Omada Health

Founded Year

2011Stage

IPO | IPOTotal Raised

$529.67MDate of IPO

6/6/2025About Omada Health

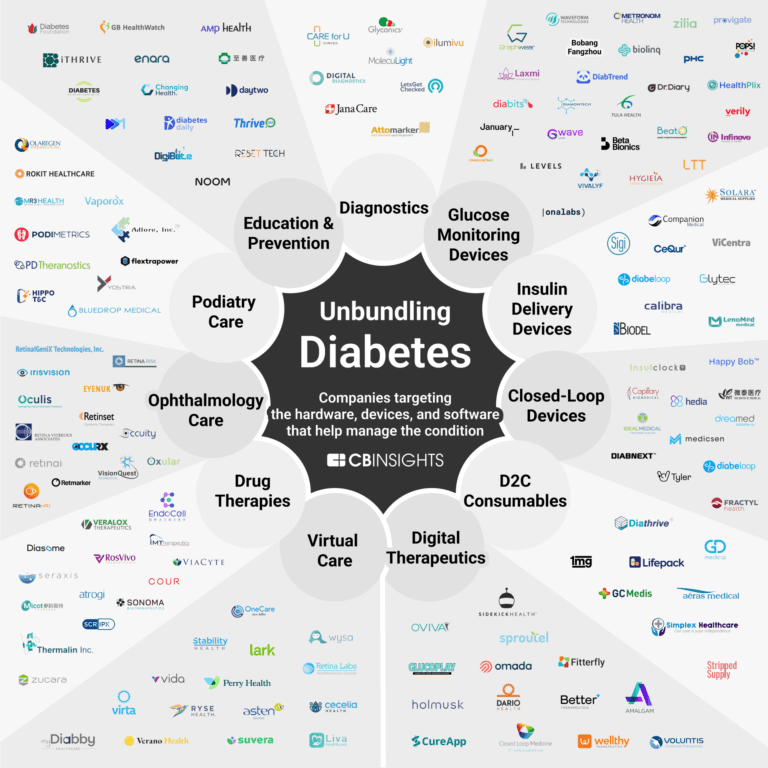

Omada Health is a virtual-first healthcare provider, focuses on chronic condition management. The company offers virtual care programs for prediabetes, diabetes, hypertension, and musculoskeletal health, utilizing health coaching, connected devices, and behavioral science. Omada primarily serves employers, health plans, benefit consultants, and health systems. It was founded in 2011 and is based in San Francisco, California.

Loading...

Omada Health's Product Videos

ESPs containing Omada Health

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The chronic care management platforms market consists of tech-enabled solutions that help healthcare providers manage and coordinate care for patients with chronic conditions. These solutions include patient engagement tools, remote patient monitoring (RPM), care planning, and/or advanced analytics to improve clinical outcomes and reduce costs. Companies in this space leverage AI and other technol…

Omada Health named as Leader among 13 other companies, including Glooko, HealthSnap, and Vironix Health.

Omada Health's Products & Differentiators

Omada for Diabetes

Omada closes gaps in care to help members with diabetes prevention and co-morbidities. Comprehensive care path and team support provided to members by health coaches certified through CDC-affiliated Diabetes Training and Technical Assistance Center (DTTAC), condition-specific peer groups and communities, and virtual physician visits.

Loading...

Research containing Omada Health

Get data-driven expert analysis from the CB Insights Intelligence Unit.

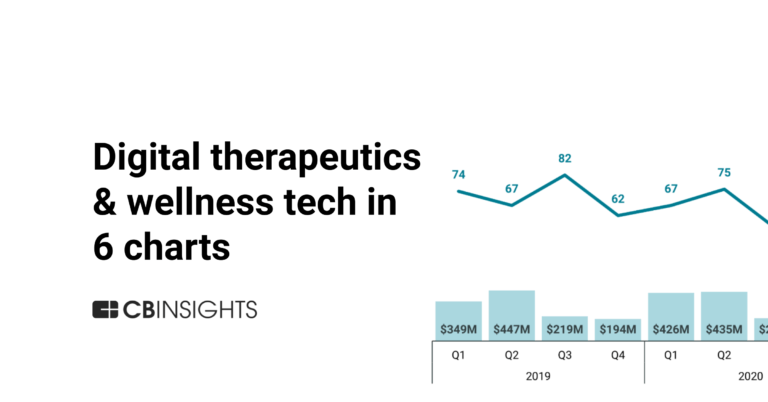

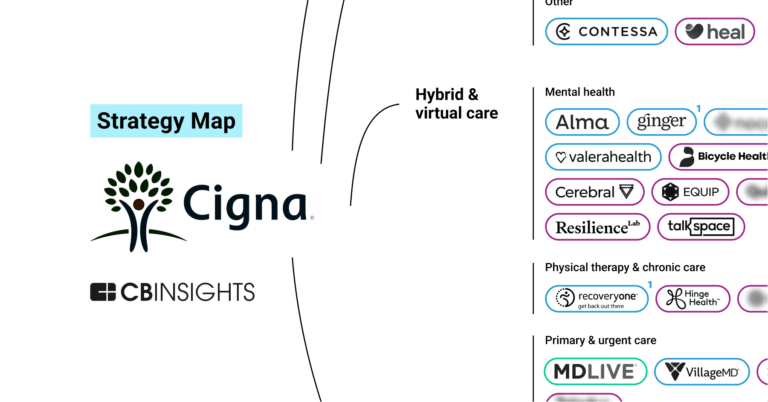

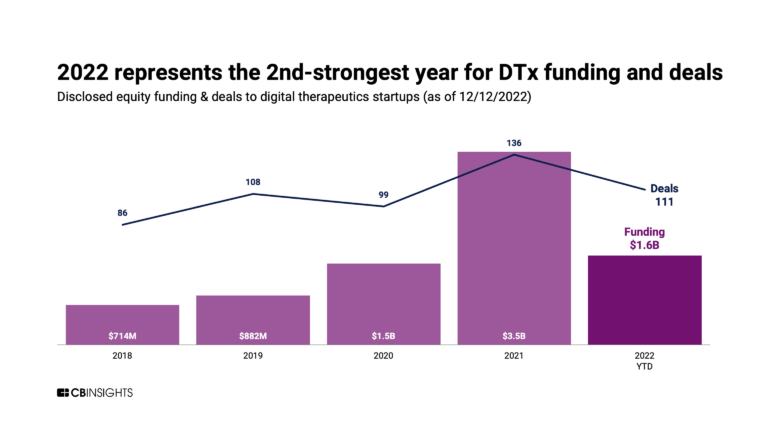

CB Insights Intelligence Analysts have mentioned Omada Health in 9 CB Insights research briefs, most recently on Jun 23, 2023.

Expert Collections containing Omada Health

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Omada Health is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Digital Health 50

300 items

The most promising digital health startups transforming the healthcare industry

Tech IPO Pipeline

282 items

Track and capture company information and workflow.

Future Unicorns 2019

50 items

Digital Health

11,408 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

3,122 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Omada Health Patents

Omada Health has filed 12 patents.

The 3 most popular patent topics include:

- finite automata

- human communication

- models of computation

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/5/2012 | Diabetes, Obesity, Nutrition, Diets, Cytokines | Application |

Application Date | 11/5/2012 |

|---|---|

Grant Date | |

Title | |

Related Topics | Diabetes, Obesity, Nutrition, Diets, Cytokines |

Status | Application |

Latest Omada Health News

Jul 7, 2025

tooling adoption and impact , and IPOs for longstanding digital health darlings. With a steady funding pace mirroring the past couple of years, the digital health sector saw several long-awaited developments signaling market maturity and momentum. But that highlight reel played against an economic and policy backdrop that is anything but steady. This piece explores H1's validating moments—the thawing of the IPO market and the growth of AI-native provider tools capturing investor attention and provider loyalty—as “proof points” of digital health's promise to deliver validated patient-centric , affordable care. We'll also take a dip into the uncharted waters on the health policy horizon . But first, let's take a look at where investors are placing their bets. More than just business as usual By the numbers, H1 2025 saw a modest increase in digital health venture funding compared to the past two years, signaling a steady venture market that's found its footing after the pandemic-driven boom. Investors poured $6.4B into US-based digital health companies across 245 deals in the first half of the year, up from $6.0B in H1 2024 and $6.2B in H1 2023. In Q2 alone, the sector brought in $3.4B in venture funding—up from the average of $2.6B per quarter since Q1 2023. This year saw fewer deals (245) compared to last year's first half (273). If H2 continues at this pace, this year could yield the lowest overall deal count since 2020. Despite fewer deals, average deal size grew ($26.1M compared to $20.4M in 2024), spurred by larger investments in later stage rounds (Series B-D ) as well as the bolstering impact of AI. AI buzz is biz For the first time, AI-enabled startups captured a majority (62%) of digital health venture funding in H1 2025. These companies, on average, raised $34.4M in funding per round—a whopping 83% premium compared to the $18.8M of their non-AI-enabled counterparts. While this premium was partly driven by supersized growth rounds, it was also evident in early stage deals: the average Series A and Series B deal sizes for AI-enabled startups were $24.4M and $54.8M respectively, compared to $15.6M and $39.6M for non-AI-enabled digital health companies. Overall, the top three funded value propositions (VPs) of digital health startups in H1 2025 were: non-clinical workflow ($1.9B), clinical workflow ($1.9B), and data infrastructure ($893M)—all of which are being transformed by AI-enablement and automation . These VPs drew more than half (55%) of overall digital health funding in H1—a first in our data since we began tracking venture funding back in 2011. H1 2025 recorded 11 mega deals (fundraises over $100M), on pace to surpass the 17 mega deals we saw throughout 2024. Nine of the 11 mega deals went to AI-enabled startups—with Abridge, a top competitor in the AI scribe space, announcing two mega rounds in just four months' time. Back-to-back mega deals within even a year's time frame is a feat few companies have achieved since 2021. And we're only in the first half of the year—newly minted unicorn OpenEvidence is rumored to be on the verge of a mega deal after its $75M Series A in February. Let's take a closer look at what's driving this investor confidence. In the flow, not in the way The relationship between clinicians and new technology hasn't always been a smooth ride , which makes the recent surge in adoption of AI tools (particularly ambient documentation and medical reference solutions) so remarkable. Strong outcomes and clear impact for clinicians have driven the rapid adoption of medical ambient documentation tools— faster than any other technology in healthcare history. Today, overall adoption rates hover between and across physician groups, with some leading hospitals reporting spikes as high as 90% among certain specialties. Consider Abridge —the ambient documentation solution is deployed at over 100 U.S. health systems, and continues expanding its list of enterprise partners and its set of use cases and features . Abridge's sustained momentum stems not only from proving value and earning trust, but also from strategic partnerships and clear plans for long-term growth. Abridge became the first “pal” in Epic's Partners and Pals program, enabling native integration into clinical workflows. And expectations for Abridge's continued growth (and skyrocketing valuation) stem from its expansion into additional hospital workflows including revenue cycle management (RCM), billing, and coding. Meanwhile, AI-native medical search tool OpenEvidence has become the fastest platform to surpass 100K clinician users. With trusted brand roots and smart partnerships , they're adding more than 50K doctors monthly. Physicians find OpenEvidence's chatGPT-style query interface intuitive and conversational, and the output fast clear , and clinically relevant Together, OpenEvidence and Abridge show that breakout growth is possible with the right mix of provider trust, intuitive and impactful products, and capital to scale. Ambient documentation and provider workflow tooling are fiercely competitive and increasingly saturated markets. But with most AI deployments stuck in pilot phases (and real-world performance benchmarks still in early innings ), there's still plenty of room for new applications to grow “Currently, only a third of AI pilots successfully scale to full system-wide deployment. To improve those odds, vendors need to earn customer trust, which requires highly secure, accurate, easy-to-use tools. It's also equally important for pilots to demonstrate consistent end-user engagement or an easy-to-measure ROI. Make it a no-brainer for health systems to adopt.” —Sofia Guerra, Vice President, Bessemer Venture Partners Exits and the future of tech-enabled care delivery Seeing venture funding propel growth and impact is exciting. What's also exciting? Exits. Undeniably, the breakout moments of 2025 so far go to tech-enabled care delivery businesses Hinge Health and Omada Health Breaking the recent hiatus in IPOs (just two digital health public exits in the past three years), digital physical therapy platform Hinge Health launched on the NYSE in May, and virtual chronic care provider Omada Health on the Nasdaq in June. These public market debuts have given investors much-needed redemption after an exit drought, tough public market performances , and a string of recent take-privates Just as AI-native tools are delivering on the promise of digital health in provider contexts, tech-enabled services companies are realizing transformed, sustainable care delivery. Omada and Hinge spent the past decade-plus weathering first mover challenges: creating first-of-their-kind evidence bases on clinical and economic outcomes, earning customer trust, and applying data science to optimize care delivery. Not to mention, they launched their tech stacks and care models before today's ecosystem of plug-and-play solutions were available to accelerate time-to-market, making their market resilience and tech evolution particularly impressive. Both are continuously iterating on how to best (and pragmatically) leverage AI—Hinge has shared its push toward automation of care delivery while Omada has used AI to augment coaching workflows for years and recently released its first consumer-facing AI to offer nutrition support. “Over the last decade, the foundation of Hinge Health has been built on two things: 1) an exceptional, clinically-validated member experience and 2) strong client relationships and great partners. Those two things are necessary but not sufficient to succeed at scale—AI and computer vision were a critical third element that allowed us to simultaneously improve the member experience and improve our cost structure.” —Jim Pursley, President, Hinge Health While IPO celebrations are well-deserved, the long and winding road continues. Hinge took a valuation haircut with a $3B public market debut, relative to its $6.2B valuation in 2021. Both Omada and Hinge are still seeking the promised land—and public market expectations—of sustained profitability and growth. We'll be watching to see what growth strategies they pursue, with Omada hitting the ground running in the weight loss market and Hinge expanding into in-person care access. Thanks to their hard-earned wins (and battle scars), there's a clearer, albeit not perfectly smooth, path for virtual-first care businesses to reach durability and impact at scale. Looking ahead, ongoing public market performance will reveal the long-term value of these businesses, hopefully kickstarting a virtuous cycle of exits and comps that inform healthy investments, valuations, and growth trajectories for emerging digital health startups. Mergers on the dancefloor Although the public markets are alluring, most digital health companies take a different exit ramp: M&A. With 107 M&A deals closed in H1 2025, this year is on track to quickly surpass —and nearly double—the 121 M&A deals recorded in 2024. Digital health companies continue to be the most frequent acquirers of other digital health companies, accounting for 63% of all deals so far this half. Many are continuing to execute what we refer to as the “ tapestry weaving ” playbook—acquiring new capabilities to create more robust and broad offerings (e.g., longevity upstart Superpower acquiring Base and Feminade Meanwhile, private equity (PE) players are banking on a new roll-up strategy: AI-native startups coupled with legacy healthcare players. The bet is that combining the established distribution networks and trusted services of legacy companies with cutting-edge technology will drive meaningful efficiency, margin, and scale gains. New Mountain Capital (NMC) has been putting this new playbook to work. Most recently, NMC combined Access Healthcare , a veteran RCM and business process outsourcing firm, with the AI tech of SmarterDx and Thoughtful.ai to form the newly minted Smarter Technologies —making things even more interesting in the RCM space . And earlier this year, NMC acquired Machinify , weaving its AI tech into a ( previously ) combined entity of legacy payment integrity providers Apixio, Varis, and The Rawlings Group. Through these roll-ups, PE firms are effectively underwriting the shift from legacy healthcare services to AI-powered solutions. Time will tell if this approach to inorganic growth will be successful long term. As non-AI-native companies seek new capabilities, these platforms will serve as important test cases for buy versus build strategies. Not just a tale of tailwinds We've covered the IPOs, adoption, and PE-driven proof points for digital health this half, but still haven't addressed the biggest stories in the healthcare news cycle: broader economic and tariff -related uncertainty , and of course, the impact of the budget bill. Throughout H1, the Trump administration's plan to Make America Healthy Again (MAHA) began coming into view. MAHA's first report focuses on childhood chronic illness, with several decisions to come on the administration's strategic plan to address it. Meanwhile, the administration has put out an unprecedented volume of executive orders , ranging from AI deregulation and healthcare price transparency to lower prescription drug pricing . In the graphic below, we highlight some of the major actions and initiatives impacting digital health from the first half of this year (a big thank you to the policy reporters and experts whose minute – by – minute analysis keeps us up to date). Now, most eyes are on the budget bill . The bill introduces Medicaid work requirements and Obamacare marketplace changes that are projected to leave millions uninsured , which could create ripple effects including intensifying uncompensated care losses and shrinking addressable markets. While the bill provides a modest, temporary increase in Medicare reimbursement rates, it does not include provisions from prior versions to address physician payment sustainability in the long term. The call of innovators has always been to find opportunities amidst change and headwinds. As policies solidify and implementation becomes reality, digital health innovators are wise to identify how they may support federal priorities—such as chronic disease or food as medicine —and elevate initiative-aligned digital health solutions. Federal agencies and legislative committees are hosting listening sessions and hearings emphasizing a more tech-enabled healthcare experience . They're also seeking responses to requests for information from stakeholders across the ecosystem (e.g., on the use of AI in clinical decision support or new care models ). Participating can both steer federal digital health initiatives and strengthen future lobbying positioning. All-in-all, early engagement during this first-year window could shape the contours of policies that will determine how healthcare is paid for, regulated, and accessed—all of which set innovation trajectories in motion. “Players across the digital health landscape are living in an uncertain environment because they don't know when, how, or if agencies will implement executive order directives. That being said, there are more opportunities than ever before for digital health companies to get involved and steer evolving regulations—from submitting responses to RFIs to connecting with agencies working on digital health, like CMMI and CMS. They are sincerely hoping to hear from as many people as possible and inviting new voices to these discussions.” —Rachel Stauffer, Principal, McDermott+ From promise to proof While this half's top-line numbers look familiar, several “proof points” give this half strong momentum—from unprecedented provider adoption to fresh IPOs. Digital health is proving it is more than just steady and resilient; the sector is entering a new phase of traction and impact, with AI playing a linchpin role. And although an IPO may not always be on the horizon, the proof is in the pudding—digital health can deliver on its core thesis: to improve care quality, accessibility, and affordability. By staying anchored to these north stars and championing them in key policy forums, digital health will help the healthcare industry weather shifting global, economic, and policy tides. Tap into insights and strategic guidance for enterprise companies with Rock Health Advisory Get in touch with the venture team at Rock Health Capital Join us in advancing ecosystem change at RockHealth.org And last but not least, stay plugged into the Rock Health community and all things digital health with the Rock Weekly Footnotes Series D rounds were limited in sample size (n=3). Rock Health defines AI-enabled digital health startups as startups using artificial intelligence, machine learning, and/or deep learning as a core part of their product or offerings. Even among non AI-enabled startups, we anticipate AI use in some internal or operational capacity, though AI is not (publicly) a core part of their product or offerings. In the peak of digital health funding in 2020-2021, we recorded 18 instances in which companies raised back-to-back mega deals, with the second raise happening within a year of the first; since 2022, we have seen only six such back-to-back mega deals in digital health. EHRs are widely used among providers, but this surge in adoption happened over decades and with federal incentives for compliance. Omada Health is a Rock Health portfolio company.

Omada Health Frequently Asked Questions (FAQ)

When was Omada Health founded?

Omada Health was founded in 2011.

Where is Omada Health's headquarters?

Omada Health's headquarters is located at 500 Sansome Street, San Francisco.

What is Omada Health's latest funding round?

Omada Health's latest funding round is IPO.

How much did Omada Health raise?

Omada Health raised a total of $529.67M.

Who are the investors of Omada Health?

Investors of Omada Health include Armentum Partners, dRx Capital, Civilization Ventures, Wellington Management, Perceptive Advisors and 33 more.

Who are Omada Health's competitors?

Competitors of Omada Health include Hinge Health, Healthify, Better Therapeutics, Twill, Wellthy Therapeutics and 7 more.

What products does Omada Health offer?

Omada Health's products include Omada for Diabetes and 3 more.

Who are Omada Health's customers?

Customers of Omada Health include Castell and Federated Insurance.

Loading...

Compare Omada Health to Competitors

Virta offers diabetes management and weight control within the healthcare sector. It provides nutrition-based programs aimed at enhancing metabolic health and assisting individuals in weight loss and managing type 2 diabetes. Its services target individuals looking to manage their diabetes and weight through a structured nutrition plan, with support from health coaches and technology. It was formerly known as KetoThrive. It was founded in 2014 and is based in Denver, Colorado.

WellDoc focuses on the healthcare technology sector, specifically in the domain of chronic care management. The company offers an AI-driven digital coaching platform that aids in the self-management of various chronic conditions such as diabetes, hypertension, heart failure, and obesity. Its platform also provides data-driven insights to support care team interventions and decision-making and promotes general wellness and education. WellDoc primarily serves health plans, health systems, employers, and partners in the healthcare industry. It was founded in 2005 and is based in Columbia, Maryland.

Lyra Health operates in workforce mental health care within the health benefits industry. The company provides a digital platform that connects employees to mental health providers and tools, utilizing artificial intelligence (AI) for provider matching and offering evidence-based support. Lyra Health serves employers seeking to provide mental health benefits and support employee well-being. It was founded in 2015 and is based in Burlingame, California.

Calibrate operates within the healthcare and wellness industry, providing a program that includes clinician prescribed GLP-1 medication and personalized video coaching. The company serves sectors that offer employer-sponsored health programs and those seeking long-term weight management solutions. It was founded in 2019 and is based in New York, New York.

Vida Health specializes in personalized health coaching and chronic condition management within the healthcare sector. The company offers a digital health platform that provides programs for managing diabetes, obesity, depression, and hypertension, utilizing a network of healthcare providers. It primarily serves employers, health plans, and consultants aiming to address health issues for their members and manage healthcare costs. It was founded in 2014 and is based in San Francisco, California.

Palta develops a range of application-based products in the digital health segment. It provides insights into the health and behavioral habits of customers and helps them detect health problems through artificial intelligence (AI) systems. Its applications focus on preventative healthcare and well-being. It was formerly known as Haxus Ventures. It was founded in 2016 and is based in London, United Kingdom.

Loading...