LaunchDarkly

Founded Year

2014Stage

Series D | AliveTotal Raised

$330.34MValuation

$0000Last Raised

$200M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-21 points in the past 30 days

About LaunchDarkly

LaunchDarkly specializes in feature management for software development within the technology sector. It offers a platform for development teams to control software releases for software delivery. The company primarily serves sectors such as financial services, healthcare, and government, providing solutions that cater to developers, product managers, and mobile application teams. It was founded in 2014 and is based in Oakland, California.

Loading...

ESPs containing LaunchDarkly

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The A/B testing software market enables businesses to test variations of digital experiences, features, and content to optimize conversion rates and user engagement. These platforms provide capabilities for running controlled experiments across websites, mobile apps, and product features, including split testing, multivariate testing, and feature flag management. Solutions typically offer visual e…

LaunchDarkly named as Leader among 10 other companies, including Amplitude, Wingify, and Statsig.

Loading...

Research containing LaunchDarkly

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned LaunchDarkly in 2 CB Insights research briefs, most recently on Sep 29, 2023.

Sep 29, 2023

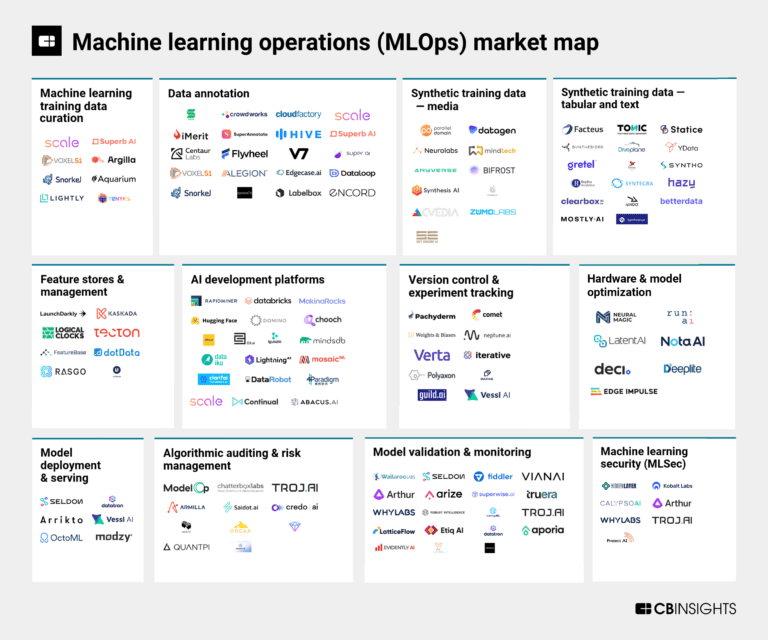

The machine learning operations (MLOps) market mapExpert Collections containing LaunchDarkly

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

LaunchDarkly is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Artificial Intelligence

10,047 items

Latest LaunchDarkly News

Jul 3, 2025

The Latest 20VC + SaaStr: Rule of 80, 9-Figure Zombies, and the Death of Predictable Venture Math Like Read Time: min We’re back on 20VC, with Harry, Rory from Scale and SaaStr’s Jason Lemkin. On on Figma’s IPO, the AI transformation deadline, and why most B2B companies are already too late. The Bottom Line Up Front Jason’s Rule: “If you haven’t grown because of AI, you’ve failed.” After 18 months since ChatGPT launched, if your B2B company hasn’t re-accelerated growth through AI by June 30th, 2025, you’re likely irrelevant. Oracle did it. Intercom did it. If you’re still “working on it,” you’re already dying. Rory’s Reality: “Large amounts of money don’t change people as much as they reveal what they really are.” The AI investment boom ($300-400B annually) may not yield economically rational returns, and we’re seeing the inevitable outcome of fewer, bigger winners reshaping venture entirely. Harry’s Humility: “I think we overestimate our ability to predict our winners.” None of his Fund I predicted winners became actual fund returners, fundamentally challenging reserve allocation models and forcing brutal honesty about early-stage investing. Figma’s Phenomenal IPO Numbers The episode opens with Figma’s S-1 filing revealing truly impressive metrics: $821M revenue (46% YoY growth) $1.5B cash, no debt Rule of 80+ (growth rate + margins) Rory’s take: “This is just games to figure out what the model is going to be – $20B, $25B, or $30B?” The company is clearly tracking toward a billion-dollar revenue run rate with exceptional unit economics. 🚨 FIGMA S-1 DROPPED 🚨 The Adobe Acquisition That Got Away Remember when everyone mocked Adobe for “overpaying” at $20B? Fast forward to today’s likely $25-30B IPO valuation, and Scott Belsky looks prescient. Key insight: Adobe should have been patient and paid “two years ahead” for a winner. The synergies would have made it a stellar deal, especially given Figma’s expansion beyond designers – 30% of users are now developers. Jason’s brutal assessment: “Scott Belsky’s gone now [Adobe’s ex-CPO]. It’s always weird when you do M&A and it’s driven by an SVP or other non-founder, because there’s a good chance you outlast them as a founder.” The Venture Partner Orphan Problem The conversation reveals a critical issue plaguing venture today: partner turnover orphaning portfolio companies. The problem: When your champion leaves the firm, “your ability to get something done in that venture firm goes down.” Even if they keep their board seat, they’re “useless” because they’re no longer “in the room where the money is allocated.” Jason’s solution: Some firms have different partners make reserve decisions to avoid emotional attachment to underperforming investments. But this creates its own problems – the new decision-maker lacks historical context. Reserve Allocation Reality Check Harry’s brutal honesty: Looking at his Fund I, “none of the five I had as fund returners are actual fund returners, and the five that will be, I never had as fund returners.” This challenges the entire reserve model at seed/Series A stages. When you can’t predict winners, you end up allocating reserves to “fastest growing companies” – essentially “triple digits growth, double digits per month. That’s it. What do they do again? SaaS for haircuts? I’m in.” Index’s $3.5B Liquidity Bonanza Between Figma and Scale, Index is returning $3.5B to LPs in a compressed timeframe. This exemplifies the “fewer, bigger winners” trend reshaping venture returns. Rory’s observation: “Instead of getting $400-500M, you’re returning $2B+. It’s the inevitable outcome of concentration and longer holding periods.” The new math: Only firms like Founders Fund and Index are achieving 3x DPI on large fund sizes. For LPs, if you’re in Kleiner, Index, and Sequoia, “you’re getting a lot of money back.” Index is the most underrated firm in venture right now. They have returned $8.78BN+ on 3 deals in the last 6 months: Figma: 16.8% (potential $25BN IPO): $4.2BN Wiz: 12-13% ($32BN acquisition): $4BN Scale AI: 2% ($29BN post money acquisition price): $580M Total: $8.78BN (wow… pic.twitter.com/ka0zAj7RrN Melio’s “Discouraging” $2.5B Exit Despite Harry calling it “encouraging,” Jason found Melio’s acquisition “discouraging”: $153M ARR with a trailing 127% CAGR (!) Sold for $2.5B (13-14x revenue) Why sell at that growth rate? The deal reveals the messy reality of 2021 vintage investing. Melio had raised at a $4.5B valuation with a ~$600m+ preference stack. Late-stage investors were happy to get 1x back. Key insight: This creates “weird dynamics” on boards – some investors are “blankly indifferent” while early investors and founders care deeply about the difference between $1.5B and $2B. Jason’s liberating perspective: “No one who wrote a check in 2021 at $4B is going to stop a 1x exit. They’ll be grateful to get their money back.” M&A Is Back! Melio’s $2.5B Exit to Xero — In Just 7 Years! The AI Transformation Deadline: June 30th, 2025 Jason’s Harsh Reality “My rule is if you haven’t grown because of AI yet, you’ve failed. You had 18 months since ChatGPT launched to do this. If you didn’t get it done in these 18-20 months, be honest about if you ever will.” Examples of success: Vlex: 25-year-old Spanish legal company became AI-relevant, acquired by Clio for $1B Oracle: “0 to $50M in 12 months” – if Oracle can become AI-native, what’s your excuse? The AI Native Advantage Harry’s portfolio includes a company that will exceed Superhuman’s revenue in 9 months – what took Superhuman 8 years to build. “The benefits and tailwinds from being AI-first versus layering on is massive.” The brutal math: With growth rates flat across 300+ B2B companies despite AI investment, it’s net-zero sum. “If you haven’t pulled yourself out by now, you might be utterly irrelevant.” The $300-400B AI Investment Question Rory’s heretical question: “Will you get the ROI? Will it be an economically rational decision when you look back 2-3 years from now?” The staggering CapEx investment ($300-400B annually) is turning “Warren Buffett’s idea of a dream business into a cash incineration machine.” Two definitions of “economically rational”: Boring accountant logic: Positive NPV Game theory logic: “I got to show up at the party with AGI. Otherwise I won’t get invited.” Meta’s $100M talent acquisitions: Will concentrated wealth ($100M packages) demotivate AI researchers? As Rory notes, “large amounts of money reveal what you really want to do.” The Death of Mid-Market SaaS The 9-Figure Zombie Problem Too small for IPOs in the new market Too expensive for PE at current multiples Struggling to find strategic buyers Jason’s portfolio reality: Two companies got “mediocre M&A offers” recently. When asked about PE interest: “No one’s contacted them. Like, ever.” Constellation Software’s 2X Model The roll-up company openly advertises “2X revenue” acquisitions. Their SaaStr presentation was essentially titled “2X. Who wants 2X? Show up 2 p.m. on the West Lawn.” The cruel math: Everyone’s rationalized away 2021 valuations, but sellers want 5x-6x while low-end buyers like Constellation still think assets are only worth 2x. Scale’s Acquisition Creates a Data Gold Rush Meta’s Scale acquisition has “allocated out” roughly $1B in revenue to competitors like Surge AI, which quietly built to $1B revenue with a one-page website and no VC funding. Surge’s badass minimalism: “The quality of your data determines the ceiling of your ambitions.” Four paragraphs. That’s it. When you only have seven desperate customers each spending $100M+, you don’t need sales and marketing. Edwin C’s founder story: “Founded in 2020, quietly gets to a billion” while everyone obsessed over Scale’s $14B+ pay out. The Great Founder Exodus of 2025 CEO Turnover Hits Records LaunchDarkly CEO quits to run Asana Cursor raising at $28B valuation The exhaustion factor: What looked like a “4-6 year journey” became “12-13 years.” For founders, that’s potentially half their working life before an exit. Rory’s empathy: “Sometimes you have to re-incentivize founders. Sometimes you have to accept that a transition is appropriate.” CEO Resignations Are Up 24%. And At An All-Time High. Winner-Take-Most Economics The extreme concentration at the top creates “weird deal hopping.” When only 0.0000001% outcomes matter, even being 10th doesn’t look as good as being 5th. The PGA analogy: Win the tournament, get $5M. Finish 20th-50th, you’re “barely scraping along covering expenses.” Key Takeaways for B2B Leaders 1. The AI Deadline Has Passed If you’re still “working on AI strategy” in late 2025, you’ve missed the window. Oracle figured it out. Intercom figured it out. You had 18 months. More here. 2. Reserve Allocation is Broken You can’t predict winners at early stages. Harry’s fund returners weren’t his predicted winners, and vice versa. This challenges fundamental VC math. 3. Exit Expectations Need Reality Checking For 9-figure revenue companies with mediocre growth, 2x-5x outcomes may be the new normal. The days of 10x+ exits for everything are over. 4. LP Math is Unforgiving LPs “know the exact amounts of how all this capital has to play out.” They understand the risks and the need for huge outcomes. No one’s getting fooled by vanity metrics. 5. Founder Mental Health Matters The journey is longer and harder than expected. Having honest conversations about transitions, incentives, and burnout isn’t weakness – it’s strategic planning. The Most Quotable Moments Jason on AI urgency: “If Oracle can get AI native by June 30th and your startup can’t, I mean, I’ll smile, but I’d give up.” Rory on big money: “Large amounts of money don’t change people as much as they reveal what they really are.” Harry on fund returners: “I think we overestimate our ability to predict our winners.” Jason on Atherton mansions: “The massive pad in Atherton is like almost 100% correlation to decline in revenue.” This breakdown captures the brutal honesty and practical insights that make Jason, Harry, and Rory’s conversation essential listening for anyone in B2B SaaS. The AI transformation window has closed, the math on exits has changed, and only the brutally honest will survive the next phase of the market.

LaunchDarkly Frequently Asked Questions (FAQ)

When was LaunchDarkly founded?

LaunchDarkly was founded in 2014.

Where is LaunchDarkly's headquarters?

LaunchDarkly's headquarters is located at 1999 Harrison Street, Oakland.

What is LaunchDarkly's latest funding round?

LaunchDarkly's latest funding round is Series D.

How much did LaunchDarkly raise?

LaunchDarkly raised a total of $330.34M.

Who are the investors of LaunchDarkly?

Investors of LaunchDarkly include Uncork Capital, Threshold Ventures, Bloomberg Beta, Bessemer Venture Partners, Heavybit and 26 more.

Who are LaunchDarkly's competitors?

Competitors of LaunchDarkly include Statsig, UserTesting, AB Tasty, Split Software, CloudBees and 7 more.

Loading...

Compare LaunchDarkly to Competitors

ConfigCat is a developer-centric feature flag service in the software development industry. The company offers a platform for managing feature toggles and configurations, enabling real-time feature rollouts and updates across various platforms without redeploying code. ConfigCat supports a range of integrations and programming languages, providing tools for A/B testing, user segmentation, and compliance with GDPR and ISO 27001 standards. It was founded in 2018 and is based in Budapest, Hungary.

Unleash provides a feature management platform designed for large enterprises and operates within the software development industry. The company offers a system that enables scalable, secure, and private feature flag management, allowing businesses to deploy software features safely and efficiently. Unleash primarily serves the needs of developers and enterprises by providing tools for feature rollout strategies, instant rollbacks, and kill switches while ensuring data governance and compliance with security standards. It was founded in 2019 and is based in Oslo, Norway.

Kameleoon specializes in web and feature experimentation as well as AI-driven personalization within the digital optimization sector. Its main offerings include a unified platform that facilitates A/B testing, feature management, and personalized user experiences based on visitor behavior. Kameleoon primarily serves medium and enterprise-sized companies looking to enhance visitor engagement and drive growth. It was founded in 2012 and is based in New York, New York.

Statsig operates as a product development platform that focuses on experimentation, analytics, feature management, and user engagement tools. The company offers products for running experiments, managing feature rollouts, analyzing product data, and observing user interactions through session replays. Statsig serves sectors such as artificial intelligence, gaming, and e-commerce. It was founded in 2021 and is based in Bellevue, Washington.

PostHog provides a platform for product development and analytics within the software industry. Its offerings include product analytics, session replay, feature flags, error tracking, and tools for conducting experiments and surveys. PostHog serves various sectors that require product analytics and feature management solutions. PostHog was formerly known as Hiberly. It was founded in 2020 and is based in San Francisco, California.

Taplytics specializes in testing and feature management solutions for digital products. It offers a suite of tools that enable product, engineering, and marketing teams to conduct experiments and manage feature rollouts across web, mobile, and other platforms. The company primarily serves sectors such as finance and insurance, retail and e-commerce, media and entertainment, and food and quick service restaurants. It was founded in 2013 and is based in Toronto, Canada.

Loading...