Investments

2890Portfolio Exits

681Funds

33Partners & Customers

3Service Providers

3About New Enterprise Associates

New Enterprise Associates is a global venture capital firm focused on technology and healthcare sectors. The company offers funding to entrepreneurs at various stages of company development, from seed stage to IPO. NEA primarily serves the technology and healthcare industries, investing in companies. It was founded in 1977 and is based in Menlo Park, California.

Expert Collections containing New Enterprise Associates

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find New Enterprise Associates in 12 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

Restaurant Tech

20 items

Hardware and software for restaurant management, bookings, staffing, mobile restaurant payments, inventory management, and more.

Synthetic Biology

382 items

Grocery Retail Tech

16 items

Startups providing tools to grocery businesses to improve in-store operations. Includes IoT tools, customer analytics platforms, in-store robots, predictive inventory management systems,and more. (Does not include on-demand grocery delivery startups or online-only grocery stores)

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Education Technology (Edtech)

58 items

Research containing New Enterprise Associates

Get data-driven expert analysis from the CB Insights Intelligence Unit.

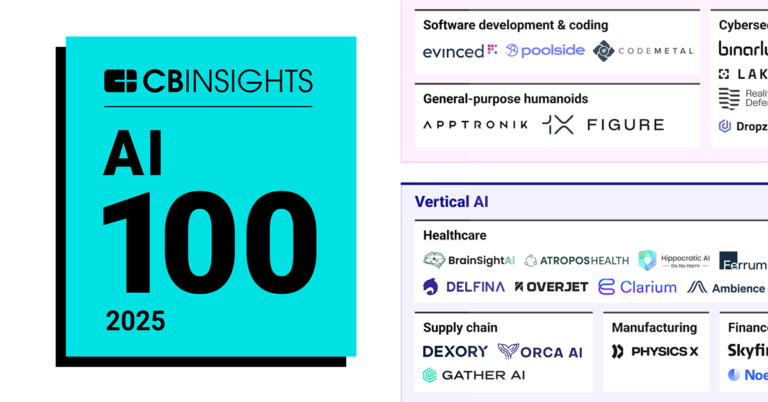

CB Insights Intelligence Analysts have mentioned New Enterprise Associates in 2 CB Insights research briefs, most recently on Apr 24, 2025.

Apr 24, 2025 report

AI 100: The most promising artificial intelligence startups of 2025Latest New Enterprise Associates News

Jul 2, 2025

SAN FRANCISCO & NEW YORK–( BUSINESS WIRE )–Foresight, the New York City based software company on a mission to connect the private market through data, today announced the close of a $5.5 million seed funding round led by NEA with participation from KDX Ventures. In conjunction with the financing, Madison Faulkner, a partner on NEA's Technology Investing Team, will join Foresight's board of directors. Founded in 2023, Foresight helps private market investors, lenders, and acquirers use data to make financial decisions about private companies. Through its proprietary AI-driven data mesh, the Foresight platform unifies data from 50+ sources and applications, including third-party sourcing feeds, CRMs, cap table vendors, shared drives, company KPIs, and fund accounting software. This single source of truth is integrated into the dashboards, analytics, and modeling tools within Foresight's SaaS applications for sourcing, diligence, and post-investment portfolio management. “Private markets are fragmented—filled with point solutions and siloed data. Everyone is chasing the elusive ‘single pane of glass' to make sense of it all,” said Jason Miller, Founder & CEO, Foresight. “But unifying and structuring that data into a seamless, usable knowledge graph was a fundamental, unsolved problem until Foresight.” Miller, a West Point grad and Army veteran, has spent his entire business career building technology for the private markets, including a decade at BlackRock and several years at Point72 and Greycroft, where he identified the ubiquitous problem of siloed data. “The private market is at the inflection point that every industry goes through during the adoption of new technology and the shift to becoming data-driven,” said Adam Devine, Foresight Co-founder and CRO. “Foresight helps every type of private company investor, banker, and acquirer to become powered by data and will enable new ways for market participants to engage, collaborate and transact with one another.” Devine is a serial entrepreneur and has led go-to-market for several AI-driven enterprise software companies. Since launching with founding customers in April 2023, Foresight's software has been deployed within some the most sophisticated venture capital and private equity firms, such as Forerunner and Kleiner Perkins, and the company has created partnerships with several of the private market's biggest data and services companies. “We believe Foresight enables every type of private company investor, banker, and acquirer to become data-driven,” said Madison Faulkner, Partner, NEA. “I have known Jason for years as an industry expert with a deep understanding of how to effectively use data in the private markets. When NEA first saw Foresight's product, we quickly understood the firm-wide value it could deliver—from investing to services and operations. We're thrilled to partner with Jason, Adam, and the team as they work to deliver precision around structured data for private market-focused businesses.” Foresight plans to use the infusion of capital to expand its product and GTM teams and encourages applications through its careers page . The team is headquartered in New York City with a presence in San Francisco. About Foresight The smartest private market professionals use Foresight's platform to make their best sourcing, diligence, and portfolio management decisions. Foresight's AI-driven infrastructure unifies every source of pre- and post-investment private company data (sourcing feeds, CRM, KPI, cap table, fund accounting) and builds this single source of truth into SaaS modules for filtering the universe of companies, managing deal pipelines, and collecting, monitoring, and modeling company and fund performance. By solving the industry-wide problem of siloed data and disconnected point tools, Foresight makes each member of every team at a private fund smarter, faster, and more efficient. Foresight's customers range from newer venture managers that want to super-charge growth to global private equity firms committed to data-driven transformation. Foresight is headquartered in New York City with an office in San Francisco and is backed by NEA, Greycroft, and KDX Ventures. For more information, please visit www.foresightdata.com About NEA New Enterprise Associates, Inc. (NEA) is a global venture capital firm focused on helping entrepreneurs build transformational businesses across multiple stages, sectors and geographies. Founded in 1977, NEA has more than $27 billion in assets under management as of December 31, 2024, and invests in technology and healthcare companies at all stages in a company's lifecycle, from seed stage through IPO. The firm's long track record of investing includes more than 280 portfolio company IPOs and more than 470 mergers and acquisitions. For more information, please visit www.nea.com Contacts Media Contact Adam Devine: adam@foresightdata.com

New Enterprise Associates Investments

2,890 Investments

New Enterprise Associates has made 2,890 investments. Their latest investment was in Foresight as part of their Seed on June 26, 2025.

New Enterprise Associates Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

6/26/2025 | Seed | Foresight | $5.5M | Yes | 2 | |

6/18/2025 | Series A - II | Firestorm | $10M | No | 1 | |

6/11/2025 | Series B | SpliceBio | $135M | No | Asabys Partners, EQT, Gilde Healthcare, Novartis Venture Funds, Roche Ventures, Sanofi Ventures, UCB Ventures, and Ysios Capital Partners | 9 |

6/2/2025 | Series H | |||||

6/2/2025 | Series D |

Date | 6/26/2025 | 6/18/2025 | 6/11/2025 | 6/2/2025 | 6/2/2025 |

|---|---|---|---|---|---|

Round | Seed | Series A - II | Series B | Series H | Series D |

Company | Foresight | Firestorm | SpliceBio | ||

Amount | $5.5M | $10M | $135M | ||

New? | Yes | No | No | ||

Co-Investors | Asabys Partners, EQT, Gilde Healthcare, Novartis Venture Funds, Roche Ventures, Sanofi Ventures, UCB Ventures, and Ysios Capital Partners | ||||

Sources | 2 | 1 | 9 |

New Enterprise Associates Portfolio Exits

681 Portfolio Exits

New Enterprise Associates has 681 portfolio exits. Their latest portfolio exit was Verona Pharma on July 09, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

7/9/2025 | Acq - Pending | 11 | |||

7/1/2025 | Acquired | 6 | |||

6/25/2025 | Acq - Fin | 2 | |||

Date | 7/9/2025 | 7/1/2025 | 6/25/2025 | ||

|---|---|---|---|---|---|

Exit | Acq - Pending | Acquired | Acq - Fin | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 11 | 6 | 2 |

New Enterprise Associates Acquisitions

9 Acquisitions

New Enterprise Associates acquired 9 companies. Their latest acquisition was NeueHealth on December 24, 2024.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

12/24/2024 | Series E+ | $1,575M | Acq - Pending | 3 | ||

6/6/2018 | Other Venture Capital | |||||

11/26/2014 | Series A | |||||

11/10/2011 | Seed / Angel | |||||

10/17/2011 |

Date | 12/24/2024 | 6/6/2018 | 11/26/2014 | 11/10/2011 | 10/17/2011 |

|---|---|---|---|---|---|

Investment Stage | Series E+ | Other Venture Capital | Series A | Seed / Angel | |

Companies | |||||

Valuation | |||||

Total Funding | $1,575M | ||||

Note | Acq - Pending | ||||

Sources | 3 |

New Enterprise Associates Fund History

33 Fund Histories

New Enterprise Associates has 33 funds, including New Enterprise Associates III LP.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

4/1/2025 | New Enterprise Associates III LP | $300M | 2 | ||

1/27/2023 | New Enterprise Associates Growth Equity Fund I | $3,180M | 1 | ||

1/27/2023 | New Enterprise Associates XVIII | $3,050M | 1 | ||

9/4/2020 | NEA BH SPV II | ||||

3/11/2020 | New Enterprise Associates XVII |

Closing Date | 4/1/2025 | 1/27/2023 | 1/27/2023 | 9/4/2020 | 3/11/2020 |

|---|---|---|---|---|---|

Fund | New Enterprise Associates III LP | New Enterprise Associates Growth Equity Fund I | New Enterprise Associates XVIII | NEA BH SPV II | New Enterprise Associates XVII |

Fund Type | |||||

Status | |||||

Amount | $300M | $3,180M | $3,050M | ||

Sources | 2 | 1 | 1 |

New Enterprise Associates Partners & Customers

3 Partners and customers

New Enterprise Associates has 3 strategic partners and customers. New Enterprise Associates recently partnered with Speedinvest on May 5, 2015.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

5/28/2015 | Partner | Austria | New Enterprise, Speedinvest unveil collaboration to target ‘Best’ European start-ups New Enterprise Associates , Speedinvest unveil collaboration to target ` Best ' European start-ups | 2 | |

Partner | |||||

Vendor |

Date | 5/28/2015 | ||

|---|---|---|---|

Type | Partner | Partner | Vendor |

Business Partner | |||

Country | Austria | ||

News Snippet | New Enterprise, Speedinvest unveil collaboration to target ‘Best’ European start-ups New Enterprise Associates , Speedinvest unveil collaboration to target ` Best ' European start-ups | ||

Sources | 2 |

New Enterprise Associates Service Providers

7 Service Providers

New Enterprise Associates has 7 service provider relationships

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Counsel | General Counsel | ||

Service Provider | |||

|---|---|---|---|

Associated Rounds | |||

Provider Type | Counsel | ||

Service Type | General Counsel |

Partnership data by VentureSource

New Enterprise Associates Team

36 Team Members

New Enterprise Associates has 36 team members, including current Founder, General Partner, Charles Ashton Newhall.

Name | Work History | Title | Status |

|---|---|---|---|

Charles Ashton Newhall | Greenspring Associates, and T. Rowe Price | Founder, General Partner | Current |

Name | Charles Ashton Newhall | ||||

|---|---|---|---|---|---|

Work History | Greenspring Associates, and T. Rowe Price | ||||

Title | Founder, General Partner | ||||

Status | Current |

Compare New Enterprise Associates to Competitors

Sequoia Capital is a venture capital firm that focuses on supporting startups from inception to initial-public offering (IPO) within sectors. They provide investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Accel is a venture capital firm that invests in and partners with teams from the inception of private companies through their growth phases, primarily in the technology sector. Accel was formerly known as Accel Partners. It was founded in 1983 and is based in Palo Alto, California.

Bessemer Venture Partners works as a venture capital firm with offices in New York, Silicon Valley, Boston, Mumbai, and Herzliya. Bessemer primarily invests in early-stage opportunities but also participates in late-stage financing and occasionally makes seed-stage investments as well. The firm invests in the following areas: cleantech, data security, financial services, healthcare, online retail, and SaaS. Bessemer Venture Partners typically makes investments in the range of $4M–$10M. It was founded in 1911 and is based in San Francisco, California.

Kleiner Perkins serves as a venture capital firm with a focus on technology and life sciences sectors. The company invests in innovative and forward-thinking startups, offering financial support and strategic partnerships to help them grow. Kleiner Perkins primarily serves sectors such as software, biotechnology, healthcare, and internet technology. It was founded in 1972 and is based in Menlo Park, California.

Lightspeed Venture Partners operates as an early-stage venture capital firm. It focuses on accelerating disruptive innovations and trends in the enterprise and consumer sectors. It was founded in 2000 and is based in Menlo Park, California.

Greylock Partners is a venture capital firm that focuses on early-stage investments in the technology sector. The company provides funding to AI-focused companies at the pre-seed, seed, and Series A stages. Greylock Partners offers a company-building program to support pre-idea and pre-seed founders in developing their startups. It was founded in 1965 and is based in Menlo Park, California.

Loading...