DriveWealth

Founded Year

2012Stage

Series D | AliveTotal Raised

$550.8MValuation

$0000Last Raised

$450M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+34 points in the past 30 days

About DriveWealth

DriveWealth is a financial technology platform that provides Brokerage-as-a-Service within the financial services industry. The company offers an application programming interface that allows partners to create and manage investment workflows, including traditional trading and options for fractional share ownership. DriveWealth serves banks, broker-dealers, asset managers, digital wallets, and consumer brands. It was founded in 2012 and is based in New York, New York.

Loading...

ESPs containing DriveWealth

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The B2B robo-advisors market offers automated portfolio creation services to financial institutions, such as banks, wealth managers, and other financial advisors. The robo advisor-as-a-service market is driven by the growing demand for low-cost, automated investment solutions that can help individuals and institutions manage their portfolios more efficiently and effectively. These solutions need m…

DriveWealth named as Leader among 8 other companies, including Marstone, InvestSuite, and Quantec.

DriveWealth's Products & Differentiators

API infrastructure

DriveWealth offers a comprehensive range of investment products delivered through a single platform, which includes U.S. stocks, bonds, mutual funds, ETFs and local assets. By allowing global investors access to U.S. equities and international markets, DriveWealth fosters financial inclusivity through seamless API integration into partners’ existing platforms, providing end-users access to high-value investment options and real-time analytics.

Loading...

Research containing DriveWealth

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned DriveWealth in 2 CB Insights research briefs, most recently on Nov 17, 2022.

Expert Collections containing DriveWealth

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

DriveWealth is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Wealth Tech

2,658 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

108 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

DriveWealth Patents

DriveWealth has filed 2 patents.

The 3 most popular patent topics include:

- corporate finance

- derivatives (finance)

- financial markets

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/8/2018 | 8/30/2022 | Financial markets, Derivatives (finance), Share trading, Investment, Stock market | Grant |

Application Date | 2/8/2018 |

|---|---|

Grant Date | 8/30/2022 |

Title | |

Related Topics | Financial markets, Derivatives (finance), Share trading, Investment, Stock market |

Status | Grant |

Latest DriveWealth News

Jun 11, 2025

This iframe contains the logic required to handle Ajax powered Gravity Forms. The financial services industry is undergoing deep technological change. API-first architectures are creating new possibilities for integration. Digital platforms are democratizing access to investing. Artificial intelligence is personalizing wealth management. Digital-first brokerages are redefining what’s possible. Global investing barriers are falling. Traditional firms are navigating complex digital transformations. And infrastructure companies are scaling to meet growing demands. To help us understand these critical trends, we’re joined by Harry Temkin, Chief Digital Officer at DriveWealth. DriveWealth is at the forefront of embedded investing technology, powering fractional trading and digital investment experiences for partners across the globe. As CDO, Harry leads the company’s technology strategy and digital innovation initiatives, bringing decades of experience in financial technology. Temkin shares, “Our mission is to democratize investing through embedded finance. We’re powering digital wallets around the world. We’re making it seamless for users to invest in U.S. equities, even if they’re in countries where that wasn’t possible before.” What makes DriveWealth stand out is its technology stack. It enables global retail investing at scale, powering apps from Brazil to the Philippines. “We’re not just a brokerage. We’re a technology firm that embeds investment capability into ecosystems.” Temkin notes. He also discusses how real-time trading and fractional investing are changing expectations. “People want to make decisions quickly, and our systems make that possible in real time, not hours later.” As digital platforms evolve, DriveWealth is preparing to integrate emerging technologies. Such as merging generative AI to further enhance user engagement. “We’re looking at how AI can personalize investment journeys, not just provide chat responses,” Temkin says. Listen to the full episode Enabling cross-border investing with embedded technology At the heart of DriveWealth’s strategy is cross-border investing, allowing users in Latin America, Asia, and beyond to access U.S. equities. “We’re operating in over 150 countries today,” Temkin shares. “And it’s all powered through APIs that integrate with digital wallets and fintech apps.” The conversation dives into how DriveWealth partners with digital wallets, neobanks, and super apps to bring investment functionality directly to end-users. “What we’re doing is embedding the brokerage experience directly into those platforms,” Temkin explains. He also highlights the regulatory complexities of operating globally. “Every market has its own KYC/AML requirements. Our job is to streamline that, to abstract complexity away from our partners.” The power of real-rime rrading Real-time trading isn’t just a feature — it’s foundational to user trust and experience, says Temkin. “When someone executes a trade, they want confirmation and clarity immediately. That’s what we deliver.” DriveWealth’s platform enables fractional, real-time execution of trades. This makes investment accessible even for users without large capital. “We don’t just support buying a share of Apple; we let you buy $5 worth of Apple, instantly,” Temkin adds. This has opened new opportunities for fintechs offering stock back rewards, giving users fractional shares as loyalty incentives. “It’s one of the fastest-growing embedded investment use cases,” he notes. From APIs to personalization: What’s next in Embedded Finance Temkin shares that DriveWealth’s roadmap includes more than just APIs and execution. “We’re thinking about next-gen engagement: how do we use generative AI to guide users based on their behavior, preferences, and goals?” He adds that personalization will be critical in making digital investment experiences feel natural, not forced. “We’re evolving from passive tools to active partners in a user’s financial life.” Generative AI might soon play a role in surfacing insights and next steps for users. It may even create an intelligent interface for investing. “This could be a game-changer for less experienced investors,” Temkin suggests. The Big Ideas Embedded investment is an infrastructure play, not just a feature. “We’re not adding investing to apps. We’re powering platforms that center investment in everyday experiences.” DriveWealth is making global retail investment seamless. “From Brazil to Indonesia, users are accessing U.S. markets without needing to know what happens behind the curtain.” Stock back rewards are building financial engagement. “You spend money and get a piece of the companies you support. People love that. It’s simple, but powerful.” Real-time trading is no longer optional. “It builds trust. People need to see confirmation and execution instantly. That’s become the norm.” Generative AI could become a personalized investment guide. “AI won’t replace the interface, but it could enhance understanding and help users take smarter actions.” Read the transcript (for TS Pro subscribers) 0 comments on ““Embedded investing isn’t a feature — it’s a platform”: DriveWealth’s Harry Temkin on the future of investing” You must be logged in the post a comment.

DriveWealth Frequently Asked Questions (FAQ)

When was DriveWealth founded?

DriveWealth was founded in 2012.

Where is DriveWealth's headquarters?

DriveWealth's headquarters is located at 28 Liberty Street, New York.

What is DriveWealth's latest funding round?

DriveWealth's latest funding round is Series D.

How much did DriveWealth raise?

DriveWealth raised a total of $550.8M.

Who are the investors of DriveWealth?

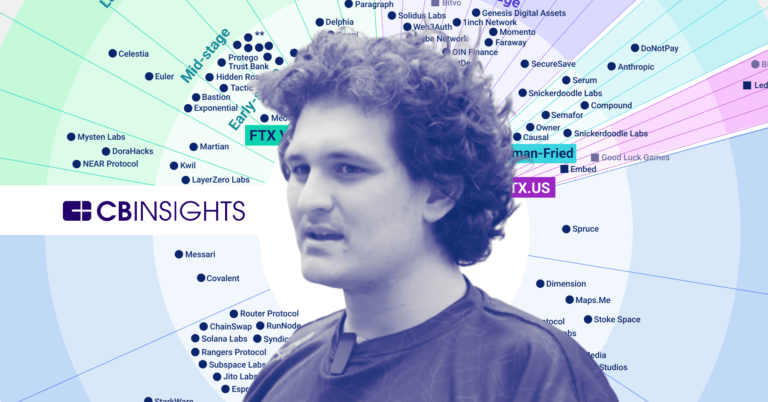

Investors of DriveWealth include Point72 Ventures, Fidelity International Strategic Ventures, FTX, SoftBank, Accel and 12 more.

Who are DriveWealth's competitors?

Competitors of DriveWealth include Borderless, Alpaca, lemon.markets, Tradier, Velexa and 7 more.

What products does DriveWealth offer?

DriveWealth's products include API infrastructure.

Who are DriveWealth's customers?

Customers of DriveWealth include Toss, Revolut and Stake.

Loading...

Compare DriveWealth to Competitors

Alpaca is an application programming interface (API) for stock, options, and cryptocurrency trading, operating within the fintech and brokerage industry. The company provides APIs that facilitate algorithmic trading, app development, and investing features. Alpaca serves a range of clients, including fintech startups, digital wallets, broker-dealers, hedge funds, proprietary trading firms, algorithmic traders, robo-advisors, and crypto exchanges. It was founded in 2015 and is based in San Mateo, California.

Apex Fintech Solutions focuses on investing and wealth management tools within the financial technology sector. The company provides platforms, application programming interfaces (APIs), and services aimed at supporting investing and wealth management. Apex Fintech Solutions serves the financial technology (fintech), embedded finance, advisory, and institutional sectors. It was founded in 2012 and is based in Dallas, Texas.

Upvest is a financial technology company specializing in investment application programming interface (API) within the financial technology (fintech) sector. The company provides a platform for businesses to offer various investment experiences, including account creation, trade execution, and digital reporting. Upvest primarily serves the financial technology industry. It was founded in 2017 and is based in Berlin, Germany.

Atomic specializes in financial services and investment management. The company provides a platform offering wealth management, savings accounts, fractional trading, and Treasury management services. Atomic primarily serves fintechs, banks, and consumer-facing companies looking to integrate investing experiences into their products. Atomic was founded in 2020 and is based in San Francisco, California.

Velexa offers an investing platform for financial institutions and companies in the financial services sector. Their offerings include tools that allow businesses to integrate investing services into their customer experiences. These solutions include platform technology and execution and post-trading services. It was founded in 2021 and is based in London, United Kingdom.

lemon.markets provides infrastructure for investment products within the financial services industry. The company offers a brokerage application programming interface (API) that enables the creation and management of investment products, including features for account management, order execution, asset custody, and financial reporting, compliant with regulations. lemon. markets serve financial technology companies, banks, and software companies looking to integrate investment functionalities into their offerings. It was founded in 2020 and is based in Berlin, Germany.

Loading...