Small businesses remain a ripe opportunity for digital transformation.

According to the World Bank, 90% of businesses worldwide qualify as small- and medium-sized enterprises (SMEs — also known as small- and medium-sized businesses, or SMBs), and they account for about half of global GDP. But in a Federal Reserve survey from 2023, only 34% of US-based small businesses said they currently accept digital or mobile payments, pointing to just one of the many openings for digitization in the US and abroad.

Financial institutions and private tech companies alike are stepping up to the plate.

Several major banks and leaders are expanding their small business services, including: PayPal, which is growing its ecosystem of SMB services; Fiserv, which is expecting revenue to double in the next 2 years for its small-merchant POS system, Clover; and Mastercard, which launched 10 new small business programs over the last year.

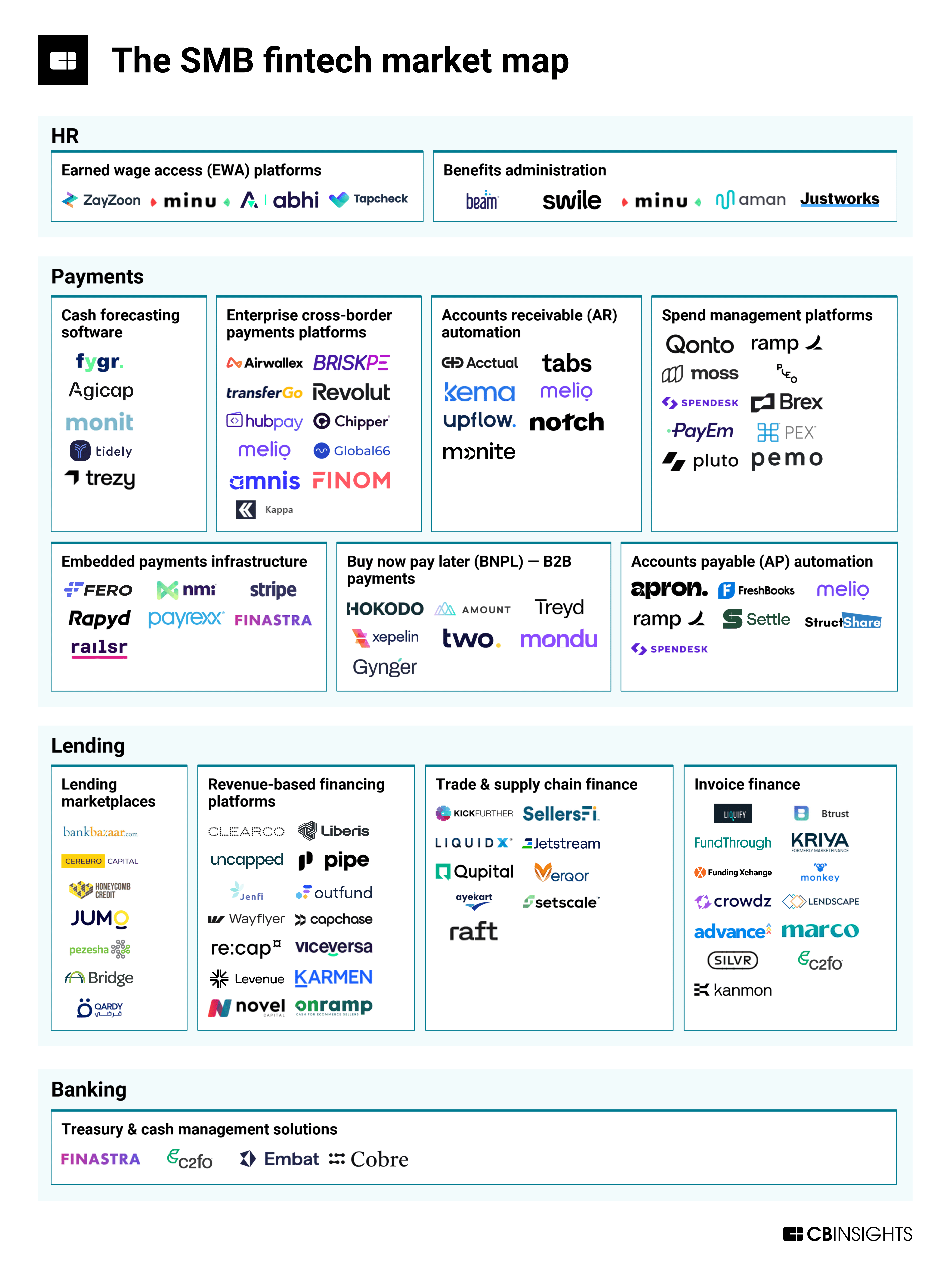

Meanwhile, the landscape of private tech companies developing financial solutions for SMBs continues to evolve. In the market map below, we identify 105 tech companies offering fintech tailored to SMBs across 14 different markets. We organized markets by major divisions in financial operations:

- HR: These solutions help small businesses manage employee benefits and payments.

- Payments: Vendors in this category assist companies in managing payments both within and outside their business, integrating payment acceptance and processing into customer-facing platforms, and overseeing expenses.

- Lending: These platforms and tools enable small businesses to access loans and other forms of financing for business growth.

- Banking: These companies help finance teams manage their businesses’ liquidity and track real-time cash positions.

Please click to enlarge.

To identify players for this market map, we included startups with a CB Insights Mosaic score (a proprietary measure of private company health and growth) of 400 or greater that raised funding since January 1, 2023. We then filtered that list based on whether companies have offerings targeting small and medium businesses. Categories are not mutually exclusive and are not intended to be exhaustive.

Key takeaways

- Investors have concentrated SMB fintech funding on foundational solutions, like embedded payments infrastructure and spend management. Financial services infrastructure has established itself as a must-have for SMBs: embedded payments tools ($9.6B), spend management platforms ($3.5B), and enterprise cross-border payments ($3.4B) have collectively raised 77% of all funding across markets on the map since 2020. This dynamic highlights the need for SMBs to establish essential financial systems before layering new technologies on top.

- Investors and financial institutions should focus on solutions that flexibly integrate with existing systems. Small businesses are willing to cherry-pick the solutions that will drive the highest ROI, rather than overhauling their entire tech stack. Within payments markets, accounts payable (AP) automation companies have attracted 3x more funding than AR automation companies ($2.2B vs. $733M) and, perhaps more significantly, more than 6x as many partnerships (287 vs. 44). These indicators not only point to AP automation’s clearer ROI for SMB users (who may have more payables to process than receivables), but also to SMBs’ selectiveness about where and when they invest in technology. For the tech companies themselves, emphasizing a range of integration partners will help prove the value and ease of adopting their solutions.

- The growth in digital-native SMBs is driving early-stage growth and valuations for tech-enabled borrowing. Nearly two-thirds (63%) of the 43 deals for revenue-based financing platforms since 2020 have been early-stage. The high share of early-stage activity suggests that there are still numerous entry points for disruptive fintechs, especially as the companies they serve — such as e-commerce, SaaS, and digital brands — continue to evolve. At the same time, investors are placing a high premium on revenue-based financing solutions: multiple SMB-focused companies in the market (Wayflyer, Pipe, and Clearco) are unicorns, compared to only 1 in the market for invoice finance (C2FO).

Market descriptions

HR

Earned wage access (EWA) platforms

The earned wage access (EWA) platforms market provides solutions for employees to access their earned wages before scheduled paydays, addressing financial stress and reducing reliance on high-cost credit options. These platforms integrate with existing payroll systems to verify earned wages and facilitate immediate transfers to employees’ accounts. Many providers also offer additional financial wellness tools such as budgeting assistance, savings features, and financial education resources. EWA platforms serve various industries including retail, healthcare, and manufacturing, typically targeting HR managers and payroll administrators seeking to improve employee retention and productivity.

Equity funding 2025 YTD: $103M|5 deals

Headcount 1-year change: +13%

The benefits administration market provides solutions to help human resources teams manage their employee benefits programs. These platforms look across health insurance, wellness programs, and more. Providers often have features to support employee enrollment and participation analytics. The market is driven by the need for employers to attract and retain top talent, comply with government regulations, and provide a competitive and targeted benefits package.

Equity funding 2025 YTD: No deals

Headcount 1-year change: +5%

The cash forecasting software market uses historical data, financial algorithms, and predictive analytics to forecast future cash flows accurately. Cash forecasting software helps businesses improve cash flow visibility, identify potential cash gaps or surpluses, and mitigate liquidity risks. These solutions typically integrate with existing ERP systems, accounting software, and banking platforms to aggregate financial data. The platforms also facilitate scenario modeling, enabling organizations to simulate different financial scenarios and assess the impact on cash flows.

Equity funding 2025 YTD: No deals

Headcount 1-year change: +4%

Enterprise cross-border payments platforms

The enterprise cross-border payments platforms market enables businesses to send and collect payments globally. Companies in this market offer currency exchange solutions that help users monitor exchange rates and hedge currency risk. Some companies also provide specialized solutions for different industries. In addition to enterprise solutions, many providers in this market also offer consumer-specific solutions.

Equity funding 2025 YTD: $71M|2 deals

Headcount 1-year change: +24%

Featured companies:

Accounts receivable (AR) automation

The accounts receivable (AR) automation market streamlines invoicing and payment collection processes. Vendors provide APIs and software development kits that allow companies to embed accounts receivable functionalities into their enterprise resource planning software, customer relationship management systems, and other digital platforms. The tools allow automated invoicing, payment reminders and processing, cash application, credit management, and more.

Equity funding 2025 YTD: $2M|1 deal

Headcount 1-year change: -1%

The spend management platforms market enables businesses to efficiently manage and control their expenditures through integrated software solutions, including virtual corporate cards, expense management systems, procurement software, and budget tracking tools. Vendors use APIs and cloud-based platforms to integrate these solutions into existing financial and operational systems, allowing for real-time visibility into spending patterns, automated approval workflows, and enhanced compliance controls. These platforms streamline financial processes, reduce administrative burdens, and provide AI-powered insights, helping organizations optimize budgets, negotiate better terms with suppliers, and achieve cost savings.

Equity funding 2025 YTD: $87M|5 deals

Headcount 1-year change: +14%

Embedded payments infrastructure

The embedded payments infrastructure market provides API-based solutions that enable companies to integrate payment processing into non-banking digital platforms without building the infrastructure from scratch. These solutions use APIs and software development kits to embed payment functionalities into software applications, websites, IoT devices, and digital ecosystems. Companies in this market offer features including simplified integration, fraud detection, subscription management, and customized security parameters. The technology primarily serves e-commerce, SaaS platforms, marketplaces, and financial institutions looking to enhance user experience and monetize transactions.

Equity funding 2025 YTD: $20M|2 deals

Headcount 1-year change: +10%

Buy now pay later (BNPL) — B2B payments

The buy now pay later (BNPL) — B2B payments market offers flexible financing options for businesses to enhance their purchasing power and manage their working capital and cash flow by acquiring goods or services immediately and paying for them in installments over time. BNPL solutions in the B2B market provide streamlined application processes, quick approvals, and transparent terms for businesses to make purchases and manage their payments efficiently. These solutions typically include online platforms, embedded finance tools, or integrated payment systems that enable point-of-sale financing decisions. Key features include flexible payment terms, automated credit decisioning, and integration with existing procurement and financial systems to provide businesses with tailored payment plans.

Equity funding 2025 YTD: $21M|2 deals

Headcount 1-year change: -5%

Accounts payable (AP) automation

The accounts payable automation market allows businesses to streamline and automate invoice processing and payment activities. Vendors provide platforms that integrate with existing enterprise resource planning systems and accounting software through APIs and software development kits. These platforms automate invoice capture and matching, data extraction, approval workflows, and payment processing, reducing manual tasks and minimizing errors. This integration improves operational efficiency, enhances cash flow management, strengthens vendor relationships, and supports compliance with financial regulations.

Equity funding 2025 YTD: N/A|1 deal

Headcount 1-year change: +6%

Lending

The lending marketplaces market includes online platforms that connect lenders and borrowers through digital technologies. These platforms use data analytics, automation, and AI to streamline the lending process and provide access to credit for individuals and small businesses who may be underserved by traditional financial institutions. The market serves both borrowers seeking competitive loan options and lenders looking to expand their customer base and optimize lending rates. These platforms typically offer features such as loan comparison tools, financial education resources, simplified application processes, and tailored services for specific customer segments.

Equity funding 2025 YTD: $23M|3 deals

Headcount 1-year change: +1%

Revenue-based financing platforms

The revenue-based financing platforms market offers an alternative funding approach where businesses exchange a percentage of future revenues for upfront capital without traditional equity dilution or fixed-interest debt. These platforms use proprietary algorithms and data analytics to evaluate financial health, growth potential, and creditworthiness to determine funding amounts and repayment terms. Primary users include e-commerce companies, SaaS businesses, and digital-native ventures with predictable revenue streams. Key features include automated underwriting processes, flexible repayment schedules tied to business performance, and rapid funding decisions. These solutions enable businesses to fund marketing, inventory, product development, and operations while maintaining ownership control.

Equity funding 2025 YTD: N/A|1 deal

Headcount 1-year change: +9%

Featured companies:

The trade & supply chain finance market facilitates loans and financial instruments for businesses engaged in global trade, helping them optimize cash flows and mitigate risks associated with cross-border transactions. Vendors offer digital platforms with financing solutions such as letters of credit, invoice financing, and guarantees, leveraging technologies like blockchain, AI, and APIs to streamline operations. These solutions integrate with supply chain management systems and banking ecosystems to improve transparency, enhance operational efficiency, and accelerate financial settlements, enabling businesses to strengthen trade relationships and expand globally.

Equity funding 2025 YTD: $76M|3 deals

Headcount 1-year change: +1%

The invoice finance market provides technology solutions that enable businesses to access funds against their unpaid invoices. Through APIs and user-friendly software, these platforms connect companies needing immediate cash flow with funders willing to advance payments on outstanding invoices. Solutions range from dedicated invoice financing platforms to broader financial management systems with invoice finance capabilities. These technologies simplify invoice processing, enhance transparency, and expedite funding timelines while reducing paperwork burden. The market includes factoring services, invoice discounting platforms, early payment programs, and integrated financial operation systems that facilitate better cash flow management.

Equity funding 2025 YTD: $56M|2 deals

Headcount 1-year change: -6%

Featured companies:

Banking

Treasury & cash management solutions

The treasury & cash management solutions market provides software and platforms for treasurers, CFOs, and finance teams to manage liquidity and gain real-time cash position visibility. These solutions connect directly to bank accounts, aggregate financial data, and deliver actionable insights in a centralized platform. Key capabilities include payment automation, cash flow forecasting, fraud protection, and bank connectivity APIs. The market helps organizations streamline financial operations, reduce manual processes, and enhance decision-making through automated transaction tagging and AI-powered analytics.

Equity funding 2025 YTD: $31M|1 deal

Headcount 1-year change: +1%

RELATED CB INSIGHTS RESEARCH

- State of Fintech Q1’25 Report

- The future of the customer journey: AI agents take control of the buying process

- Shopify’s next move: How the e-commerce giant is evolving into a full-stack platform for commerce and media

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign up for a free trial to learn more about our platform.