Gemini

Founded Year

2015Stage

Series A | AliveTotal Raised

$400MValuation

$0000Last Raised

$400M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-29 points in the past 30 days

About Gemini

Gemini is a cryptocurrency exchange and custodian that specializes in digital asset services. The company offers a platform for buying, selling, storing, and staking various cryptocurrencies, as well as trading cryptocurrency derivatives. Gemini serves a diverse market, including individual and institutional investors, fintechs, and banks. Gemini was formerly known as Gemini Trust Company. It was founded in 2015 and is based in New York, New York.

Loading...

ESPs containing Gemini

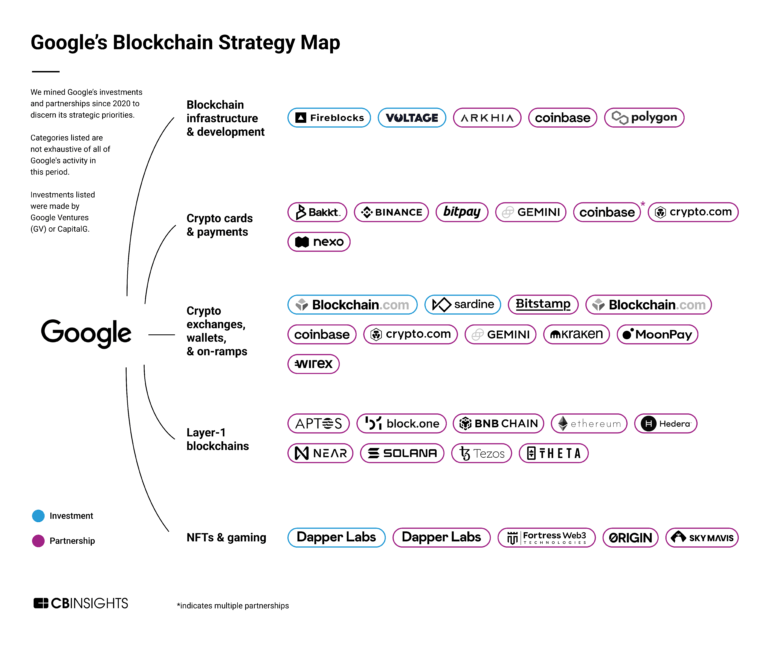

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

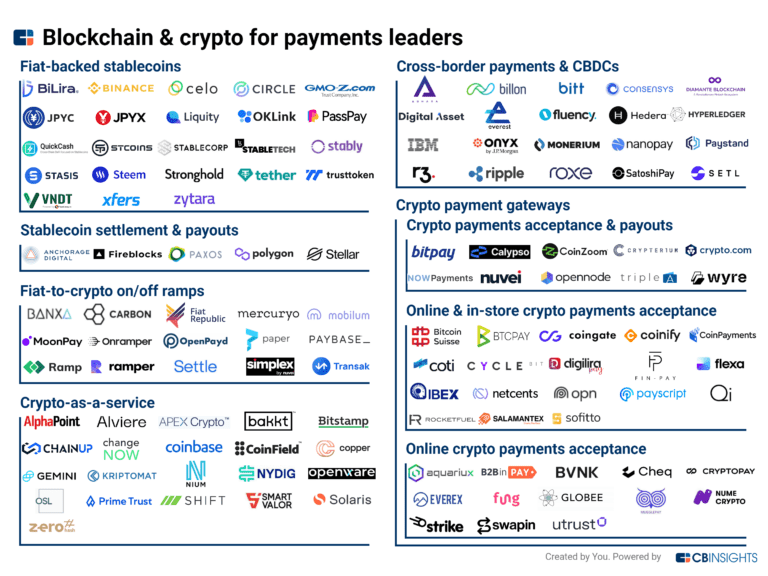

The fiat-backed stablecoins market provides digital currencies that maintain stable value by being fully backed by fiat currency reserves held in bank accounts or other financial instruments. Companies in this market primarily issue stablecoins pegged to various national currencies (e.g., USD, EUR, JPY) or provide infrastructure specifically for fiat-backed stablecoin creation and management. Thes…

Gemini named as Highflier among 14 other companies, including Circle, Coinbase, and Tether.

Loading...

Research containing Gemini

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Gemini in 8 CB Insights research briefs, most recently on May 8, 2024.

Expert Collections containing Gemini

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Gemini is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Blockchain

11,152 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Stablecoin

433 items

Latest Gemini News

Jul 3, 2025

Like Read Time: min Zohran Mamdani won the New York mayoral primary election on June 24, which has since caused a stir among the crypto industry’s upper crust. Mamdani will face off against incumbent Mayor Eric Adams in November, and it’s clear that many in the crypto industry are uneasy about the prospect of a Mamdani victory. Executives and pro-crypto government officials alike have decried his policy proposals, with critics equating his left-leaning policies to Soviet collectivism. Mamdani laid out many specific policy positions, several of which were further left than the Democratic Party norm, but he has remained relatively silent on cryptocurrency. His opponent, Adams, in contrast, is promoting it at great length. With the general election growing closer, observers are now weighing if Mamadani will challenge the crypto industry — or if he even can. Mamdani won the New York City mayor primary election against Andrew Cuomo. Source: NYT What does Mamdani think about crypto? In the days following the election, major crypto figures like Gemini crypto exchange co-founder Tyler Winklevoss, as well as US AI and crypto czar David Sacks, offered a scathing critique of Mamdani. Tyler Winklevoss called New York City a “broken kleptocracy” under Democratic rule and, regarding Mamdani’s surging popularity in the mayoral election, said, “It appears things will have to get worse in NYC before they get better.” Sacks called on Silicon Valley, which is in California, to “wake up” to the supposed rising tide of communism in New York. Source: David Sacks During his campaign, Mamdani outlined a number of policies that raised eyebrows among moderate Democrats and conservative opponents alike, but he has offered little in regard to how he will approach regulating the city’s crypto industry. The few public statements he has made were relatively tame. In 2023, a year after the implosion of the Terra stablecoin ecosystem and the broader crypto crash that followed, New York Attorney General Letitia James called for more consumer protections within the stablecoin industry. Mamdani, who was then a member of the New York City Assembly, agreed. Source: Zohran Mamdani Such statements were hardly rare for the time, when customers from collapsed or bankrupted firms like Celsius, Terra and FTX were left out to dry. Two years later, crypto would only come up in his campaign in the context of his opponent, former Mayor Andrew Cuomo. Mamdani took issue with Cuomo advising crypto exchange OKX in its response to a Securities and Exchange Commission probe. OKX would eventually plead guilty to charges of violating US Anti-Money Laundering laws. Mamdani’s concerns over consumer protection are far from fringe. US financial regulators and lawmakers, even pro-crypto ones, have called and continue to advocate for consumer protections as new crypto legislation makes its way through Congress. Related: New York AG urges Congress to bolster protections in crypto bills Before the Senate voted on the GENIUS Act, Senator Kirsten Gillibrand, one of the bill’s sponsors, said the act moved ahead only once it contained “significant improvements to a number of important provisions,” including consumer protection. Can Mamdani challenge the crypto industry? As mayor of New York City, Mamdani would have considerable influence over issues like municipal taxes, licensing, building permits, etc. But the office’s ability to influence the crypto industry — for good or bad — appears limited. At the beginning of his term in 2021, the current mayor, Adams, promised to make NYC a crypto hub, beginning with a pledge to take his paychecks in Bitcoin (BTC). His administration made a number of pro-crypto statements, announced blockchain education efforts and stated it was exploring a digital wallet for public benefits recipients. As of late 2024, few felt that NYC had become the hub that Adams promised. Thomas Pacchia, founder of the NYC-based Bitcoin bar PubKey, told Cointelegraph in October 2024 that there was “nothing that I can notice” that changed since Adams took office. “If there were specific programs, it never really came across my desk at PubKey or any of the other stuff that I’ve done,” he said. Adams continues to make pro-crypto statements and overtures to the industry, but at its core, his office’s influence is limited in this regard. The financial industry in the city has to answer to state regulators like the New York Department of Financial Services and the attorney general. It stands to reason that, even if Mamdani wanted to go to war with the crypto industry, he’d need to coordinate state regulators first. While Attorney General James has been tough on crypto, and the BitLicense is tricky to get, crypto companies are still opting to move to New York. Another strategy could be for the crypto industry to simply support Mamdani. According to crypto lawyer Aaron Brogan, willingness to compromise on certain issues, along with a few campaign contributions for the upcoming general election, may do much to sway Mamdani to a neutral, if not pro-crypto stance. Mamdani faces threats ahead of a very possible win Whether Mamdani would “go to the mattresses” with the crypto industry or even be able to significantly challenge it remains to be seen. But the chances of Mamdani winning the election look good, according to American businessman and political strategist Bradley Tusk. “The general election is not going to be competitive,” he wrote on June 24. Tusk said that even if Cuomo runs as an independent, which he is as of June 27, “The voters don’t want [Cuomo] back — and he didn’t seem to want the job either. Adams polls at around 10% in terms of favorability and re-elect.” So, the chances of Mamdani winning, especially with a record-breaking young voter turnout, look bright — presuming crypto money doesn’t get involved… and the Trump administration does not deport him. In his aforementioned post, Winklevoss floated the idea of supporting a candidate who could oppose Mamdani. While Winklevoss did not commit to spending, the crypto lobby has shown to be effective in influencing election outcomes. Furthermore, Mamdani’s platform included a policy of not cooperating with Immigration and Customs Enforcement officials, who have been conducting mass arrests of immigrants, including some citizens, around the United States. This drew the ire of President Donald Trump, who falsely claimed that Mamdani, who moved to the US at seven and was naturalized in 2018, was in the country illegally. Representative Andy Ogles hurled Islamophobic epithets at Mamdani on X and called for him to be denaturalized and kicked out of the country. Mamdani faces an uphill battle for the mayor’s office in New York, and the crypto industry may be the least of his problems. Magazine: Pakistan will deploy Bitcoin reserve in DeFi for yield, says Bilal Bin Saqib

Gemini Frequently Asked Questions (FAQ)

When was Gemini founded?

Gemini was founded in 2015.

Where is Gemini's headquarters?

Gemini's headquarters is located at 600 3rd Avenue, New York.

What is Gemini's latest funding round?

Gemini's latest funding round is Series A.

How much did Gemini raise?

Gemini raised a total of $400M.

Who are the investors of Gemini?

Investors of Gemini include United Talent Agency, Marcy Venture Partners, Mogo, Newflow Partners, Boost VC and 14 more.

Who are Gemini's competitors?

Competitors of Gemini include IoniaPay, BurjX, Ledger, BitGo, Alt 5 Sigma and 7 more.

Loading...

Compare Gemini to Competitors

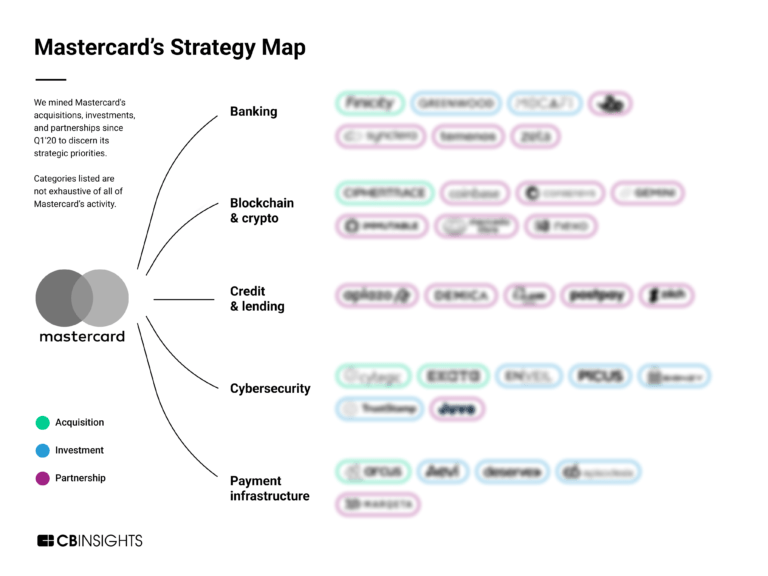

Kraken focuses on digital currency exchange. The company provides a platform for trading various digital currencies, including bitcoin, offering a secure and efficient service for its users. Kraken primarily serves the financial technology industry. It was founded in 2011 and is based in San Francisco, California.

BitGo provides digital asset custody and financial services within the cryptocurrency sector. It offers secure wallet solutions, qualified custody, and financial services including trading, financing, and wealth management. It serves institutional investors, trading firms, investment advisors, exchanges, retail platforms, and developers. It was founded in 2013 and is based in Palo Alto, California.

Copper is a technology company that focuses on providing secure digital asset services to institutional investors within the cryptocurrency sector. The company offers a suite of solutions, including institutional custody, prime brokerage services, and collateral management, all designed to facilitate secure and efficient digital asset transactions. Copper primarily caters to hedge funds, trading firms, foundations, exchanges, ETP providers, venture capital funds, and miners seeking advanced infrastructure for managing digital assets. It was founded in 2018 and is based in Zug, Switzerland.

Binance develops a cryptocurrency exchange platform. It specializes in trading various digital assets. The company offers services such as spot market trading, futures and options trading, as well as peer-to-peer transactions. Binance also provides tools for margin trading, automated trading bots, and educational resources. It was founded in 2017 and is based in George Town, Cayman Islands.

Fireblocks provides infrastructure for digital asset operations in the financial technology sector. It offers services including custody and management of cryptocurrency operations, wallet solutions, token creation and distribution, and facilitation of blockchain payments. It serves trading firms, financial technologies, financial institutions, and web3 companies. It was founded in 2018 and is based in New York, New York.

Anchorage Digital offers a cryptocurrency platform that provides financial services and infrastructure solutions for institutions. It offers services including custody, staking, trading, and governance for digital assets. Anchorage Digital serves sectors such as wealth management, venture capital firms, governments, exchange-traded fund (ETF) issuers, and asset managers. It was founded in 2017 and is based in San Francisco, California.

Loading...