Caribou

Founded Year

2016Stage

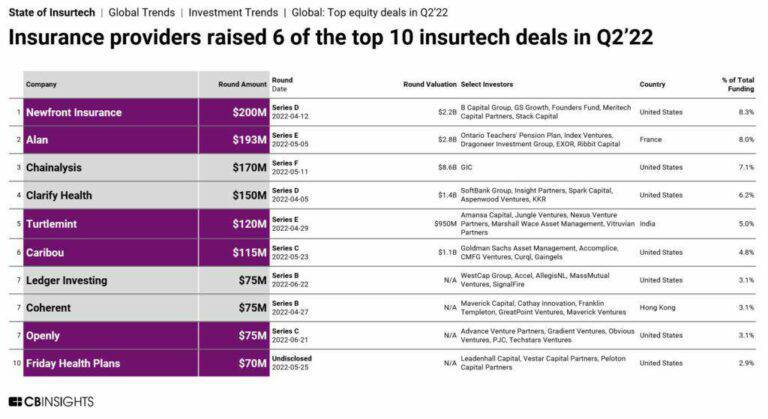

Series C | AliveTotal Raised

$193.64MValuation

$0000Last Raised

$115M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+119 points in the past 30 days

About Caribou

Caribou specializes in auto loan refinancing. The company provides a transparent loan process, allowing customers to access competitive rates and potentially reduce their monthly payments without impacting their credit score during pre-qualification. Caribou's primary clientele includes individuals seeking to refinance their existing auto loans for better terms. It was founded in 2016 and is based in Denver, Colorado.

Loading...

Loading...

Research containing Caribou

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Caribou in 3 CB Insights research briefs, most recently on Oct 10, 2022.

Expert Collections containing Caribou

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Caribou is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Digital Lending

2,464 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Insurtech

4,553 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Caribou News

Jun 21, 2025

Experian reported at the end of 2024 that monthly average car payments were $742 for new vehicles and $545 for used ones, but new data from auto refinancing company Caribou has shown that the amounts that different generations pay vary more than you might think. Caribou's study included Gen Z, born between 1997 and 2012, millennials, born from 1981 to 1996, Gen X, born between 1965 and 1980, and baby boomers, born from 1946 to 1964. In its report, Caribou cited Gen Z as spending the largest share of their income on car payments, but millennials were listed as having bigger average loan balances at $38,600. Gen Z was listed as spending the least monthly income on vehicle payments, and baby boomers had the highest average credit score at 735. According to Caribou, Gen Z drivers are most likely to be behind the wheel of a Honda Civic , with an average loan amount of $32,069 and having a 14.05% APR. Millennials were cited as frequently driving a Chevrolet Silverado 1500 and taking on loans with a 12.44% APR. Their higher loan balances can be attributed to the colliding costs of education, housing, and family. Gen X is described as carrying the most significant original loan amounts due to a fondness for larger trucks like the Ford F-150 , but these higher starting costs meant the demographic was more likely to achieve the highest monthly savings after refinancing at $147. Next to Gen Z, baby boomers took out the lowest loans at $35,844 on average, and they carried the lowest APR of 11.91%, aligning with millennials in their preference for the Chevrolet Silverado 1500. Tom Sandoval Impresses ‘AGT' Judges With Surprise Audition Tape June 21, 2025 5:50 PM Scott Wolf's Ex Kelley Claims She's ‘Barely Seen' Kids Post-Hospitalization June 21, 2025 5:43 PM Jussie Smollett Engaged to Boyfriend Jabari Redd: ‘He Said YES' June 21, 2025 4:42 PM Inside Ashley Olsen's Life Outside of Hollywood: Where Is She Now? June 21, 2025 4:34 PM The effect of refinancing on these generations' auto loans Caribou evaluated what these generations' auto loans looked like after refinancing by accessing its customers with good credit scores and steady incomes who refinanced their auto loans in 2024. Gen X scored the highest average refinance monthly savings of $147, with millennials following at $143, and baby boomers and Gen Z logging $131 and $126 average monthly refinance savings, respectively. Gen X and baby boomers were tied for the lowest monthly refinance APR at 8.39%, while millennials landed at 8.42%, and Gen Z at 8.50%. Across the board, annual percentage rate (APR) reductions ranged from 3.51 to 5.56 percentage points. "Car payments are one of the biggest monthly expenses for millions of Americans, and for too long, people have assumed they're stuck with the rate they got at the dealership. Our data shows that drivers of all ages can unlock real savings by refinancing. This isn't just some money hack; it's a necessity for many households," said Simon Goodall, CEO of Caribou. Final thoughts While refinancing might pose upfront costs that increase your overall loan cost, Caribou's data shows that generations from baby boomers to Gen Z can benefit from the practice. Higher original loan balances mean larger payments earlier in a borrowing term, but they can also lead to greater savings through refinancing. Caribou's report also illustrates that Gen Z drivers face unique affordability challenges with their pattern of spending larger shares of their monthly income on car payments despite lower loan amounts. Baby boomers exhibited strength in multiple categories on account of their stronger average credit scores. Copyright 2025 The Arena Group, Inc. All Rights Reserved. This story was originally published June 21, 2025 at 8:30 AM.

Caribou Frequently Asked Questions (FAQ)

When was Caribou founded?

Caribou was founded in 2016.

Where is Caribou's headquarters?

Caribou's headquarters is located at 717 17th Street, Denver.

What is Caribou's latest funding round?

Caribou's latest funding round is Series C.

How much did Caribou raise?

Caribou raised a total of $193.64M.

Who are the investors of Caribou?

Investors of Caribou include TruStage Ventures, Motley Fool Ventures, Accomplice, Gaingels, Moderne Ventures and 14 more.

Who are Caribou's competitors?

Competitors of Caribou include Jerry and 6 more.

Loading...

Compare Caribou to Competitors

Jerry offers an AllCar app focused on simplifying car ownership through technology in the insurance and financial services sectors. The company offers a platform for comparing car insurance policies, refinancing car loans, estimating repair costs, and tracking driving habits. Jerry's services cater to individual car owners looking to manage their automotive expenses and maintenance. It was founded in 2017 and is based in Palo Alto, California.

The Zebra provides an online insurance comparison platform. Its product provides real-time rates and educational resources to inform consumers while at the same time helping them find the coverage, service level, and pricing to suit their needs. Its product simultaneously helps the insurance companies connect with their consumers too. The company was founded in 2012 and is based in Austin, Texas.

Squeeze is a licensed insurance agency that focuses on household bill optimization and savings within the insurance and mortgage sectors. The agency offers real-time quotes and automatic policy re-shopping for various types of insurance, aiming to find lower rates for customers without charging them fees. Squeeze primarily serves individuals looking to reduce their monthly expenses on auto, home, life, and other types of insurance. It was founded in 2015 and is based in Boca Raton, Florida.

Insurify is a digital insurance agent that provides quotes for various insurance policies. The company offers a platform for consumers to compare, buy, and manage their auto, home, pet, and renters insurance. Insurify serves as an intermediary in the insurance purchasing process. Insurify was formerly known as Ensurify. It was founded in 2013 and is based in Cambridge, Massachusetts.

Otto Insurance specializes in comparing insurance rates and providing estimated quotes across multiple types of insurance policies. The company offers a platform for customers to receive insurance quotes for auto, home, life, and pet insurance, simplifying the process of finding cost-effective coverage. Otto Insurance primarily serves individuals seeking personal and commercial insurance solutions. It is based in Miami Beach, Florida.

SimplyIOA is a national insurance agency focused on personal insurance products within the insurance industry. The company offers a platform for comparing and purchasing various types of insurance, including home, auto, and life, as well as coverage for natural disasters and different types of vehicles. SimplyIOA primarily serves individuals seeking insurance solutions across multiple states. It was founded in 2019 and is based in Lake Mary, Florida.

Loading...