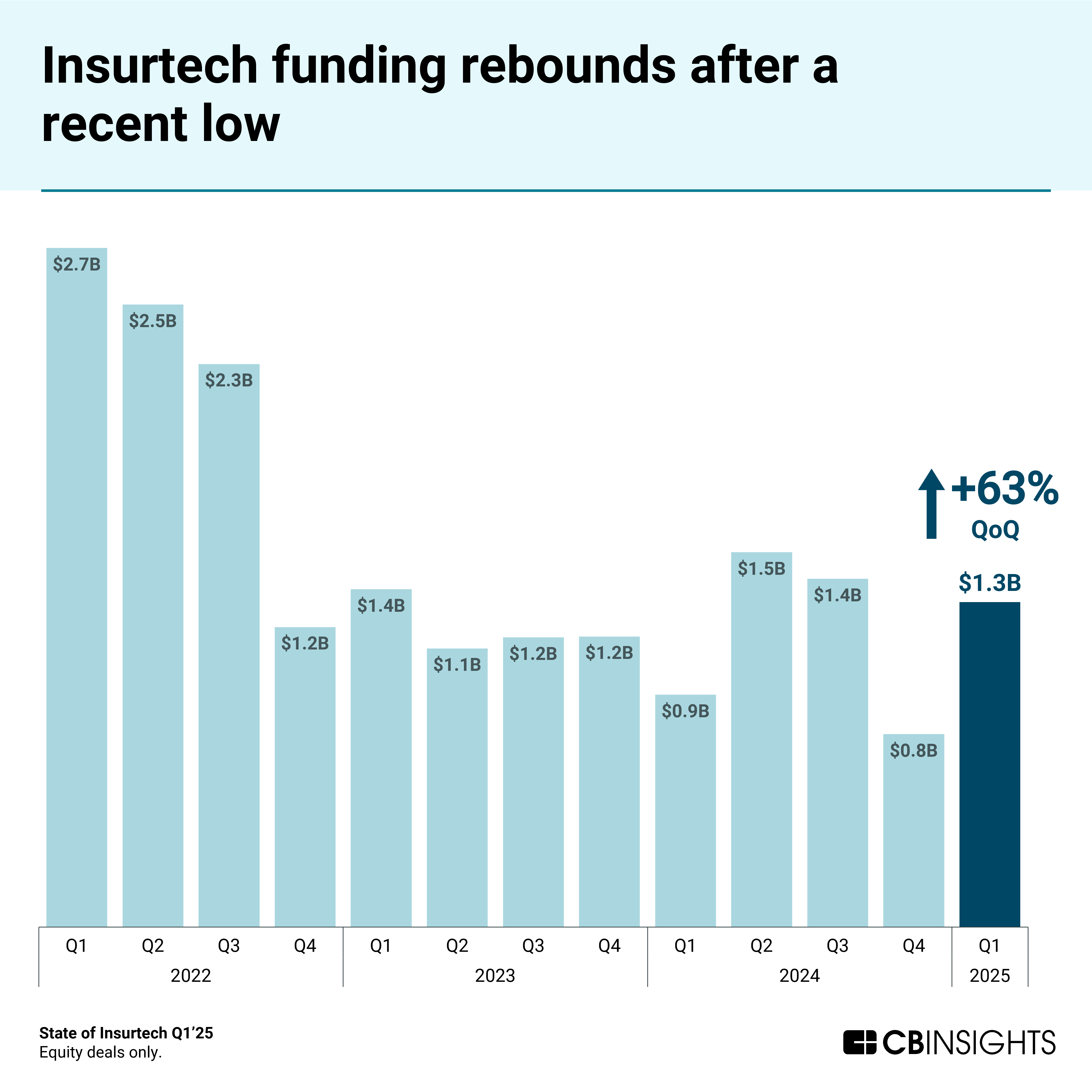

The insurtech landscape is increasingly competitive. Median deal sizes are down, and early-stage insurtech funding is at a nearly 9-year low, despite a rebound in global insurtech funding to $1.3B in Q1’25.

Insurtech does not exist in a vacuum, and the broader venture environment is centered on AI funding. In Q1’25, OpenAI raised nearly 31 times the total funding of all insurtechs combined, underscoring where capital is flowing.

AI capabilities are poised to reshape the future of insurance — whether through 100-day-old startups or 100-year-old incumbents adapting to a new competitive reality.

Download the full report to access comprehensive data and charts on the evolving state of insurtech.

Key takeaways from the report include:

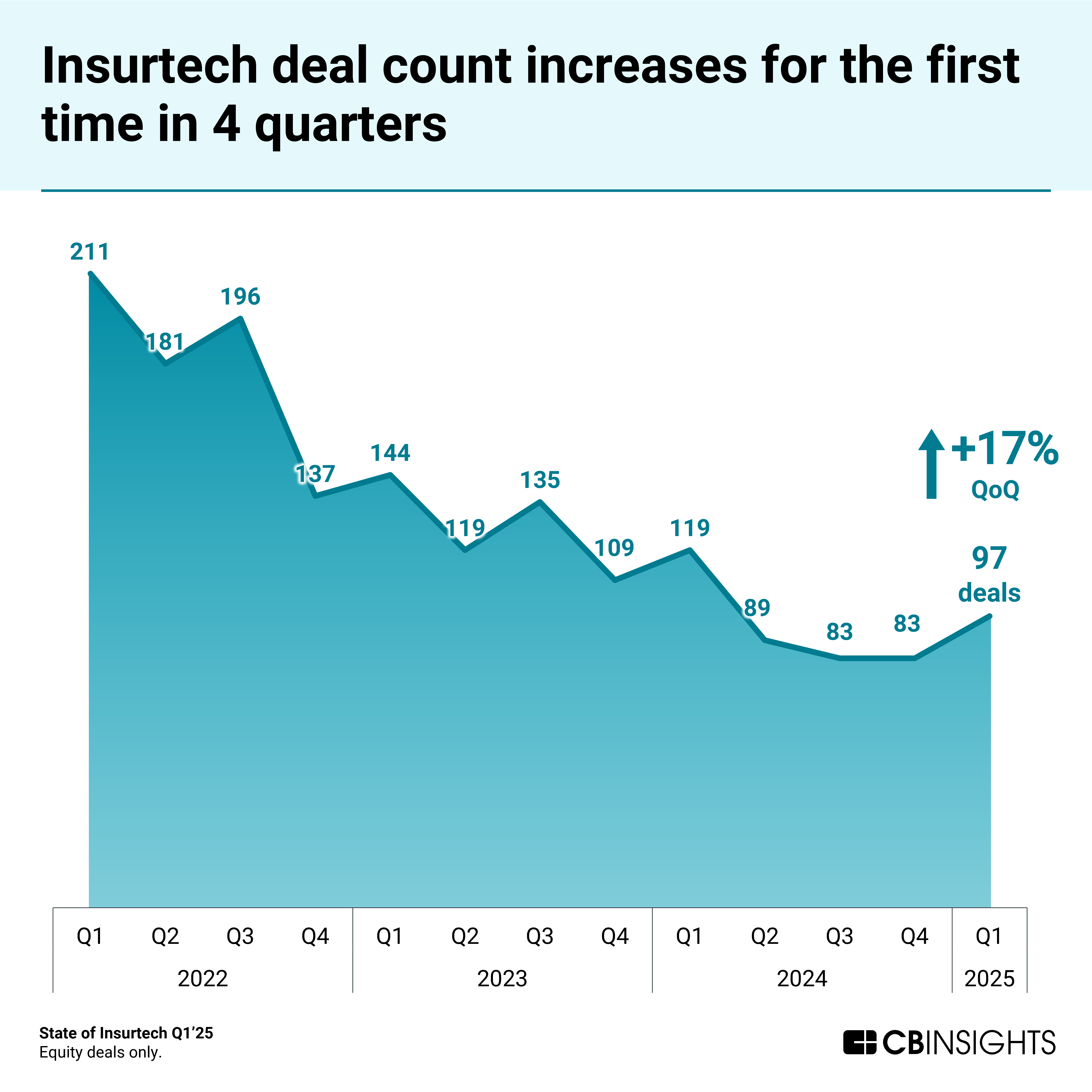

- Insurtech dealmaking increases for the first time in a year. Global insurtech deal count increased 17% quarter-over-quarter (QoQ), from 83 in Q4’24 to 97 in Q1’25. Property & casualty insurtech drove the increase, from just 51 deals — a near 8-year low — in Q4’24 to 70 in Q1’25.

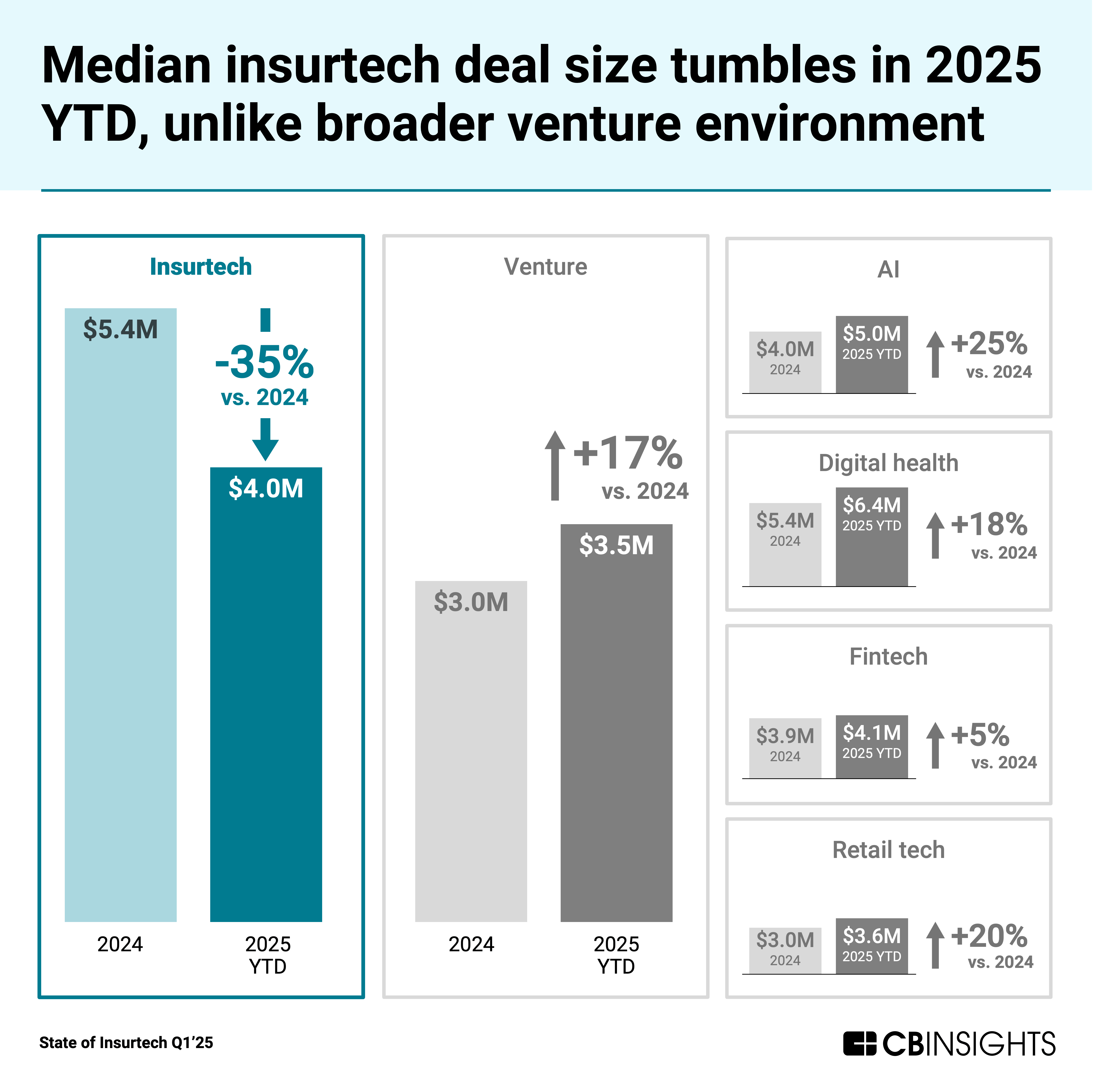

- Median insurtech deal size tumbles 35% in 2025 YTD (year to date) to $4.0M. The median insurtech deal size has not been lower since 2019 ($3.4M). The decline stands out because median deal sizes across the broader venture environment rose 17% YTD to $3.5M, while insurtech’s fell.

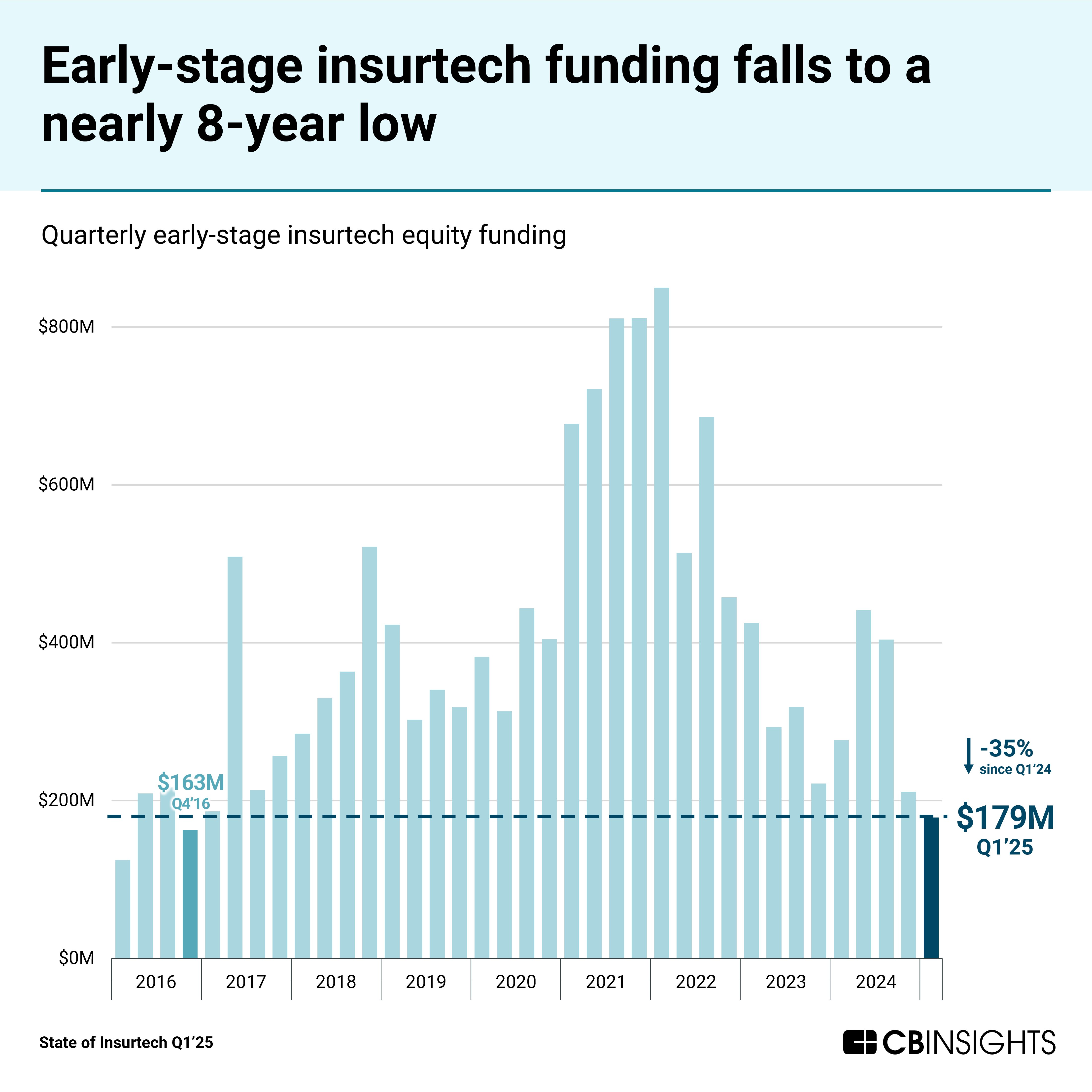

- Early-stage insurtech funding reaches a nearly 8-year low — $179M. Early-stage insurtech funding fell 35% year-over-year (YoY) from $277M in Q1’24.

- Late-stage insurtech dealmaking paints a cautious growth picture. The 7 insurtechs that raised Series D+ deals in Q1’25 saw median headcount growth of just 3% over the past 12 months — far lower than insurtechs raising at earlier stages.

- Silicon Valley sees 1 in 5 global insurtech deals. Silicon Valley’s share of global insurtech equity deals has nearly doubled YoY, from 10.9% in Q1’24 to 21.9% in Q1’25. Funding to Silicon Valley-based insurtech increased to $0.3B — the highest level since Q4’23 ($0.4B).

Insurtech dealmaking increases for the first time in a year

Insurtech deal count increased 17% QoQ, from 83 deals in Q4’24 to 97 in Q1’25 — a reversal of the broader venture trend, where deal count declined 7% over the same period.

The rebound was driven by property & casualty insurtech, which jumped from just 51 deals — a near 8-year low — in Q4’24 to 70 in Q1’25. Meanwhile, life & health insurtech saw deal count dip to 27 in Q1’25.

This increase in activity followed an abnormally weak Q4, when funding had fallen to $0.8B. In Q1’25, insurtech funding surged 63% to $1.3B — slightly above the 10-quarter average of $1.2B. Notably, insurtech was the only fintech vertical to post a funding gain this quarter.

Nearly $400M toward three $100M+ mega-round deals contributed to the broader funding rebound:

- Quantexa, a data management and financial crime prevention platform, raised a $175M Series F deal.

- Openly, a homeowners-focused general agency and program administrator, raised a $123M Series E deal.

- Instabase, an AI platform for unstructured data, raised a $100M Series D deal.

Future implication: These mega-rounds signal investors’ readiness to write large checks for select insurtechs — even in a cautious funding environment. For incumbents, this underscores the importance of tracking well-capitalized startups that could pose competitive threats through 2025.

Median insurtech deal size tumbles in Q1’25

Half of the quarter’s top 10 insurtech deals went to AI-centered startups: Quantexa, Instabase, Nirvana, Taktile, and Naked. But unlike the broader venture market, insurtech lacked the depth of large-dollar AI deals needed to lift the median.

While the average insurtech deal size ticked up 6% to $15.8M in 2025 YTD, the median insurtech deal size tumbled from $5.4M in 2024 to $4.0M — its lowest point since 2019 ($3.4M). This trend diverged from the broader venture environment, where a spike in $100M+ mega-rounds pushed medians higher.

Early-stage insurtech saw a similar dynamic, with median deal sizes declining to $3.0M in 2025 YTD — even as the broader venture landscape saw an increase, from $2.0M in 2024 to $2.8M. Fertility-focused platform Gaia raised the largest early-stage insurtech deal in Q1’25 ($15M Series A).

Future implication: Smaller check sizes could give incumbent insurers an opening to partner with capital-constrained insurtechs — potentially securing more favorable terms and early access to emerging tech that would be harder to land in a hotter market.

Early-stage insurtech funding reaches a nearly 8-year low

Early-stage insurtech startups raised just $178.5M across 56 deals in Q1’25 — the lowest total since Q4’16 ($162.8M). Funding has dropped sharply over the past year, falling 35% from Q1’24.

Early-stage insurtech deal share has also tumbled over the past few years. In 2022, 71% of deals went to early-stage insurtechs, while in 2025 YTD, it was just 58%.

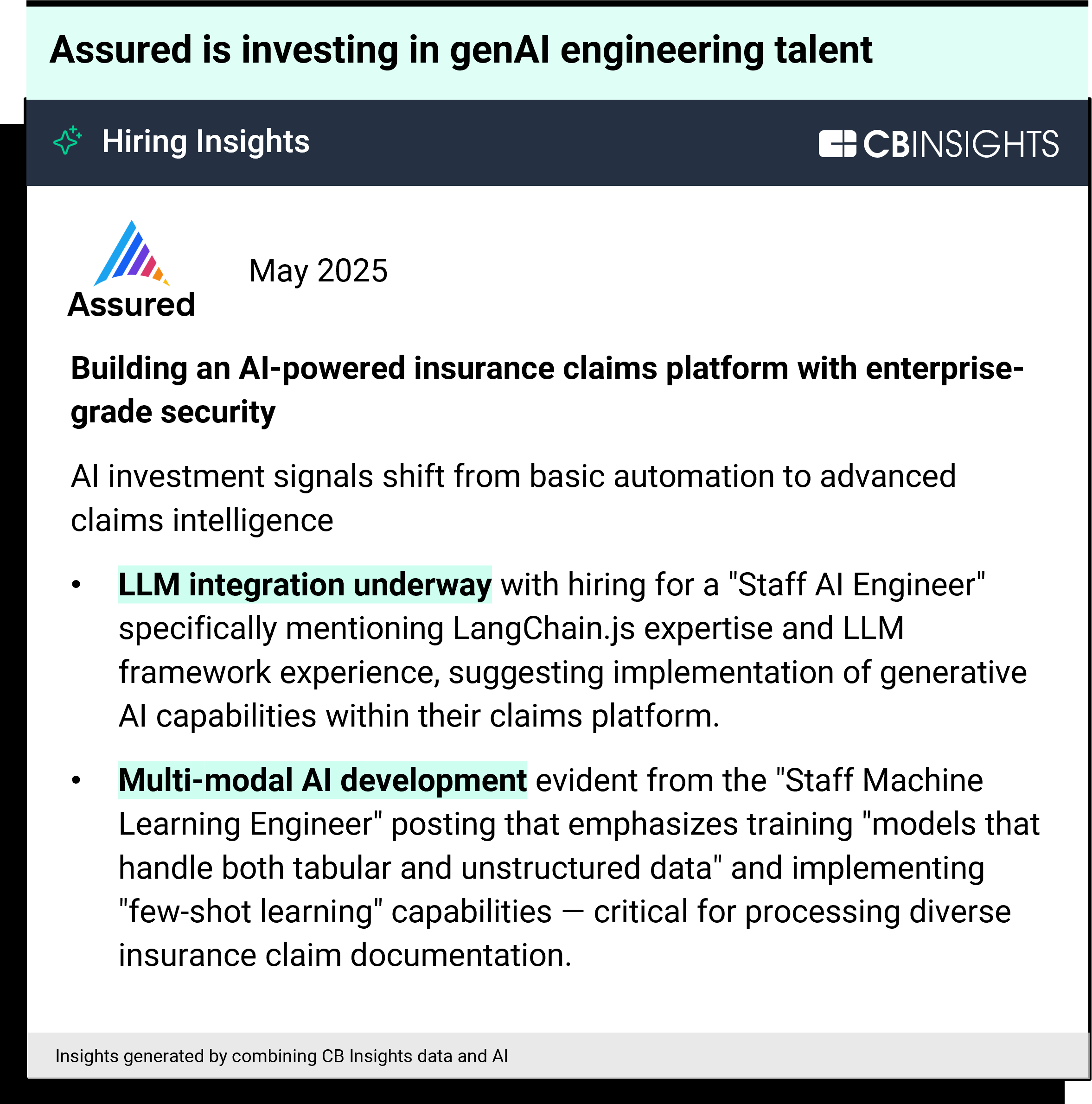

Still, the quarter delivered one notable early-stage highlight: AI claims platform Assured became just the second new insurtech unicorn since Q4’23. The startup raised an undisclosed Series A round at a $1B valuation, backed by ICONIQ Capital and Kleiner Perkins.

Assured also ranks in the global top 4% of companies for hiring momentum and is actively prioritizing genAI-focused hires:

Future implication: The sustained drop in early-stage insurtech funding risks shrinking the industry’s future innovation pipeline. To stay ahead, insurance execs should prioritize identifying and building relationships with promising startups now — before competition for a smaller pool of standouts intensifies.

Late-stage insurtech dealmaking paints a cautious growth picture

The 7 insurtechs that raised Series D+ rounds in Q1’25 posted median 12-month headcount growth of just 3% — significantly lower than their earlier-stage peers. Only one of them — insurance customer communication platform Ushur — saw double-digit growth over the same period.

Ushur is also the only insurtech among the 7 with an above-average M&A probability within the next 2 years. This signals a potential standstill in the late-stage insurtech market, especially as the IPO pipeline remains frozen — just 2 insurtechs have gone public since 2023.

Future implication: With just 3% median headcount growth, late-stage insurtechs are showing signs of stagnation. In a market where public investors expect clear growth momentum, more of these companies may be pushed toward M&A exits — often at compressed valuations.

Silicon Valley sees 1 in 5 global insurtech deals

Silicon Valley has now seen 2 consecutive quarters of elevated insurtech dealmaking. The share of global insurtech deals to Silicon Valley-based startups nearly doubled YoY, rising from 10.9% in Q1’24 to 21.9% in Q1’25. Comparatively, 9% of deals across the broader venture environment went to Silicon Valley-based companies in Q1’25.

2 of the quarter’s top 5 insurtech deals went to Silicon Valley-based insurtechs: Instabase and Nirvana ($80M Series C). As a result, Silicon Valley’s insurtech funding in Q1’25 increased to $0.3B — the highest level since Q4’22 ($0.4B). By comparison, Europe’s insurtech market saw $0.4B in funding across 26 deals in Q1’25, slightly edging out Silicon Valley’s total.

Silicon Valley also saw a major insurtech exit in Q1’25: Munich Re announced its acquisition of Palo Alto-based Next Insurance — one of insurtech’s most-promising startups — at a $2.6B valuation.

Future implication: As the world’s premier tech ecosystem, Silicon Valley remains a leading indicator for insurtech innovation. Insurance executives should track tech talent migration into insurtech as a signal of where future competitive threats may emerge.

MORE INSURTECH RESEARCH FROM CB INSIGHTS

- Our 6 predictions for the insurance space in 2025

- How genAI is reshaping the insurance value chain

- Insurtech 50: The most promising insurtech startups of 2024

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.