Merck & Co

Founded Year

1891Stage

IPO | IPODate of IPO

1/1/1919Market Cap

210.98BStock Price

84.02Revenue

$0000About Merck & Co

Merck & Co is a biopharmaceutical company involved in the development of medicines and vaccines. The company provides health solutions for the prevention and treatment of diseases in both people and animals. Merck & Co serves the healthcare sector with its offerings. It was founded in 1891 and is based in Rahway, New Jersey.

Loading...

Loading...

Research containing Merck & Co

Get data-driven expert analysis from the CB Insights Intelligence Unit.

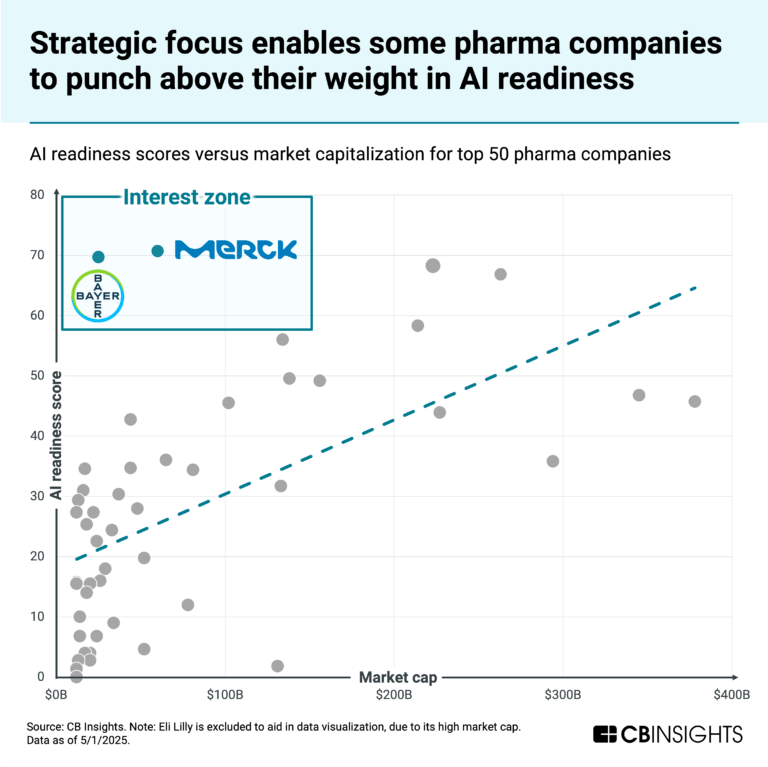

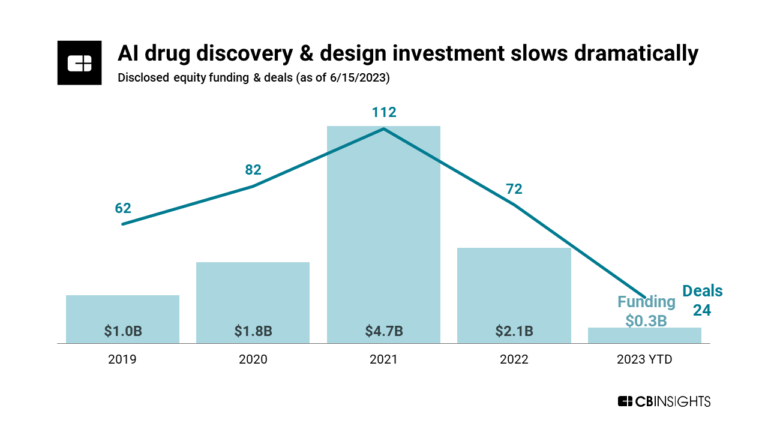

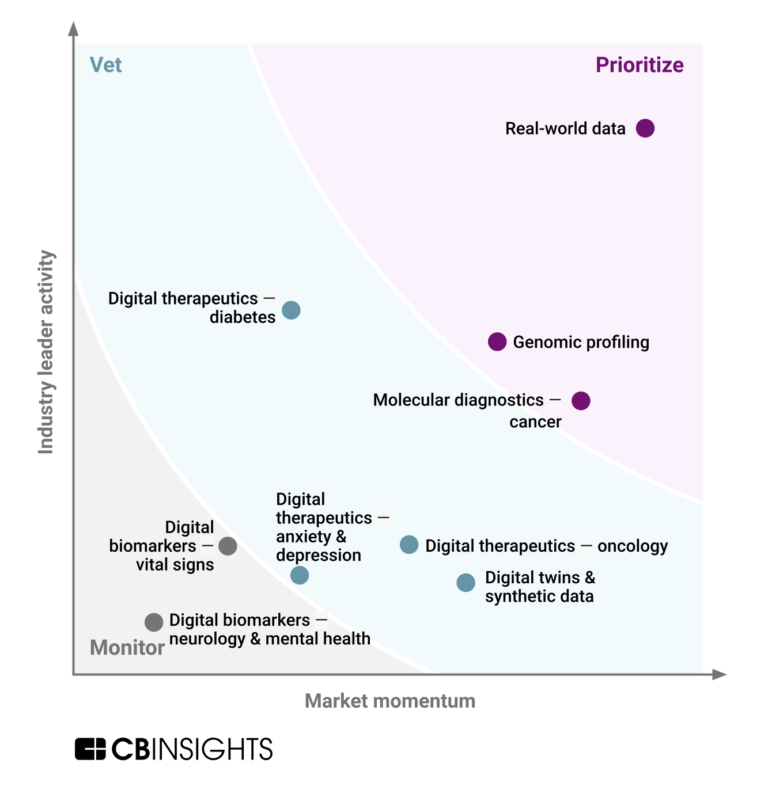

CB Insights Intelligence Analysts have mentioned Merck & Co in 3 CB Insights research briefs, most recently on Jul 3, 2025.

Merck & Co Patents

Merck & Co has filed 5635 patents.

The 3 most popular patent topics include:

- transcription factors

- clusters of differentiation

- monoclonal antibodies

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/23/2020 | 4/8/2025 | Multiple sclerosis, Autoimmune diseases, Pharmacokinetics, Dosage forms, Antineoplastic drugs | Grant |

Application Date | 10/23/2020 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Multiple sclerosis, Autoimmune diseases, Pharmacokinetics, Dosage forms, Antineoplastic drugs |

Status | Grant |

Latest Merck & Co News

Jul 11, 2025

Fri Jul 11 2025 - 05:33 Every year, thousands of patients sit in doctors’ offices with needles in their arms receiving a dose of a wonder drug called Keytruda. The cancer medicine earned Merck $29.5 billion (€25.2 billion) in sales last year. But drip by drip, the US pharma company’s time is running out. In 2028, Keytruda’s patent ends, allowing rivals to sell the same drug at a cheaper price. Investors are spooked and Merck’s shares have sunk 35 per cent over the past 12 months. While the company has been at pains to show it is prepared, Daina Graybosch, an analyst at Leerink, says the so-called patent cliff is hanging over the business. Merck has a “massive hole” in its revenue to fill. “They can’t fill it with one drug,” she says. Merck on Wednesday appeared to take a step towards addressing the looming Keytruda patent cliff. The company is closing in on a $10 billion deal to buy London-based biotech Verona Pharma, which has an approved respiratory disease drug that analysts predict could generate peak annual sales of approaching $4 billion. READ MORE Losing the intellectual property rights for blockbuster drugs is a long-standing ritual for pharma companies. Drugmakers can earn fortunes when new discoveries are first sold to patients. Governments grant them about 20 years of patent life per drug. But up to half of that time can be used before the drug gets to market. When the patent is up, competitors are allowed to release generic rivals, potentially wiping out billions of dollars of revenue for the original proprietor. Drugs worth about $180 billion of revenue a year are going off patent in 2027 and 2028, says research firm Evaluate Pharma, representing almost 12 per cent of the global market. Bristol Myers Squibb and Pfizer are also facing 2028 patent expirations for top-selling drugs. The boom-and-bust cycle is the result of an uneasy compromise in how we fund innovation that is expensive to create but cheap to copy. Governments would rather grant limited monopolies to the private sector than fund much of this essential but risky work themselves. Stephen Haber, a professor of political science and history at Stanford University, says that without patents, medicines would not exist. Healthcare systems baulk at expensive new drugs, given to more people as populations age. Developing countries struggle to access the innovation until patents expire. To get through bust periods historically, pharma companies would go on spending sprees, buying up smaller biotechs, where many innovative drugs are discovered, to fill their pipelines in advance of the patent expiry. An uncertain political climate has resulted in the sector at large moving cautiously. First, companies feared that former US president Joe Biden’s aggressive Federal Trade Commission could stop deals in their tracks. Then came his successor Donald Trump’s threat of US tariffs on the sector. The industry also lacks clarity on how much they will be able to charge for drugs, as politicians pressure them to cut prices. The patent system was established in Britain during the industrial revolution and was first formalised in law in the US. Intellectual property protections were essential to the development of the pharma industry in the late 19th century and to it thriving in countries such as the United States, UK and Germany. “It’s not an accident that there’s only a few countries in the world that are huge pharmaceutical developers,” Haber says. When a drug goes off patent, other companies can seek approval for their copycat versions. These are usually made based on reverse engineering and are informed by the proprietor’s patent filings. The copycats are then tested to ensure they are equivalent to the branded medicine. But crucially, they do not need to go through the expensive clinical trials process again. The pharma industry suffers from patent cliffs in ways that others such as the tech industry do not. This is mainly because the key active ingredient in a drug is covered by one main patent, which is hard to invent around, and chemical formulas are relatively easy to copy. So pharma companies have to focus relentlessly on refilling their pipelines before their best-sellers lose patent protection. At present, companies actually have plenty of money to spend on deals due to the success of the drugs going off patent plus an industry-wide move to slim down operations. EY estimates that companies are sitting on $1.3 trillion in deal-making firepower. Companies are searching for the “Goldilocks” targets, neither too big nor too small. In 2009, in advance of the last major patent cliff, there were several megamergers: Pfizer bought Wyeth for $68 billion, Merck bought Schering-Plough for $41 billion and Roche acquired Genentech for $47 billion. But there has not been a megamerger in pharma since 2019, when Bristol Myers Squibb bought Celgene for $90 billion. These huge deals have fallen out of favour with many investors, who worry about competition law scrutiny and see them as tough to integrate. Smaller targets can be relatively cheap as the biotech market is down 50 per cent since its peak in February 2021, and many early-stage companies are trading below cash. But ideally Big Pharma is looking for biotechs with drugs that could come on to the market soon – and sell in their billions. One difference since the last major set of patent cliffs is that companies are now looking for drugs to buy in China . They often buy ex-China rights to early-stage innovative medicines and then conduct the later-stage trials themselves, so they can provide global data to western regulators. So far this year, there have been licensing deals between Chinese companies and US and European partners worth up to $35 billion, data from EY shows. Daniel Parisotto, managing director in healthcare investment banking at Oppenheimer, says Big Pharma is attracted to Chinese assets – typically the rights to develop and sell the drugs outside China – because they have smaller upfront costs than western deals, where much of the price is tied to a drug reaching certain milestones, like trials, or approvals. Drugmakers pay less upfront than they would in the West. “But ultimately the jury is still out on whether those Chinese assets have a higher failure rate or the same success rate as western assets,” he says. Pharma also deploys strategies to extend the life of its existing drugs. Robin Feldman, a law professor at the University of California San Francisco, says the record for extending a patent beyond the original expiry is more than 30 years. Before Keytruda, the world’s bestselling medicine was AbbVie’s Humira, a wonder drug that fights arthritis, Crohn’s disease and other inflammations. In 2020, AbbVie earned $16 billion in the US alone from Humira, and it was charging $77,000 a year for the drug, a 2021 congressional report said. Humira’s basic patent expired in 2016, but AbbVie obtained 132 other patents for administering and making the drug, essentially fortifying Humira’s exclusivity with a “patent thicket”. The last of these patents expires in 2034. US lawmakers baulked at the lingering high cost for Humira and sued AbbVie. The city of Baltimore alleged people were paying millions of dollars unnecessarily to AbbVie and that its patent strategy violated competition law. But in 2022, a US appeals court ruled for the company, saying there was nothing wrong with holding a lot of patents. Nevertheless the pharma industry is facing renewed political scrutiny for such tactics. Trump has railed against high drug prices. In the US, pharma companies have been able to keep rivals off the market by offering discounts to wholesalers and pharmacy benefit managers across a range of drugs in return for not carrying the cheaper rival to the now off-patent branded drug. Despite predictions of a dramatic drop in sales, the 2027-28 cliff could be more like a “steep hill”, says Frank Lichtenberg, professor of healthcare management at Columbia Business School. The blockbuster drugs going off patent are almost all biologics – infusions derived from biological, not chemical, processes – and they are harder to replicate than pills. Lichtenberg thinks it could take five years for sales to slump as much as 75 per cent, far longer than the months it took for some bestselling tablets to be replaced by generics last time. Biosimilars – generic versions of biologics – are harder to reverse engineer and are subject to different laws, which mean branded drugmakers only share broad information about the manufacturing process. When biosimilars get to market, US pharmacists cannot by law automatically swap them in as cheaper alternatives as they can with generics. And when they do, the price drops are not as steep. Lichtenberg estimates they sell for about half the price of the branded drug, rather than 10 or 20 per cent of the price for a generic. The US has been far slower than Europe in adopting biosimilars, but that may soon change. The US Food and Drug Administration (FDA) was already speeding up its process of approving biosimilars and a recent Trump executive order directed the regulator to find ways to accelerate approvals further. The Trump administration is also working on policies that would make it easier for pharmacists to substitute biosimilars for a branded drug as is already done in Europe. For companies such as Merck, all these potential policy changes only add to the uncertainty around how severe their patent cliff will be. It is going to be hard to find another drug that can treat so many patients – or generate so many billions. – Financial Times

Merck & Co Frequently Asked Questions (FAQ)

When was Merck & Co founded?

Merck & Co was founded in 1891.

Where is Merck & Co's headquarters?

Merck & Co's headquarters is located at 126 East Lincoln Avenue, Rahway.

What is Merck & Co's latest funding round?

Merck & Co's latest funding round is IPO.

Who are Merck & Co's competitors?

Competitors of Merck & Co include Kenvue, AbbVie, AstraZeneca, Daiichi Sankyo, Acadia and 7 more.

Loading...

Compare Merck & Co to Competitors

Sumitomo Pharma is a biopharmaceutical company focused on developing therapeutic and scientific breakthroughs. The company's main offerings include the development of novel cancer therapeutics and a robust pipeline of treatments aimed at addressing unmet clinical needs in oncology. Sumitomo Pharma was formerly known as Sumitomo Dainippon Pharma. It was founded in 1897 and is based in Osaka, Japan.

LifeArc operates as a self-financing medical research charity. The organization specializes in drug discovery, diagnostics development, antibody humanization, and intellectual property management, aiming to lab-based scientific discoveries into diagnostics, treatments, and cures. LifeArc collaborates with various sectors including the pharmaceutical industry, biotechnology sector, and academic institutions to develop and commercialize medical research. LifeArc was formerly known as MRC Technology. It was founded in 2000 and is based in London, United Kingdom.

Boehringer Ingelheim is involved in healthcare within the pharmaceutical and animal health sectors. The company conducts research and development of products for humans and animals. Boehringer Ingelheim serves the healthcare industry with an emphasis on pharmaceutical products. It was founded in 1885 and is based in Ingelheim am Rhein, Germany.

Pfizer is a biopharmaceutical company involved in the discovery, development, and manufacturing of medications and vaccines aimed at improving health outcomes. The company serves the healthcare sector with its medical solutions. It is based in Jakarta, Indonesia.

Cerba HealthCare provides medical diagnostics within the healthcare sector. It offers diagnostic services including proximity biology, specialty biology, clinical trial biology, anatomical and cytological pathology, medical imaging, and preventive biology. These services are used for the diagnosis and management of diseases. It was founded in 1967 and is based in Issy-les-Moulineaux, France.

Medicines for Malaria Venture is a product development partnership involved in antimalarial drug research and development within the healthcare sector. The company focuses on discovering, developing, and delivering malaria medicines for various populations, with the objective of addressing malaria. It serves the healthcare industry, concentrating on malaria in underserved populations. It was founded in 1999 and is based in Geneva, Switzerland.

Loading...