HighRadius

Founded Year

2006Stage

Series C | AliveTotal Raised

$475MValuation

$0000Last Raised

$300M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-45 points in the past 30 days

About HighRadius

HighRadius specializes in AI-enabled autonomous finance solutions for the office. The company provides a suite of products designed to automate and optimize order-to-cash, treasury, and record-to-report processes for businesses. Its solutions aim to reduce days sales outstanding (DSO), enhance working capital management, accelerate financial close, and improve overall productivity without the need for extensive technical knowledge. It was founded in 2006 and is based in Houston, Texas.

Loading...

HighRadius's Product Videos

ESPs containing HighRadius

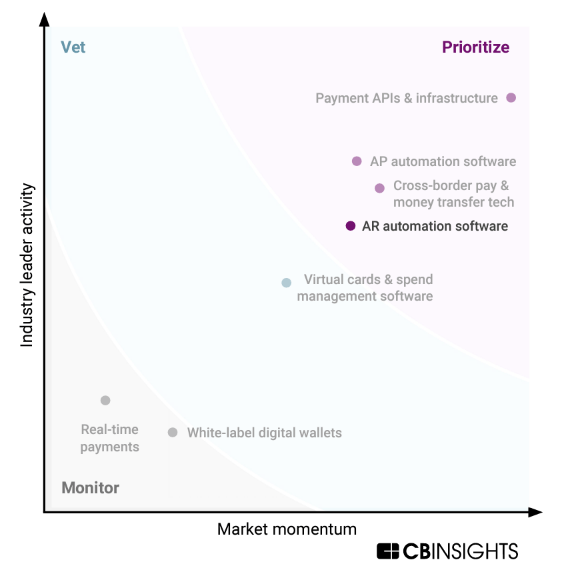

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The treasury & cash management solutions market helps corporate treasurers, CFOs, and finance teams manage liquidity and gain real-time cash position visibility. These enterprise-focused solutions connect directly to bank accounts, aggregate financial data, and deliver actionable insights in a centralized platform. Key capabilities include payment automation, cash flow forecasting, fraud protectio…

HighRadius named as Outperformer among 15 other companies, including SAP, Kyriba, and Coupa.

HighRadius's Products & Differentiators

Credit

HighRadius Autonomous Receivable platform has 5 solutions. Customers can subscribe to them individually or any combination. Each Solution has 4 editions with base capabilities to suit varying customer sizes and demands. 1. Credit onboards prospective customers and proactively manages credit risk of existing customers through real-time monitoring of external data. AI models predict upcoming blocked orders and provide recommendations to the collections team.

Loading...

Research containing HighRadius

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned HighRadius in 2 CB Insights research briefs, most recently on Oct 26, 2023.

Oct 26, 2023

The CFO tech stack market mapExpert Collections containing HighRadius

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

HighRadius is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

SMB Fintech

355 items

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Artificial Intelligence

10,047 items

HighRadius Patents

HighRadius has filed 25 patents.

The 3 most popular patent topics include:

- parallel computing

- payment systems

- diagrams

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

7/26/2022 | 3/18/2025 | Diagrams, Accounting terminology, Payment systems, Payment service providers, Parallel computing | Grant |

Application Date | 7/26/2022 |

|---|---|

Grant Date | 3/18/2025 |

Title | |

Related Topics | Diagrams, Accounting terminology, Payment systems, Payment service providers, Parallel computing |

Status | Grant |

Latest HighRadius News

Jun 18, 2025

Drafting of financial statements and audit trails Applying manual flags on questionable transactions The workload ate up resources and there was barely any time left for strategic planning or risk analysis. AI-based financial automation leverages machine learning, natural language processing (NLP), robotic process automation (RPA), and other AI technologies to automate financial tasks. Rather than depending only on humans to interpret them, these technologies learn from patterns, sense the deviations in patterns, and automate repetitive functions on their own — in real time. Key components often include: Automated Invoice Processing Systems – Automatically extract, verify, and archive invoice data with minimal to no human intervention. Cash Flow Forecasting – Use historical data to predict future financial states and support proactive financial planning. Regulatory Compliance Monitoring – AI tools that track evolving regulations and adjust compliance protocols accordingly. Anomaly Detection – Identify potential fraud, errors, or unusual transaction patterns far more quickly than traditional systems. Going From Reactive To Proactive Finance The transition isn’t simply technological — it’s tactical. AI enables businesses to: React in the moment instead of playing catch-up with old data Predict outcomes, adapt easily and fast Free up your financial professionals to focus on advisory roles rather than administrative tasks. An example of this evolution is evident in platforms such as HighRadius which leverages AI to optimise accounts receivable (AR) processes, improve working capital, and lower DSO (Days Sales Outstanding). Such solutions, by pulling data into one place and automating foundational processes, enable finance teams to work faster, more accurately and smarter. AI is changing the way European businesses manage finance – here’s how the two sides measure up Intelligent Accounting and Bookkeeping Income and expense transactions are classified at transaction time Auto-reconciliation of bank statements and ledgers Tax Offices of EU countries integration support This not only minimises the error factor but also keeps the differences with the country-specific VAT regulations, thus providing a welcomed relief for finance departments. Improved Forecasting and Budgeting Functions One of AI’s most powerful aspects is its capability to forecast and simulate the future using past information. AI enables: Trend analysis to compare performance across departments or subsidiaries Budgeting based on real-time market changes and operational adjustments In economically diverse markets like Europe, where local market understanding continues to be key, forward-looking sentiments provide businesses with a competitive advantage. Fraud Prevention and Risk Management Business fraud is still a major concern, particularly for sectors in which transactions are carried out in volume or involve cross-border payments. AI employs pattern identification and exception (anomaly) detection to: Detect anomalous behaviour as it happens Discover potential internal or external fraudsters Alert on unusual behavior to minimize financial risk. Businesses that must comply with EU directives such as PSD2 and AML directives are finding that AI solutions help them comply with the regulations and improve risk visibility. Automation of Compliance and Readiness for Audit In the EU, regulatory requirements are extensive and in a constant state of change. Businesses can use AI-powered automation to: Produce compliant financial statements in seconds Automatically track audit trails between departments Be informed of new legislations and immediately apply new compliance rules This way European businesses are kept nimble whilst maintaining governance. Examples of AI Automation A multi-country VAT processing solution for an e-commerce retailer. A children’s clothing supplier mitigates VAT processing risk for e-commerce. Edh is a leading children’s clothing supplier with five stores and an online shop. We recently worked with a medium-sized German firm operating in several EU countries that was finding it increasingly complex to juggle different VAT responsibilities. By incorporating AI-driven financial tools: The VAT rates were automatically applied at the time of checkout depending on the Customer’s location. Country by Country reporting was produced, ready for local tax filing Errors in compliance decreased by more than 80% As a result, it has enabled them to speed up their month-end close processes, and decreased the dependency on external consultants. Fintech Startup That Can Spot Payment Fraud as It Happens A Paris fintech company that manages B2B digital payments used machine learning algorithms to track customer activity. With AI: Profiles were created for new customers immediately The company’s fraud-related losses were down 47% in less than one year This led to increased customer confidence and a few enterprise customers who worried about payment security. Manufacturer Turns to AI for Supply Chain Finance Efficiency Spanish manufacturer with a pan-Europe supply chain deployed AI to improve working capital. Benefits included: Automatic payment scheduling to take advantage of early-pay discounts Better liquidity planning throughout the financial year. The metamorphosis enabled the CFO to align operations with financial strategy and to take advantage of the synergy between production and capital flows. Challenges and Considerations The Human Factor – Reskilling and Change Management The promise of AI is compelling, but it doesn’t come without challenges to implement. Reskilling of the existing finance teams is one of the top cited fears across European companies. Automation is eliminating repetitive tasks, forcing finance professionals to move toward more strategic, analytical roles. Employees may feel concerned about potential job loss due to AI adoption Organizations must invest in continuous learning and professional development Leadership should clearly communicate a bold vision for human-AI collaboration Data Privacy and Regulation Adherence Running in Europe also requires abiding by stringent privacy rules, particularly under GDPR. Businesses must ensure: AI models are trained using anonymized and secure data Personal and financial information is safeguarded through secure and responsible data practices AI solutions must ensure compatibility with EU-wide regulations and software standards Innovation tempered with compliance is crucial to prevent legal or reputational damage. Integration of AI with Legacy Systems DataComm is in place in many businesses and so they are using old infrastructure. The technical complexity of plugging AI tools into these environments can be: APIs might not available or might be compatible Data silos must be unified Investment is required to put in practice This requires the use of SCALABLE INTEROPERABLE solutions that can scale with the business over time. The Strategic Advantage: The End-of-Year Becomes the Reason to Automate Now Yet despite these challenges, the strategic advantages of financial automation far exceed the pains of business growing pains, particularly in Europe, with its rapidly evolving digital landscape. Competing in a Digital Europe By implementing AI-enabled financial platforms, enterprises can: Increase efficiency of operation Creating financial strength in uncertain times The European Union is actively promoting the adoption of AI technology with digital transformation funds and innovation grants, so there has never been a better time to invest in modernisation. Strategic Growth is Made Possible Through Automation With automation handling the repetitive work, finance leaders can shift their focus to: Scaling across European country markets M&A candidates that are more financially transparent In other words, AI doesn’t replace the finance department — it supercharges it. Financial automation using AI is no longer the future—it’s what gives you an edge today. It is more than simply operational efficiency for European companies. It’s all about transforming finance into a smarter, faster, more agile function that can steer through the new complexities of today’s economic landscape. From better forecasting to fraud detection and regulatory compliance, AI is proving to be the invisible friend to some of the most innovative companies in Europe. By embracing this shift now, businesses situate themselves to not just survive but thrive, in a digital-first economy.

HighRadius Frequently Asked Questions (FAQ)

When was HighRadius founded?

HighRadius was founded in 2006.

Where is HighRadius's headquarters?

HighRadius's headquarters is located at 2107 CityWest Boulevard, Houston.

What is HighRadius's latest funding round?

HighRadius's latest funding round is Series C.

How much did HighRadius raise?

HighRadius raised a total of $475M.

Who are the investors of HighRadius?

Investors of HighRadius include Susquehanna Growth Equity, Tiger Global Management, Howie Liu, Michael Scarpelli, Frank Slootman and 8 more.

Who are HighRadius's competitors?

Competitors of HighRadius include AvidXchange, OnPay, Cforia Software, Tipalti, Coupa and 7 more.

What products does HighRadius offer?

HighRadius's products include Credit and 4 more.

Who are HighRadius's customers?

Customers of HighRadius include Land O’Lakes, Inc. is a member-owned agricultural cooperative based in the Minneapolis-St. Paul suburb of Arden Hills, Minnesota, focusing on the dairy industry., Mattel is a toy manufacturing and entertainment company.It is headquartered at El Segundo, California., Duracell Inc. is an American manufacturing company that produces batteries and smart power systems., J. J. Keller & Associates, Inc. is a publisher and service organization, providing a wide spectrum of regulatory and information products and services ,complementary forms and supply products to customers regulated by the Department of Transportation, Occupational Safety and Health Administration, and more than 300 state agencies. and 3 more.

Loading...

Compare HighRadius to Competitors

Billtrust provides accounts receivable automation and order-to-cash solutions within the financial services sector. The company offers services that improve the invoicing process, support multi-channel payments, and allow matching and posting for business-to-business transactions. Billtrust's solutions serve various industries, improving cash application and electronic handling of invoices and payments. It was founded in 2001 and is based in Hamilton, New Jersey.

Global PayEx focuses on B2B payments modernization and working capital optimization within the financial technology sector. The company offers a suite of services including automation of accounts receivable and payable, electronic invoice presentment, and payment reconciliation, all powered by artificial intelligence to enhance financial operations for businesses. It was founded in 2011 and is based in Rockville, Maryland.

Routable is a financial technology company that specializes in accounts payable automation for businesses. The company offers a platform that streamlines invoice processing, vendor payments, and compliance management, while also providing tools for customizable approval workflows, payment reconciliation, and vendor onboarding. Routable's solutions cater to various sectors, including marketplaces, gig economy, insurance, real estate, logistics, manufacturing, and nonprofit organizations. It was founded in 2017 and is based in San Francisco, California.

Kyriba operates within the financial technology sector and focuses on liquidity performance. Its offerings include a platform for cash and treasury management, risk management, and payment processing. Kyriba serves sectors such as finance, technology, retail, manufacturing, and insurance, targeting CFOs, treasurers, and IT leaders. It was founded in 2000 and is based in San Diego, California.

Fintainium provides financial technology solutions within the B2B payments and receivables sector. The company offers a platform for cash flow management, embedded payments, mass disbursements, and lending services for businesses. Fintainium serves small and medium-sized businesses, financial institutions, FinTech companies, software companies, and accounting firms. Fintainium was formerly known as ePayRails. It was founded in 2018 and is based in Jacksonville, Florida.

Vic.ai is a company that provides AI-based solutions for accounts payable automation in the finance sector. The company's offerings include invoice processing, expense management, and analytics to support financial operations. Vic.ai's platform aims to assist AP operations and enhance invoice accuracy. It was founded in 2017 and is based in New York, New York.

Loading...