Modern Health

Founded Year

2017Stage

Series D | AliveTotal Raised

$168.06MValuation

$0000Last Raised

$74M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+13 points in the past 30 days

About Modern Health

Modern Health serves as a global mental health solution provider in the healthcare industry. It offers services including one-on-one clinical therapy, group therapy sessions, and self-guided mental health resources designed to support the emotional, professional, social, financial, and physical well-being of employees. It primarily serves employers, consultants, health plans, and individuals seeking mental health benefits for their workforce or clients. Modern Health was formerly known as Modern Healthcare. It was founded in 2017 and is based in San Francisco, California.

Loading...

ESPs containing Modern Health

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

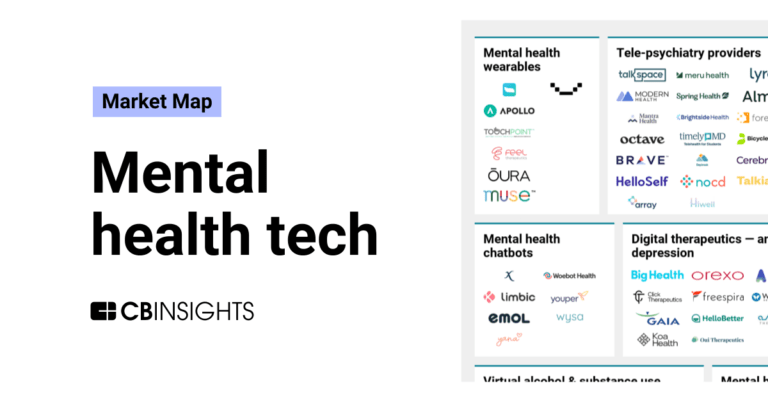

The tele-psychiatry providers market utilizes technology to deliver remote mental health services to patients. This market includes platforms offering psychiatric consultations, therapy, and medication management through video conferencing and digital tools. Providers serve individuals, employers, educational institutions, and healthcare facilities with services ranging from crisis support to ongo…

Modern Health named as Outperformer among 15 other companies, including Teladoc Health, Talkspace, and Spring Health.

Modern Health's Products & Differentiators

Modern Health

Matching Members To The Right Care Using millions of data points & proprietary technology, including AI & machine learning, we match individuals with the right care based on clinical needs & preferences, driving impressive outcomes while reducing healthcare costs & lost productivity for employers. We’re creating a future where powerful anonymized data is combined with cutting-edge technology to create a truly personalized recommendation engine. This goes beyond conventional standards, creating precise care plans based on an individual’s unique needs, experiences, & preferences. The result? Higher engagement & more meaningful outcomes. Unlike other solutions, we take a full population health approach to supporting people. Our innovative needs-based care approach is proven to not only reduce mental health issues but also prevent

Loading...

Research containing Modern Health

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Modern Health in 1 CB Insights research brief, most recently on Sep 13, 2023.

Sep 13, 2023

The mental health tech market mapExpert Collections containing Modern Health

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Modern Health is included in 7 Expert Collections, including HR Tech.

HR Tech

5,910 items

The HR tech collection includes software vendors that enable companies to develop, hire, manage, and pay their workforces. Focus areas include benefits, compensation, engagement, EORs & PEOs, HRIS & HRMS, learning & development, payroll, talent acquisition, and talent management.

Unicorns- Billion Dollar Startups

1,276 items

Digital Health 50

150 items

The most promising digital health startups transforming the healthcare industry

Conference Exhibitors

5,302 items

Digital Health

11,408 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

3,122 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Latest Modern Health News

Jul 3, 2025

Overview The Global mental health services market is projected to grow from USD 0.5 billion in 2024 to USD 0.7 billion by 2034, registering a CAGR of 4.1% between 2025 and 2034. This growth is driven by rising awareness of mental health conditions and the increasing number of people diagnosed with depression, anxiety, and stress-related disorders. As mental health becomes a public health priority, more individuals are actively seeking professional support. This shift is fostering sustained demand across counselling, psychotherapy, inpatient care, and psychiatric treatment services. Stigma associated with mental health is gradually declining, making it easier for people to access care without fear or shame. Greater acceptance within families, workplaces, and communities is enabling early intervention and improved outcomes. Health campaigns and public education are also playing a key role in encouraging help-seeking behaviour. This change is opening new opportunities for care providers and enabling the development of specialised services tailored to different population groups, such as adolescents, veterans, and the elderly. Telehealth continues to transform the mental health landscape by improving accessibility, especially in underserved regions. Online therapy, mobile mental health apps, and video consultations allow people to access care from their homes. This convenience helps eliminate geographical and logistical barriers, leading to increased service utilisation. As digital adoption accelerates, providers are expanding virtual care infrastructure and investing in secure, user-friendly platforms to meet growing demand across rural and urban populations alike. The growing burden of mental health challenges tied to the COVID-19 pandemic, such as trauma and post-traumatic stress disorder (PTSD), is also shaping market trends. Many individuals continue to experience lingering psychological effects due to isolation, loss, or healthcare stress. This has spurred a heightened need for trauma-informed care and integrated behavioural health services. Health systems are now prioritising prevention and early intervention strategies to mitigate long-term mental health effects across affected populations. In July 2024, Acadia Healthcare and Nebraska Methodist Health System announced plans to build a 96-bed behavioural health hospital in Council Bluffs, Iowa. This initiative highlights the rising investment in mental health infrastructure to meet growing demand. The facility will offer comprehensive psychiatric and behavioural health services, contributing to regional service expansion. Overall, increasing provider collaborations, innovation in care delivery, and policy focus on mental wellness are expected to sustain the market’s upward trajectory throughout the forecast period. Key takeaways In 2024, the global mental health services market recorded US$ 0.5 billion in revenue and is projected to reach US$ 0.7 billion by 2034. The market is growing steadily at a compound annual growth rate (CAGR) of 4.1% over the forecast period from 2025 to 2034. Outpatient services led the service type segment in 2024, capturing a notable 42.3% share due to increasing preference for non-residential care models. Service categories include outpatient, telehealth, residential, inpatient, and emergency services, with outpatient services emerging as the dominant mode of delivery in recent years. Based on end-users, hospitals and clinics accounted for the largest share in 2024, holding 48.6% of the total market revenue. Other significant end-users include home healthcare providers, educational institutions, the corporate sector, and community mental health centres, reflecting widespread adoption. North America led the global mental health services market in 2024, commanding a 38.5% share due to strong infrastructure and growing awareness initiatives. Challenge: Shortage of qualified mental health professionals One of the biggest challenges in the mental health services sector is the lack of trained professionals. This includes psychiatrists, psychologists, and licensed counsellors. The shortage creates serious access issues, especially in rural and underserved regions. Patients often face long waiting periods for care, which can worsen mental health conditions. According to the U.S. Health Resources and Services Administration (HRSA), over 122 million Americans live in designated Mental Health Professional Shortage Areas as of August 2024. This means one-third of the population does not have enough mental health providers nearby. The growing demand for services cannot be met, limiting timely and effective treatment for those in need. Opportunity: Growth of telehealth services in mental healthcare Telehealth offers a major opportunity for the expansion of mental health services. It allows people to connect with therapists, psychologists, and psychiatrists through digital platforms. This removes the need for travel and increases access for individuals in remote or underserved areas. It is also more convenient for those who prefer the privacy of online consultations. India’s “Tele MANAS” program shows how successful telehealth can be. By early 2025, it had handled over 1.8 million calls across 53 centres in 36 States and Union Territories. Continued growth in telehealth integration is expected to improve reach, affordability, and continuity of care. Impact of macroeconomic and geopolitical factors on the mental health services market Macroeconomic factors strongly shape the mental health services market. Economic growth often leads to increased public and private healthcare spending. This results in better insurance coverage and improved reimbursement for mental health services. However, during downturns or periods of inflation, healthcare budgets are often reduced. This limits patient access due to rising out-of-pocket costs and restricted employer-sponsored benefits. The International Monetary Fund (IMF) projects global GDP growth at 3.1% for 2024. Despite this, regional economic disparities may continue to affect mental health funding and access differently across markets. Geopolitical events also influence mental health demand and resource allocation. Conflicts, migration, and displacement drive up the need for crisis intervention and long-term psychological care. Refugee populations especially require mental health support, which strains already limited local systems. At the same time, global cooperation on mental health policies can drive innovation and harmonisation of care models. Increased awareness of mental health as a public health issue supports continued investment. This global momentum allows mental health services to remain resilient, even during economic and geopolitical disruptions. U.S. tariff policies affect mental health services indirectly through their impact on technology imports. Many clinics depend on imported tools like virtual reality devices and telehealth hardware. According to the U.S. Census Bureau, medical technology imports remained high in 2023 and 2024. New tariffs could increase costs for these items, limiting digital innovation in therapy. The American Hospital Association (AHA) warns that tariffs on medical supplies may raise healthcare costs. However, these trade policies might encourage local production, helping to build a stable domestic supply of therapeutic tools. Key players analysis Key players in the mental health services market are adopting focused strategies to support long-term growth. They are expanding their treatment offerings by developing new therapies and digital tools for mental health disorders. Companies are also investing in automation and high-throughput technologies. These tools improve treatment consistency and scalability. Collaborations with biotechnology firms, healthcare providers, and academic institutions are rising. Such partnerships aim to bring advanced therapies into clinical use faster. This approach helps companies stay ahead in a growing and competitive healthcare environment. To improve access, companies are increasing their presence in key regions. New facilities and service centres are being built to serve wider populations. Expanding distribution networks improves access and reduces waiting times. It also supports region-specific treatment strategies. These infrastructure improvements help deliver faster and more localised care. The goal is to ensure timely support for mental health needs. Organisations are also focused on improving operational efficiency and treatment outcomes. This strategy helps them maintain leadership in a rapidly evolving healthcare sector. Acadia Healthcare is a prominent player in the U.S. mental health market. Headquartered in Nashville, Tennessee, Acadia operates one of the largest networks of behavioural healthcare facilities. The company offers both inpatient and outpatient services for mental health and substance use disorders. It follows a patient-centred model with a focus on comprehensive treatment. Acadia’s widespread network supports access across the country. The company plays a key role in addressing the growing demand for specialised mental health services and improving patient outcomes across diverse regions. Key players: Teladoc Health, Talkspace, Pfizer, Lundbeck, Johnson & Johnson, Modern Health, Headspace, Bristol Myers Squibb, Acadia Healthcare Conclusion The mental health services market is showing steady growth due to rising awareness, better acceptance, and wider use of telehealth. More people are now open to seeking help, and digital platforms are making care easier to access, especially in remote areas. Key players are expanding services, building new facilities, and adopting new technologies to improve treatment. While challenges like workforce shortages remain, efforts in public education, government support, and private sector investment are helping the market move forward. The ongoing focus on prevention, early treatment, and personalised care is expected to keep driving demand. Overall, the market is set to grow steadily as mental health becomes a global health priority.

Modern Health Frequently Asked Questions (FAQ)

When was Modern Health founded?

Modern Health was founded in 2017.

Where is Modern Health's headquarters?

Modern Health's headquarters is located at 650 California Street, San Francisco.

What is Modern Health's latest funding round?

Modern Health's latest funding round is Series D.

How much did Modern Health raise?

Modern Health raised a total of $168.06M.

Who are the investors of Modern Health?

Investors of Modern Health include Kleiner Perkins, Founders Fund, Battery Ventures, Felicis, Lachy Groom and 14 more.

Who are Modern Health's competitors?

Competitors of Modern Health include Cognera Health, Journey, Anise Health, Likeminded, Spring Health and 7 more.

What products does Modern Health offer?

Modern Health's products include Modern Health and 4 more.

Who are Modern Health's customers?

Customers of Modern Health include Lyft, https://www.cebt.org/, Denny's, Doordash and Rivian.

Loading...

Compare Modern Health to Competitors

Lyra Health operates in workforce mental health care within the health benefits industry. The company provides a digital platform that connects employees to mental health providers and tools, utilizing artificial intelligence (AI) for provider matching and offering evidence-based support. Lyra Health serves employers seeking to provide mental health benefits and support employee well-being. It was founded in 2015 and is based in Burlingame, California.

Spring Health is a mental health solution provider that focuses on employee wellbeing and health plan offerings. The company offers various services including digital support, coaching, therapy, and medication management, tailored to individual needs through technology. Spring Health serves employers and health plans, providing mental health benefits and services. It was founded in 2016 and is based in New York, New York.

Unmind is a workplace wellbeing platform that creates mentally healthy work environments across various sectors. The company offers tools and services to support mental health, utilizing a data-driven approach to provide personalized care and insights for organizational well-being strategies. Unmind primarily serves enterprises looking to enhance their employees' mental health and well-being. It was founded in 2016 and is based in London, United Kingdom.

Headspace is a digital health company that focuses on mental wellness and mindfulness. It offers products, including guided meditations, sleep aids, and mindful movement exercises designed to improve mental health and well-being. It primarily serves individuals seeking personal mental health support and organizations looking to enhance employee well-being. It was founded in 2010 and is based in Santa Monica, California.

Calm operates as a mental wellness brand in the health and wellness industry. The company provides a digital platform for sleep, meditation, and relaxation, aimed at helping users manage stress, sleep better, and live healthier, happier lives. It primarily serves the corporate sector, providing mental fitness and resilience as an employee benefit. It was founded in 2012 and is based in San Francisco, California.

Big Health focuses on digital mental health care, providing services in the mental health sector. It offers digital programs aimed at improving sleep quality, managing anxiety, and enhancing mood through cognitive behavioral therapy. Big Health serves health systems, health plans, and employers with its mental health care platform. It was founded in 2010 and is based in San Francisco, California.

Loading...