Roughly 1,100 France-based investors backed equity deals last year, creating a competitive landscape where strategic positioning is crucial.

To differentiate themselves, top French firms like Partech are aggressively pursuing deals in high-growth areas like AI and sustainability tech that position them to capture outsized returns.

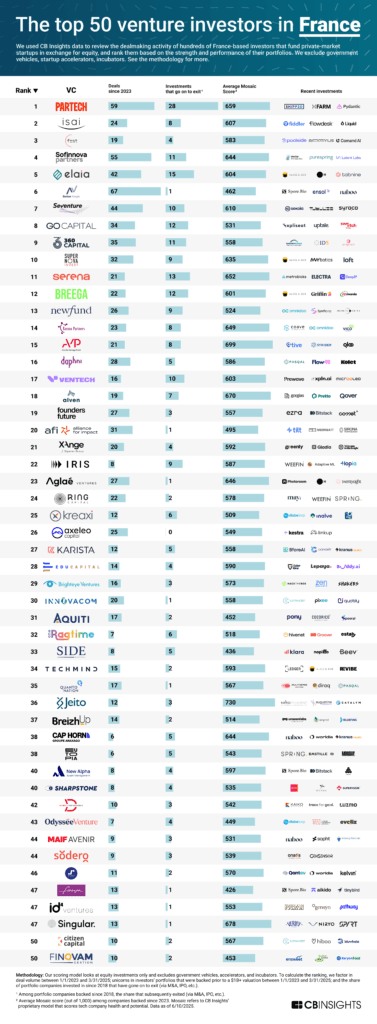

Using CB Insights data, we analyzed which investors are building the strongest foundations for portfolio success. Below, see our picks for the top 50 venture investors in France, key takeaways on the list, and a note on methodology.

Venture firms — make sure we’re representing your full portfolio by reaching out to investoroutreach@cbinsights.com to set up a review of CB Insights’ coverage of your investments.

Note: Updated on 6/27/2025 to include IRIS in 22nd position.

Note: Updated on 6/27/2025 to include IRIS in 22nd position.

Key takeaways

- Partech tops our ranking, having recorded 28 exits since 2018 and joined 59 startup deals since 2023 (as of 3/31/2025). AI leads with 11 deals (or 19%), followed by sustainability tech with 10 deals (or 17%).

- ISAI and Frst Capital stand out as the only investors to back future unicorns – Liquid AI and poolside, respectively – early. Liquid AI, focused on general-purpose AI, was last valued at $2B in Dec ’24, while Poolside, building AI for software development, hit $3B in Oct ’24.

- Biotech specialist Jeito Capital leads in terms of the quality of its recent investments. Its investments since 2023 have a higher average Mosaic score (730 out of 1,000) than any other investor here. Top performers in its portfolio include NMD Pharma (778) and Augustine Therapeutics (770).

Methodology

We used CB Insights data to review the dealmaking activity of hundreds of France-based investors that fund private-market startups in exchange for equity, and rank them based on the strength and performance of their portfolios.

Our scoring model factors in deal volume between 1/1/2023 and 3/31/2025; unicorns in investors’ portfolios that were backed prior to a $1B valuation; and the share of portfolio companies invested in since 2018 that have gone on to exit. We exclude government vehicles, startup accelerators, incubators.

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.