Gecko Robotics

Founded Year

2013Stage

Series D | AliveTotal Raised

$345.42MValuation

$0000Last Raised

$125M | 1 mo agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+39 points in the past 30 days

About Gecko Robotics

Gecko Robotics offers ultrasonic inspection robots and enterprise software solutions that provide comprehensive data and predictive insights for asset health management. Gecko Robotics primarily serves the energy, manufacturing, government, and maritime industries with their technology solutions. It was founded in 2013 and is based in Pittsburgh, Pennsylvania.

Loading...

ESPs containing Gecko Robotics

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The job site inspection & monitoring robots market focuses on robots designed for inspecting and monitoring industrial settings and infrastructure. These robots are used in sectors like construction, manufacturing, and oil & gas to conduct assessments, monitor progress, and ensure safety and efficiency. These robots often enable inspection of hazardous or confined spaces. Driven by advancements in…

Gecko Robotics named as Leader among 8 other companies, including Boston Dynamics, ANYbotics, and Ghost Robotics.

Loading...

Research containing Gecko Robotics

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Gecko Robotics in 2 CB Insights research briefs, most recently on Mar 1, 2024.

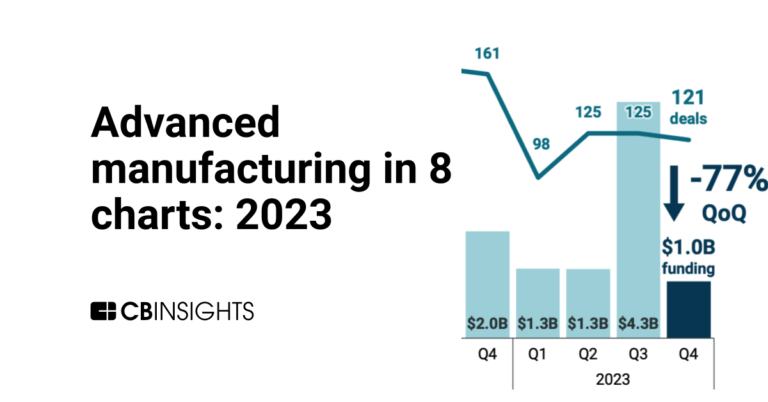

Mar 1, 2024

Advanced manufacturing in 8 charts: 2023Expert Collections containing Gecko Robotics

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Gecko Robotics is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,277 items

Robotics

2,703 items

This collection includes startups developing autonomous ground robots, unmanned aerial vehicles, robotic arms, and underwater drones, among other robotic systems. This collection also includes companies developing operating systems and vision modules for robots.

Advanced Manufacturing

6,695 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

Job Site Tech

942 items

Companies in the job site tech space, including technologies to improve industries such as construction, mining, process engineering, forestry, and fieldwork

Renewable Energy

4,803 items

Artificial Intelligence

9,911 items

Gecko Robotics Patents

Gecko Robotics has filed 67 patents.

The 3 most popular patent topics include:

- robotics

- nondestructive testing

- piping

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/25/2022 | 2/18/2025 | Nondestructive testing, Robotics, Piping, Radar, Surgery | Grant |

Application Date | 5/25/2022 |

|---|---|

Grant Date | 2/18/2025 |

Title | |

Related Topics | Nondestructive testing, Robotics, Piping, Radar, Surgery |

Status | Grant |

Latest Gecko Robotics News

Jun 23, 2025

The inspection robots market , valued at $940.0 million in 2020, is poised for significant growth, with projections estimating a market size of $13,942.5 million by 2030. This represents a robust compound annual growth rate (CAGR) of 30.9% from 2021 to 2030. Inspection robots have become integral to industrial operations across sectors such as manufacturing, oil and gas, pharmaceuticals, and food and beverages. These robots enhance operational efficiency, ensure equipment reliability, and prioritize worker safety by automating critical inspection processes. Download PDF Sample Copy@ https://www.alliedmarketresearch.com/request-sample/A08254 Inspections are vital for maintaining quality control, detecting faults, and ensuring compliance with safety standards. Inspection robots, equipped with advanced sensors and imaging technologies, perform tasks that are challenging or hazardous for human inspectors. They are capable of navigating confined spaces, climbing vertical surfaces, and conducting non-destructive testing, making them indispensable in modern industrial settings. These robots can be stationary, such as robotic arms used in assembly lines, or mobile, allowing for flexible deployment across various environments. Market Dynamics Drivers Inspection robots offer unparalleled advantages over traditional manual inspections. Their ability to access hard-to-reach areas, such as tight spaces, high walls, or complex machinery, enables more thorough and efficient inspections. Equipped with technologies like infrared imaging and ultrasonic sensors, these robots can detect defects, leaks, or structural weaknesses that are invisible to the human eye. They can also scan through packaging or outer layers, ensuring comprehensive quality control without invasive methods. Worker safety is a significant driver of market growth. Inspection robots allow remote operation, reducing the need for workers to enter hazardous environments, such as offshore drilling platforms, heavy machinery zones, or underwater pipelines. By minimizing human exposure to dangerous conditions, these robots enhance workplace safety and reduce the risk of accidents. Additionally, inspection robots streamline data collection and analysis, improving operational efficiency. They generate precise, organized data that can be integrated into digital systems for real-time monitoring and predictive maintenance. This capability reduces downtime, lowers maintenance costs, and optimizes resource allocation. The adoption of inspection robots also contributes to cost savings by automating repetitive tasks and reducing reliance on manual labor. Challenges Despite their benefits, the high initial cost of inspection robots remains a barrier to widespread adoption. The integration of advanced components, such as high-resolution cameras, sensors, and AI-driven software, increases the cost of development and deployment. Small and medium-sized enterprises (SMEs) may find it challenging to justify the upfront investment, particularly in cost-sensitive industries. Operational reliability is another concern. While inspection robots are designed for precision, they may encounter difficulties in unpredictable environments or fail to respond appropriately in complex scenarios, potentially leading to hazardous situations. Regular maintenance and software updates are required to ensure consistent performance, adding to operational costs. The COVID-19 pandemic significantly disrupted the inspection robots market. Lockdowns and restrictions halted manufacturing, construction, and transportation activities, leading to a decline in both production and demand for inspection robots. Supply chain disruptions further exacerbated the challenges, delaying the deployment of new systems. However, as industries resume normal operations, the market is expected to recover, with companies anticipated to operate at full capacity by the end of 2021. Enquire Before Buying@ https://www.alliedmarketresearch.com/purchase-enquiry/A08254 Opportunities The integration of Internet of Things (IoT) and Artificial Intelligence (AI) technologies presents significant opportunities for market expansion. IoT-enabled inspection robots can communicate with other devices, enabling real-time data sharing and remote monitoring. AI enhances their ability to analyze complex datasets, identify patterns, and make autonomous decisions, improving inspection accuracy and efficiency. These advancements are expected to drive innovation and open new applications for inspection robots across industries. Market Segmentation By Robot Type The inspection robots market is divided into stationary robotic arms and mobile robots. In 2020, mobile robots accounted for the largest revenue share due to their versatility and ability to navigate diverse environments. However, stationary robotic arms are projected to grow at the highest CAGR during the forecast period, driven by their precision in automated manufacturing processes. By Testing Type The market is segmented into automated metrology and non-destructive inspection (NDI). NDI dominated the market in 2020, as it is widely used for detecting internal defects without damaging components. Automated metrology, which focuses on precise measurements for quality control, is expected to register the highest CAGR, fueled by demand for high-precision manufacturing. By End-User Industry The oil and gas sector led the market in 2020, driven by the need for reliable inspections in hazardous environments like pipelines and offshore platforms. The pharmaceutical industry is projected to grow at a significant CAGR of 31.9%, as stringent regulatory requirements and the need for contamination-free production environments drive the adoption of inspection robots. By Region North America held the largest market share in 2020, supported by advanced industrial infrastructure and significant investments in automation. The Asia-Pacific region is expected to exhibit the highest CAGR during the forecast period, driven by rapid industrialization, increasing adoption of automation technologies, and government initiatives to promote smart manufacturing in countries like China, Japan, and India. Latin America, the Middle East, and Africa (LAMEA) are also anticipated to witness substantial growth, particularly in the oil and gas and mining sectors. Competitive Landscape The inspection robots market is highly competitive, with key players focusing on innovation and strategic partnerships to strengthen their market position. Major companies include Eddyfi Technologies, Gecko Robotics, Inc., Genesis Systems, Honeybee Robotics, Invert Robotics, JH Robotics, Inc., Montrose Technologies Inc., Shenzhen SROD Industrial Group Co., Ltd., Universal Robots, and Waygate Technologies. These companies are adopting strategies such as product launches, business expansions, and collaborations to enhance their product offerings and meet evolving customer demands. For instance, advancements in sensor technology and AI-driven analytics have enabled companies to develop next-generation inspection robots with improved accuracy and adaptability. Partnerships with technology providers and industry stakeholders are also facilitating the integration of IoT and cloud-based solutions, further enhancing the capabilities of inspection robots. Update On Demand@ Key Benefits for Stakeholders This report offers a comprehensive analysis of the inspection robots market, providing valuable insights for stakeholders. It includes detailed market trends, growth projections, and dynamics from 2021 to 2030. The report conducts an in-depth analysis of key market segments, offering estimations for robot types, testing types, end-user industries, and regions. By tracking product positioning and competitor strategies, it provides a clear understanding of the competitive landscape. The report also includes a regional analysis, highlighting opportunities in North America, Europe, Asia-Pacific, and LAMEA. This enables stakeholders to identify high-growth markets and tailor their strategies accordingly. Furthermore, the report profiles leading market players, analyzing their strategies and innovations to provide a holistic view of the industry's competitive outlook. David Correa Allied Market Research email us here Visit us on social media: LinkedIn Facebook YouTube X Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Gecko Robotics Frequently Asked Questions (FAQ)

When was Gecko Robotics founded?

Gecko Robotics was founded in 2013.

Where is Gecko Robotics's headquarters?

Gecko Robotics's headquarters is located at 100 South Commons, Pittsburgh.

What is Gecko Robotics's latest funding round?

Gecko Robotics's latest funding round is Series D.

How much did Gecko Robotics raise?

Gecko Robotics raised a total of $345.42M.

Who are the investors of Gecko Robotics?

Investors of Gecko Robotics include Founders Fund, Y Combinator, US Innovative Technology Fund, Cox Enterprises, XN Capital and 29 more.

Who are Gecko Robotics's competitors?

Competitors of Gecko Robotics include eSmart Systems, Energy Robotics, Buzz Solutions, Abyss, Honeybee Robotics and 7 more.

Loading...

Compare Gecko Robotics to Competitors

Cyberhawk Innovations provides drone inspection services and digital asset management within the capital projects, oil and gas, energy, and utility sectors. The company offers services including engineering inspections, geospatial surveys, emissions monitoring, and cloud-based software solutions for visual data management and analytics. Cyberhawk serves sectors such as infrastructure, marine, power grid, generation, renewables, and utilities. It was founded in 2008 and is based in Livingston, Scotland.

Kongsberg Ferrotech develops autonomous robots designed to solve subsea problems. The company's robot can perform maintenance on subsea equipment in one single operation without divers or other conventional equipment, enabling clients to perform repair procedures immediately after inspection. It was founded in 2014 and is based in Kongsberg, Norway.

HUVRData specializes in reliability automation within the asset integrity management sector. It provides a platform for managing inspection data, workflows, and analytics for industries such as renewables, oil and gas, manufacturing, and maritime. The company serves sectors that require asset inspection and maintenance, including energy and manufacturing industries. It was founded in 2014 and is based in Austin, Texas.

Bominwell Robotics is involved in the design and manufacturing of municipal pipeline inspection equipment within the environmental technology sector. The company provides products such as CCTV inspection systems for pipelines, along with monitoring, mapping, maintenance, and cleaning equipment. These products are used by government municipal management systems, urban planning departments, and emergency response teams. It was founded in 2014 and is based in Shenzhen, Guangdong.

Inloc Robotics focuses on automated sewer defect detection within the engineering and robotics sectors. The company provides solutions that analyze inspection videos to identify defects in sewer systems, in accordance with standards such as the European 13508-2. Inloc Robotics also offers systems that connect perceptions with actions in automation and control, including Industry 4.0 and IoT. It was founded in 2013 and is based in Spain.

Square Robot focuses on robotic tank inspection within the industrial automation sector. The company offers autonomous, submersible inspection robots that perform certified inspections and associated services for tanks while they remain in service. The company primarily serves industries that require storage tank maintenance and inspection, such as the oil and gas industry. It was founded in 2016 and is based in Marlborough, Massachusetts.

Loading...