MoneyView

Founded Year

2014Stage

Series E - II | AliveTotal Raised

$185.45MValuation

$0000Last Raised

$4.65M | 10 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-5 points in the past 30 days

About MoneyView

MoneyView is a digital platform focused on personal finance and lending services. The company offers various financial products including personal loans, business loans, home loans, credit cards, and insurance, along with investment options like fixed deposits and digital gold. MoneyView serves individuals and businesses. It was founded in 2014 and is based in Bengaluru, India.

Loading...

MoneyView's Product Videos

_thumbnail.png?w=3840)

_thumbnail.png?w=3840)

MoneyView's Products & Differentiators

Money View Loans

An instant personal loan app that helps provide customised personal loans in just a few minutes. The App uses data & external factors like bureau/liabilities to provide the max loan amount, tenure & ROI- All this with a 100% online, easy application process. The customers can find their eligibility in less than 2 minutes & proceed with the application.

Loading...

Research containing MoneyView

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned MoneyView in 1 CB Insights research brief, most recently on Oct 3, 2024.

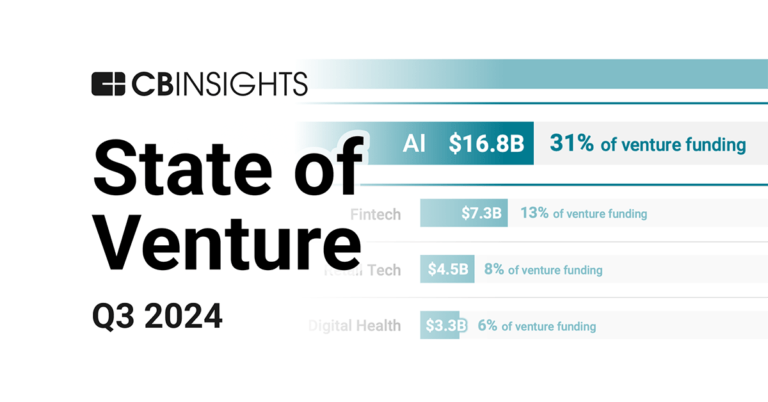

Oct 3, 2024 report

State of Venture Q3’24 ReportExpert Collections containing MoneyView

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

MoneyView is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Digital Lending

2,464 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

13,978 items

Excludes US-based companies

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest MoneyView News

Jul 8, 2025

ET Special Artificial intelligence (AI) is no longer a buzzword in Indian startups; it's the battleground. As billions pour into AI-first ventures and government-backed infrastructure scales up, the big question isn't whether India will play the AI game; it's how Indian startups can win it. In 2024, Indian startups raised $30.4 billion in funding—a 6.5% dip from 2023 —according to Tracxn. Despite the decline, the ecosystem showed resilience, with new unicorns such as Rapido, Ather, Perfios, Porter, and Money View reflecting continued innovation and investor confidence. Amidst this sustained resilience, a receding funding winter, and an AI-driven momentum where Indian startups are increasingly building and leveraging AI solutions, a panel at the ET Soonicorns Summit 2025 will address the question every founder, investor, and policymaker is asking: What does it take to scale Indian AI startups into billion-dollar powerhouses over the next decade? ET Special Titled ‘The Billion-Dollar AI Blueprint: Scaling Indian Startups in the Next Decade,' the session brings together some of the sharpest minds from product, policy, investment, and frontier AI research: Shally Modi, Co-founder, Pratilipi Shweta Rajpal Kohli, President & CEO, Startup Policy Forum Manish Gupta, Senior Director, Google DeepMind Raghunandan G, Founder, Zolve Ritesh Banglani, Co-founder & CEO, Stellaris Venture Partners The session aims to dive deep into the central question looming large over India's AI ecosystem: Can our startups scale before the window of global opportunity closes? Why this panel matters: Cracking the scale code India's startup ecosystem is entering a make-or-break moment. While the country is teeming with AI-first ventures, global scale remains elusive for most. As the US and China sprint ahead with capital, compute, and cutting-edge IP, India must confront a hard truth: innovation without scale won't cut it. From securing long-term capital and building AI talent at scale to owning sustainable IP, expanding into global markets, and staying ahead on ethical compliance and governance, the session's premise is clear: building foundational AI is just the starting point. To lead on the global stage, Indian startups must crack the scale equation. With $11.3 billion already flowing into Indian startups in 2025 and AI policy levers moving fast, this panel aims to define the strategy behind the slogans. Meet the power players on stage: Shally Modi, Co-founder, Pratilipi: At the helm of India's most successful vernacular content platform, Modi brings insights from scaling language-first AI in a market as complex as India. Her on-the-ground view of AI's application in storytelling, personalisation, and creator monetisation is deeply relevant as India eyes a bottom-up AI revolution. Shweta Rajpal Kohli, President & CEO, Startup Policy Forum: A former public policy head at global tech giants and now a policy entrepreneur, Kohli will offer a sharp, insider take on what Indian regulation gets right—and where it stifles scale. Expect her to weigh in on data localisation, AI governance, and startup compliance fatigue. Manish Gupta, Senior Director, Google DeepMind: Gupta represents the R&D depth India must build at scale. His presence adds global heft and provokes a key question: Can India build its own DeepMind—or does it need to? Raghunandan G, Founder, Zolve: Raghunandan is no stranger to scale. Having built and exited TaxiForSure, and now leading cross-border neobank Zolve, he brings a builder's clarity to a market obsessed with valuation over value. Expect grounded insight on talent models, GTM playbooks, and investor-founder alignment. Ritesh Banglani, Co-founder & CEO, Stellaris Venture Partners: One of India's most respected VCs, Banglani has backed some of the country's sharpest tech startups. His perspective on what separates an AI soonicorn from an AI statistic will likely set the tone for how capital chases capability in the years ahead. The big picture: Why scale is mission-critical for Indian AI The AI opportunity isn't just about building tools; it's about shaping a new economy. According to Statista, India's AI market is expected to hit $244.22 billion in 2025, on its way to a projected $1.01 trillion by 2031. But here's the catch: scale is not a by-product of good tech. It needs deliberate architecture—capital, compute, policy, and people. And India's making moves. If this infrastructure aligns with startup innovation, India could unlock both domestic dominance and export scale. While this session is expected to grab headlines, it is part of a broader AI and Deep Tech Dominance track at the Soonicorns Summit 2025, each panel addressing a critical lever in India's AI playbook: AI Investments in India: Chasing Hype or Backing Real Disruption? This high-stakes session features top investors such as Sanjay Swamy (Prime Venture Partners), Hemant Mohapatra (Lightspeed Ventures), and Manish Singhal (pi Ventures) debating what's real in India's AI surge—and what's just branding. AI for Bharat: How Localised Data Centres Can Bridge the Digital Divide - Featuring Adarsh Natarajan (Aindra) and Ankit Bose (Nasscom), this panel focuses on India's unique advantage—solving for underserved populations using culturally and linguistically localised AI. Can India Build Its Own ChatGPT or DeepSeek? The Agentic AI Race Is On - From Hanooman.ai to Microsoft Innovation Hub, this session convenes the core players pushing India's AGI frontier. As the world races to build agentic, self-improving AI systems, India is no longer watching from the sidelines. The verdict: From deep tech to deep impact? The Billion-Dollar AI Blueprint panel doesn't just ask whether India can build big in AI—it asks how it can do it differently, more inclusively, and at a velocity that rewrites the script. In a world where 99% of AI startups won't scale, this panel is a front-row seat to what the top 1% are doing right. And more importantly, what India needs to do to lead the AI age on its terms. The ET Soonicorns Summit 2025 returns to Bengaluru on August 22, bringing together unicorn and soonicorn founders, investors, policymakers, and AI leaders for a day of sharp dialogue, bold ambition, and hard questions. With the theme ‘From Research Labs to Revenue Models: The Billion-Dollar Blueprint for Scaling Indian AI Startups,' this year's edition is poised to redefine what scale means in the Indian context. Whether you're building, backing, or regulating India's tech future, this is where the playbook will be written. 360 One Wealth is the presenting partner of the ET Soonicorns Summit 2025 (This article is generated and published by the ET Spotlight team. You can get in touch with them at etspotlight@timesinternet.in

MoneyView Frequently Asked Questions (FAQ)

When was MoneyView founded?

MoneyView was founded in 2014.

Where is MoneyView's headquarters?

MoneyView's headquarters is located at 3rd Floor, Survey No. 17, 1A, Outer Ring Road, Bengaluru.

What is MoneyView's latest funding round?

MoneyView's latest funding round is Series E - II.

How much did MoneyView raise?

MoneyView raised a total of $185.45M.

Who are the investors of MoneyView?

Investors of MoneyView include Accel, Nexus Ventures, Tiger Global Management, Evolvence India, Rockstone Ventures and 8 more.

Who are MoneyView's competitors?

Competitors of MoneyView include Tala and 6 more.

What products does MoneyView offer?

MoneyView's products include Money View Loans and 2 more.

Loading...

Compare MoneyView to Competitors

Simpl is a checkout network that specializes in providing a seamless online commerce experience for shoppers and enterprises within the digital payments industry. The company offers consumer payment solutions such as 1-tap checkout, pay after delivery, and interest-free installment payments, designed to simplify and secure the online shopping process. Simpl primarily serves the e-commerce industry by enabling merchants to offer these payment options to their customers. Simpl was formerly known as Get Simpl. It was founded in 2015 and is based in Bengaluru, India.

BharatPe provides financial services. It offers merchant discount rate (MDR) services and allows merchants to sign up and start receiving the funds in their respective bank accounts. It serves offline retailers and businesses. The company was founded in 2018 and is based in Gurgaon, India.

Kissht is a financial technology platform that provides personal and business loans. The company uses a digital loan process that requires no physical documentation, allowing for the disbursement of funds to customers' bank accounts. Kissht's services are aimed at consumers looking for financial solutions. It was founded in 2015 and is based in Mumbai, India.

Oriente operates as a financial technology (fintech) company. It provides identity-first digital solutions. The company offers services including artificial intelligence (AI) driven credit scoring, on-demand lending, and point-of-sale (POS) financing. It serves the fintech sector and utilizes big data analytics and machine learning to deliver financial services. It was founded in 2017 and is based in Hong Kong.

ShopSe is a financial technology company that focuses on consumer financing. The company offers a digital EMI marketplace where customers can make purchases and pay for them over time with flexible payment plans. It primarily serves the retail industry. It was founded in 2020 and is based in Mumbai, India.

SoLo Funds is a financial technology company specializing in community finance within the peer-to-peer lending sector. The company facilitates a platform where individuals can lend to and borrow from each other with terms they set themselves and offers a suite of banking services to support these transactions. SoLo Funds primarily serves individuals seeking alternative financial services and those from underserved communities. It was founded in 2018 and is based in Los Angeles, California.

Loading...