Mambu

Founded Year

2011Stage

Debt | AliveTotal Raised

$445.51MValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-2 points in the past 30 days

About Mambu

Mambu is a software-as-a-service (SaaS) company that focuses on providing a cloud banking platform within the financial services industry. The company offers a composable banking infrastructure that enables clients to create and manage lending and deposit services, as well as integrate with various application programming interfaces (APIs) for a customizable financial experience. Mambu primarily serves sectors such as banks, credit unions, and retailers looking to offer digital financial products. It was founded in 2011 and is based in Amsterdam, Netherlands.

Loading...

Mambu's Product Videos

ESPs containing Mambu

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

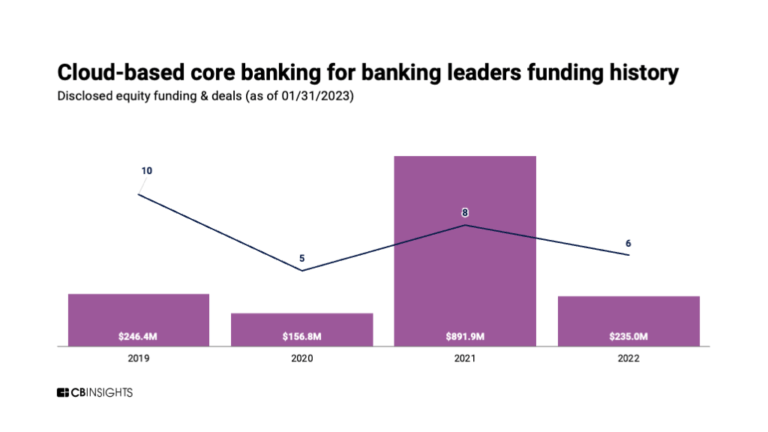

The lending APIs & infrastructure market provides end-to-end solutions for digital lending operations, including loan management systems, risk management tools, and compliance management capabilities. These platforms enable financial institutions to originate, process, and service loans through API-driven architecture that supports integration with existing systems. The market encompasses core ban…

Mambu named as Outperformer among 15 other companies, including Oracle, Fiserv, and FIS.

Mambu's Products & Differentiators

Mambu platform

A SaaS and cloud-native core banking platfrom

Loading...

Research containing Mambu

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Mambu in 4 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

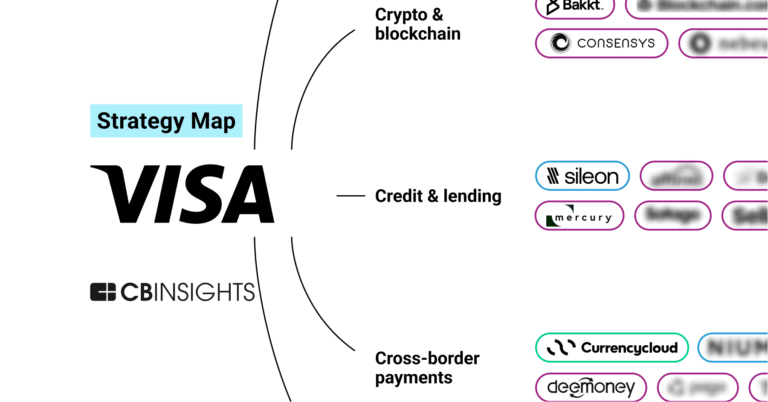

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market mapExpert Collections containing Mambu

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Mambu is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Digital Lending

2,567 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

13,978 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

1,124 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest Mambu News

Jul 1, 2025

1 Innovasjon Norge har valt Knowit och Mambu för att modernisera sin bankplattform, vilket markerar en viktig milstolpe i den digitala omvandlingen av offentliga finansiella tjänster. Den nya lösningen, som bygger på Mambus molnbaserade teknik och sömlöst integreras i det norska finansiella systemet av Knowit, kommer att optimera Innovasjon Norges låne-, bidrags- och garantifunktioner. Detta möjliggör ökad effektivitet och skalbarhet för organisationen och de företag den stödjer. Den nya lösningen kommer att optimera Innovasjon Norges låne-, bidrags- och garantifunktioner. Detta möjliggör ökad effektivitet och skalbarhet för organisationen och de företag den stödjer. Som Norges statligt ägda nationella utvecklingsbank spelar Innovasjon Norge en avgörande roll i att stödja innovation och näringslivsutveckling i alla delar av landet. För att möta sina kunders behov krävs en modern och skalbar lösning som ersätter den äldre bankplattform som idag hanterar kritiska funktioner såsom låneansökningar, produktkonfiguration, finansiering, kreditprocesser och ärendehantering. ”Innovasjon Norge har en viktig roll som industribank och stödjer norska företag genom att erbjuda ett komplett utbud av finansieringslösningar: risklån, marknadslån, garantier och bidrag. Vi ser fram emot att vidareutveckla våra tjänster tillsammans med Knowit och Mambu för att bygga en finansiell plattform som ska tjäna våra kunder under lång tid framöver”, säger Leon Bakkebø, EVP Banking & Financing på Innovasjon Norge. Den nya bankplattformen kommer att effektivisera manuella processer, förbättra datakvalitet och möjliggöra bättre insikter i realtid. Dessa förbättringar är i linje med Innovasjon Norges mål att öka digitalisering och operationell effektivitet. Knowit är huvudansvarig systemintegratör och kommer att säkerställa smidig implementering och integration i Norges finansiella ekosystem. ”Vi är stolta över att få stödja Innovasjon Norge i att förverkliga sina digitala mål. Tillsammans med Mambu levererar vi en lösning som automatiserar processer, förbättrar datastyrning och möjliggör realtidsinsikter – allt för att stärka Innovasjon Norges förmåga att stötta norska företag. Vi har redan idag omfattande erfarenhet av att implementera och modernisera finansiella lösningar i Norden, och har bland annat ett liknande projekt för Statens Pensjonskasse i Norge där leveransen beräknas vara på plats inom kort”, säger Jan Georg Lehmann, Chief Commercial Officer på Knowit Financial Solutions. Projektet löper över fyra år med möjlighet till årlig förlängning upp till totalt åtta år. Avtalet signerades tidigare i veckan och arbetet med att utveckla och förbättra den finansiella plattformen har redan påbörjats.

Mambu Frequently Asked Questions (FAQ)

When was Mambu founded?

Mambu was founded in 2011.

Where is Mambu's headquarters?

Mambu's headquarters is located at Piet Heinkade 55, Amsterdam.

What is Mambu's latest funding round?

Mambu's latest funding round is Debt.

How much did Mambu raise?

Mambu raised a total of $445.51M.

Who are the investors of Mambu?

Investors of Mambu include 4G Capital, EQT, Runa Capital, Acton Capital, Bessemer Venture Partners and 10 more.

Who are Mambu's competitors?

Competitors of Mambu include BackBase, M2P, FlexM, Sopra Banking Software, Zafin and 7 more.

What products does Mambu offer?

Mambu's products include Mambu platform.

Who are Mambu's customers?

Customers of Mambu include ABN Amro - New10, N26 and Cake bank.

Loading...

Compare Mambu to Competitors

Business Alliance Financial Services (BAFS) specializes in providing commercial lending software and services to financial institutions. Their main offerings include a cloud-based lending platform known as BLAST, along with a suite of services that support client onboarding, credit administration, and regulatory compliance. They also offer financial statement analysis, credit risk rating systems, and data analytics solutions to enhance the commercial lending process. It was founded in 2009 and is based in Monroe, Louisiana.

BrightFi is a financial technology company that provides digital banking services that help financial institutions and non-banks of all sizes who want to launch banking products, configure, test and deploy new products or digital brands at a fraction of the time and cost.

Lumin Digital offers a cloud-native platform that supports retail and commercial banking, as well as digital account opening, with tools for user engagement, administrative support, risk management, digital marketing, and data analytics. Lumin Digital serves banks and credit unions. It was founded in 2016 and is based in San Ramon, California.

Bankdata is a technology company in the financial sector, focusing on developing financial infrastructure solutions. The company provides software that supports banking activities for individuals and businesses, while ensuring the security and reliability of financial services. Bankdata primarily serves the banking industry, offering products that enhance user interfaces and accessibility for digital banking services. It was founded in 1966 and is based in Fredericia, Denmark.

Nymbus operates in the financial services industry and provides alternatives to traditional banking business models. The company offers products and solutions designed to enable financial institutions of all sizes to grow and serve their customers without the need for core conversion. Nymbus primarily caters to banks and credit unions looking to launch digital banking services, create niche financial brands, or deploy core banking platforms. It was founded in 2015 and is based in Jacksonville, Florida.

Abrigo focuses on providing software solutions in the financial sector. The company offers a range of products that help in lending, financial crime detection, risk management, and analytics. Its products are designed to assist in various aspects such as commercial lending, consumer lending, anti-money laundering, fraud detection, and portfolio risk management. Abrigo was formerly known as Sageworks. It was founded in 2000 and is based in Austin, Texas.

Loading...