The insurance industry faces a new reality: embrace genAI or be left behind.

Insurance leaders are looking to emerging AI capabilities to reshape how they work. For instance, on AIG’s August 2024 earnings call, chairman and CEO Peter Zaffino highlighted an objective to use AI to “redesign and refine the end-to-end underwriting workflow.”

The industry’s opportunity in generative AI centers on increasing decision-making capabilities and operational speed, from improving quote-to-bind ratio to offering real-time guidance for employees. Two forces drive the opportunity: tech advances across the broader genAI ecosystem; and a wealth of unstructured data within the insurance industry.

Startups also recognize this opportunity and are moving quickly to develop and deploy genAI in insurance-specific applications.

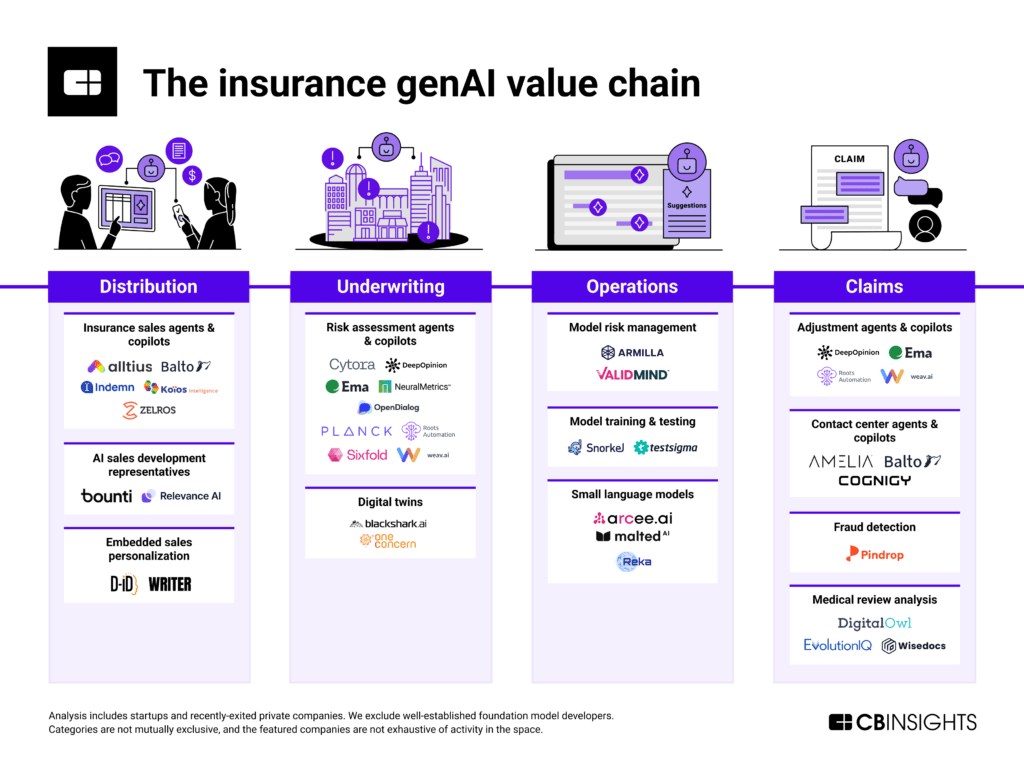

In this report, we use CB Insights datasets like business relationships, investments, and earnings transcripts to identify generative AI’s disruptive potential across each step of the insurance value chain — distribution, underwriting, operations, and claims.

The report focuses on companies with one of the following attributes: an insurance-relevant product position, a strategic investment from or partnership with an insurance firm; or an executive with insurance experience.