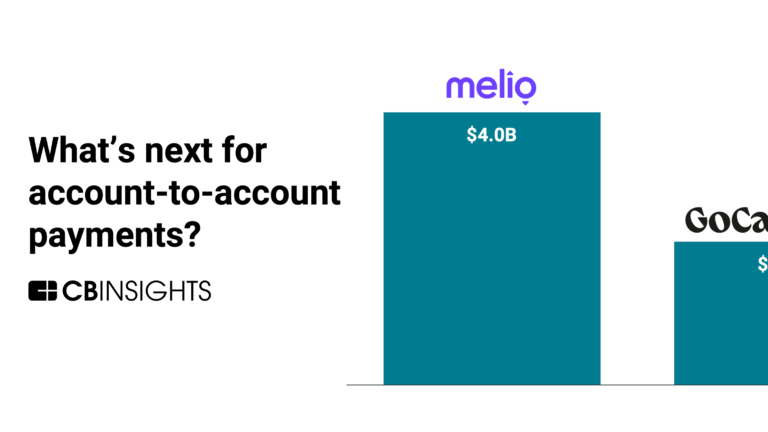

GoCardless

Founded Year

2011Stage

Series G | AliveTotal Raised

$529.32MValuation

$0000Last Raised

$312M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-17 points in the past 30 days

About GoCardless

GoCardless provides online payment processing solutions for various business sectors. The company offers services for one-off, recurring, and invoice payments, including options for subscriptions, installments, and automated payment collection. GoCardless serves sectors that require payment processing and management, such as e-commerce, real estate tech, and cloud computing. It was founded in 2011 and is based in London, United Kingdom.

Loading...

GoCardless's Product Videos

ESPs containing GoCardless

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The real-time payments (RTP) processing market provides infrastructure, technologies, and platforms that enable instant, 24/7/365 electronic payment transactions with immediate settlement and finality. This market includes payment rail operators (such as The Clearing House's RTP network and Federal Reserve's FedNow), technology providers offering connectivity and processing solutions, and cloud in…

GoCardless named as Challenger among 15 other companies, including Mastercard, Visa, and FIS.

GoCardless's Products & Differentiators

GoCardless Payments

GoCardless is the world’s largest direct bank pay network, processing over $30bn in payments every year. We enable businesses to collect payments directly from their customers bank accounts without the need for card network intermediaries. Operate globally, but feel local with bank debit payment options in over 30 countries, including the UK (Bacs Direct Debit), Eurozone countries (SEPA), the USA (ACH), Canada (PAD), Australia (BECS) and New Zealand (PaymentsNZ). Manage your payments from a single platform, customizable to match your needs - whether you’re a small business or global enterprise. It’s time to say goodbye to cards for good.

Loading...

Research containing GoCardless

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned GoCardless in 8 CB Insights research briefs, most recently on Aug 23, 2024.

Expert Collections containing GoCardless

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

GoCardless is included in 9 Expert Collections, including Restaurant Tech.

Restaurant Tech

1,075 items

Hardware and software for restaurant management, bookings, staffing, mobile restaurant payments, inventory management, cloud kitchens, and more. On-demand food delivery services are excluded from this collection.

Unicorns- Billion Dollar Startups

1,276 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SMB Fintech

1,648 items

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,978 items

Excludes US-based companies

Latest GoCardless News

Jul 1, 2025

Share this post: multifi , a leading provider of innovative financial solutions for UK small and medium-sized businesses (SMBs), has partnered with the bank payment company GoCardless to give their customers better credit options, including longer repayment periods and more flexible payment plans Through this collaboration, GoCardless’s Direct Debit feature will be integrated directly into the multifi platform. This will create a seamless repayment process, making it easier for businesses to manage their cashflow and focus on growth. This partnership enhances multifi’s credit products, offering custom solutions for both new and established businesses. It provides extended repayment flexibility and a dual-tier structure designed to support businesses at different stages of growth. Plus, the process is now streamlined with enhanced current account integration and automated repayment calculations, making managing finances even simpler. Pat Phelan, Chief Commercial Officer at GoCardless, said: “We’re proud to power these flexible financing options for multifi. By using Direct Debit — with automatic collections and failure rates far lower than cards — multfi customers will gain peace of mind knowing their repayments will be made on time, every time. The regular and predictable nature of these repayments will also improve their cash flow management.” Sunil Dial, Director of Revenue at multifi, said: “These enhancements represent a significant step forward in our mission to provide the most straightforward business finance product in the market. By extending our repayment terms and introducing a more flexible payment structure, we’re offering our broker partners an even more compelling product to present to their clients.” People In This Post News Fintech TV Fintech News Funding About Us At Fintech Finance, we aim to produce the slickest episodes, interviews and event coverage, looking at the complete range of topics within financial services, from branches to blockchain. We travel extensively across borders to find the most interesting and undiscovered features, be it in Manchester or Mongolia. All of our video coverage is written up into our extensive magazine library that consists of “The Fintech Magazine,” “The Paytech Magazine,” and “The Insurtech Magazine.” …basically, we travel around the world, chat to the best and brightest people in Fintech while making the most entertaining, exciting and insightful content in the industry! Fintech Finance Awards Website

GoCardless Frequently Asked Questions (FAQ)

When was GoCardless founded?

GoCardless was founded in 2011.

Where is GoCardless's headquarters?

GoCardless's headquarters is located at 65 Goswell Road, London.

What is GoCardless's latest funding round?

GoCardless's latest funding round is Series G.

How much did GoCardless raise?

GoCardless raised a total of $529.32M.

Who are the investors of GoCardless?

Investors of GoCardless include Permira, BlackRock, Accel, Balderton Capital, Notion Capital and 20 more.

Who are GoCardless's competitors?

Competitors of GoCardless include Worldpay, Satispay, Clip, Stripe, PayNearMe and 7 more.

What products does GoCardless offer?

GoCardless's products include GoCardless Payments and 4 more.

Who are GoCardless's customers?

Customers of GoCardless include Docusign and Gravity Active Entertainment.

Loading...

Compare GoCardless to Competitors

Lemonway is a payment institution that specializes in providing payment processing and wallet management solutions for marketplaces, crowdfunding platforms, and e-commerce websites. The institution offers a modular payment system that enables clients to handle transactions, from collection to disbursement, with a focus on KYC/AML regulatory compliance. Lemonway primarily serves the e-commerce industry, crowdfunding platforms, and other online marketplaces. It was founded in 2007 and is based in Paris, France.

Klarna provides payment solutions and shopping services. The company offers price comparison, installment payments, and consumer financing for online shopping. Klarna serves the ecommerce industry, providing services to both consumers and retailers. Klarna was formerly known as Kreditor . It was founded in 2005 and is based in Stockholm, Sweden.

Cellulant develops an electronic payment service connecting customers with banks and utility services to create a payment ecosystem. It offers a single application program interface payments platform that provides locally relevant and alternative payment methods for global, regional, and local merchants. Its platform enables businesses to collect payments online and offline while allowing anyone to pay from their mobile money, local and international cards, and directly from their bank. It was founded in 2004 and is based in Nairobi, Kenya.

Previse specializes in financial transaction analytics and AI-driven insights within the fintech industry. The company offers a platform that connects, matches, and monitors data to provide insights for businesses. Previse's solutions cater to enterprises, financial institutions, and fintechs, focusing on automating payment processes, managing credit risk, and improving decision-making. It was founded in 2016 and is based in London, England.

ToneTag provides contactless payment solutions using soundwave technology in the financial technology sector. The company offers services including voice-assisted payments, digital billing, and merchant payment solutions. ToneTag serves sectors such as retail, food and beverage, and banking. ToneTag was formerly known as Naffa Innovations. It was founded in 2013 and is based in Bengaluru, India.

TouchBistro focuses on providing an all-in-one point of sale (POS) and restaurant management system in the restaurant industry. The company offers a range of services, including front-of-house, back-of-house, and guest engagement solutions, which help restaurateurs streamline their operations, manage their menu, sales, staff, and more. Its services are designed to increase sales, improve guest experiences, and save time and money. It was founded in 2011 and is based in Toronto, Canada.

Loading...