Investments

998Portfolio Exits

126Funds

17Partners & Customers

4About Mitsubishi UFJ Capital

Mitsubishi UFJ Capital or MUCAP is a venture capital firm within the Mitsubishi UFJ Financial Group. It is a commercial financial institution that specializes in healthcare, electronics, and high-technology investments. It supports companies in their pre-seed and pre-series A stages with growth capital investments, and aims to partner with the companies until initial public offering (IPO), mergers and acquisitions (M&A), and other exit strategies. It was founded in 1974 and is based in Tokyo, Japan.

Research containing Mitsubishi UFJ Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Mitsubishi UFJ Capital in 4 CB Insights research briefs, most recently on Apr 29, 2025.

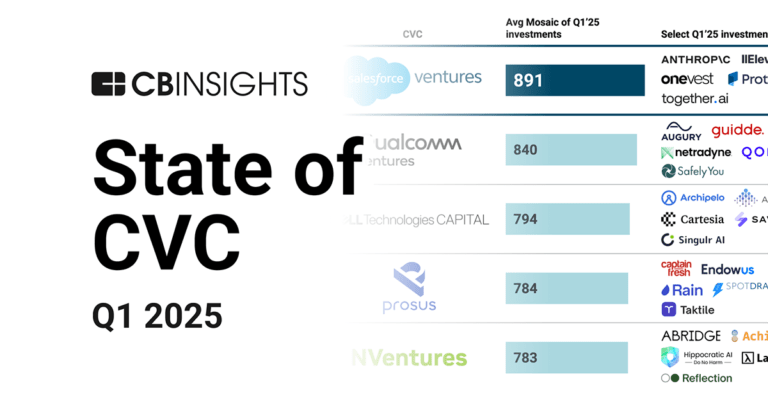

Apr 29, 2025 report

State of CVC Q1’25 Report

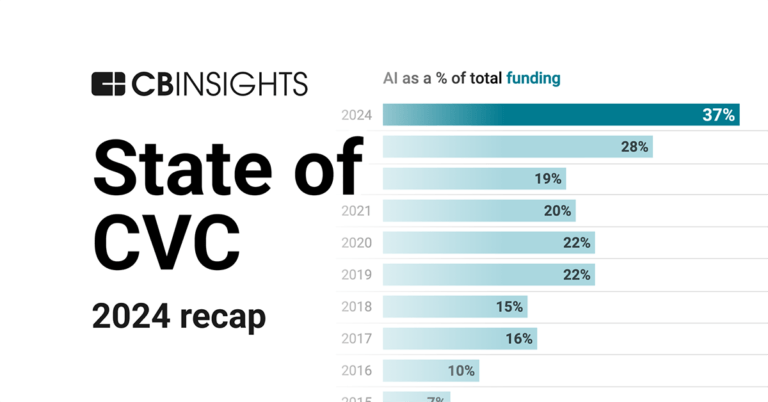

Feb 4, 2025 report

State of CVC 2024 Report

Jan 4, 2024 report

State of Venture 2023 Report

Nov 1, 2023 report

State of CVC Q3’23 ReportLatest Mitsubishi UFJ Capital News

Jul 7, 2025

最先端血管内治療の実現を目指すGlobal Vascular株式会社に追加出資 Global Vascular株式会社について 同社の技術は、東海大学医学部と慶應義塾大学理工学部の医工連携共同研究チームHasebe Research Group(以下「HRG」)の長年の研究成果から生まれたものであり、同社はHRG発のスタートアップ企業です。 開発中の膝下動脈用ステント(写真:Global Vascular社 提供) 出資背景 2023年11月の初回出資以降、株主として伴走させて頂く中で、同社メンバーであれば本事業を成功に導き、多くの患者様を救うことができるという確信が更に増し今回追加出資を致しました。 三菱UFJキャピタルは、1974年に設立以来、三菱UFJフィナンシャル・グループのベンチャーキャピタルとして業界をリードするノウハウを提供し、幅広い業種に対する投資を行っています。IPOを実現されたお客さまは、幅広い業種にわたり約930社と、業界トップクラスの実績を有しています。 ライフサイエンス分野においては、2017年2月の1号ファンド以降、「三菱UFJライフサイエンス4号ファンド」(200億円)を含め計500億円と継続的にファンドを設立しています。ライフサイエンスに特化した民間ファンドの運営としては国内最大級であり、創薬、再生医療、医療機器(デジタルヘルスを含む)などのベンチャー企業を対象に最長約12年間の期間で投資を行っています。バイオベンチャー投資にとどまらず、アカデミア創薬、製薬会社のカーブアウト案件、製薬会社の開発プロジェクトへの投資、医療機器関連にも注力しています。 ◆会社概要

Mitsubishi UFJ Capital Investments

998 Investments

Mitsubishi UFJ Capital has made 998 investments. Their latest investment was in LiLz as part of their Series B - II on July 08, 2025.

Mitsubishi UFJ Capital Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

7/8/2025 | Series B - II | LiLz | $2.94M | No | 2 | |

7/2/2025 | Series B | OPTEMO | $3.48M | No | 2 | |

6/30/2025 | Series B | Global Vascular | $6.92M | No | Diamond Medino Capital, Fast Track Initiative, Medikit, Mitsui Sumitomo Insurance Venture Capital, Sumitomo Mitsui Trust Bank, TUSIC, TUSIMCo, and Undisclosed Investors | 2 |

6/30/2025 | Series A | |||||

6/27/2025 | Series A |

Date | 7/8/2025 | 7/2/2025 | 6/30/2025 | 6/30/2025 | 6/27/2025 |

|---|---|---|---|---|---|

Round | Series B - II | Series B | Series B | Series A | Series A |

Company | LiLz | OPTEMO | Global Vascular | ||

Amount | $2.94M | $3.48M | $6.92M | ||

New? | No | No | No | ||

Co-Investors | Diamond Medino Capital, Fast Track Initiative, Medikit, Mitsui Sumitomo Insurance Venture Capital, Sumitomo Mitsui Trust Bank, TUSIC, TUSIMCo, and Undisclosed Investors | ||||

Sources | 2 | 2 | 2 |

Mitsubishi UFJ Capital Portfolio Exits

126 Portfolio Exits

Mitsubishi UFJ Capital has 126 portfolio exits. Their latest portfolio exit was Daiki Sound on April 23, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

4/23/2025 | Acquired | 2 | |||

3/27/2025 | IPO | Public | 3 | ||

3/27/2025 | Acquired | 2 | |||

Date | 4/23/2025 | 3/27/2025 | 3/27/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | IPO | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | Public | ||||

Sources | 2 | 3 | 2 |

Mitsubishi UFJ Capital Fund History

17 Fund Histories

Mitsubishi UFJ Capital has 17 funds, including Mitsubishi UFJ Capital VII.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

2/20/2019 | Mitsubishi UFJ Capital VII | Multi-Stage Venture Capital | Closed | $136.98M | 1 |

2/20/2019 | Mitsubishi UFJ Life Science II | Multi-Stage Venture Capital | Closed | $91.32M | 1 |

2/20/2017 | Mitsubishi UFJ Life Science I | Multi-Stage Venture Capital | Closed | $88.37M | 1 |

2/20/2017 | Mitsubishi UFJ Capital VI | ||||

11/30/2015 | Mitsubishi UFJ Venture Fund II |

Closing Date | 2/20/2019 | 2/20/2019 | 2/20/2017 | 2/20/2017 | 11/30/2015 |

|---|---|---|---|---|---|

Fund | Mitsubishi UFJ Capital VII | Mitsubishi UFJ Life Science II | Mitsubishi UFJ Life Science I | Mitsubishi UFJ Capital VI | Mitsubishi UFJ Venture Fund II |

Fund Type | Multi-Stage Venture Capital | Multi-Stage Venture Capital | Multi-Stage Venture Capital | ||

Status | Closed | Closed | Closed | ||

Amount | $136.98M | $91.32M | $88.37M | ||

Sources | 1 | 1 | 1 |

Mitsubishi UFJ Capital Partners & Customers

4 Partners and customers

Mitsubishi UFJ Capital has 4 strategic partners and customers. Mitsubishi UFJ Capital recently partnered with AGC on March 3, 2025.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

3/4/2025 | Partner | Japan | Mitsubishi UFJ Capital ; President : Takuro Kojima , Headquarters : Tokyo ) and AGC Inc. -LRB- AGC Inc. ; President : Yoshinori Hirai , Headquarters : Tokyo ) have signed a mandate agreement for the technical evaluation of drug manufacturing , as part of Mitsubishi UFJ Capital 's investment activities in drug discovery startups , etc. . | 1 | |

8/19/2021 | Partner | ||||

1/10/2019 | Partner | ||||

1/23/2015 | Vendor |

Date | 3/4/2025 | 8/19/2021 | 1/10/2019 | 1/23/2015 |

|---|---|---|---|---|

Type | Partner | Partner | Partner | Vendor |

Business Partner | ||||

Country | Japan | |||

News Snippet | Mitsubishi UFJ Capital ; President : Takuro Kojima , Headquarters : Tokyo ) and AGC Inc. -LRB- AGC Inc. ; President : Yoshinori Hirai , Headquarters : Tokyo ) have signed a mandate agreement for the technical evaluation of drug manufacturing , as part of Mitsubishi UFJ Capital 's investment activities in drug discovery startups , etc. . | |||

Sources | 1 |

Mitsubishi UFJ Capital Team

10 Team Members

Mitsubishi UFJ Capital has 10 team members, including current President, Kei Andoh.

Name | Work History | Title | Status |

|---|---|---|---|

Kei Andoh | President | Current | |

Name | Kei Andoh | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | President | ||||

Status | Current |

Compare Mitsubishi UFJ Capital to Competitors

Spiral Ventures is a venture capital firm. The film invests in fintech, logistics/transportation, artificial intelligence, IoT, sharing economy, marketplace, HR tech, big data, media platforms, healthcare, and online advertising sectors. Spiral Ventures was formerly known as IMJ Investment Partners. Spiral Ventures was founded in 2012 and is based in Tokyo, Japan.

Inclusion Japan is a venture capital firm that invests in startups and provides consultancy services to large enterprises. The company collaborates with startups and offers consultancy to enterprises for business development. It was founded in 2011 and is based in Tokyo, Japan.

Skyland Ventures is a Japanese investment company focused on seed-stage startups. It provides cashback and MEV (Miner Extractable Value) solutions with BNB, Polygon chain, etc. The company was founded in 2012 and is based in Tokyo, japan.

31VENTURES is the corporate venture capital arm ("Venture Co-creation Department") of Mitsui Fudosan, engaging in the seed stage to Series A investments. Its primary investment focus is real estate, IoT, security, energy and green tech, sharing economy, fin-tech, e-commerce, robotics, and life sciences. The company was founded in 2015 and is based in Tokyo, Japan.

Samurai Incubate operates as a venture capital firm. The company primarily invests in early-stage startups and provides growth support, including assistance with development plans, human resources, and fundraising strategies. It also offers incubation services for companies related to personal computers, mobile media, and software as a service (SaaS), as well as for executive, management, marketing, sales, and human resource departments. It was founded in 2008 and is based in Tokyo, Japan.

TSUCREA is a startup incubator that supports startups in various stages of development. The company offers services such as business expansion, funding support, and business development across different sectors. TSUCREA serves startups seeking guidance and resources to grow. It is based in Tokyo, Japan.

Loading...