Jeito Capital

Founded Year

2017Stage

Corporate Minority | AliveTotal Raised

$59.12MLast Raised

$59.12M | 5 yrs agoAbout Jeito Capital

Jeito Capital is a biotechnology investment firm focused on financing medical innovations with a patient benefit approach. The company supports entrepreneurs through its team of experts across the drug development value chain and capital investments to ensure business growth. Jeito Capital aims to assist in the development of treatments in specific therapeutic areas and facilitate the market entry of new treatments. It was founded in 2017 and is based in Paris, France.

Loading...

Loading...

Research containing Jeito Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Jeito Capital in 1 CB Insights research brief, most recently on Jun 13, 2025.

Jun 13, 2025

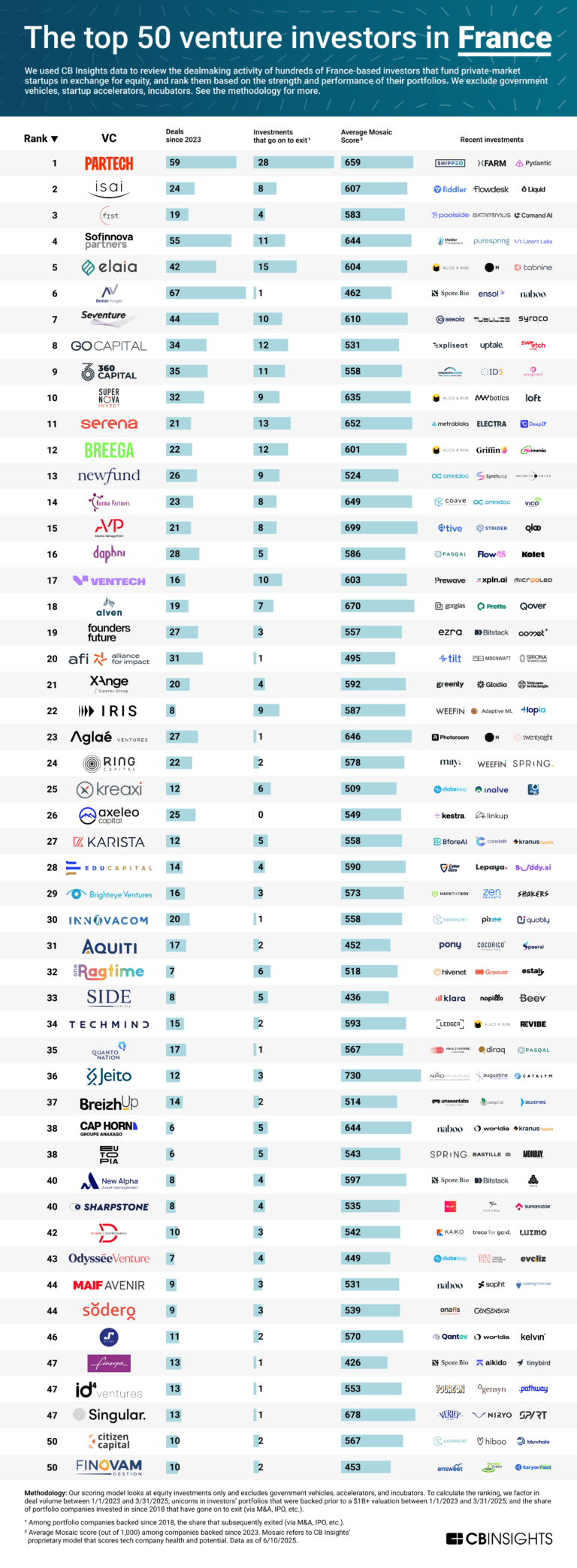

The top 50 venture investors in FranceLatest Jeito Capital News

Jun 5, 2025

Jeito names Pascal Touchon as operating partner Plus: Co-founder, CBO Grimaud leaving Valneva and new CMO for Context Therapeutics By BioCentury Staff June 5, 2025 12:17 AM UTC European venture firm Jeito Capital named Pascal Touchon as its newest operating partner. Touchon, a former CEO of cell therapy company Atara Biotherapeutics Inc. (NASDAQ:ATRA), remains that company’s chairman. He represents Jeito on the board of Catalym GmbH, and holds board seats at Ipsen Group (Euronext:IPN; Pink:IPSEY), Medincell S.A. (Euronext:MEDCL) and CDR-Life Inc. Vaccine developer Valneva SE (Euronext:VLA; NASDAQ:VALN) said co-founder and CBO Franck Grimaud will leave the company June 25. Grimaud has been with Valneva and predecessor company Vivalis S.A. for 26 years; Valneva was formed via the 2012 merger of Vivalis with Intercell AG... BCIQ Company Profiles

Jeito Capital Frequently Asked Questions (FAQ)

When was Jeito Capital founded?

Jeito Capital was founded in 2017.

Where is Jeito Capital's headquarters?

Jeito Capital's headquarters is located at 33 rue Lafayette, Paris.

What is Jeito Capital's latest funding round?

Jeito Capital's latest funding round is Corporate Minority.

How much did Jeito Capital raise?

Jeito Capital raised a total of $59.12M.

Who are the investors of Jeito Capital?

Investors of Jeito Capital include Sanofi.

Who are Jeito Capital's competitors?

Competitors of Jeito Capital include Abingworth and 5 more.

Loading...

Compare Jeito Capital to Competitors

Catalio Capital Management is a multi-strategy investment firm that invests in biomedical technology and healthcare companies. The firm engages in various investment strategies, including private equity investments in biomedical technology companies, senior-secured financing, a long bias, fundamental equity long/short strategy in global healthcare equities, and co-investment opportunities for limited partners. The firm invests in drugs, devices, diagnostics, and data within the healthcare sector. It was founded in 2020 and is based in Baltimore, Maryland.

Gershon Capital specializes in venture capital funding and strategic advisory within the life sciences and healthcare technology sectors. The company offers capital investment, FDA regulatory services, clinical trial design, and commercialization support for emerging healthcare and life science companies, leveraging advancements in AI and ML technologies. Gershon Capital primarily serves startups and growth-stage companies in the healthcare technology, biotechnology, and life sciences industries. It was founded in 2009 and is based in Switzerland.

Light Curve Capital focuses on leveraging advances in data sciences and computational methods to impact the life sciences sector. It specializes in identifying, investing in, and supporting assets and companies within the life sciences domain. The firm is equipped with a team that possesses deep domain knowledge and operational expertise to back technologies and therapeutic areas anticipated to transform life sciences. It is based in South Salem, New York.

MVM Partners operates as an investment firm. It focuses on high-growth healthcare businesses in various sectors, including medical technology, pharmaceuticals, and diagnostics. The firm provides growth equity to commercial-stage businesses and supports the development and market entry of healthcare products and technologies. MVM Partners collaborates with management teams to drive growth, make strategic acquisitions, and establish new standards of care in medicine. It was founded in 1997 and is based in London, United Kingdom.

Aegis Ventures is a startup studio focused on originating, launching, and scaling companies across various sectors. The company partners with entrepreneurs and industry leaders to provide ideas, capital, and expertise to address societal problems. Aegis Ventures primarily targets sectors such as health, data, and digital technologies. It was founded in 2020 and is based in New York, New York.

Axil Capital is a venture capital firm specializing in investments in the biomedical and healthcare technology sectors. It focuses on funding and supporting the growth of early-stage ventures, providing financial resources and strategic guidance. Axil Capital primarily serves the life sciences and healthcare industries, facilitating the development and expansion of innovative companies within these sectors. The company was founded in 2017 and is based in Tokyo, Japan.

Loading...