Harvey

Founded Year

2022Stage

Series E | AliveTotal Raised

$806MValuation

$0000Last Raised

$300M | 19 days agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+68 points in the past 30 days

About Harvey

Harvey specializes in domain-specific artificial intelligence for the legal and professional services sectors. The company provides products for tasks such as contract analysis, due diligence, compliance, and litigation. Its solutions are used by global law firms and Fortune 500 enterprises. The company was founded in 2022 and is based in San Francisco, California.

Loading...

ESPs containing Harvey

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

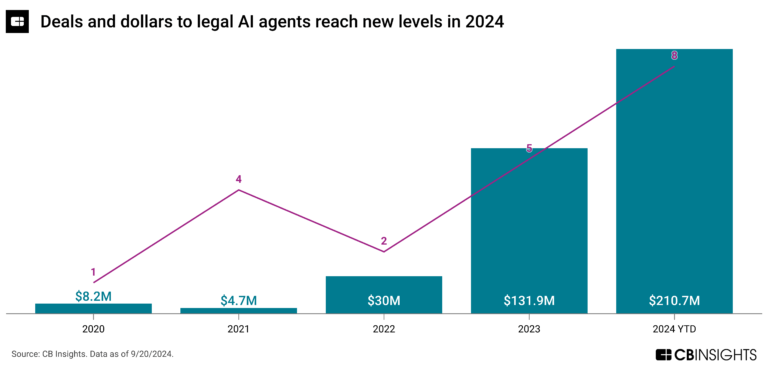

The legal AI agents & copilots market provides AI-powered tools that use natural language instructions to assist lawyers with day-to-day legal work. These solutions automate and streamline tasks such as legal research, document summarization, contract analysis and review, legal document drafting, and case preparation. Companies in this market primarily use generative AI technology and large langua…

Harvey named as Leader among 15 other companies, including Thomson Reuters, Luminance, and Clio.

Loading...

Research containing Harvey

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Harvey in 14 CB Insights research briefs, most recently on Apr 29, 2025.

Apr 29, 2025 report

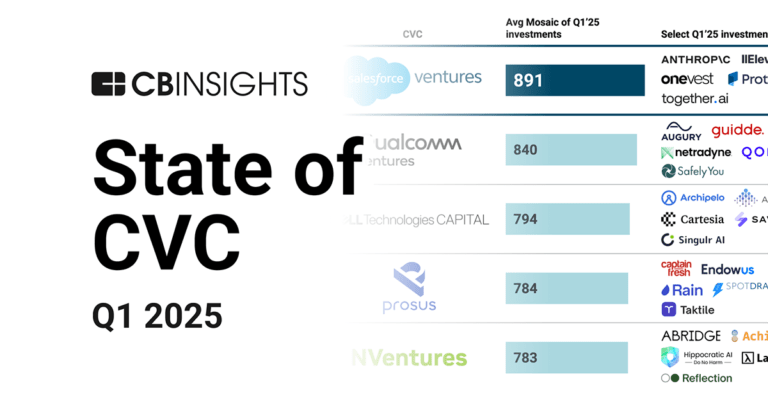

State of CVC Q1’25 Report

Mar 6, 2025

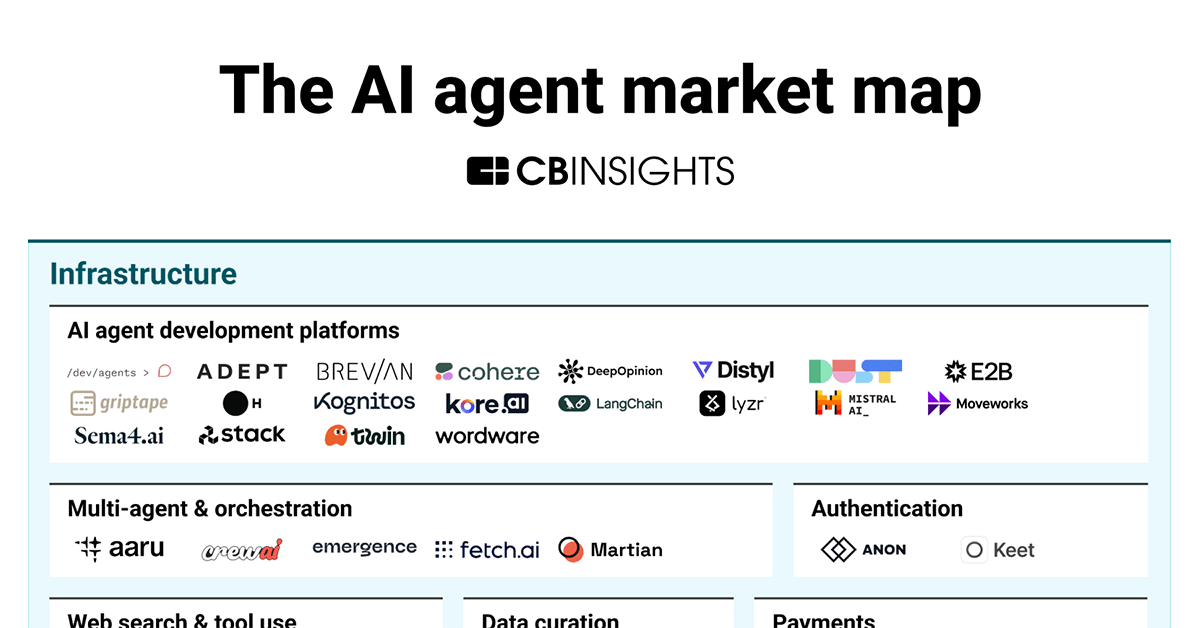

The AI agent market map

Oct 29, 2024 report

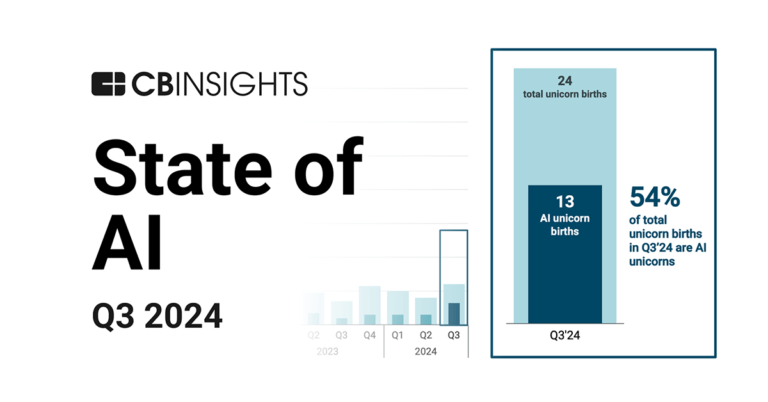

State of AI Q3’24 Report

Oct 4, 2024

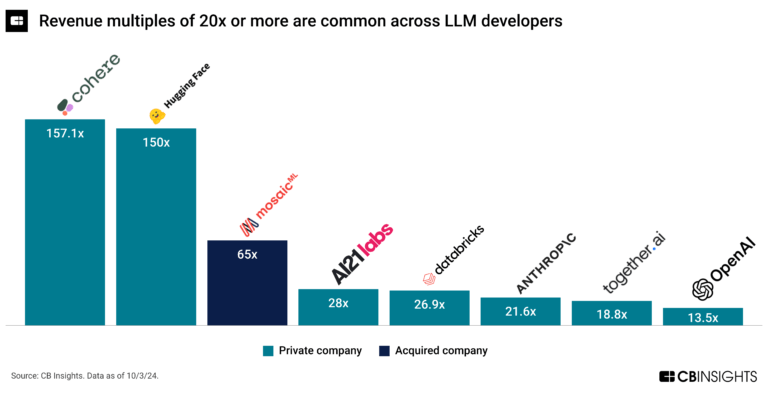

The 3 generative AI markets most ripe for exits

Oct 3, 2024 report

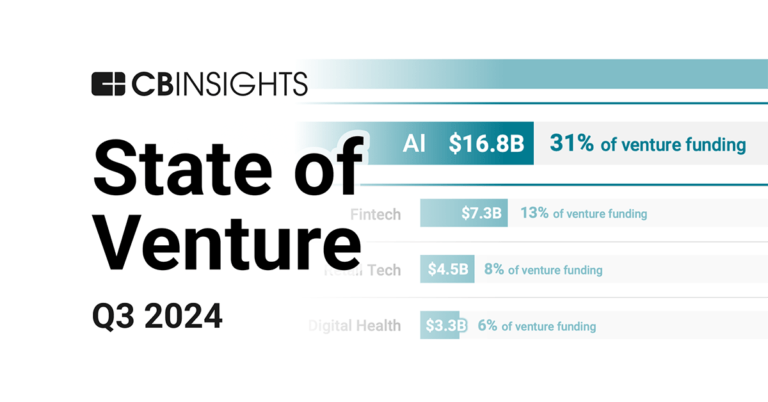

State of Venture Q3’24 Report

Aug 7, 2024

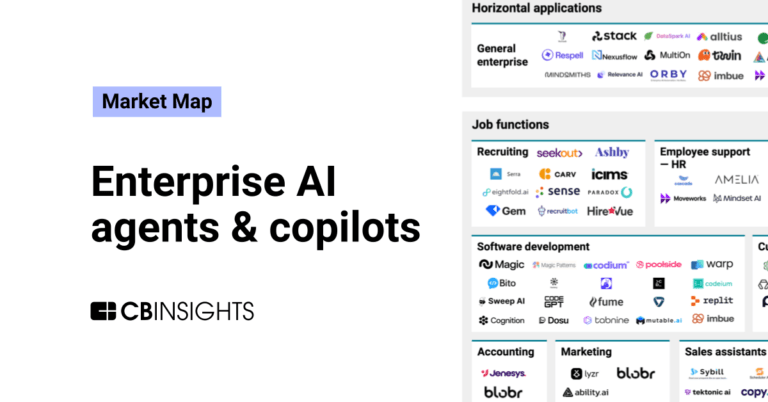

The enterprise AI agents & copilots market mapExpert Collections containing Harvey

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Harvey is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

AI 100 (All Winners 2018-2025)

100 items

Generative AI 50

50 items

CB Insights' list of the 50 most promising private generative AI companies across the globe.

Generative AI

2,308 items

Companies working on generative AI applications and infrastructure.

Artificial Intelligence

10,045 items

AI Agents & Copilots Market Map (August 2024)

322 items

Corresponds to the Enterprise AI Agents & Copilots Market Map: https://app.cbinsights.com/research/enterprise-ai-agents-copilots-market-map/

Latest Harvey News

Jul 3, 2025

A new class of enterprise software company is emerging. Thousands of AI-native startups have launched in the past 18 months, each pitching an intelligent agent to replace human workers: AI SREs, AI SDRs, AI accountants, AI paralegals. These are not workflow accelerators or data entry helpers, but end-to-end systems designed to do the work for you. We call them Services-as-Software companies, and they’re redefining the structure, value, and go-to-market motion of enterprise software. Success in Services-as-Software is fundamentally different from success in the SaaS era. Gone are the days where startups could differentiate themselves by having the best features. AI has accelerated the collapse of software primitives. Decades of enterprise UX and domain logic have been compressed into a few modular capabilities: inbox triage, structured data tables, LLM-powered search, workflow routing, and generative response. What used to take months of application-specific design can now be assembled in a weekend. As a result, nearly every AI product now looks the same. A legal ops system looks like a claims processor. A RevOps copilot looks like an underwriting assistant. When every company can ship the same primitives using the same models, what you build is no longer your moat. How you integrate, embed, and operate becomes the moat. That shift – from tooling to delivery – is why Services-as-Software companies are outperforming their peers. They deliver outcomes. Current AI capabilities require significant customization to deliver reliable business outcomes. This is particularly evident in enterprise deployments where data variability is extreme, workflow complexity is high, and performance standards are unforgiving. Consider the difference between a consumer chatbot that provides “helpful” responses and an enterprise legal assistant that must flag compliance risks with 99%+ accuracy. Over the past year, we’ve studied dozens of Services-as-Software companies and found three consistent patterns that separate companies with real traction from those riding the hype cycle. 1. Product differentiation comes from implementation In the pre-AI software era, product differentiation came from proprietary code, superior architecture, UX craftsmanship, and feature velocity. Engineering organizations competed on the strength of their frameworks, infrastructure, and ability to ship roadmap items at pace. In the AI world, differentiation has become even harder. Foundation models – Claude, GPT-4, Gemini – are available to all. Open-source alternatives rapidly close any capability gaps. The cost of building surface-level functionality (autocomplete, classification, summarization) is approaching zero. So how can startups differentiate themselves? For Services-as-Software companies, differentiation comes from business outcomes. What matters now is how deeply a system embeds into a customer’s operating environment: how well it conforms to their internal workflows, idiosyncratic data structures, domain-specific language, and organizational incentives. The changing role of the forward-deployed engineer provides a clear example of how this shift is playing out in practice. In the pre-AI era, forward-deployed engineers were often treated as specialized implementation consultants – technical enough to configure systems and customer-facing enough to support go-lives. Now, forward-deployed engineers have become one of the most strategic assets in enterprise AI companies. They: Navigate highly variable customer environments where no two workflows are the same Forward-deployed engineers begin every engagement with a “shadow-the-user” discovery sprint – mapping every step, tool, hand-off, and exception that keeps the current process running. They document unspoken tribal knowledge (e.g., “Jane from AP manually fixes invoices that fail OCR on Fridays”) and surface latent dependencies the product team never sees. Example: Sierra embeds an engineer inside a Fortune 500 support team for two weeks, shadowing agents across Zendesk, Slack, and an in-house escalation spreadsheet. The engineer uncovers a hidden rule – VIP customers jump the queue if their last CSAT < 4 – which would have broken the bot’s triage logic had it remained invisible. Convert edge-case business rules into configurable parameters the agent can read, tweak, and audit Once quirks are surfaced, FDEs encode them as runtime-editable settings – thresholds, allow-lists, YAML policies – rather than hard-wiring them into code or prompts. At one direct procurement startup, the rule “any bearing order above $10,000 triggers a competitive RFQ” lives in an admin panel; when steel prices spike, a category manager lowers the threshold to $7,500, clicks save, and the sourcing agent adapts on its next run – no redeploy, no engineering ticket, with every change logged for audit. Instrument and tune models using production feedback loops FDEs wire every decision point to telemetry – capturing confidence scores, human overrides, and downstream business metrics – then set up automated retraining or prompt updates when performance drifts. Example: A legal tech company has legal engineers which track clause-extraction accuracy in live contracts. Each false negative generates a labeled example that flows into a nightly fine-tune job. Within a month, the model’s recall on indemnification clauses climbs from 92% to 98% without interrupting service. Develop re-usable implementation scaffolding that feeds back into the core product Patterns that succeed in one deployment – custom adapters, monitoring dashboards, migration scripts – are abstracted into modules the next customer can enable with a flag. This turns one-off effort into compounding product leverage. Example: After building a PostgreSQL change-data-capture pipeline for a healthcare client, the FDE team packages it into an “ingestion kit” now offered to every prospect running on legacy relational databases, cutting future deployment time by 70%. Harvey is another great example. Dozens of legal AI vendors can extract entities from contracts. Harvey differentiates by using forward-deployed legal engineers who sit inside Am Law 100 firms for weeks to codify how redlines are handled, how clauses are structured, and how decisions are escalated. Those implementations become fine-tuned substrates that become part of Harvey’s deployment framework. In short, in enterprise AI, integration is not a post-sale activity. It is the product surface. 2. The line between pre-sales and post-sales no longer exists Traditional enterprise software sales follow a predictable sequence: lead qualification, discovery calls, product demos, technical evaluation, commercial negotiation, and post-sale implementation. This linear process works when customers can evaluate software functionality independently of their specific operational environment. AI systems have fundamentally broken this model. Because AI performance depends on data quality, workflow integration, and domain-specific tuning, customers can’t meaningfully evaluate these systems without experiencing them in their actual operating environment. The customer now expects to experience functionality, integration, and outcome before a contract is signed. The market has grown increasingly skeptical as AI companies promise transformative outcomes. Customers have adopted an “I’ll believe it when I see it” mentality, demanding proof of concept with real data before any commitment. Consider a Fortune 500 company evaluating an AI-powered procurement assistant. Traditional demos with clean sample data fail because their actual purchase orders contain legacy formatting, incomplete vendor information, and industry-specific terminology that only surface when processing real transaction volumes. When AI systems claim to automate entire human roles, the evaluation bar becomes exponentially higher – the AI must handle every exception a human would encounter, from vendor disputes to emergency purchases to policy interpretations. This has created a cost of sale crisis. AI POCs now require data ingestion, orchestration logic, prompt tuning, and live model validation. Unlike traditional SaaS pilots that take days to configure, AI evaluations demand forward-deployed engineering time, stakeholder alignment, and workflow-specific customization. The cost of evaluating a bad-fit customer is measured in headcount hours, not product clicks. Moreover, this effort doesn’t end at implementation. AI solutions require ongoing adaptation to remain performant as businesses evolve – new product lines, revenue streams, and workflows all demand continuous tuning and adjustment. The traditional “deploy and maintain” model has become “deploy and continuously re-engineer.” Churn in this model carries a material cost: when a pilot fails, the vendor forfeits not only anticipated revenue but also the weeks of implementation work required to reach proof-of-concept, and even modest churn can erode margins once the substantial engineering effort and the non-trivial token expenses – far higher than the penny-level costs of traditional software infrastructure – are taken into account. Leading companies are adapting through strategic classification systems. One healthcare portfolio company distinguishes between “Below the Line” deals with standard workflows and templated integrations versus “Above the Line” deals requiring custom systems that trigger gating processes and manual technical scoping. Harvey co-develops use cases with legal teams during sales so workflows are live and measurable before contracts are signed. Clay equips its sales team with practitioners who do the work while selling the automation. The companies that master this new model win big. Each successful engagement compounds knowledge through reusable adapters, workflow patterns, and stakeholder frameworks that make future deployments faster and cheaper. Enterprise AI companies must accept the elevated cost of sale with the understanding that the depth of their customer integrations will eventually become their competitive moat. In a world where AI capabilities rapidly commoditize, implementation expertise becomes the lasting differentiator. 3. Companies are aligning their pricing with customer outcomes The shift to Services-as-Software forces companies to think less about feature gating and more about value alignment. Traditional SaaS pricing was built for a world where software was a tool. In the Services-as-Software model, pricing must reflect that AI is doing work, not just enabling it. While business models vary, the trendline is moving from access-based to outcome-based pricing. We propose understanding this evolution as spectrum: access-based, usage-based, workflow-based, and outcome-based pricing. Seat / access-based pricing remains foundational – customers pay to use the product through seat-based subscriptions. This model essentially functions as an embedded insurance policy: predictable and simple, but misaligned when usage varies or value spikes. All pricing has an element of embedded insurance, but the cost of this insurance rises as AI capabilities expand unpredictably. Usage-based pricing charges based on activity – charge for tokens, minutes, or queries so the bill scales with activity. It is transparent, but it forces buyers to translate raw usage into ROI themselves and leaves vendors whipsawed whenever model-pricing drops faster than they can re-price. Voice-AI platforms like Bland live here today because “minutes spoken” is the cleanest metric they can defend, yet every optimization that cuts call length also cuts revenue. Workflow-based pricing charges per job done – documents processed, reports written, support tickets triaged. Customers like the predictability and the abstraction away from infrastructure minutiae, while vendors enjoy a tighter link between revenue and work accomplished. The drawback is instrumentation overhead – defining, measuring, and policing what counts as a completed task. Harvey straddles this middle ground: law firms pay roughly a thousand dollars per lawyer each year, but renewal conversations revolve around hours saved, not seats deployed. Outcome-based pricing aligns perfectly with value delivered. Companies pay when a desired result occurs – e.g., a lead converted or a ticket resolved. However, outcome-based pricing doesn’t work if there’s too much variability from company to company. Outcome is ultimately a function of the customer’s product, not just your software. AI SDR tools illustrate this challenge perfectly. Despite promising to deliver measurable sales outcomes, most use task-based or usage-based pricing because customer results vary dramatically. Since sales outcomes depend heavily on the customer’s industry, target market, competitive landscape, and internal processes (not just the AI tool’s capabilities) outcome guarantees become impossible to standardize. When implemented correctly with consistent, measurable results, outcome-based pricing builds trust, but it requires robust instrumentation and delivery confidence across diverse customer environments. In the new AI world, buyers don’t purchase software; they purchase the outcomes it delivers. Pricing will evolve over time to become more outcome based as application layer companies continue to reimagine and own more and more of the human workflows. The progression toward outcome-based pricing will be messy, with false starts, hybrid tiers, and plenty of margin surprises. The sooner startups internalize that reality, the sturdier (and stickier) their customer relationships will become. Focus on speed-to-value rather than “vibe revenue” Over the past year, AI has flattened the old hierarchy of “features → workflows → outcomes.” When primitives are free and demos interchangeable, durable advantage shifts to implementation depth: forward-deployed engineers who tame messy data and edge-case workflows; sales motions that blur pre- and post-sales so customers experience real value before they sign; and contracts that evolve from seats to usage to tasks and, ultimately, to shared outcomes. Chasing “vibe revenue” can juice early sign-ups, but lasting growth comes only from the loop – rapid speed-to-value, compounding operational data, and renewals that swell because the software keeps doing more of the work, more reliably, every quarter. Why fight so hard to perfect that loop? Because the prize isn’t the familiar $200B SaaS pool; it’s the $4.6T enterprises pour each year into salaries and outsourced services – the very labor-intelligent agents are now poised to absorb. Every startup that masters deep integration and outcome insurance carves off a slice of that multi-trillion-dollar frontier – and each successful deployment becomes cheaper, faster, and harder for competitors to dislodge. The opportunity is vast, and the only currency that matters is the speed with which you can turn promises into provable results. Published on July 3, 2025 Written by Ashu Garg and Jaya Gupta

Harvey Frequently Asked Questions (FAQ)

When was Harvey founded?

Harvey was founded in 2022.

Where is Harvey's headquarters?

Harvey's headquarters is located at 575 Market Street, San Francisco.

What is Harvey's latest funding round?

Harvey's latest funding round is Series E.

How much did Harvey raise?

Harvey raised a total of $806M.

Who are the investors of Harvey?

Investors of Harvey include Elad Gil, Kleiner Perkins, Google Ventures, SV Angel, Conviction Capital and 19 more.

Who are Harvey's competitors?

Competitors of Harvey include Wordsmith, General Counsel AI, Legora, Lexroom, Eudia and 7 more.

Loading...

Compare Harvey to Competitors

Eudia focuses on augmented intelligence for legal teams within the enterprise sector. Their main offering is an AI-driven platform that provides insights from contracts and legal data, which aims to assist enterprise legal departments. Eudia primarily serves Fortune 500 legal teams. It was founded in 2023 and is based in San Francisco, California.

Ivo specializes in artificial intelligence (AI)-driven contract review solutions within the legal technology sector. The company offers a platform that automates risk assessment, facilitates negotiations, and generates reports. Ivo serves legal teams in enterprises with contract management. Ivo was formerly known as Latch. It was founded in 2021 and is based in San Francisco, California.

Alexi specializes in generative artificial intelligence (AI) for the legal sector. It focuses on enhancing litigation processes. The company offers AI enabled solutions that generate legal research memos, assist in litigation argument brainstorming, and automate routine litigation tasks. Alexi primarily serves law firms of various sizes and in-house legal teams. It was founded in 2017 and is based in Toronto, Canada.

LegalMation provides artificial intelligence solutions for the legal sector, focusing on litigation and dispute resolution. The company offers tools that assist in the creation of legal documents such as responsive pleadings, discovery requests, and demand letters, along with analytics and matter profiling to support legal workflows. LegalMation serves corporate legal departments, law firms, and insurance companies. It was founded in 2017 and is based in Los Angeles, California.

Legora operates an artificial intelligence platform designed to support legal professionals within the legal sector. It offers tools that aid in legal document review, drafting, and research, thereby improving team efficiency. Legora's solutions are tailored to the needs of firms, providing a collaborative workspace that integrates with existing workflows for research, document analysis, and drafting. It was formerly known as Leya. It was founded in 2023 and is based in Stockholm, Sweden.

CaseMine is a legal technology company focused on leveraging artificial intelligence to enhance legal research and case analysis. Its main offerings include an AI-powered legal research platform that assists legal professionals in finding relevant case laws and statutes, and an AI legal assistant named AMICUS that provides strategic guidance and accurate answers to legal queries. The company primarily serves legal professionals seeking efficient research tools and case management solutions. It was founded in 2014 and is based in Noida, India.

Loading...