Investments

398Portfolio Exits

46Funds

3Partners & Customers

4About M12

M12 is a corporate venture fund for Microsoft. The firm seeks to invest in companies operating in cloud infrastructure, artificial intelligence, cybersecurity, developer tools, vertical SaaS, web3, and gaming. M12 uses its deep expertise and extensive platform to help early-stage companies in those key thesis areas accelerate growth and build strategic partnerships. The firm was founded in 2016 and is based in Redmond, Washington.

Expert Collections containing M12

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find M12 in 1 Expert Collection, including Fortune 500 Investor list.

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Research containing M12

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned M12 in 10 CB Insights research briefs, most recently on Apr 29, 2025.

Apr 29, 2025 report

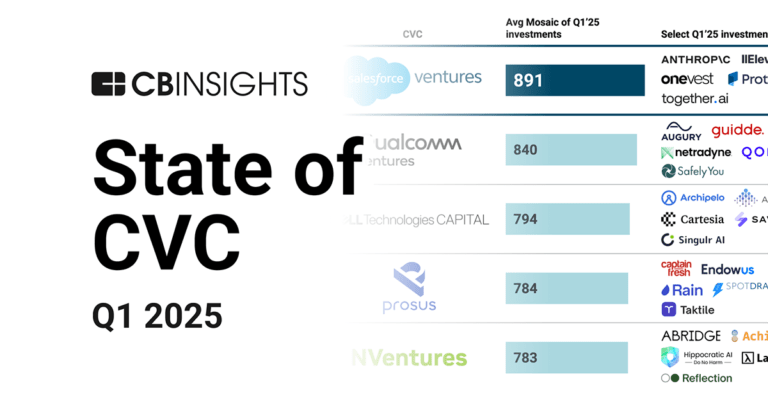

State of CVC Q1’25 Report

Jan 30, 2025 report

State of AI Report: 6 trends shaping the landscape in 2025

May 16, 2024 report

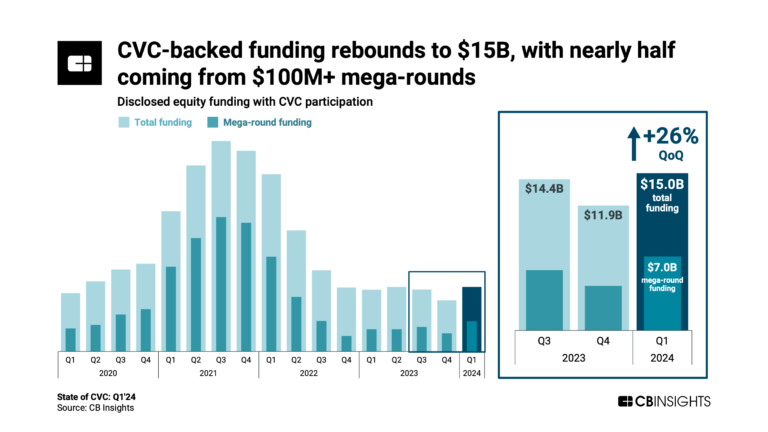

State of CVC Q1’24 Report

Mar 26, 2024

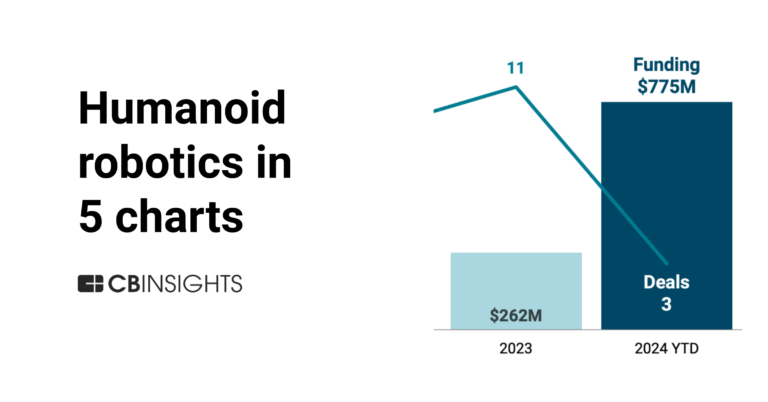

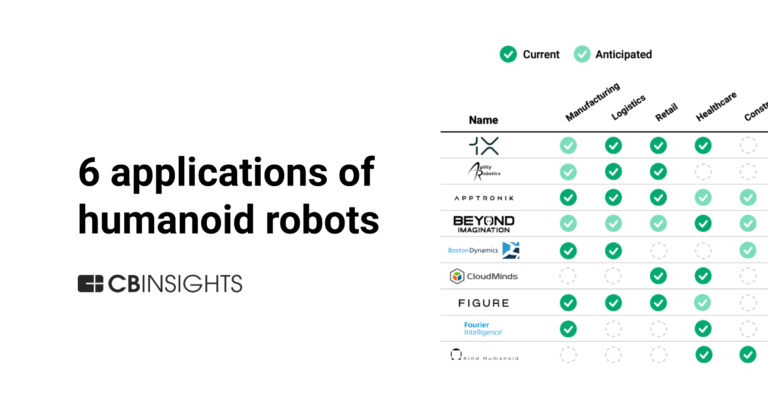

6 applications of humanoid robots across industries

Feb 5, 2024

6 cybersecurity markets gaining momentum in 2024Latest M12 News

Jun 17, 2025

Jun 17, 2025 • GCV reporters Michelle Gonzalez, corporate vice president and global head at M12, is one of the 100 leading corporate venturing professionals in our 2025 Powerlist Michelle Gonzalez has been corporate vice president and global head of M12 for nearly four years. She was headhunted for the position and was attracted by the role because she felt it would allow her to have real impact on a broad, global scale. Since joining M12, the CVC arm has expanded its active portfolio to more than 100 investments and 20 exits. So far in 2025, M12 has invested in US-based AI engineering and LLM evaluation platform Arize AI, designed to help companies test and evaluate AI products, and UK-headquartered software development firm Solve Intelligence. While some of Microsoft’s most headline-grabbing investments in generative AI – such as the relationship with OpenAI – have come directly through the parent corporation rather than M12, the CVC unit has built strong expertise in this area. So far in 2025, M12 has invested in US-based AI engineering and LLM evaluation platform Arize AI, designed to help companies test and evaluate AI products, and UK-headquartered software development firm Solve Intelligence, which enables in-browser document editing for patent attorneys. Gonzalez was ahead of the trend in bringing the CVC unit closer to the parent corporation, having made this shift in 2023. The unit retains autonomy in investment decisions but engages closely with Microsoft senior executives, providing updates, pitching new ideas and sharing insights. Before Microsoft and M12, Gonzalez was managing partner at Area 120, Google’s internal incubator, where she led a transformation to coordinate the organisation’s strategy and investment criteria with Google’s core businesses. During her tenure, a record number of projects were spun in to become key products at the company. Gonzalez began her career in corporate innovation at consulting firm McKinsey & Co. She previously gained experience as a partner at IBM Ventures and as a senior product and business leader at Apple, leading product for the news, books and movies businesses outside the US. She was also an entrepreneur-in-residence and investor at Comcast Ventures. One of Gonzalez’s hobbies is connecting people and learning through conversation, which led her to co-found the Influencer Series, a community of technology leaders, which has hosted more than 90 roundtable discussions with 4,000 founders, investors and tech executives since 2010. The Global Corporate Venturing Powerlist represents the 100 individuals spearheading the future of the corporate venturing industry. These individuals excel in terms of their venturing approach and structure, number and quality of portfolio companies and in their contributions to the corporate venturing profession.

M12 Investments

398 Investments

M12 has made 398 investments. Their latest investment was in Eventual as part of their Series A on June 24, 2025.

M12 Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

6/24/2025 | Series A | Eventual | $20M | Yes | Citibank, and Felicis | 3 |

6/12/2025 | Series C | Meter | $170M | Yes | 53 Stations, Baillie Gifford, General Catalyst, J.P. Morgan, Lachy Groom, Sequoia Capital, Tishman Speyer, and WndrCo | 4 |

5/12/2025 | Seed VC - II | Upscale | $5.5M | Yes | Breakpoint Capital, Eniac Ventures, nvp capital, and SuperAngel.Fund | 2 |

4/10/2025 | Series B | |||||

4/9/2025 | Series A |

Date | 6/24/2025 | 6/12/2025 | 5/12/2025 | 4/10/2025 | 4/9/2025 |

|---|---|---|---|---|---|

Round | Series A | Series C | Seed VC - II | Series B | Series A |

Company | Eventual | Meter | Upscale | ||

Amount | $20M | $170M | $5.5M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | Citibank, and Felicis | 53 Stations, Baillie Gifford, General Catalyst, J.P. Morgan, Lachy Groom, Sequoia Capital, Tishman Speyer, and WndrCo | Breakpoint Capital, Eniac Ventures, nvp capital, and SuperAngel.Fund | ||

Sources | 3 | 4 | 2 |

M12 Portfolio Exits

46 Portfolio Exits

M12 has 46 portfolio exits. Their latest portfolio exit was Neon on May 14, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

5/14/2025 | Acquired | 12 | |||

4/16/2025 | Acquired | 3 | |||

2/18/2025 | Acquired | 6 | |||

Date | 5/14/2025 | 4/16/2025 | 2/18/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 12 | 3 | 6 |

M12 Fund History

3 Fund Histories

M12 has 3 funds, including Microsoft Ventures AI Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

Microsoft Ventures AI Fund | 1 | ||||

M12 Europe Fund | |||||

GitHub Fund |

Closing Date | |||

|---|---|---|---|

Fund | Microsoft Ventures AI Fund | M12 Europe Fund | GitHub Fund |

Fund Type | |||

Status | |||

Amount | |||

Sources | 1 |

M12 Partners & Customers

4 Partners and customers

M12 has 4 strategic partners and customers. M12 recently partnered with Incentive on April 4, 2015.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

4/21/2015 | Vendor | United States | LOS ANGELES -- April 21 , 2015 -- Incentive , a leading provider of a complete , socially powered enterprise collaboration platform for mid-market organizations and enterprise teams , today announced it has joined Microsoft , a global initiative empowering entrepreneurs around the world on their journey to build great companies . | 1 | |

11/3/2013 | Partner | ||||

Partner | |||||

Partner |

Date | 4/21/2015 | 11/3/2013 | ||

|---|---|---|---|---|

Type | Vendor | Partner | Partner | Partner |

Business Partner | ||||

Country | United States | |||

News Snippet | LOS ANGELES -- April 21 , 2015 -- Incentive , a leading provider of a complete , socially powered enterprise collaboration platform for mid-market organizations and enterprise teams , today announced it has joined Microsoft , a global initiative empowering entrepreneurs around the world on their journey to build great companies . | |||

Sources | 1 |

M12 Team

16 Team Members

M12 has 16 team members, including current Chief Operating Officer, Oriona Spaulding.

Name | Work History | Title | Status |

|---|---|---|---|

Oriona Spaulding | Chief Operating Officer | Current | |

Name | Oriona Spaulding | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Chief Operating Officer | ||||

Status | Current |

Loading...