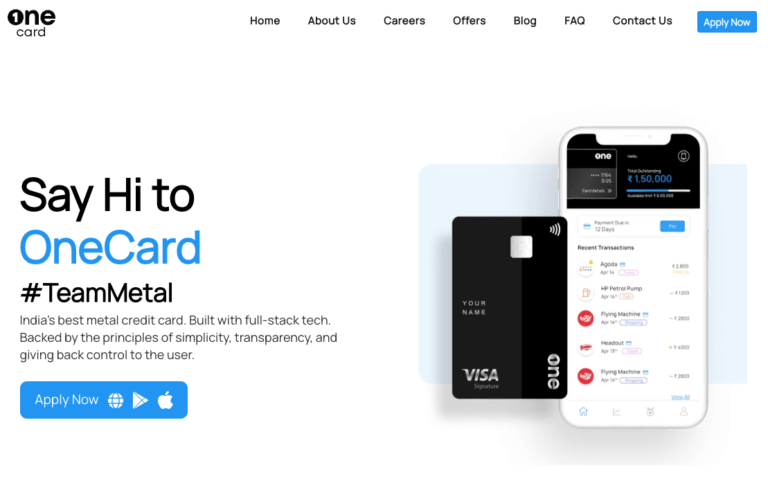

OneCard operates as a financial services company that provides a metal credit card. OneCard serves individuals seeking a credit card with benefits like family sharing limits and flexible equated monthly installment (EMI) options. It was founded in 2019 and is based in Pune, India.

Loading...

Loading...

Research containing OneCard

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned OneCard in 1 CB Insights research brief, most recently on Jul 20, 2022.

Expert Collections containing OneCard

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

OneCard is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Digital Lending

2,464 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,978 items

Excludes US-based companies

Latest OneCard News

May 16, 2025

The Indian fintech ecosystem is evolving fast — and these leaders are at the forefront of change, driving financial inclusion, innovation, and digital-first solutions. From cross-border payments to credit access and digital wealth, these trailblazers are pushing boundaries in their respective niches. Fintech startups have truly reshaped how business is done in underserved markets. By turning these promises into tangible solutions, they’ve opened up a world of opportunities for small and medium enterprises to grow and thrive. 1. Upasana Taku – Co-founder & COO, MobiKwik A true fintech veteran, Upasana Taku has built MobiKwik into one of India’s leading digital financial platforms, offering everything from payments to BNPL and credit. Her focus on financial inclusion continues to drive innovation for underserved users. She has been recognized as the first woman to lead a payments startup, featured in Forbes Asia’s Power Businesswomen list (2019), and ranked 12th in the Kotak Wealth Hurun 2020 list of India’s richest self-made women. 2. Prachi Dharani – Co-founder & CEO, PayGlocal Prachi Dharani is redefining how Indian businesses accept payments from global customers. As co-founder and CEO of PayGlocal, she’s tackling one of fintech’s toughest challenges: making cross-border payments seamless, secure, and locally adaptable. Under her leadership, PayGlocal is helping Indian merchants access international revenue while maintaining trust, reducing fraud, and navigating compliance with ease. The company’s advanced security systems have already prevented fraud attempts worth over INR 1 billion. 3. Nitya Sharma – Co-founder & CEO, Simpl Nitya Sharma has played a crucial role in making credit accessible at checkout for millions of consumers. Simpl’s “pay later” model allows users to transact with trust and ease, removing friction from digital commerce. His expertise in financial services informs their approach to building innovative checkout solutions and enhancing the post-purchase experience for users. 4. Anurag Sinha – Co-founder & CEO, OneCard (FPL Technologies) Anurag Sinha is transforming India’s credit card market with OneCard — a mobile-first, no-fee credit card designed for young, tech-savvy users. The focus on transparency and control is reshaping user expectations around credit. With a strong emphasis on digital onboarding and smart credit management, OneCard is appealing to India’s emerging middle class. Under Anurag’s leadership, the platform has rapidly expanded its footprint while staying focused on user-centric innovation. 5. Akshay Mehrotra – Co-founder & CEO, Fibe (formerly EarlySalary) Akshay Mehrotra is redefining short-term credit access in India through Fibe, a digital lending platform offering instant personal loans and salary advances to underserved, credit-thin consumers. By leveraging AI and alternative data, Fibe enables fast, responsible lending for young professionals and first-time borrowers, making it a key player in India’s financial inclusion journey.

OneCard Frequently Asked Questions (FAQ)

When was OneCard founded?

OneCard was founded in 2019.

Where is OneCard's headquarters?

OneCard's headquarters is located at Phase II, Baner, Taluka Haveli Baner Gaon, Pune.

What is OneCard's latest funding round?

OneCard's latest funding round is Bridge.

How much did OneCard raise?

OneCard raised a total of $263.52M.

Who are the investors of OneCard?

Investors of OneCard include Peak XV Partners, Z47, QED Investors, Better Tomorrow Ventures, Alteria Capital and 10 more.

Who are OneCard's competitors?

Competitors of OneCard include CRED and 7 more.

Loading...

Compare OneCard to Competitors

Slice operates as a financial technology company. The company offers a digital prepaid account for everyday payments, a fast and simple way to make payments via credit or UPI. The company primarily serves the financial services industry. Slice was formerly known as Slice Pay. It was founded in 2016 and is based in Bengaluru, India.

Uni is a fintech company that focuses on redefining the credit card experience within the financial services industry. The company offers credit cards with features such as cashback rewards, zero foreign exchange markup, and a user-friendly mobile application for managing finances. Uni primarily serves the consumer finance sector with its innovative credit card solutions. It was founded in 2020 and is based in Bengaluru, India.

Stashfin is a financial services platform that provides digital lending solutions within the financial sector. The company offers credit lines and personal loans to borrowers, addressing their credit needs through a digital experience. Stashfin serves individuals looking to manage their financial situation and establish their credit history. It was founded in 2016 and is based in Gurgaon, India.

KB NBFC serves as a financial services provider focused on credit solutions for students in India. The company offers a range of products, including financing for online purchases, loans for two-wheelers, and college tuition, as well as cash loans, all tailored to the needs of college students with flexible repayment options. It was founded in 2016 and is based in Bangalore, India.

CRED offers a members-only platform that offers financial and lifestyle progress for creditworthy individuals in the financial services sector. The company provides tools for managing credit cards, improving credit scores, and rewarding financial decisions with exclusive perks and privileges. CRED's services cater to individuals looking for secure financial management and lifestyle benefits. It was founded in 2018 and is based in Bengaluru, India.

PhonePe is a digital payments company that offers a range of financial services across various sectors. The company provides a platform for UPI payments, online payment gateway services, and financial products, including insurance and investment options. PhonePe caters to both businesses and consumers, offering solutions like offline payment services, merchant lending, and an app marketplace, as well as personal loans and digital gold investments. It was founded in 2015 and is based in Bangalore, India. PhonePe operates as a subsidiary of Walmart. It was acquired by Flipkart in 2016.

Loading...