NVIDIA

Founded Year

1993Stage

PIPE - III | IPOTotal Raised

$12.6MMarket Cap

3834.95BStock Price

157.25Revenue

$0000About NVIDIA

NVIDIA operates in accelerated computing, focusing on artificial intelligence, high-performance computing, and graphics processing. The company provides products including graphics processing units (GPUs), AI platforms, and data center infrastructure for various applications. NVIDIA's solutions serve sectors such as gaming, creative design, autonomous vehicles, robotics, and edge computing. It was founded in 1993 and is based in Santa Clara, California.

Loading...

Loading...

Research containing NVIDIA

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned NVIDIA in 67 CB Insights research briefs, most recently on Jun 26, 2025.

Jun 26, 2025

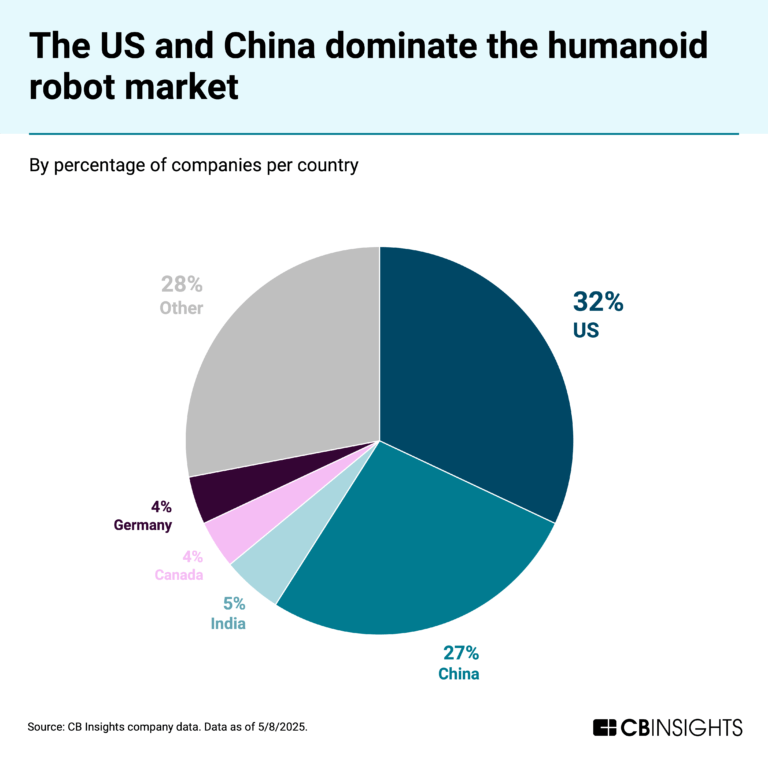

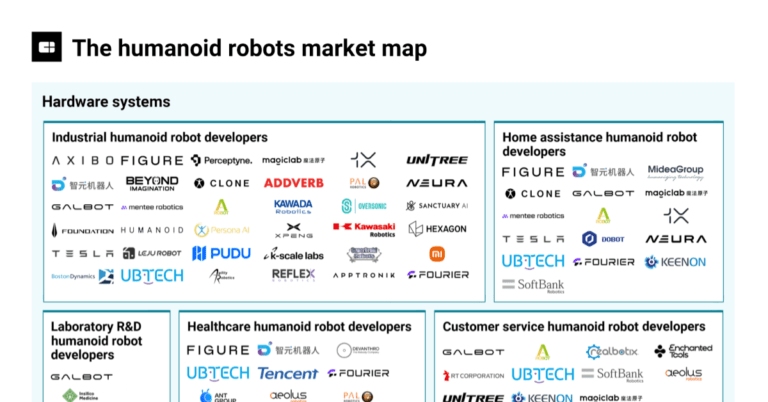

The humanoid robots market map

May 5, 2025

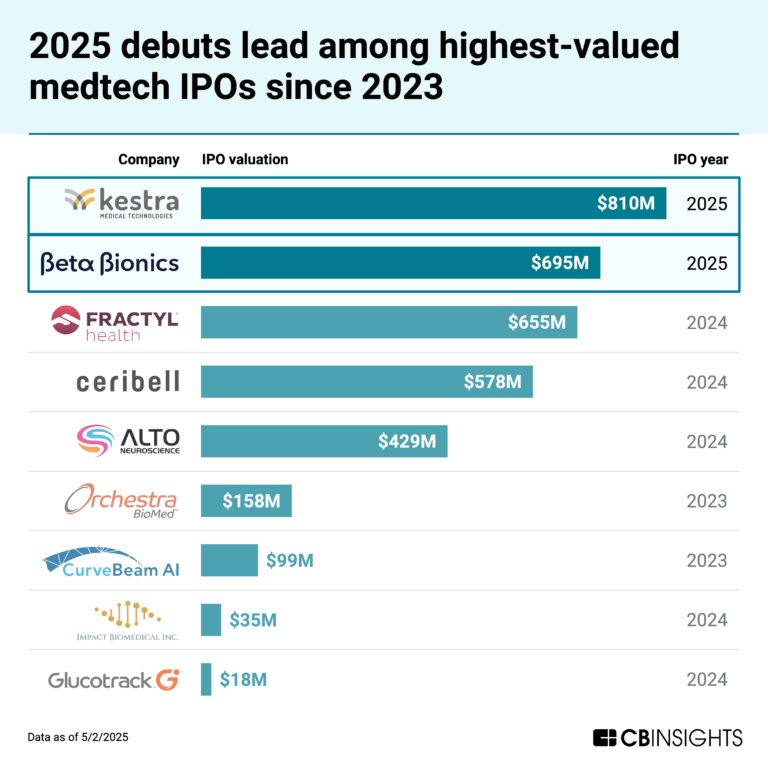

3 shifts that will define the future of medtech

Apr 3, 2025

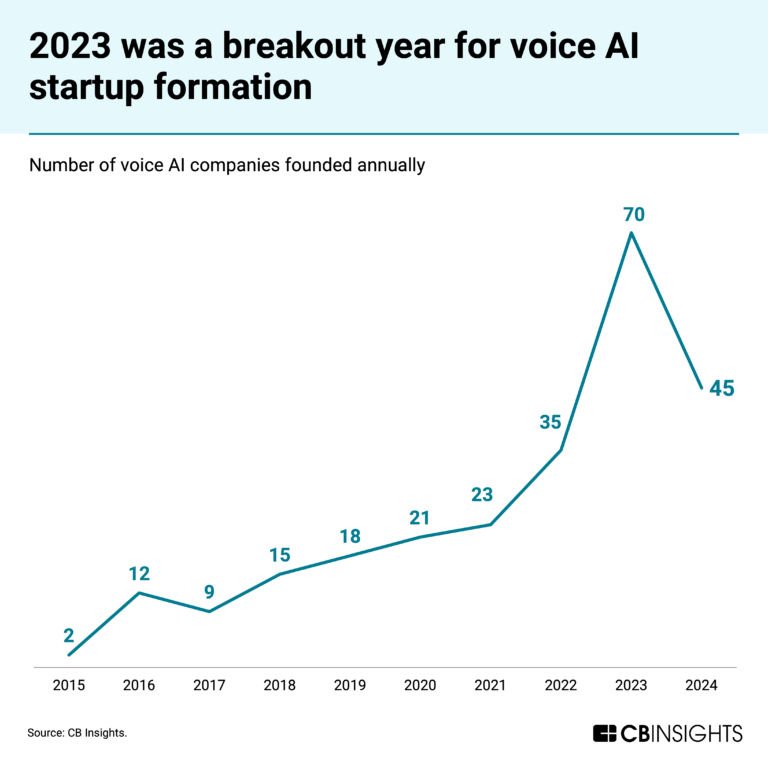

Voice AI’s sweet spot: ordering fries with that

Mar 26, 2025

Nvidia’s next big bet? Physical AI

Mar 21, 2025 report

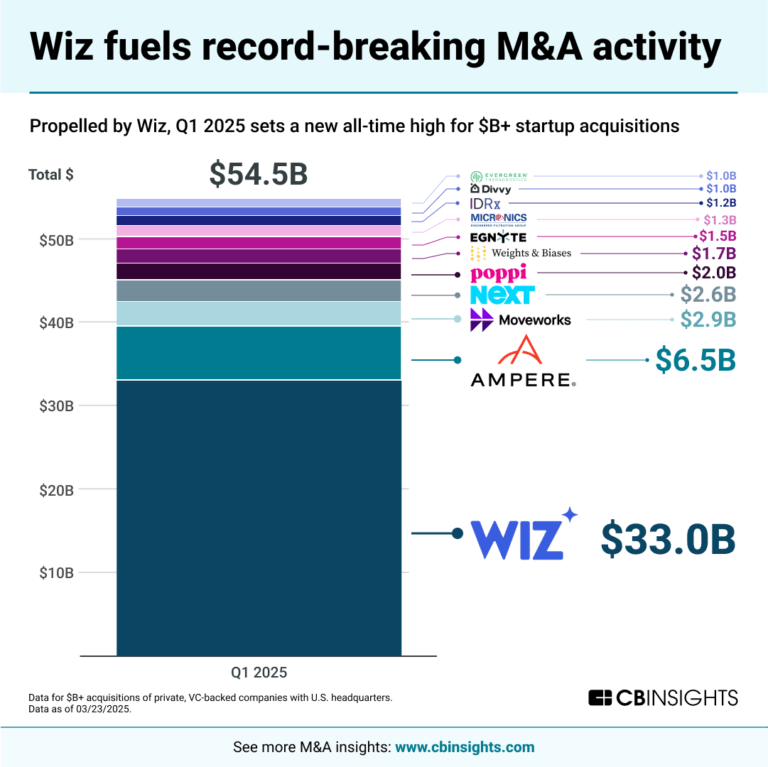

7 tech M&A predictions for 2025Expert Collections containing NVIDIA

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

NVIDIA is included in 10 Expert Collections, including Auto Tech.

Auto Tech

2,188 items

Companies working on automotive technology, which includes vehicle connectivity, autonomous driving technology, and electric vehicle technology. This includes EV manufacturers, autonomous driving developers, and companies supporting the rise of the software-defined vehicles.

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Conference Exhibitors

6,062 items

Companies that will be exhibiting at CES 2018

Gaming

5,683 items

Gaming companies are defined as those developing technologies for the PC, console, mobile, and/or AR/VR video gaming market.

Semiconductors, Chips, and Advanced Electronics

7,380 items

Companies in the semiconductors & HPC space, including integrated device manufacturers (IDMs), fabless firms, semiconductor production equipment manufacturers, electronic design automation (EDA), advanced semiconductor material companies, and more

Advanced Manufacturing

3,822 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

NVIDIA Patents

NVIDIA has filed 6552 patents.

The 3 most popular patent topics include:

- artificial neural networks

- artificial intelligence

- machine learning

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/9/2020 | 4/8/2025 | Wireless networking, Radio electronics, Communication circuits, UMTS (telecommunication), Receiver (radio) | Grant |

Application Date | 4/9/2020 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Wireless networking, Radio electronics, Communication circuits, UMTS (telecommunication), Receiver (radio) |

Status | Grant |

Latest NVIDIA News

Jul 3, 2025

The pause was more than welcome given his Liberation Day announcement had caused a massive risk-off move, sending the S&P 500 tumbling nearly into a bear market. The move up has been akin to a lock-out rally driven predominantly by retail investors who stepped in to "buy the dip." Down days have been scarce, and met quickly with buying from those left on the sidelines suffering from FOMO. Don't miss the move: Subscribe to TheStreet's free daily newsletter The S&P 500 has surged over 20% and the tech-heavy Nasdaq has done even better, rallying more than 30%-- massive moves considering, historically, the S&P 500's annual gain since 1957 is about 10%. The impressive surge likely has many scratching their heads, wondering if markets can continue higher in the face of sticky inflation, job losses, and sagging consumer confidence. As a result, many on Wall Street are updating their outlook, including long-time veteran analyst Dan Ives. Ives, whose career spans over twenty years, is one of the most-watched analysts. His current role as Wedbush Securities' managing director and global head of technology research gives him a unique perspective, given how technology has had an outsize impact on the stock market over the past couple years. In an exclusive interview with TheStreet, he recently offered up his latest thoughts on the S&P 500, and his target may turn heads. Michael M. Santiago/Getty Images Technology stocks regain their mojo The S&P 500 delivered back-to-back 20% plus returns over the past two years, including an impressive 24% return in 2024. Many expected the stock market to continue its winning streak in 2025, however, stocks derailed by unexpectedly high tariffs that forced a friendly Fed away from cutting rates to the sidelines worried over import taxes impact on inflation. Related: Veteran analyst sends blunt message on what's next for stocks The market also staggered earlier this year from growing concern that the launch of DeepSeek, an AI chatbot reportedly developed by China for only $6 million using prior generation semiconductors, would lead AI spending by businesses to retreat. Those concerns remain, but they've become less of a headwind over the past couple of months. While the Fed remains on pause, Fed Chairman Jerome Powell has left the door open to interest rate cuts. The Fed's dot-plot forecast shows Fed officials currently think we'll get two reductions this year, with most targeting the first cut coming in September. Similarly, AI spending growth is less of a worry. While 2026 remains a wild card, hyperscalers like Meta, Google, and Amazon have left their 2025 capital expenditure plans largely intact. In fact, Meta Platforms announced in __ that it will spend more this year, not less, because of AI. With friendlier Fed monetary policy looming and AI spending continuing to chug along, technology stocks have been among the stock market's best performers since the early April lows. Among the biggest winners: Nvidia and Palantir. Nvidia is firmly established as the biggest beneficiary of the AI spending boom. Its GPUs are far better suited to training and operating AI chatbots and Agentic AI apps, making it a premier picks-and-shovels style supplier to enterprise and cloud networks. Last year, Nvidia's sales surged 114% to $131 billion. And since OpenAI's ChatGPT stunned the world by becoming the fastest app to 1 million users when launched in 2022, Nvidia's revenue has skyrocketed a whopping 387%. Related: Rare event could derail S&P 500 record-setting rally Meanwhile, Palantir is carving out an important niche in AI development. The software company's deep expertise in data security and management, with deep roots to the Defense Department, has made it's Artificial Intelligence Platform (AIP) a hit with governments and large enterprises looking to build their own AI solutions. As a result, Palantir's revenue soared 29% to $2.87 billion in 2024, and it's momentum has continued this year. In the first quarter, revenue of $884 million grew 39%. CEO Alex Karp expects sales this year will grow 36% Dan Ives offers S&P 500 forecast turns heads Technology's contribution to stock market returns over the past couple of years puts Dan Ives in a perfect position to gauge what could happen to the market next. The information technology sector is the largest basket within the S&P 500, accounting for 33%. And the top five holdings in the S&P 500 are all technology players with ties to AI: Microsoft, Nvidia, Apple, Amazon, and Meta Platforms. In fact, those five companies account for over one quarter of the index. So, in short, as goes technology stocks, so goes the index. Fortunately, Ives thinks that technology's run isn't yet over. More Experts: "The AI revolution is just hitting its next stage of growth from software to consumer to really the rest of the supply chain," said Ives in an interview with TheStreet. "I just believe Street's underestimating numbers potentially for second half of the year." Ives thinks that spending on AI will continue as more companies look to harness its power to shave costs out of their system, using AI agents to increase efficiency and reduce labor costs. "I think numbers go a lot higher because of the spending, and because we're going to see 2 trillion of incremental spend next three years," said Ives. "And that's bullish for NVIDIA. Bullish for Microsoft. Bullish for Palantir." If Ives is correct that spending will remain a big tailwind for companies, including the companies most influential on the S&P 500, then the index will likely enjoy further gains given stocks historically follow revenue and earnings growth over time. "This is a fourth Industrial Revolution that we're living in, and we're just in the bottom, first, top, second inning of where AI is going," said Ives. So how much higher could stocks go from here? "You could be looking at S&P potentially 7,000," forecasts Ives. Related: Stocks kick off July with surprising twist The Arena Media Brands, LLC THESTREET is a registered trademark of TheStreet, Inc. This story was originally published July 2, 2025 at 7:03 PM.

NVIDIA Frequently Asked Questions (FAQ)

When was NVIDIA founded?

NVIDIA was founded in 1993.

Where is NVIDIA's headquarters?

NVIDIA's headquarters is located at 2788 San Tomas Expressway, Santa Clara.

What is NVIDIA's latest funding round?

NVIDIA's latest funding round is PIPE - III.

How much did NVIDIA raise?

NVIDIA raised a total of $12.6M.

Who are the investors of NVIDIA?

Investors of NVIDIA include Woodstock, CIBC World Markets, Alpine Woods Investments, SoftBank, Sequoia Capital and 6 more.

Who are NVIDIA's competitors?

Competitors of NVIDIA include Imagination, Arm, Hygon, Xilinx, Ambient Scientific and 7 more.

Loading...

Compare NVIDIA to Competitors

Bridgecom Semiconductors provides wireless semiconductor solutions for the Internet of Things (IoT) market. The company offers cellular modem chipsets for various IoT applications, including low-power and integration solutions for smart metering, wearables, and smart city infrastructure. Bridgecom serves sectors such as automotive, industry IoT, wearable technology, personal computing, and smart city development. It was founded in 2022 and is based in Munich, Germany.

Qualcomm focuses on intelligent computing across industries, providing technology solutions. It offers products that support artificial intelligence, enable processing, and ensure connectivity. Its technology serves sectors that require computing and communication capabilities. It was founded in 1985 and is based in San Diego, California.

Baya Systems provides customizable system IP solutions for the semiconductor industry, focusing on scaling for SoCs and Chiplets. The company offers computing systems and modular semiconductor technologies that assist in the design, analysis, and deployment of complex computing systems. Baya Systems serves sectors that require data movement and computing, including data centers, AI acceleration, automotive, and IoT. It was founded in 2023 and is based in Santa Clara, California.

Microchip Technology (NasdaqGS: MCHP) provides smart, connected, and secure embedded control solutions for the semiconductor industry. The company offers development tools and a comprehensive product portfolio that help customers create designs that minimize risk and reduce system cost and time to market. Microchip Technology primarily serves the industrial, automotive, consumer, aerospace and defense, communications, and computing markets with its solutions. It was founded in 1989 and is based in Chandler, Arizona.

Samsung Semiconductor specializes in semiconductor technology and operates within the semiconductor industry. The company offers products including DRAM, SSDs, processors, image sensors, and display ICs, which are components for various electronic devices. Samsung Semiconductor serves sectors such as mobile, automotive, computer, network, television, gaming, 5G, and AI industries. It was founded in 1974 and is based in San Jose, California.

Applied Materials is a company focused on materials engineering in the semiconductor, display, and solar industries. The company offers products and technologies such as semiconductor solutions, display technologies, roll to roll web coating, solar solutions, and automation software. Applied Materials primarily serves the electronics manufacturing industry. It was founded in 1967 and is based in Santa Clara, California.

Loading...