Next Insurance

Founded Year

2016Stage

Acquired | AcquiredTotal Raised

$1.146BValuation

$0000Revenue

$0000About Next Insurance

Next Insurance provides insurance services, specifically for the needs of small businesses. It offers insurance products, including general liability insurance, workers’ compensation insurance, professional liability insurance, commercial auto insurance, and commercial property insurance, among others. It primarily serves sectors such as retail, food and beverage, construction, consulting, education, entertainment, fitness, financial services, real estate, and more. It was founded in 2016 and is based in Palo Alto, California. In March 2025, Next Insurance was acquired by ERGO Group.6B.

Loading...

ESPs containing Next Insurance

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The full-stack insurtech carriers — commercial lines property & casualty market comprises insurtech carriers that underwrite commercial property & casualty (P&C) insurance. These lines of business may include (but are not limited to) cyber, errors & omissions, general liability, property, and workers’ compensation. As with established carriers, insurtech carriers will typically also be licensed by…

Next Insurance named as Leader among 6 other companies, including Coalition, Cowbell Cyber, and At-Bay.

Next Insurance's Products & Differentiators

General Liability

General liability insurance, also known as commercial general liability (CGL), covers the risks that affect almost every business, no matter what your industry. It is the most common insurance for small businesses and self-employed professionals, and it’s typically the first policy purchased by new businesses.

Loading...

Research containing Next Insurance

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Next Insurance in 8 CB Insights research briefs, most recently on May 8, 2025.

May 8, 2025 report

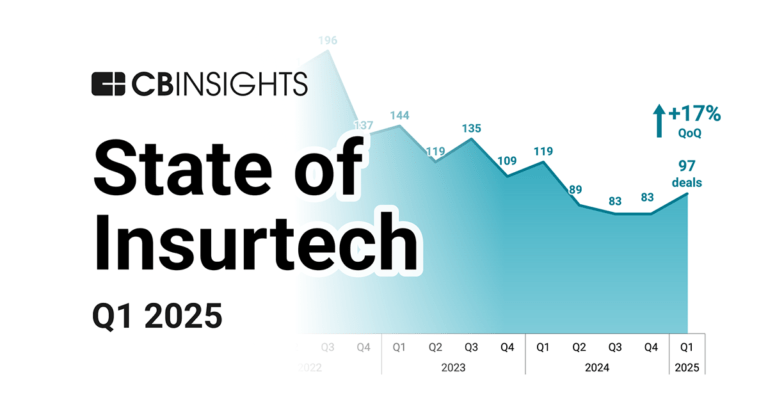

State of Insurtech Q1’25 Report

Aug 28, 2024 report

Insurtech 50: The most promising insurtech startups of 2024

Feb 23, 2024

The B2C US insurtech market map

Feb 9, 2024 report

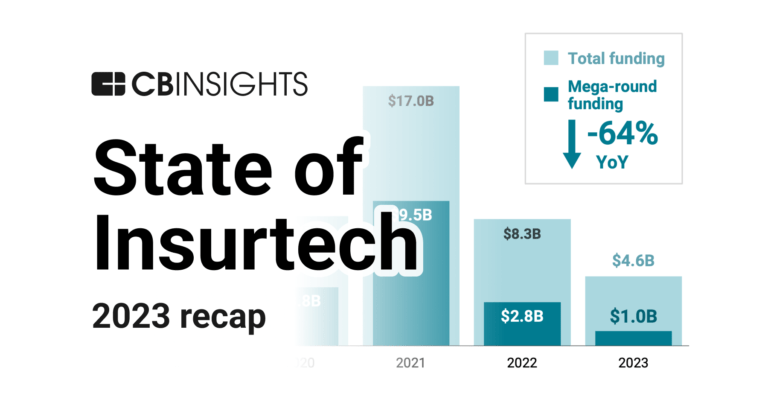

State of Insurtech 2023 Report

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing Next Insurance

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Next Insurance is included in 8 Expert Collections, including Fintech 100.

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SMB Fintech

1,586 items

Insurtech

4,555 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Tech IPO Pipeline

282 items

Track and capture company information and workflow.

Fintech

9,645 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50

150 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Latest Next Insurance News

Jun 26, 2025

The Israeli startup opts for acquisition over IPO, signaling realism in the sector. After three years in which fintech was marginalized due to market malaise and high interest rates, a shift in sentiment has become evident in recent months. Although interest rates in the U.S. have not yet begun to fall significantly, investors are already reacting to former President Donald Trump’s public criticism of the Federal Reserve chairman for not cutting rates more aggressively. Many sense that rate cuts are coming soon. High interest rates have hurt fintech companies by increasing the cost of capital, reducing borrowing, and shrinking consumer disposable income. Fintech has not yet reclaimed the spotlight from AI or cybersecurity, but on the global unicorn list, fintech companies still account for nearly half - led by Stripe, which offers services similar to Melio, and the digital wallet Revolut. Fintech also represents about half of the most valuable Israeli unicorns, a group Melio departed on Wednesday, including top-tier companies such as Rapyd and Tipalti, whose business models overlap in part with Melio’s. (Photo: Nas) The major question is how the valuations these companies achieved during the zero-interest-rate era, which ended in 2022 and is unlikely to return anytime soon, compare to their current real-world values. In the meantime, it appears that after a period of stagnation and waiting for better days, fintech investors now realize that the extraordinary valuations of that era are gone for good. As expectations recalibrate, this return to realism is sparking increased activity in the market, certainly more than we've seen in the past three years. Melio’s exit comes just months after the sale of Next Insurance, also part of the fintech world, for $2.6 billion to German insurance giant Munich Re. Like Melio, Next was sold at a lower valuation than its previous funding round ($4 billion), but still retained unicorn status and a reasonable revenue multiple. Outside Israel, AvidXchange was acquired by investment firm TPG for $2.2 billion this past May. On Wall Street, the fintech IPO market is also experiencing a revival. Some observers are already calling it a “wave,” although it’s still too early to determine whether the excitement is across the broader fintech space or limited to crypto. Israel is also participating in this revival with the IPO of eToro, a trading platform that became the first to benefit from Trump’s tariff policy, which allowed it to expand its reach. The company has undergone a valuation reset to align with market expectations and debuted on Nasdaq with strong demand, reaching a valuation of around $5 billion. While high, that’s still below the $10 billion valuation it aspired to in 2021. Related articles:

Next Insurance Frequently Asked Questions (FAQ)

When was Next Insurance founded?

Next Insurance was founded in 2016.

Where is Next Insurance's headquarters?

Next Insurance's headquarters is located at 975 California Avenue, Palo Alto.

What is Next Insurance's latest funding round?

Next Insurance's latest funding round is Acquired.

How much did Next Insurance raise?

Next Insurance raised a total of $1.146B.

Who are the investors of Next Insurance?

Investors of Next Insurance include ERGO Group, Allianz X, Allstate Strategic Ventures, Mitsui Sumitomo Insurance, Group 11 and 17 more.

Who are Next Insurance's competitors?

Competitors of Next Insurance include Amwins, Vouch, Thimble, Superscript, Pie Insurance and 7 more.

What products does Next Insurance offer?

Next Insurance's products include General Liability and 4 more.

Loading...

Compare Next Insurance to Competitors

Pie Insurance operates a platform for workers' compensation insurance. It matches price with risk across a broad spectrum of small business types that offer sustainable insurance to small business owners. The company was founded in 2017 and is based in Washington, District of Columbia.

Galaxy Finco operates as a special-purpose entity. The Company was formed for the purpose of issuing debt securities, repaying existing credit facilities, refinancing indebtedness, and for acquisition purposes. The company was founded in 2013 and is based in Jersey, United Kingdom.

Alliant Insurance Services focuses on insurance, risk management, employee benefits, and consulting. The company offers a range of services, including claims assistance, disaster preparedness and recovery, risk management solutions, and employee benefits. The company primarily serves sectors such as agribusiness, aviation, construction, cyber, energy and marine, financial institutions, healthcare, and real estate and hospitality, among others. It was founded in 1925 and is based in Irvine, California.

State Farm Insurance provides various insurance and financial services. The company offers products such as auto, homeowners, and life insurance, along with financial services like investment planning and retirement savings. State Farm Insurance serves individual customers and small businesses with their insurance and financial needs. It was founded in 1922 and is based in Bloomington, Illinois.

Coterie Insurance is involved in small business insurance within the commercial insurance sector. The company offers a range of insurance products including business owners policies, general liability, professional liability, cyber insurance, and workplace violence insurance. Coterie Insurance serves independent agents and brokers, enabling the underwriting and binding of small business insurance policies. It was founded in 2018 and is based in Cincinnati, Ohio.

Embroker offers digital insurance brokerage specializing in business insurance solutions across various industries. The company offers a range of commercial insurance packages, including professional liability, cybersecurity, and directors and officers insurance, tailored to meet the specific needs of businesses. It primarily serves sectors such as startups, law firms, tech companies, and financial services. It was founded in 2015 and is based in San Francisco, California.

Loading...