Lydia

Founded Year

2013Stage

Series C | AliveTotal Raised

$260.33MValuation

$0000Last Raised

$100M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-100 points in the past 30 days

About Lydia

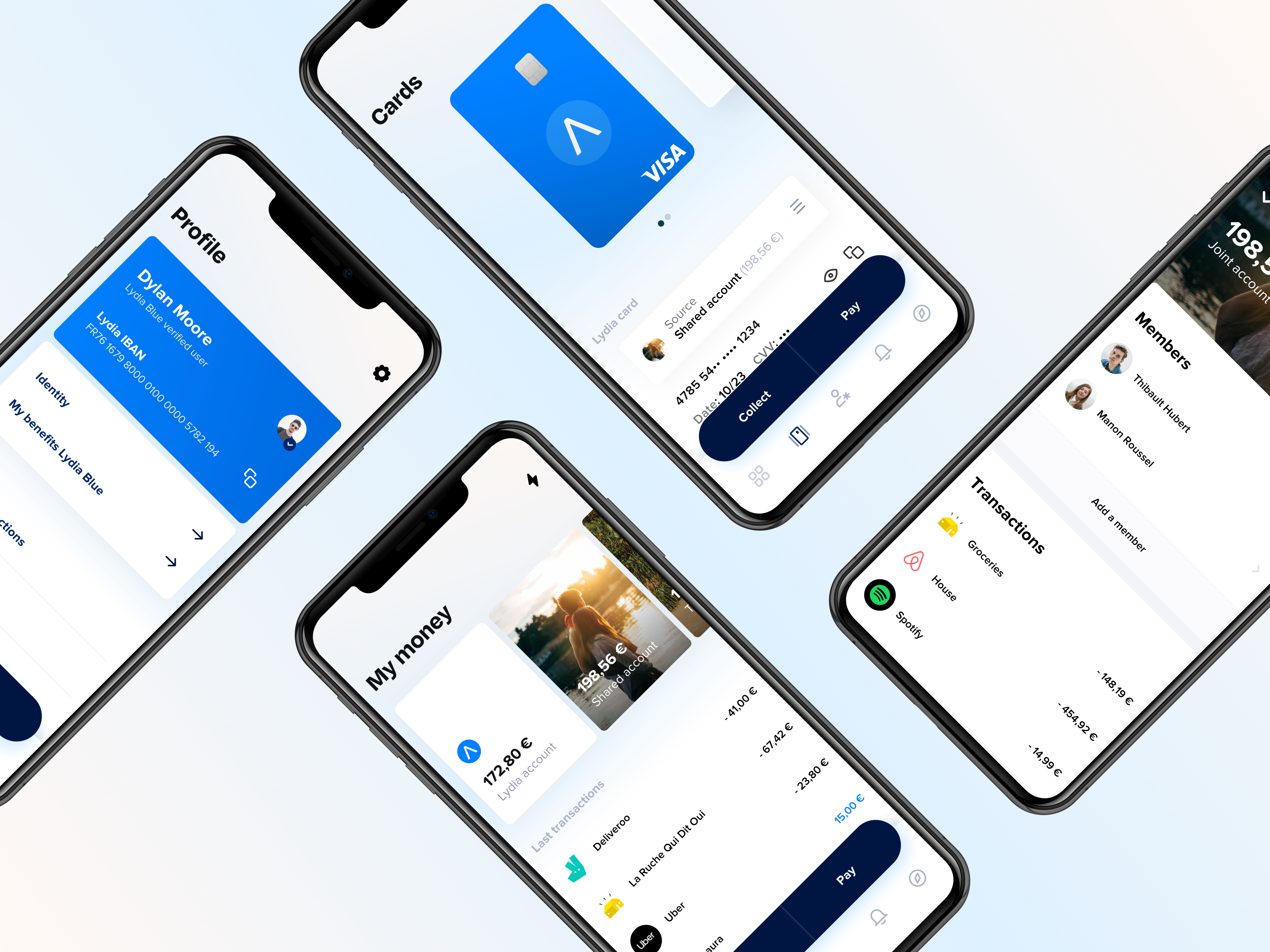

Lydia is a financial technology company that specializes in mobile and digital banking services. The company offers a range of products, including a digital current account, multi-account management, and tools for shared expenses, catering to the needs of modern consumers seeking efficient and secure online financial management. Lydia's services are designed to facilitate everyday banking, instant money transfers, and secure online payments without fees on international transactions. It was founded in 2013 and is based in Paris, France.

Loading...

Lydia's Product Videos

Lydia's Products & Differentiators

Lydia Free

A current account for occasional use

Loading...

Expert Collections containing Lydia

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Lydia is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,978 items

Excludes US-based companies

Digital Banking

1,153 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Lydia Patents

Lydia has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/28/2013 | 12/2/2014 | Grant |

Application Date | 6/28/2013 |

|---|---|

Grant Date | 12/2/2014 |

Title | |

Related Topics | |

Status | Grant |

Latest Lydia News

Jun 8, 2025

Sumeria lance les appels in-app pour lutter contre la fraude au faux conseiller bancaire 05/06/2025 Face à la recrudescence des fraudes par usurpation d’identité bancaire, Sumeria, l’application de services bancaires de Lydia Solutions, déploie une nouvelle fonctionnalité : les appels in-app. Cette technologie permet aux clients de dialoguer directement avec un conseiller depuis l’application, dans un environnement totalement sécurisé. La fraude au faux conseiller représente chaque année un préjudice estimé à 360 millions d’euros en France. En réponse, Sumeria renforce son arsenal de sécurité, déjà pionnier avec l’authentification silencieuse, en combinant ces deux dispositifs. « La sensibilisation ne suffit clairement plus face à la sophistication des nouvelles méthodes d’usurpation. Je suis fier que Sumeria soit le fer de lance de ce combat et j’invite toutes les banques opérant sur le territoire français à nous suivre dans la mise en œuvre de telles mesures, afin de relever collectivement le niveau de protection contre la fraude bancaire. » Un canal sécurisé impossible à imiter Avec ce nouveau système, un conseiller ne peut plus contacter un client que depuis l’application, rendant toute tentative de fraude externe identifiable. Un message clair est affiché : “Si vous recevez un sms ou un appel téléphonique au nom de Sumeria, c’est un fraudeur.” Cette initiative positionne Sumeria comme l’une des offres bancaires les plus sécurisées contre les fraudes basées sur la manipulation. À propos de Lydia Solutions Fondée en 2011, Lydia Solutions est l’entreprise française derrière les services Lydia (application de paiement et de cagnottes) et Sumeria (application de services bancaires pour les particuliers, notamment un compte courant rémunéré). Avec ses 250 collaborateurs basés à Paris, Nantes, Bordeaux et Lyon, Lydia Solutions s’est fixée pour mission de changer les codes de la banque avec une approche essentialiste qui vise l’épanouissement de ses clients. Acteur majeur du secteur de la finance technologique tricolore, listée dans le FT120, l’entreprise est soutenue par des investisseurs internationaux tels que Accel, Tencent, XAnge, New Alpha, Groupe Duval et Founders Future, auprès desquels elle a levé 235 M€.

Lydia Frequently Asked Questions (FAQ)

When was Lydia founded?

Lydia was founded in 2013.

Where is Lydia's headquarters?

Lydia's headquarters is located at 14 avenue de l'Opera, Paris.

What is Lydia's latest funding round?

Lydia's latest funding round is Series C.

How much did Lydia raise?

Lydia raised a total of $260.33M.

Who are the investors of Lydia?

Investors of Lydia include Tencent, Accel, Dragoneer Investment Group, Echo Street Capital, Founders Future and 10 more.

Who are Lydia's competitors?

Competitors of Lydia include Revolut, Monese, Monzo, Adro, Orange Bank and 7 more.

What products does Lydia offer?

Lydia's products include Lydia Free and 2 more.

Loading...

Compare Lydia to Competitors

Monzo engages as a digital bank that operates in the financial services sector, offering various banking products and services through its mobile app. The company provides personal and business accounts, savings and investment options, and credit and loan products. Monzo primarily serves individual consumers and businesses. Monzo was formerly known as Mondo. It was founded in 2015 and is based in London, United Kingdom.

Allica Bank specializes in financial services for established businesses and focuses on banking solutions within the financial sector. The company offers a range of products including business current accounts, savings accounts, asset finance, commercial mortgages, and growth finance. It caters primarily to small and medium-sized enterprises with a suite of financial products designed to meet their banking needs. Allica Bank was formerly known as Civilised Bank. It was founded in 2019 and is based in London, United Kingdom.

Bancacao is a developer of banking products. The company's Tzune is a digital financial services platform that offers fair, contactless, and personal solutions.

Bunq focuses on providing financial services. The company offers a range of banking products, including savings accounts, full bank accounts, and multi-currency banking, all accessible through a mobile application. Bunq primarily serves individual consumers and businesses looking for modern, hassle-free banking solutions. It was founded in 2012 and is based in Amsterdam, Netherlands.

Ant Group is involved in developing infrastructure and platforms for the service industry's digital transformation. The company provides access to financial and other services for consumers and small businesses. It was founded in 2004 and is based in Hangzhou, China.

Varo is a digital bank that provides financial services. The company offers savings accounts, credit-building tools, and borrowing options like cash advances and personal lines of credit. Varo primarily serves individuals seeking banking solutions. Varo was formerly known as Ascendit Holdings. It was founded in 2015 and is based in San Francisco, California.

Loading...