Netradyne

Founded Year

2015Stage

Series D | AliveTotal Raised

$352.52MValuation

$0000Last Raised

$90M | 6 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+66 points in the past 30 days

About Netradyne

Netradyne provides fleet safety solutions within the transportation and logistics industry. The company offers fleet camera systems that analyze driver behavior and provide in-cab audio alerts to enhance road safety. Netradyne's products include driver coaching and performance tracking through the GreenZone Score rewards system. It was founded in 2015 and is based in San Diego, California.

Loading...

ESPs containing Netradyne

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

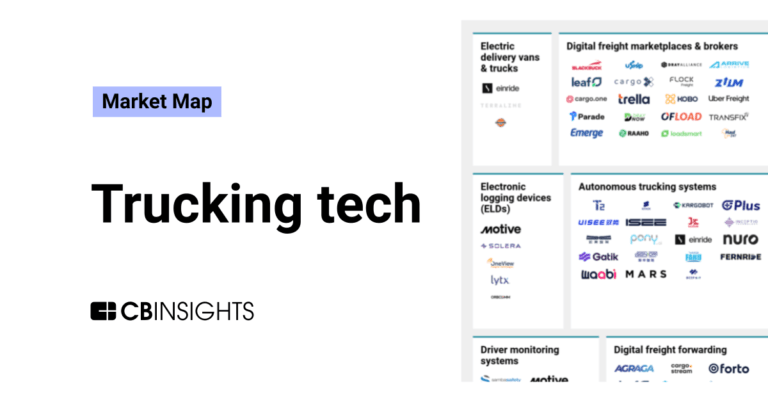

The fleet management & telematics software market provides software solutions for managing and optimizing ground fleet operations, including vehicle tracking, fuel management, maintenance scheduling, and driver performance monitoring. Fleet and logistics managers can leverage these solutions alongside IoT technology, AI, and cloud computing. Companies investing in these solutions can benefit from …

Netradyne named as Leader among 15 other companies, including Palantir, Trimble, and Samsara.

Netradyne's Products & Differentiators

Fleet Camera System

Driveri AI fleet dash cam is built to help fleet managers enhance fleet and driver safety by monitoring driver behavior, real-time vehicle location with geofencing and capturing critical events on the road with 360-degree picture and video.

Loading...

Research containing Netradyne

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Netradyne in 2 CB Insights research briefs, most recently on Mar 21, 2024.

Expert Collections containing Netradyne

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Netradyne is included in 4 Expert Collections, including Auto Tech.

Auto Tech

2,609 items

Companies working on automotive technology, which includes vehicle connectivity, autonomous driving technology, and electric vehicle technology. This includes EV manufacturers, autonomous driving developers, and companies supporting the rise of the software-defined vehicles.

Supply Chain & Logistics Tech

4,920 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,276 items

Artificial Intelligence

10,047 items

Netradyne Patents

Netradyne has filed 52 patents.

The 3 most popular patent topics include:

- autonomous cars

- advanced driver assistance systems

- hybrid electric cars

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/23/2023 | 3/25/2025 | Memory processes, Memory, Rotating disc computer storage media, Discontinued media formats, Interactive television | Grant |

Application Date | 1/23/2023 |

|---|---|

Grant Date | 3/25/2025 |

Title | |

Related Topics | Memory processes, Memory, Rotating disc computer storage media, Discontinued media formats, Interactive television |

Status | Grant |

Latest Netradyne News

Jul 2, 2025

Also in the letter: ■ India's unicorn check ■ AI talent war rages on ■ VCs' AI flight Shadowfax files confidential prospectus for its IPO (L-R), Vaibhav Khandelwal, Praharsh Chandra, Gaurav Jaithliya & Abhishek Bansal, cofounders, Shadowfax Hyperlocal logistics firm Shadowfax has filed a draft red herring prospectus (DRHP) with Sebi under the confidential route, as per a newspaper advertisement. Why it matters: The Flipkart-backed company is seeking to raise Rs 2,000-2,500 crore through its IPO, with approximately half of the funds coming from a primary share issue. By filing confidentially, Shadowfax can gauge investor appetite and tweak its offer terms without immediately putting sensitive financials into the public domain. ET reported on June 27 about Shadowfax's plans for a confidential filing By the numbers: FY24 operating revenue: Rs 1,885 crore (up 33% YoY) Ebitda: Rs 23 crore Net loss: Rs 12 crore (down 92% YoY) What's next: The company plans to deploy Rs 1,000-1,100 crore from the primary proceeds to scale up its quick-commerce delivery vertical, which is gaining momentum and showing healthier margins. The big picture: Shadowfax is part of a broader wave of new-age startups gearing up to go public. Others in the queue include PhysicsWallah, Curefoods Urban Company Capillary Technologies , Groww, Pine Labs , and Wakefit Under the radar: Following Swiggy's confidential draft filing last year, a growing number of new-age companies are opting for the same route. Shadowfax, along with PhysicsWallah Groww Shiprocket , and Boat , have all submitted their draft papers confidentially. Also Read: What is confidential IPO filing, and why do startups choose it? UPI sees marginal dip in June transactions, value down 4% The Unified Payments Interface (UPI), operated by the National Payments Corporation of India (NPCI), recorded a marginal dip in both transaction volume and value in June. By the numbers: UPI processed 18.40 billion transactions during the month, slightly down from 18.68 billion in May. The total value fell 4% to Rs 24.04 lakh crore from Rs 25.14 lakh crore, according to NPCI data released on July 1. What's behind the dip? Industry executives pointed to seasonal factors. May saw a boost from high-volume events, such as the Indian Premier League, which weren't present in June. Still, they noted that year-on-year volume growth remains strong and most expect the overall upward trend to hold. UPI also faced multiple service disruptions recently, affecting users of Google Pay, PhonePe, Paytm, and banking apps. NPCI blamed the April 12 outage on a surge in API requests from certain banks. Other channels The Immediate Payment Service (IMPS) processed 448 million transactions worth Rs 6.06 lakh crore, down from 464 million transactions worth Rs 6.41 lakh crore in May. Aadhaar Enabled Payment System (AePS) volumes slipped to 97 million from 105 million. FASTag transactions reached 386 million, down from 404 million. NPCI financials: NPCI reported a 41.7% jump in net profit to Rs 1,552 crore for FY25. As a not-for-profit, this is booked as a revenue surplus. Standalone revenue rose 19% to Rs 3,270 crore in FY25 from Rs 2,749 crore in FY24. Sponsor ETtech Top 5 & Morning Dispatch! Why it matters: ETtech Top 5 and Morning Dispatch are must-reads for India's tech and business leaders, including startup founders, investors, policy makers, industry insiders and employees. The opportunity: Reach a highly engaged audience of decision-makers. Boost your brand's visibility among the tech-savvy community. Custom sponsorship options to align with your brand's goals. What's next: Interested? Reach out to us at spotlightpartner@timesinternet.in to explore sponsorship opportunities. India mints only five unicorns so far; investors say 2021-style boom unlikely to return India's startup ecosystem kicked off 2025 on a high, with fleet-management company Netradyne hitting unicorn status early in the year. But, six months in , just four others – Porter Drools BlueStone , and Jumbotail – have joined the club. Fall from the peak: That's a far cry from the heady days of 2021, when India minted 45 unicorns in a single year. Most investors now view that as a one-off, fuelled by ultra-low interest rates, a post-pandemic digital surge, and aggressive global capital. That environment, they agree, isn't coming back. Yearwise: The number of unicorns in India since 2021: 5, till June 30. Tread lightly: Following 2021, investors have become far more selective. The emphasis has moved from blitzscaling to building more sustainable businesses. Metrics like unit economics, burn rate, and gross margins now carry more weight than topline growth alone. Also Read: SoftBank-backed Netradyne, India's first unicorn of 2025, eyes profitability by year-end Investor take: “Fund managers are now strongly committed to thesis-driven investing and a metric-driven valuation approach. This has led to more appropriate valuations in new funding rounds. This is most visible in the slower pace of new unicorn creations in India,” Abhishek Prasad, managing partner, Cornerstone Ventures, told ET. Also Read: Dhan closes in on $200 million fundraise from ChrysCap, Alpha Wave, MUFG AI talent war: OpenAI acquihires the team behind Crossing Mind Sam Altman, CEO, OpenAI and Mark Zuckerberg , CEO, Meta There's a meme doing the rounds on X: “On the left is Ronaldo. Real Madrid paid $80M to sign him from Man United. On the right is Jiahui Yu. Meta paid $100M to sign him from OpenAI.” It's funny, but it captures the serious, high-stakes race for AI talent in Silicon Valley. Driving the news: On Monday, Meta showed just how aggressive it's getting. In a major announcement, CEO Mark Zuckerberg introduced Meta Superintelligence Labs , a new unit that will lead its AI charge. The team includes 11 top researchers poached from OpenAI, Anthropic and Google. Zuckerberg has tapped Alexandr Wang, Scale AI's cofounder , to run the show. Bloomberg reports he'll also serve as Meta's c hief AI Officer. Nat Friedman, the former GitHub CEO , will work alongside Wang and lead applied research and AI products. The reorg folds Meta's LLM teams, product groups and the FAIR unit under the new MSL umbrella. Shopping on: OpenAI, feeling the heat, has responded with an acquihire of its own. It picked up the team behind Crossing Minds , known for building AI recommendation tools for ecommerce. This follows a string of buys, including io Windsurf , Rockset and Digital Illumination, as it doubles down on product and research talent. VCs on AI flight to Valley A growing number of Indian venture capital firms are heading to San Francisco to plug into the US AI boom and catch the next big wave before it hits home. Taking flight: Elevation Capital and Peak XV Partners have established a presence in Silicon Valley. Others like Blume Ventures are making regular trips there as the region's AI energy picks up. Elevation Capital has brought on Capillary Tech cofounder Krishna Mehra to anchor its US presence. Peak XV has opened a San Francisco office and tapped ex-Y Combinator principal Arnav Sahu to lead deals. Sources indicate that VC firm Z47 is also seeking to build out its US footprint. Insider's take: Two Bengaluru-based investors told ET they're flying out more often to track cutting-edge developments. “Travelling there is eye-opening in terms of what is happening in AI and the kind of talent density that is available there,” one investor said.

Netradyne Frequently Asked Questions (FAQ)

When was Netradyne founded?

Netradyne was founded in 2015.

Where is Netradyne's headquarters?

Netradyne's headquarters is located at 9171 Towne Centre Drive, San Diego.

What is Netradyne's latest funding round?

Netradyne's latest funding round is Series D.

How much did Netradyne raise?

Netradyne raised a total of $352.52M.

Who are the investors of Netradyne?

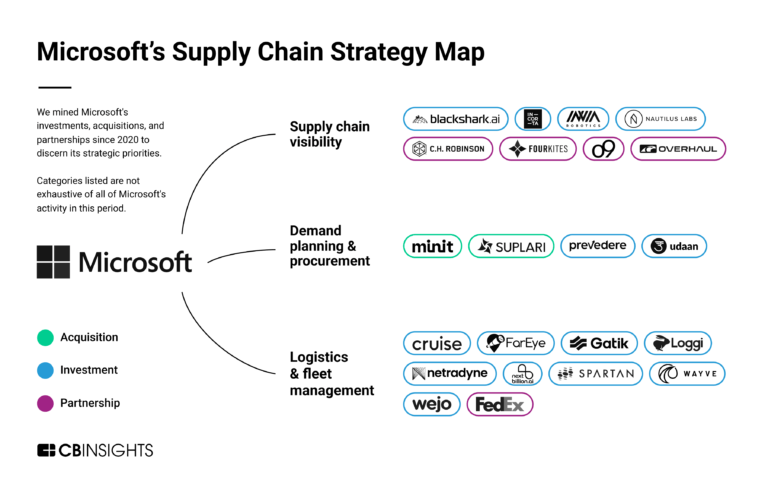

Investors of Netradyne include Qualcomm Ventures, Point72 Asset Management, Pavilion Capital, M12, Silicon Valley Bank and 6 more.

Who are Netradyne's competitors?

Competitors of Netradyne include idrive, Nauto, LightMetrics, Motive, Tourmaline Labs and 7 more.

What products does Netradyne offer?

Netradyne's products include Fleet Camera System and 1 more.

Loading...

Compare Netradyne to Competitors

GreenRoad deals with fleet driver behavior management and safety technology. The company offers solutions that provide real-time coaching and predictive artificial intelligence (AI), aiming to improve fleet safety, efficiency, and sustainability. GreenRoad's products are designed to reduce accidents, optimize fuel consumption, lower emissions, and decrease operational costs while also increasing the battery range of electric vehicles. The technology is adaptable across various vehicle types and can be deployed globally. It was founded in 2004 and is based in Cedar Park, Texas.

LightMetrics provides video telematics solutions for the automotive ecosystem and focuses on fleet safety and efficiency. The company offers real-time driver coaching and safety analytics through a platform that integrates with various dashcam hardware, utilizing edge AI technology to analyze driver behavior and provide alerts. LightMetrics serves the automotive ecosystem, including OEMs, Tier-1 suppliers, and telematics service providers, by enabling them to offer driver safety offerings without the need for dedicated hardware. It was founded in 2015 and is based in Bengaluru, India.

Motive specializes in fleet management and driver safety technology within the transportation and logistics sector. The company offers products that provide visibility into vehicle location, usage, and health, as well as driver safety and accident prevention. Motive was formerly known as KeepTruckin. It was founded in 2011 and is based in San Francisco, California.

Surfsight offers fleet safety and management solutions within the video telematics industry. The company provides dash cams that include video safety programs, fleet tracking, and digital vehicle inspection workflows to prevent accidents and manage fleet operations. Surfsight serves sectors such as construction, distribution, retail, field services, transit, trucking, and utilities. It is based in San Diego, California.

Verizon Connect provides fleet management software and solutions within the telematics industry. The company offers products, including GPS fleet tracking, vehicle maintenance alerts, performance reporting, and asset monitoring. Verizon Connect serves sectors such as distribution and delivery, government and public safety, construction and heavy equipment, transportation and logistics, oil, gas, and mining, utilities, and farming. It was founded in 2018 and is based in Atlanta, Georgia.

Tourmaline Labs provides AI-powered fleet management solutions in the transportation and logistics sector. The platform integrates and analyzes data from various sources to assist with fleet operations, safety, compliance, and sustainability. Tourmaline Labs serves large enterprises aiming to manage their transportation workforces and fleet processes. It was founded in 2014 and is based in San Diego, California.

Loading...