Modern Treasury

Founded Year

2018Stage

Series C - II | AliveTotal Raised

$183.12MValuation

$0000Last Raised

$50M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-20 points in the past 30 days

About Modern Treasury

Modern Treasury specializes in payment operations and money movement solutions within the financial technology sector. The company offers APIs for real-time financial reconciliation, bank integrations, and AI-assisted money management. Modern Treasury's products are designed to serve finance teams, product teams, and engineering teams, enhancing payment processes and financial data management. It was founded in 2018 and is based in San Francisco, California.

Loading...

ESPs containing Modern Treasury

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The automated payments reconciliation market provides a streamlined and efficient solution for reconciling payments. Auto reconciliation refers to the automated process of matching incoming payments with corresponding invoices or transactions, eliminating the need for manual reconciliation efforts. By automating the reconciliation process, businesses can save time, reduce errors, and improve finan…

Modern Treasury named as Challenger among 15 other companies, including Stripe, GoCardless, and Checkout.com.

Modern Treasury's Products & Differentiators

Payments

For companies building money movement products, Payments provides a single API and web app to manage the entire cycle of money movement, from initiating and receiving payments to reconciliation and booking to the General Ledger. It lets customers manage multiple bank payment methods like ACH, Wire, RTP, SEPA, BACS, checks and any other method supported by their bank through one integration.

Loading...

Research containing Modern Treasury

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Modern Treasury in 5 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

Jan 4, 2024

The core banking automation market mapExpert Collections containing Modern Treasury

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Modern Treasury is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

SMB Fintech

2,003 items

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

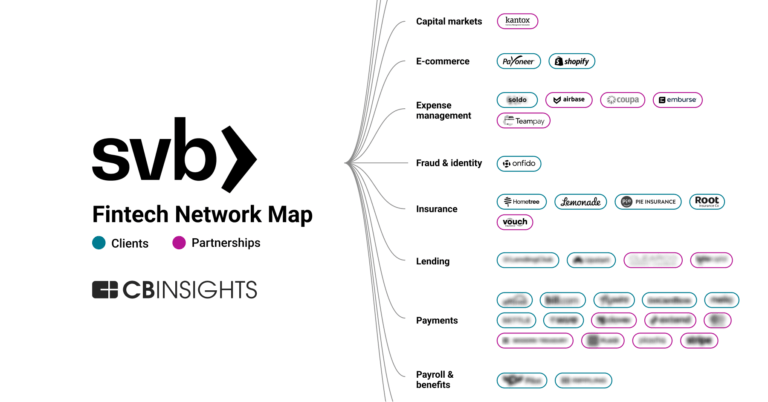

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Latest Modern Treasury News

May 3, 2025

Priority Sports Goes Wild and other Digital Transactions News briefs from 5/2/25 Priority Sports , a unit of the payments provider Priority Technology Holdings Inc., announced it has processed ticket sales since March for the Minnesota Wild, a National Hockey League team. A survey from Jack Henry & Associates Inc. found that 89% of financial institutions plan to add new payment services, including the FedNow real-time payments service, over the next two years. Other priorities are same-day ACH and contactless cards. Conducted in February, the online survey had 149 responses. Apple Inc. will allow an update to Spotify’s iPhone app that will permit users to pay for plans on an external site with no restrictions. The move follows a court order against Apple in its case against Epic Games. Payments-technology platform Modern Treasury unveiled Modern Treasury AI, which it says is the first artificial-intelligence platform purpose-built for large-company payments. The average monthly rent payment in the United States climbed 31% over the past five years, to $1,302, according to “The State of Rent: Housing Affordability Trends Across the U.S.” from Rentec Direct , a provider of technology for rent collection. John Badovinac has joined Aurora Payments as senior vice president of embedded commerce. Badovinac arrives at Aurora from Fortis Payment Systems LLC, and worked previously at Total System Services Inc. and Discover Financial Services. Share

Modern Treasury Frequently Asked Questions (FAQ)

When was Modern Treasury founded?

Modern Treasury was founded in 2018.

Where is Modern Treasury's headquarters?

Modern Treasury's headquarters is located at 77 Geary Street, San Francisco.

What is Modern Treasury's latest funding round?

Modern Treasury's latest funding round is Series C - II.

How much did Modern Treasury raise?

Modern Treasury raised a total of $183.12M.

Who are the investors of Modern Treasury?

Investors of Modern Treasury include Benchmark, Altimeter Capital, Quiet Capital, Mischief, SVB Capital and 10 more.

Who are Modern Treasury's competitors?

Competitors of Modern Treasury include FinanceKey, Nilus, Numeral, Fennech Financial, WhenThen and 7 more.

What products does Modern Treasury offer?

Modern Treasury's products include Payments and 4 more.

Who are Modern Treasury's customers?

Customers of Modern Treasury include Pipe, Settle and Trip Actions.

Loading...

Compare Modern Treasury to Competitors

Atlar offers financial management for modern finance teams operating within the financial technology sector. It offers a platform that manages cash, processes payments, and integrates with enterprise resource planning (ERP) systems to provide real-time financial data and analytics. Its platform serves various sectors, including finance, treasury, and product teams within mid-market and enterprise organizations. Atlar was formerly known as Avantir. It was founded in 2022 and is based in Stockholm, Sweden.

Moov is a payment processing platform that operates within the financial technology sector, providing services that enable businesses to accept, store, send, and spend money. The company offers card and bank payment acceptance, virtual card issuance, instant payouts, and financial data synchronization. Moov serves sectors such as digital banking, construction, fundraising platforms, loan servicing, small businesses, and transport. It was founded in 2018 and is based in Cedar Falls, Iowa.

Sila operates as a financial technology company that focuses on providing a payment platform. The company offers a range of services including fast money transfers, identity verification, fraud prevention, and bank account linking. Its services are primarily targeted towards the fintech industry. It was founded in 2018 and is based in Portland, Oregon.

Orum focuses on financial services technology, providing solutions for fast and reliable payments. The company offers a platform for payment orchestration and instant bank account verification, aiming to optimize money movement and improve business transactions. Orum's services are utilized by various sectors, including insurance, marketplaces, brokerage firms, and creator platforms. It was founded in 2019 and is based in New York, New York.

Ledge specializes in automating finance operations. The company offers a platform that centralizes payment data, provides payment visibility, automates reconciliation, and identifies problematic transactions, all aimed at simplifying the work of finance teams. It facilitates multi-bank treasury management. It primarily serves businesses that handle high-volume payments. It was founded in 2022 and is based in New York, New York.

Trovata provides solutions for cash management within the financial technology sector, including cash flow analysis, reporting, forecasting, transaction search, and payment processing. The services are designed for treasury, finance, CFOs, accounting, and IT departments, offering multi-bank data centralization and automated reporting. It was founded in 2016 and is based in Solana Beach, California.

Loading...