Insitro

Founded Year

2018Stage

Series C | AliveTotal Raised

$643MLast Raised

$400M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+45 points in the past 30 days

About Insitro

Insitro is a data-driven drug discovery and development company that utilizes machine learning and high-throughput biology. The company has a machine learning platform that combines in vitro cellular data with human clinical data to identify insights and interventions in metabolism, oncology, and neuroscience. Insitro's approach uses technology to model disease states and design therapeutic interventions. It was founded in 2018 and is based in South San Francisco, California.

Loading...

Insitro's Products & Differentiators

Statistical genetics

ML-enabled statistical genetics to discover targets and patient segments

Loading...

Research containing Insitro

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Insitro in 3 CB Insights research briefs, most recently on Mar 11, 2025.

Expert Collections containing Insitro

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Insitro is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

AI 100 (All Winners 2018-2025)

200 items

Digital Health 50

300 items

The most promising digital health startups transforming the healthcare industry

Digital Health

11,408 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Drug Discovery Tech Market Map

221 items

This CB Insights Tech Market Map highlights 220 drug discovery companies that are addressing 12 distinct technology priorities that pharmaceutical companies face.

Artificial Intelligence

10,047 items

Insitro Patents

Insitro has filed 26 patents.

The 3 most popular patent topics include:

- biotechnology

- molecular biology

- transcription factors

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/24/2024 | 3/25/2025 | Genetics, Biological databases, Bioinformatics, Rare diseases, Molecular biology | Grant |

Application Date | 4/24/2024 |

|---|---|

Grant Date | 3/25/2025 |

Title | |

Related Topics | Genetics, Biological databases, Bioinformatics, Rare diseases, Molecular biology |

Status | Grant |

Latest Insitro News

Jun 20, 2025

A dismal investment climate for publicly traded biotech companies is causing startups and their backers to tighten their belts, investors and analysts say. Published June 20, 2025 AdrlnJunkie via Getty Images Biotechnology industry watchers were hopeful at the start of 2025. Venture funding appeared to be rebounding after a lengthy slump, and a smattering of new stock offerings and company acquisitions brewed optimism that the public markets might be similarly warming up to young drugmakers. But the positivity quickly dissipated. Trump administration policies gutted scientific research funding and raised questions about U.S. drug prices. Large layoffs and upheaval at public health agencies created regulatory turmoil that added risk to what’s already, by its nature, a risky sector to invest in. The results were laid out in a June report from David Windley and Tucker Remmers, two analysts at the investment bank Jefferies. According to that report, funding in public biotech companies — be it from initial public offerings, follow-on stock offerings, or “PIPE” deals — plummeted in May. The “political and economic uncertainties” have "cast a cloud over biotech investment,” they wrote. “Since product development cycles can range 12-15 years in this industry, biotechs (and their boards and investors) want clarity on FDA regulation, drug pricing, and funding before committing to large, [long-term] investments,” Windley and Remmers wrote. Investors and industry insiders interviewed by BioPharma Dive say that the public slowdown is trickling down to startups that have already been under intense pressure during a prolonged pullback. Companies and investors are struggling to align on valuations , making funding rounds more difficult to close than in prior years. The uphill battle in the public markets is further delaying IPO plans, too. "People are waiting to see what happens, and it's extended that winter," said Tim Scott, the president of Biocom California, an industry trade group. To date, only seven biotech companies have priced IPOs in 2025 , and no large offerings have occurred since mid-February. No biotechs have publicly disclosed IPO ambitions in several months either, and one of the last to do so, Odyssey Therapeutics, pulled its offering in May. In a letter to the Securities and Exchange Commission, CEO Gary Glick wrote that it was “not in the best interests of the company” to go public at that time. One reason IPOs have ground to a halt, experts say, is that the public markets aren’t rewarding drug startups as predictably as they once were. Typically, drug companies can expect their value to climb after delivering positive clinical results. But “even companies with good data aren’t seeing a lot of movement in the public markets,” said Jonathan Norris, a managing director at HSBC Innovation Banking. As a result, Norris said, companies are looking at the time and expense it takes in the monthslong process to go public and wondering: “What’s the benefit?” “If you have any readouts that are even eye squinting, you’re going to get crushed,” he said. “It’s a tough, tough endeavor.” The shuttered IPO window is exacerbating problems for young biotechs. "If you don't have a public market opportunity, then the companies that are private have to think about ways to raise capital and stay private for longer," said Maina Bhaman, a partner at Sofinnova Partners. Feeling that burden, venture investors are becoming more conservative. While private funding hasn’t plummeted as much as its public counterpart, investors are more selective and slower-moving. Funding has become increasingly consolidated into fewer and larger “megarounds,” to the extent that more firms are compiling similar portfolios. And they’re hard to finalize, even when most of a funding syndicate is already onboard, according to Norris. "People are struggling to figure out where the bottom of the market is and what's the appropriate valuation and expectation for that investment,” he said. "A lot of VCs are pencils down right now on deals they would otherwise be moving forward on,” Scott added. Pullbacks are nothing new in biotech. But what has been unusual, some say, is how long the sector has spent in the doldrums after peaking in early 2021. One reason is the most recent boom flooded the market with more companies than it could support. But another is that the ensuing correction has intensified amid regulatory and political upheaval. A report last week from Roel van den Akker, PwC’s U.S. pharma and life science deals leader, predicted that companies will be “preparing contingency plans” to account for delays in “trial oversight” and drug applications. Drug companies are used to dealing with a high level of risk, as most experimental medicines never make it to market. But “now you've got a lot more macro uncertainty that is being layered on top," Bhaman said. On the public side, that uncertainty has resulted in less patient investors , some of whom are pressing company boards to shut down after setbacks rather than change course. But some startups are taking drastic steps, too, such as cutting programs and staff to, some experts believe, depress their value so they can still attract investment. The "lack of surety" is pressuring biotechs to be as efficient as possible with their cash, Scott said, perhaps working on one program instead of a few. There have been multiple high-profile examples of late. Eikon Therapeutics and Insitro , two well-funded startups, both cited a need for “ prudence ” in laying off staff. Norris expects more companies to proactively cut staff, or even close, as the longer-than-expected winter drags on. “Most of those companies are not going to find the investors that they're hoping for,” he said. “And I think that's just the unfortunate truth.”

Insitro Frequently Asked Questions (FAQ)

When was Insitro founded?

Insitro was founded in 2018.

Where is Insitro's headquarters?

Insitro's headquarters is located at 279 East Grand Avenue, South San Francisco.

What is Insitro's latest funding round?

Insitro's latest funding round is Series C.

How much did Insitro raise?

Insitro raised a total of $643M.

Who are the investors of Insitro?

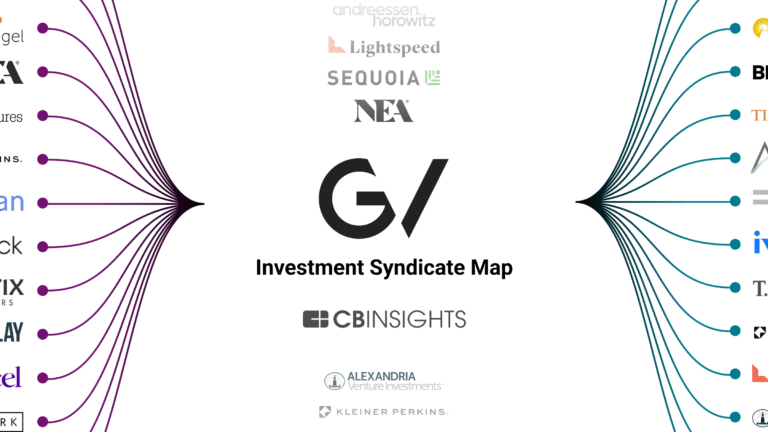

Investors of Insitro include Third Rock Ventures, Alexandria Venture Investments, ARCH Venture Partners, Andreessen Horowitz, Foresite Capital and 15 more.

Who are Insitro's competitors?

Competitors of Insitro include Healx, Atomwise, Noetik, BioSymetrics, Exscientia and 7 more.

What products does Insitro offer?

Insitro's products include Statistical genetics and 2 more.

Loading...

Compare Insitro to Competitors

Atomwise develops machine learning-based discovery engines and uses artificial intelligence (AI)-based neural networks to help discover new medicines. It predicts drug candidates for pharmaceutical companies, start-ups, and research institutions and designs drugs using computational drug design. It was formerly known as Chematria. The company was founded in 2012 and is based in San Francisco, California.

Aria Pharmaceuticals operates as a preclinical-stage pharmaceutical company that focuses on the discovery and development of novel, small-molecule therapies in the pharmaceutical industry. The company's main service is the development of new treatments for complex and hard-to-treat diseases using its proprietary symphony platform, which combines biomedical data and artificial intelligence to increase the success rates of drug discovery. Aria Pharmaceuticals primarily serves the healthcare sector, specifically targeting areas where new therapies are most needed. It was founded in 2014 and is based in Palo Alto, California.

Healx focused on drug discovery in the healthcare sector. The company specializes in developing treatments for rare diseases by leveraging artificial intelligence and drug development expertise. Healx was formerly known as Healx3. It was founded in 2014 and is based in Cambridge, United Kingdom.

Standigm specializes in AI-driven drug discovery within the pharmaceutical industry. The company provides services, including target identification, lead generation, and optimization, as well as AI SaaS solutions for drug development. Standigm primarily serves sectors engaged in pharmaceutical research and drug development. It was founded in 2015 and is based in Seoul, South Korea.

Aitia operates as a biotechnology company. It utilizes causal artificial intelligence (AI), multi-omic patient data, and Gemini Digital Twins to study the biological mechanisms of diseases in the oncology and neurodegenerative disease sectors. The company aims to create computational representations of diseases to assist in the development of therapies. It was founded in 2000 and is based in Somerville, Massachusetts.

Insilico Medicine focuses on artificial intelligence in drug discovery and development. The company provides artificial intelligence platforms for multi-omics target discovery, deep biology analysis, automated drug design, and predicting outcomes in clinical trials. The technologies are intended to assist in the process of discovering and developing new medications for various diseases. It was founded in 2014 and is based in New Territories, Hong Kong.

Loading...