Investments

237Portfolio Exits

69Funds

8Partners & Customers

3About IRIS

IRIS is a venture capital firm that provides funding and support to technology companies at various stages of their growth, including early stage funding (seed and Series A investments) and late-stage capital. The firm also offers sector-specific expertise and mentorship to assist entrepreneurs. IRIS was formerly known as Iris Capital. It was founded in 1986 and is based in Paris, France.

Research containing IRIS

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned IRIS in 1 CB Insights research brief, most recently on Jun 13, 2025.

Jun 13, 2025

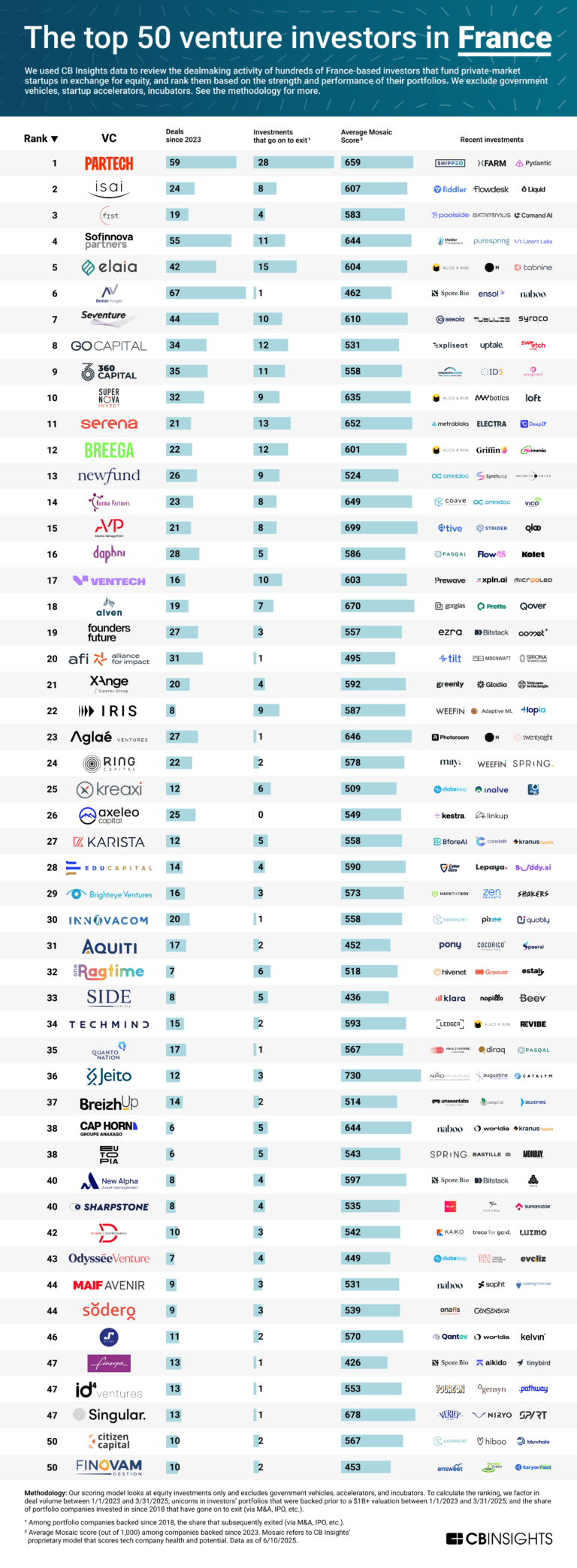

The top 50 venture investors in FranceLatest IRIS News

Jun 5, 2025

Partager | 344 mots ©Adobe Stock La fintech néerlandaise spécialisée dans la sécurité des paiements, comptant Iris à son capital depuis 2021, est rachetée par... Issu d'une banque, SurePay est désormais racheté par un gros fonds américain. Le VC franco-germanique Iris qui a participé à son développement trouve ainsi une sortie largement positive, mais ne donne toutefois pas plus de détail. Née en 2016 au (...) Cet article est réservé à nos abonnés. 83% reste à lire Pour accéder à cet article, à l'ensemble du site ainsi qu'à nos bases de données, découvrez nos formules d'abonnement .

IRIS Investments

237 Investments

IRIS has made 237 investments. Their latest investment was in Weefin as part of their Series B on March 31, 2025.

IRIS Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

3/31/2025 | Series B | Weefin | $27.05M | No | 2 | |

1/30/2025 | Seed VC - II | Nala Earth | $3.95M | Yes | Founderful, Kompas, and Pale Blue Dot | 2 |

1/28/2025 | Seed VC | Hopia | $3.54M | Yes | Kurma Partners, and Undisclosed Angel Investors | 2 |

3/11/2024 | Seed VC | |||||

11/27/2023 | Series A |

Date | 3/31/2025 | 1/30/2025 | 1/28/2025 | 3/11/2024 | 11/27/2023 |

|---|---|---|---|---|---|

Round | Series B | Seed VC - II | Seed VC | Seed VC | Series A |

Company | Weefin | Nala Earth | Hopia | ||

Amount | $27.05M | $3.95M | $3.54M | ||

New? | No | Yes | Yes | ||

Co-Investors | Founderful, Kompas, and Pale Blue Dot | Kurma Partners, and Undisclosed Angel Investors | |||

Sources | 2 | 2 | 2 |

IRIS Portfolio Exits

69 Portfolio Exits

IRIS has 69 portfolio exits. Their latest portfolio exit was SurePay on June 03, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

6/3/2025 | Shareholder Liquidity | 1 | |||

11/19/2024 | Acquired | 1 | |||

11/18/2024 | Acquired | 3 | |||

Date | 6/3/2025 | 11/19/2024 | 11/18/2024 | ||

|---|---|---|---|---|---|

Exit | Shareholder Liquidity | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 1 | 1 | 3 |

IRIS Acquisitions

5 Acquisitions

IRIS acquired 5 companies. Their latest acquisition was Jedox on January 12, 2021.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

1/12/2021 | Other Venture Capital | $27.77M | Acq - Fin | 19 | ||

6/1/2012 | ||||||

6/1/2009 | ||||||

4/3/2007 | Other Venture Capital | |||||

1/1/2003 |

Date | 1/12/2021 | 6/1/2012 | 6/1/2009 | 4/3/2007 | 1/1/2003 |

|---|---|---|---|---|---|

Investment Stage | Other Venture Capital | Other Venture Capital | |||

Companies | |||||

Valuation | |||||

Total Funding | $27.77M | ||||

Note | Acq - Fin | ||||

Sources | 19 |

IRIS Fund History

8 Fund Histories

IRIS has 8 funds, including IRIS Fund IV.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

12/7/2022 | IRIS Fund IV | $116.06M | 2 | ||

6/21/2017 | IrisNext | ||||

4/30/2012 | Iris Capital Fund III | ||||

4/1/2012 | OP Ventures Global | ||||

7/31/2011 | STC Ventures |

Closing Date | 12/7/2022 | 6/21/2017 | 4/30/2012 | 4/1/2012 | 7/31/2011 |

|---|---|---|---|---|---|

Fund | IRIS Fund IV | IrisNext | Iris Capital Fund III | OP Ventures Global | STC Ventures |

Fund Type | |||||

Status | |||||

Amount | $116.06M | ||||

Sources | 2 |

IRIS Partners & Customers

3 Partners and customers

IRIS has 3 strategic partners and customers. IRIS recently partnered with Bridgestone on January 1, 2019.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

1/16/2019 | Partner | Japan | Bridgestone EMEA and Iris Capital announce a corporate venture partnership - News - Iris Capital Commented Paolo Ferrari President and CEO of Bridgestone and Executive Vice President of the Bridgestone , `` This corporate venture partnership with Iris Capital will allow us to accelerate our strategy while supporting start-ups and exploring new and disruptive models in the mobility eco-system '' . | 2 | |

2/7/2015 | Partner | ||||

3/14/2013 | Partner |

Date | 1/16/2019 | 2/7/2015 | 3/14/2013 |

|---|---|---|---|

Type | Partner | Partner | Partner |

Business Partner | |||

Country | Japan | ||

News Snippet | Bridgestone EMEA and Iris Capital announce a corporate venture partnership - News - Iris Capital Commented Paolo Ferrari President and CEO of Bridgestone and Executive Vice President of the Bridgestone , `` This corporate venture partnership with Iris Capital will allow us to accelerate our strategy while supporting start-ups and exploring new and disruptive models in the mobility eco-system '' . | ||

Sources | 2 |

IRIS Team

11 Team Members

IRIS has 11 team members, including current Chief Financial Officer, Guy Canali.

Name | Work History | Title | Status |

|---|---|---|---|

Guy Canali | Chief Financial Officer | Current | |

Name | Guy Canali | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Chief Financial Officer | ||||

Status | Current |

Loading...