Gong

Founded Year

2015Stage

Series E | AliveTotal Raised

$583MValuation

$0000Last Raised

$250M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-17 points in the past 30 days

About Gong

Gong offers a revenue intelligence platform that focuses on sales and customer success by providing insights and analytics. It offers tools for capturing and analyzing customer interactions and managing sales pipelines. It serves sectors such as technology, finance, and professional services. It was founded in 2015 and is based in San Francisco, California.

Loading...

Gong's Product Videos

ESPs containing Gong

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The contact center agent support tools market provides solutions to common challenges faced by contact centers, such as high employee attrition, low customer satisfaction, and poor agent engagement. These tools aim to improve the efficiency and effectiveness of customer interactions by leveraging AI and automation to capture, analyze, and optimize customer conversations. The market includes a vari…

Gong named as Leader among 15 other companies, including CallMiner, Observe.ai, and Level AI.

Gong's Products & Differentiators

Gong Reality Platform

The Gong Reality Platform™ autonomously empowers customer-facing teams to take advantage of their most valuable assets – customer interactions, which the Gong platform captures and analyzes. Gong then delivers insights at scale, enabling revenue and go-to-market teams to determine the best actions for repeatable winning outcomes.

Loading...

Research containing Gong

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Gong in 6 CB Insights research briefs, most recently on Jan 3, 2024.

Jan 3, 2024

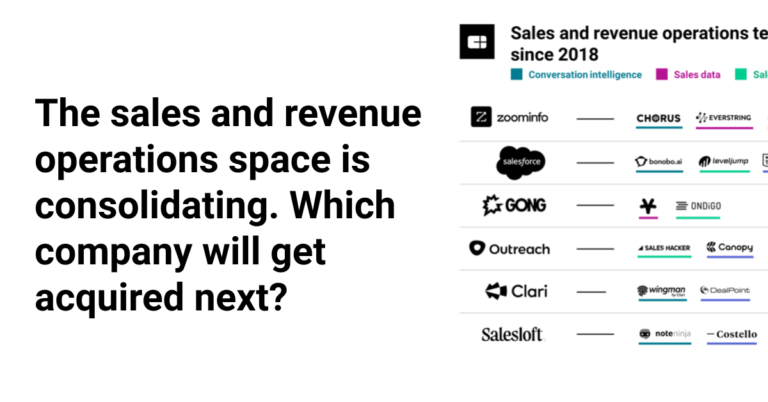

2024 prediction: Gong acquires Apollo

Dec 5, 2022

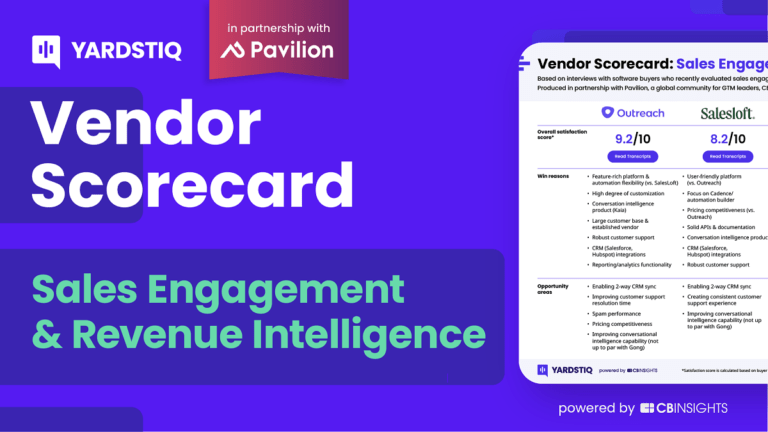

The Transcript from Yardstiq: The Gong showExpert Collections containing Gong

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Gong is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

AI 100 (All Winners 2018-2025)

199 items

Winners of CB Insights' annual AI 100, a list of the 100 most promising AI startups in the world.

Ad Tech

4,236 items

Companies offering tech-enabled marketing and advertising services.

Future Unicorns 2019

50 items

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Artificial Intelligence

10,047 items

Gong Patents

Gong has filed 59 patents.

The 3 most popular patent topics include:

- computational linguistics

- natural language processing

- machine learning

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/18/2022 | 3/18/2025 | Wrenches, Action anime and manga, Mechanical hand tools, Woodworking hand tools, Mechanisms (engineering) | Grant |

Application Date | 10/18/2022 |

|---|---|

Grant Date | 3/18/2025 |

Title | |

Related Topics | Wrenches, Action anime and manga, Mechanical hand tools, Woodworking hand tools, Mechanisms (engineering) |

Status | Grant |

Latest Gong News

Jun 23, 2025

June 30, 2025: The date where if your team hasn’t rolled out a truly great AI into production yet … and seen a boost from it … It’s time to reboot the team. It’s time. It’s time to call it. June 30, 2025 marks the time we need to wrap up the era of stalling, of waiting to see in AI. Because we’ve waited, and seen, and learned. We’ve officially crossed the threshold where “AI-first” has moved from competitive advantage to table stakes. If your engineering team, your product team, or your leadership team hasn’t shipped meaningful AI capabilities into production by now, that have led to a material increase in revenue — you don’t have a strategy problem. You have a talent (and vision) problem. The 18-Month “Let’s See” Window Has Closed Let’s be brutally honest about the timeline here. ChatGPT launched in November 2022. Claude, GPT-4, and the foundation model explosion happened through 2023. By early 2024, every serious B2B company had access to the same foundational AI capabilities through APIs that cost pennies on the dollar. That gave everyone roughly 18 months to figure it out. Eighteen months to experiment, to build, to learn, and to ship something that moves the needle. The companies that used those 18 months wisely aren’t just winning—they’re lapping the competition. Look at the hypergrowth AI B2B companies that are redefining what’s possible: Anthropic (Claude): Hit $3 billion in annualized revenue by May 2025, up from $1 billion in December 2024 — that’s 200% growth in 5 months Sierra: Reached $50M ARR in 2024 and $4.5 billion valuation — 300%+ growth rate for an AI customer service platform Cursor: The fastest-growing SaaS company ever, hitting $100M ARR in just 12 months and now at $200M ARR — 10x faster than traditional SaaS Loveable: Reached $1M ARR in 8 days, $10M in 2 months, and $60M ARR in 6 months — Europe’s fastest-growing AI startup ever Harvey AI: Surpassed $50M ARR and targeting $100M within 8 months at a $3B valuation — revolutionizing legal tech Perplexity: Crossed $100 million in annualized revenue just 20 months after launching premium subscriptions — transforming AI search • Mercor: Hit $75M ARR in 2 years with 51% month-over-month growth and $2B valuation — AI-powered recruiting that’s already profitable Owner.com: Hit $50M ARR growing 150% YoY at $1B valuation with AI-powered restaurant tech — helping local businesses compete with giants like Domino’s RevenueCat: AI has turbocharged it powering $1B+ in mobile subscriptions for leaders including … ChatGPT . ElevenLabs rocketing to $100m+ ARR powering voice for AI leaders. Gong: Reaccelerated to $300M+ ARR driven by AI features seeing 400%+ YoY growth and 50% usage increases — revenue intelligence powered by AI Dialpad: Surpassed $300M ARR with 50%+ YoY growth, fueled by DialpadGPT and 250M+ AI Recaps in 6 months — communications intelligence at scale Palantir: Revenue acceleration from 13% in 2023 to 36% in Q4 2024, driven by AIP launch — proving even established companies can reboot with AI What “Truly Great AI” Actually Means I’m not talking about slapping a chatbot on your landing page or adding “AI-powered” to your marketing copy. I’m talking about AI that genuinely transforms your core product experience in ways that create measurable business impact. Great AI in production looks like: Superhuman-level assistance that users can’t live without. Linear’s AI issue triaging doesn’t just categorize tickets—it predicts resolution time, suggests optimal assignees, and auto-generates technical context that saves engineering teams 2-3 hours per sprint. Users report they “feel helpless” working in other project management tools now. Invisible intelligence that makes your product fundamentally better. Figma’s AI design suggestions don’t feel like a separate feature—they feel like the product got smarter. Conversion rates on design handoffs increased 60% because the AI anticipates developer needs during the design process. Workflow transformation that creates new value. Loom’s AI meeting summaries didn’t just transcribe—they created entirely new workflows around asynchronous collaboration. Teams that adopted it saw 30% reduction in follow-up meetings and 50% faster project velocity. The common thread? These aren’t AI features bolted onto existing products. They’re AI-native experiences that reimagine what the product can do. The Talent Reckoning Here’s what I’ve learned from talking to 200+ SaaS founders over the past six months: The companies shipping great AI aren’t necessarily the ones with the biggest AI budgets or the fanciest ML infrastructure. They’re the companies that made hard decisions about their teams early. The CTO who said “we don’t need AI people, our engineers can figure it out“ is now 12 months behind companies that hired AI-native talent in early 2024. Traditional software engineering skills and AI engineering skills have meaningful overlap, but they’re not the same thing. Prompt engineering, model fine-tuning, vector databases, retrieval-augmented generation—these aren’t concepts you pick up over a weekend. The product leader who treated AI as “just another feature” missed that AI requires fundamentally different product thinking. Great AI products aren’t built by adding smart components to dumb workflows. They’re built by reimagining the workflow around what AI makes possible. This requires product leaders who viscerally understand the technology, not just the market opportunity. The CEO who delegated AI strategy to someone who “really gets AI” discovered too late that AI strategy is business strategy. The companies winning with AI aren’t optimizing existing processes—they’re creating entirely new business models. That requires leadership that understands both the technology possibilities and the market implications. The Reboot Playbook If you’re reading this and realizing you’re in the “reboot” camp, here’s the harsh but actionable truth: Stop trying to retrain your existing team. I’ve watched dozens of companies spend 6-12 months trying to upskill engineers who fundamentally don’t believe in AI-first development. Meanwhile, their competitors hired AI-native talent and shipped three product iterations. You can’t afford the learning curve anymore. Hire for AI-first thinking, not AI expertise. The best AI hires I’ve seen aren’t necessarily the ones with the deepest ML backgrounds. They’re the ones who instinctively think about problems through an AI lens—who see a manual process and immediately envision how LLMs could transform it, who understand that great AI products feel magical because they anticipate user needs. Give your new AI team real authority. Half-measures don’t work in AI. The companies succeeding are the ones where AI engineering sits at the leadership table, where AI considerations drive product roadmap decisions, where AI capabilities influence go-to-market strategy. If your AI team reports to someone who doesn’t fundamentally believe in AI-first product development, you’re setting them up to fail. Accept that you’re starting over. Your existing product roadmap, your engineering processes, your QA workflows—much of it was designed for deterministic software in a pre-AI world. AI products require different testing methodologies, different deployment strategies, different success metrics. Fighting this reality will slow you down more than embracing it. The Competitive Reality The uncomfortable truth is that we’re already seeing market separation. Companies with great AI in production aren’t just growing faster—they’re fundamentally changing customer expectations in their categories. Customers who experience Notion’s AI writing don’t just prefer it to other wiki tools—they find other wiki tools frustratingly primitive. Users who work with GitHub Copilot don’t just code faster—they find traditional IDEs limiting and outdated. This isn’t about features anymore. It’s about raising the bar for what software can do. Your competitors with great AI aren’t just winning deals. They’re redefining what winning looks like in your category. And if you’re still debating whether AI is hype or reality, you’ve already lost the positioning battle. Big Companies Don’t Really Have More Time Yes, bigger companies have a bigger base to protect, and move more slowly in general. But just becausae your installed base isn’t leaving, doesn’t mean you new customer acquisition hasn’t already materially slowed due to AI competitors. And that there isn’t “stealth churn” in your base. The Path Forward June 30, 2025 isn’t just an arbitrary deadline. It’s the date where the excuses run out. “We’re a small company” doesn’t work when two-person startups are shipping AI features that feel more sophisticated than your enterprise product. “Our customers aren’t asking for AI” doesn’t work when your customers are using AI tools to work around your product’s limitations. “We need to see more ROI data” doesn’t work when your competitors are creating entirely new value propositions that make ROI comparisons irrelevant. The companies that will dominate the next decade of SaaS aren’t the ones with the best AI today. They’re the ones building AI-native cultures, AI-first product experiences, and AI-enabled business models. If your team hasn’t shipped great AI into production yet, the question isn’t whether you need to make changes. The question is whether you have the courage to make them fast enough to matter. The window for gradual transformation has closed. The window for dramatic transformation is still open. But not for much longer. Related Posts

Gong Frequently Asked Questions (FAQ)

When was Gong founded?

Gong was founded in 2015.

Where is Gong's headquarters?

Gong's headquarters is located at 201 Spear Street, San Francisco.

What is Gong's latest funding round?

Gong's latest funding round is Series E.

How much did Gong raise?

Gong raised a total of $583M.

Who are the investors of Gong?

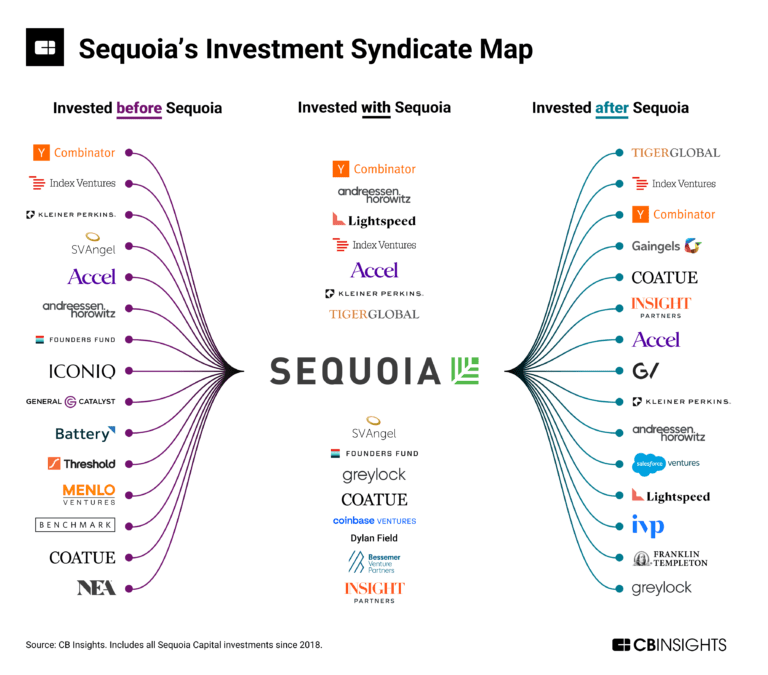

Investors of Gong include Sequoia Capital, Coatue, Salesforce Ventures, Thrive Capital, Tiger Global Management and 10 more.

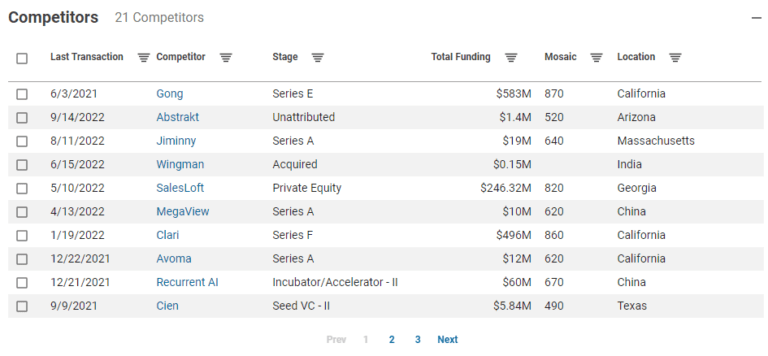

Who are Gong's competitors?

Competitors of Gong include Jeeva, Bigtincan, SalesLoft, Showpad, 400F and 7 more.

What products does Gong offer?

Gong's products include Gong Reality Platform.

Who are Gong's customers?

Customers of Gong include Mintel, ComplyAdvantage, Hubspot, Aircall and Monday.com.

Loading...

Compare Gong to Competitors

Seismic is a sales enablement platform that provides customer-facing teams with various tools. The company's offerings include automation, insights, and content aimed at improving sales, marketing, and customer service. Seismic serves sectors such as financial services, manufacturing, and technology. Seismic was formerly known as Nu:Pitch. It was founded in 2010 and is based in San Diego, California.

Addvocate specializes in providing sales strategies through the integration of artificial intelligence (AI) and customer feedback within the sales technology sector. The company offers AI-driven tools that provide personalized sales insights and strategies. Addvocate's solutions are designed to cater to the needs of sales professionals seeking to optimize their sales cycles and strategies. It was founded in 2024 and is based in Paris, France.

Mindtickle offers sales enablement and revenue productivity solutions within the information technology and services sector. It offers a platform that includes sales training, content management, coaching, and analytics to enhance sales team performance. Mindtickle's platform is designed to serve industries, including automotive, medical devices, consumer goods, chemical, and technology sectors. It was founded in 2011 and is based in San Francisco, California.

Salesloft provides revenue growth and efficiency solutions within the sales technology sector. Its main offering is a Revenue Orchestration Platform that helps sales teams prioritize and act on buyer signals, manage pipelines, and forecast sales outcomes. The platform is used by revenue operations, sales leaders, and customer success teams, and includes tools for technology and workflow optimization, team productivity, and customer engagement. It was founded in 2011 and is based in Atlanta, Georgia.

Highspot provides a sales enablement platform. The platform includes managing sales content, executing sales plays and playbooks, engaging buyers, onboarding and training sales representatives, and providing sales coaching, supported by analytics and AI technology. Highspot serves sectors, including financial services, manufacturing, healthcare, life sciences, and technology. It was founded in 2012 and is based in Seattle, Washington.

People.ai is a company that provides an AI data platform for go-to-market teams. The company offers products for sales activities such as account planning, deal inspection, content generation, account enablement, and forecasting, utilizing a data foundation and generative AI capabilities. People.ai serves sectors that require sales and revenue operations solutions, utilizing AI technology to enhance sales processes. It was founded in 2016 and is based in San Francisco, California.

Loading...