Innovaccer

Founded Year

2014Stage

Secondary Market | AliveTotal Raised

$650.68MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+139 points in the past 30 days

About Innovaccer

Innovaccer is a healthcare technology company that provides a platform for data activation and analytics in value-based care. The platform integrates and analyzes healthcare data for clinical, financial, operational, and experiential outcomes. Innovaccer's solutions serve providers, payers, the public sector, and life sciences. It was founded in 2014 and is based in San Francisco, California.

Loading...

Innovaccer's Product Videos

ESPs containing Innovaccer

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The population health data platforms market provides software solutions that help healthcare providers and organizations to manage and analyze data related to the health of a defined population, such as a specific community or patient group. These platforms enable the collection and integration of data from various sources, including electronic health records, claims data, social determinants of h…

Innovaccer named as Highflier among 15 other companies, including Oracle, IBM, and Veradigm.

Innovaccer's Products & Differentiators

Data Activation Platform (DAP)

The Innovaccer Data Activation Platform (DAP) is the leading healthcare platform that offers integration capability with an in-built Extract-Transform-Load (ETL) process and algorithms/rules to ensure the acquired data is transformed and presented in a unified manner.

Loading...

Research containing Innovaccer

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Innovaccer in 11 CB Insights research briefs, most recently on Apr 29, 2025.

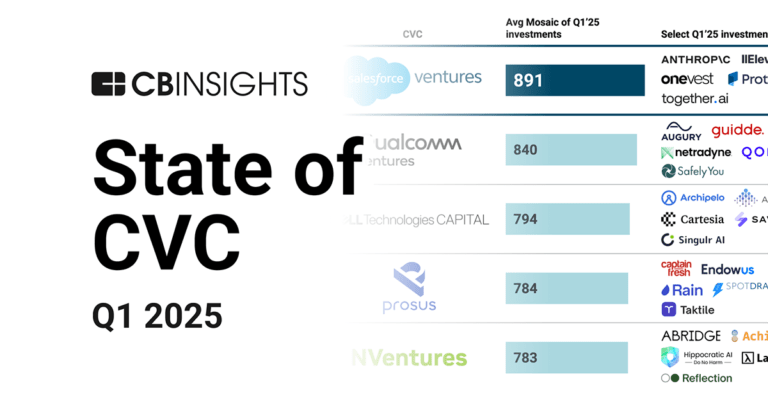

Apr 29, 2025 report

State of CVC Q1’25 Report

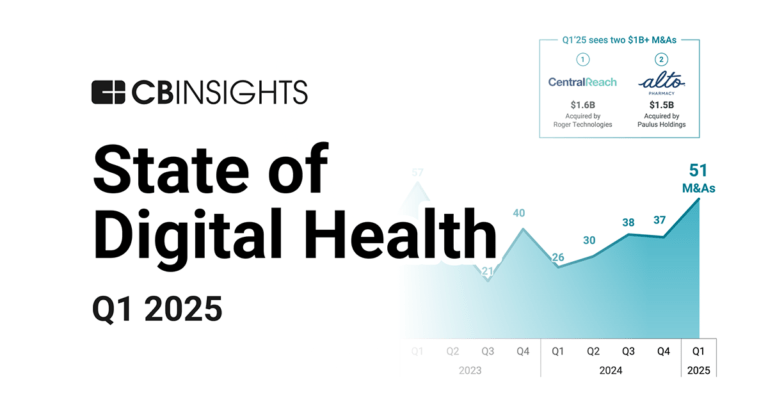

Apr 17, 2025 report

State of Digital Health Q1’25 Report

Mar 6, 2025

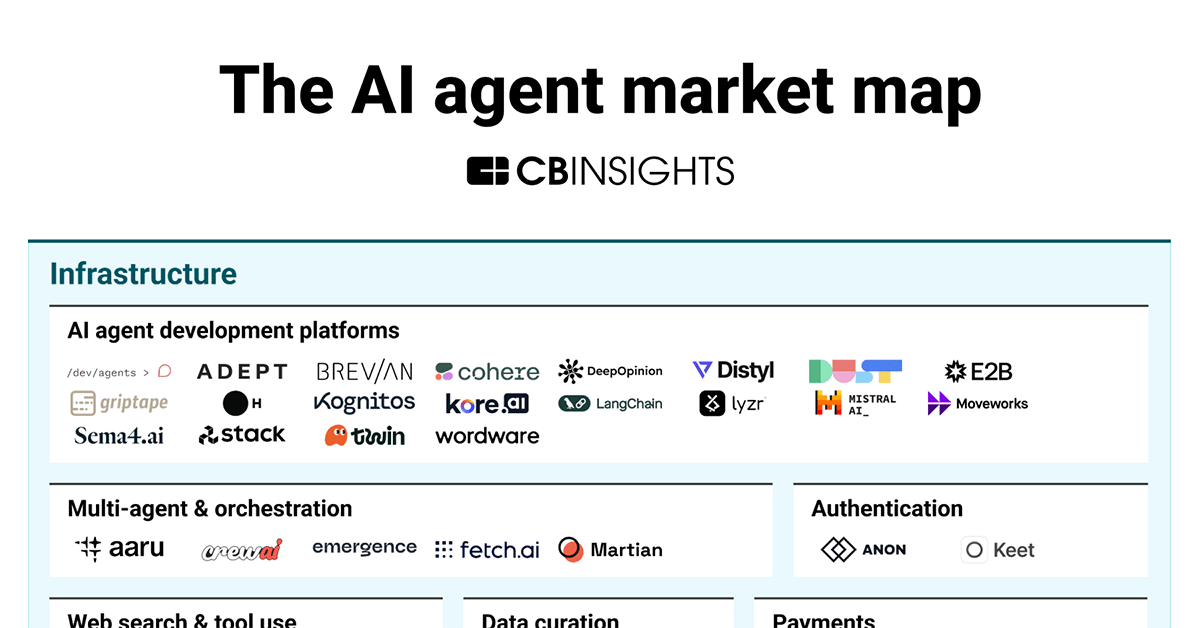

The AI agent market map

Nov 10, 2023

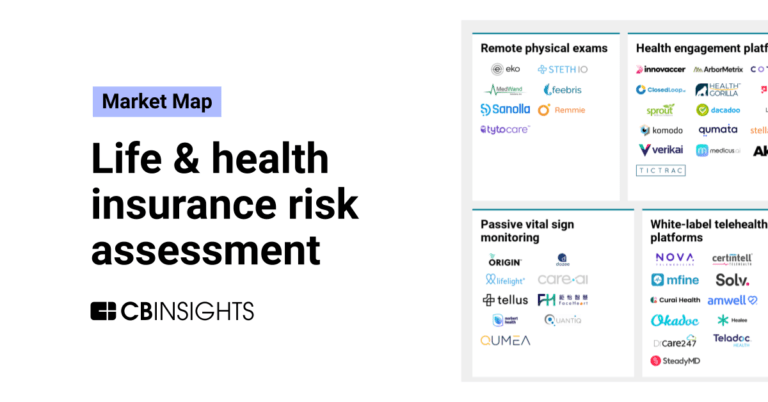

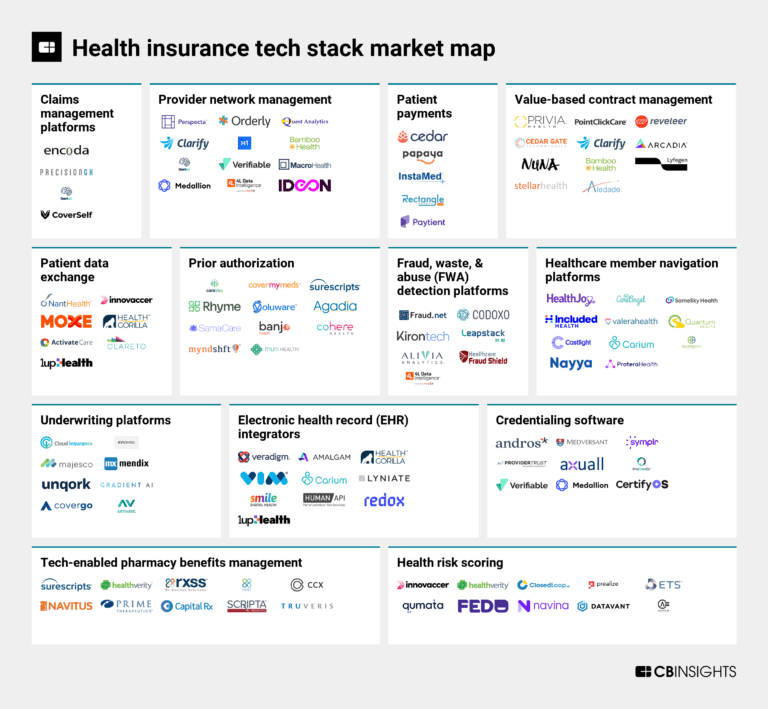

The health insurance tech stack market map

Sep 22, 2023

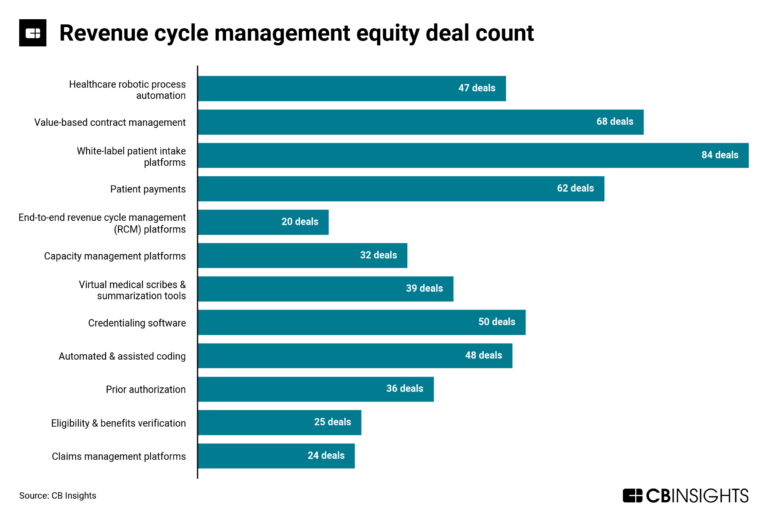

The revenue cycle management market map

Aug 1, 2023

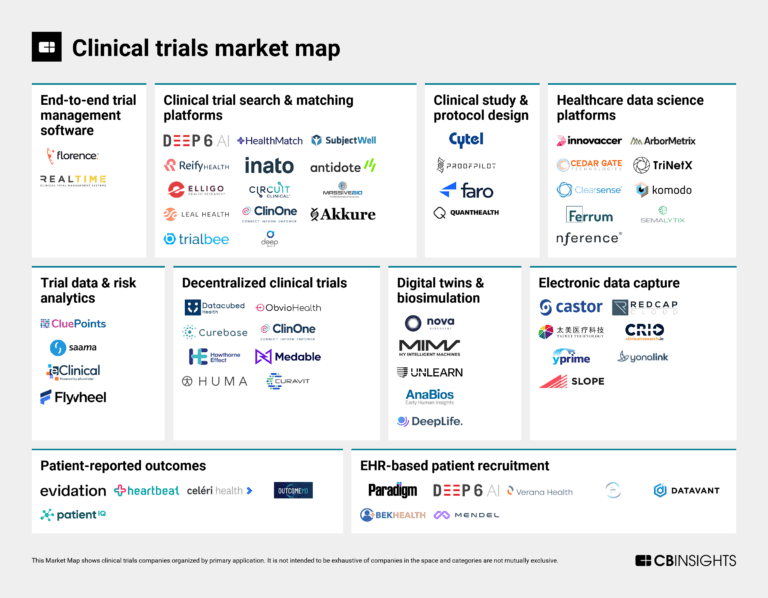

The clinical trials market mapExpert Collections containing Innovaccer

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Innovaccer is included in 9 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Value-Based Care & Population Health

1,262 items

The VBC & Population Health collection includes companies that enable and deliver care models that address the health needs for defining populations along the continuum of care, including in the community setting, through participation, engagement, and targeted interventions.

Conference Exhibitors

5,302 items

Digital Health 50

300 items

The winners of the second annual CB Insights Digital Health 150.

Digital Health

11,408 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

3,122 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Innovaccer Patents

Innovaccer has filed 11 patents.

The 3 most popular patent topics include:

- data management

- electronic health records

- health informatics

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/21/2022 | 12/31/2024 | Cryptography, Data management, Computer security, Key management, Computer network security | Grant |

Application Date | 11/21/2022 |

|---|---|

Grant Date | 12/31/2024 |

Title | |

Related Topics | Cryptography, Data management, Computer security, Key management, Computer network security |

Status | Grant |

Latest Innovaccer News

Jul 2, 2025

Supported by several deals exceeding $100 million, including four that crossed the $200 million mark, startup funding in 2025 is closely tracking last year's trend. Moreover, tighter control on layoffs, a higher number of IPO filings, and the launch of large funds have helped maintain overall stability. [Overview] According to data compiled by TheKredible, Indian startups raised approximately $6.72 billion in funding during the first half of 2025. This amount included 148 growth and late-stage deals totaling $5.15 billion, along with 404 early-stage deals worth $1.57 billion. Additionally, there were 74 undisclosed deals during this period. During this period, five startups including Jumbotail, Drools, Porter, Netradyne, and Juspay entered the unicorn club. Interestingly, all of them are based in Bengaluru. A recent report by Tracxn placed India as the third largest recipient of startup funding globally, following the United States and the United Kingdom. However, the report curiously omitted China, which raised $6.9 billion in the first quarter of 2025 alone. [Y-o-Y and M-o-M trend] The H1 funding closely mirrors the same period in 2024, when the ecosystem secured around $7 billion over six months. While the funding in the last six months surpassed the H1 2023 numbers, it falls significantly short of the $20 billion raised in H1 2022 and $13 billion in H1 2021. On a month-on-month basis, June saw just under $1 billion in funding, lower than the $1.14 billion raised in May. This is also the third time total monthly funding has fallen below the $1 billion mark during the first half of 2025. [Top 10 growth stage deals in H1] H1 2025 saw a flurry of late-stage activity with ten startups raising over $100 million each. Leading the chart was AI-focused Impetus Technologies with $350 million, followed by healthtech player Innovaccer at $275 million and cross-border fintech Zolve at $251 million. Logistics firm Porter, HR tech startup Darwinbox, and used-car platform Spinny also featured among the top, alongside Infra.Market, Jumbotail, Raphe mPhibr, and Leap Finance. Noida-based Raphe mPhibr scooped up $100 million in the largest private funding round raised by an Indian aerospace company. [Top 10 early stage deals in H1] PB Healthcare stood out with a massive $218 million seed round, the largest in this bracket. Fintech player Saarthi Finance followed with $55.5 million in its Series A round, while SaaS startup Atomicwork secured $25 million. The list also featured EKA Mobility ($23.3 million), Sanlayan ($22 million), and Lucidity ($21 million). [Mergers and Acquisitions] H1 2025 saw a mix of strategic and consolidation-driven acquisitions in the Indian startup ecosystem, with consumer goods giant HUL leading the charts through its $350 million acquisition of D2C skincare brand Minimalist. Everstone followed with a $200 million buyout of SaaS player Wingify, while Delhivery continued its logistics expansion by acquiring Ecom Express for $166 million. Other notable deals included TAL Education snapping up edtech firm Epic for $95 million and Head Digital Works acquiring Deltatech Gaming for $56.6 million. The fintech space remained active, with Razorpay, InCred Money, and Findi making targeted acquisitions to strengthen vertical capabilities. [City and segment wise deals] Bengaluru led startup funding in H1 2025 with $2.93 billion across 218 deals, accounting for over 43% of the total. Delhi NCR followed with $1.62 billion from 166 deals, while Mumbai secured $880 million through 99 deals. Chennai and Pune saw moderate activity, raising $136 million and $180 million respectively. These five cities together contributed the majority of venture funding during the period. Fintech led startup funding in H1 2025 with $1.58 billion across 83 deals, followed by healthtech and e-commerce with $828 million and $684 million respectively. AI and foodtech also saw steady interest, raising $523 million and $237 million. [Stage wise deals] In H1 2025, Series B deals topped the charts with $1.35 billion in funding, followed by Series D and Series A rounds, which brought in $1.01 billion and $960 million respectively. Seed stage remained the busiest with over 200 deals, while Series C raised $788 million. Early-stage rounds like pre-seed and pre-Series A saw limited activity, and debt funding contributed $413 million. Check TheKredible for more details. [Layoffs, shutdowns and departures] Indian startups saw a wave of layoffs in H1 2025, with companies like VerSe, Gupshup, and Zypp Electric leading the cuts. The trend reflects growing caution amid funding challenges and a shift toward leaner operations. However, overall layoffs stood at around 1,000 during H1, excluding public companies like Zomato and Ola Electric, which laid off 600 and 1,000 employees respectively. In comparison, Indian startups laid off 3,300 people in H1 2024, marking a sharp decline in large-scale job cuts seen in previous years. [Comparison: Q1 vs Q2] For a clearer picture of how startup funding and sectoral trends evolved through the year, we've compiled a Q1 vs Q2 comparison chart highlighting key shifts across both quarters. [Trends in H1 2025] Raining IPOs and confidential filings: Several Indian startups including Shadowfax, Physics Wallah, boAt, Urban Company, Shiprocket, Groww, Pine Labs, Capillary Tech, Wakefit, Indiqube, and Curefoods have filed their draft red herring prospectuses (DRHPs) and are gearing up for their stock market debuts in the coming months. Interestingly, Shadowfax, boAt, Shiprocket, Groww, Aequs and PhysicsWallah chose the confidential route for their IPOs. Vertical consolidation via M&A: M&A deals such as Razorpay acquiring POP, InCred Money acquiring Stocko, and Findi acquiring BANKIT indicate that startups are doubling down on vertical integration and specialization to enhance their offerings. Fund launches: Startup funding in India is expected to stay strong in 2025, backed by large venture capital funds announced in the first half of the year. A91 Partners ($665M), Accel ($650M), L Catterton ($600M), Multiples Asset Management ($430M), and Bessemer Venture Partners ($350M) were among the top fundraisers. These developments indicate a strong capital base and growing investor readiness to back promising startups in the coming months. Healthcare and AI: Healthcare and AI saw strong funding in H1 2025 and remained in the top five sectors, just like in 2024. Healthtech raised $828 million and AI attracted $523 million, a sign of continued investor confidence in both areas. Comments

Innovaccer Frequently Asked Questions (FAQ)

When was Innovaccer founded?

Innovaccer was founded in 2014.

Where is Innovaccer's headquarters?

Innovaccer's headquarters is located at 101 Mission Street, San Francisco.

What is Innovaccer's latest funding round?

Innovaccer's latest funding round is Secondary Market.

How much did Innovaccer raise?

Innovaccer raised a total of $650.68M.

Who are the investors of Innovaccer?

Investors of Innovaccer include M12, B Capital, Generation Investment Management, Kaiser Permanente, Danaher Ventures and 29 more.

Who are Innovaccer's competitors?

Competitors of Innovaccer include Arcadia, Navina, Smile Digital Health, Datavant, Lifen and 7 more.

What products does Innovaccer offer?

Innovaccer's products include Data Activation Platform (DAP) and 4 more.

Who are Innovaccer's customers?

Customers of Innovaccer include Kaiser Permanente, CommonSpirit and St Peter's Health.

Loading...

Compare Innovaccer to Competitors

Clinithink is a technology company specializing in artificial intelligence for the life sciences and healthcare sectors. The company offers AI solutions that analyze unstructured healthcare data. Clinithink serves the pharmaceutical and healthcare industries with its AI technology aimed at enhancing clinical trial processes, disease diagnosis, and revenue management. It was founded in 2009 and is based in Bridgend, United Kingdom.

Arcadia is a business intelligence platform for human health. The company's platform delivers actionable insights for its customers to advance care and research, drive strategic growth, and achieve financial success. It helps with health plans, healthcare providers, employer groups, life sciences, and customer stories. It was founded in 2002 and is based in Boston, Massachusetts.

Optum is a health solution and care delivery organization that provides health care services, financial health accounts, and pharmacy benefits management. The company offers care, financial tools for health expenses, and pharmacy services including home delivery and specialty medications. Optum serves individuals and families, providers and organizations, employers, brokers, and consultants within the health care, financial, and pharmacy sectors. It was founded in 2011 and is based in Eden Prairie, Minnesota.

Inovalon provides healthcare software and analytics solutions. It offers a cloud-based platform that connects users with national-scale connectivity, primary source data access, and analytics for clinical outcomes and healthcare economics. The company serves payers, providers, pharmacies, and life sciences organizations within the healthcare sector. Inovalon was formerly known as MedAssurant. It was founded in 1998 and is based in Bowie, Maryland.

NextGen Healthcare provides integrated health IT solutions and data analytics in the healthcare sector. The company has cloud-based electronic health records (EHR) and practice management (PM) software, as well as interoperability, patient engagement, revenue cycle management, and value-based care analytics. NextGen Healthcare serves mid-size to enterprise practices and small practices with specialty-specific content and services. NextGen Healthcare was formerly known as NXGN Management. It was founded in 1974 and is based in Irvine, California.

Datavant operates as a health data platform company that focuses on health data security, accessibility, and usability. The company provides a platform and network that allow for data exchange and interoperability within the healthcare ecosystem, allowing organizations to connect and use real-world data. Datavant serves health plans, healthcare providers, life sciences, government, non-profits, and data analytics sectors. It was founded in 2017 and is based in Phoenix, Arizona.

Loading...