Forter

Founded Year

2013Stage

Series F | AliveTotal Raised

$525MValuation

$0000Last Raised

$300M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-20 points in the past 30 days

About Forter

Forter specializes in identity intelligence for digital commerce, focusing on fraud prevention and customer security across digital platforms. The company provides services including fraud management, payment optimization, chargeback recovery, identity protection, and abuse prevention, aimed at improving security and efficiency in online transactions. Forter's solutions are utilized by sectors within the digital commerce industry to support processes for businesses and consumers. Forter was formerly known as Ryzyco. It was founded in 2013 and is based in New York, New York.

Loading...

Forter's Product Videos

ESPs containing Forter

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

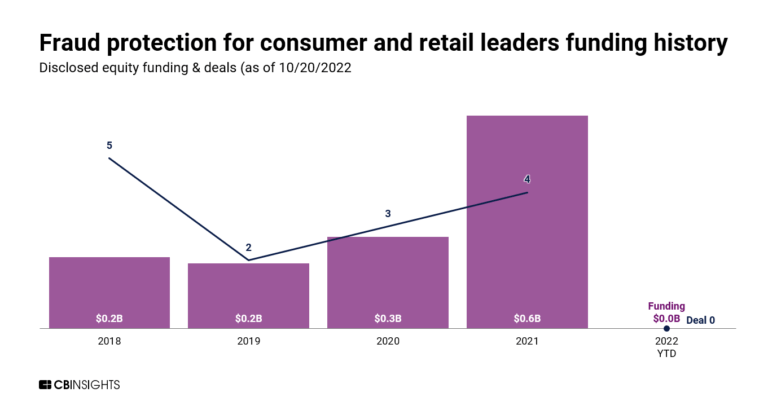

The payments fraud detection & prevention market offers a range of technologies helping businesses detect and block anomalous payment activity. Vendors in this market cater to many different industries, from financial services to e-commerce. These solutions cover a range of different types of financial fraud like chargebacks, ACH, wire, and credit card fraud. Most providers leverage advanced techn…

Forter named as Outperformer among 15 other companies, including Mastercard, Oracle, and Fiserv.

Forter's Products & Differentiators

Forter Payment Protection

Forter’s Payment Protection platform provides accurate, real-time decisions for every transaction -- allowing more good buyers to make purchases while keeping fraud out. The Payment Protection platform includes solutions to help merchants deal with transaction fraud, phone fraud, and omnichannel fraud. Additionally, the platform offers solutions to help with PSD2 protection, Forter’s Trusted Authorization solution to connect merchants directly with issuing banks, and Forter’s 100% chargeback guarantee to erase chargeback costs from a merchant’s bottom line.

Loading...

Research containing Forter

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Forter in 7 CB Insights research briefs, most recently on Mar 18, 2024.

Mar 14, 2024

The retail banking fraud & compliance market map

Feb 27, 2023 report

Top fraud prevention companies — and why customers chose themExpert Collections containing Forter

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

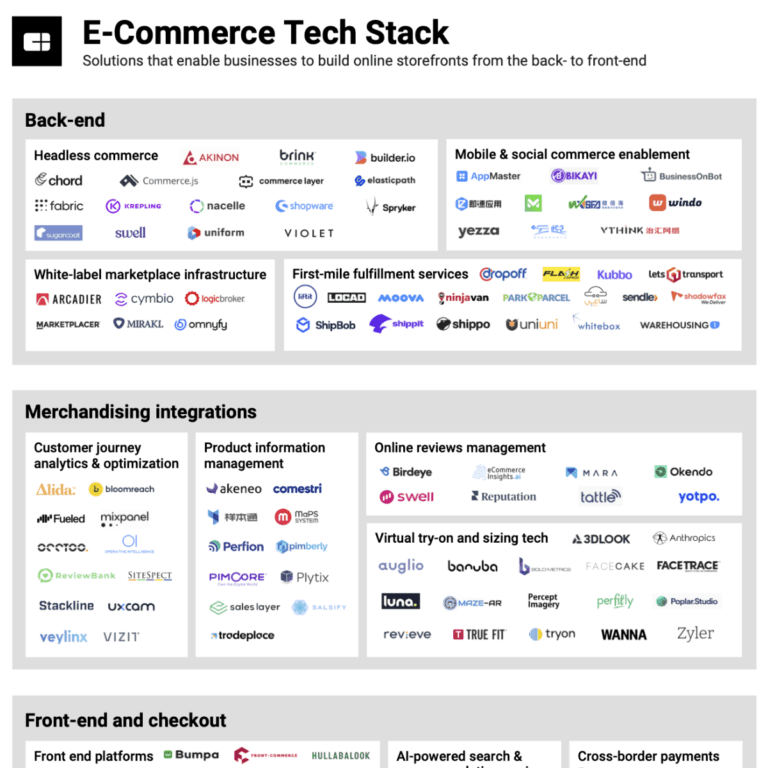

Forter is included in 11 Expert Collections, including E-Commerce.

E-Commerce

11,558 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,276 items

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

825 items

Conference Exhibitors

5,302 items

Forter Patents

Forter has filed 5 patents.

The 3 most popular patent topics include:

- online payments

- payment service providers

- payment systems

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/8/2016 | 8/1/2017 | Rules of inference, Data management, Information technology management, Transaction processing, Internet culture | Grant |

Application Date | 1/8/2016 |

|---|---|

Grant Date | 8/1/2017 |

Title | |

Related Topics | Rules of inference, Data management, Information technology management, Transaction processing, Internet culture |

Status | Grant |

Latest Forter News

Jun 27, 2025

Forter reports 52% of clients abusing return policies to get more for their money Friday 27 June 2025 09:43 CET | News Forter study has found that customers admitted to flouting retailers' return policies more, with 52% of Brits deliberately abusing online retail policies in the last year. Following this announcement, the new report launched by Forter shows that clients also prefer to never buy from a retailer again if it doesn’t have a policy they can abuse, as, in their opinion, businesses are now making it so easy to abuse the system and get free stuff. These customers represent 18% of the surveyed individuals. Included in the top ways clients are bending the rules set by businesses are deliberately sending the wrong items back (6%), buying in bulk in order to avoid delivery costs (22%), creating their own unauthorised `try before you buy`â¯service through bulk purchasing and free returns (21%), abusing flexible return policiesâ¯to try or wear expensive items they couldn’t otherwise afford (31%), and creating multiple online accounts â¯with the same retailer in order to receive promotions and perks (12%). More information on Forter’s new report findings According to the official press release, an alarming factor shown by the report is that seven in ten of the 2.000 UK and 2.000 US consumers believe it’s the retailers at fault for making it easy to abuse flexible return policies. 58% of them also say retailers make it easy to open multiple accounts to take advantage of promotions. At the same time, the process of identifying money represents the key driver, as over a quarter (29%) of shoppers who have taken advantage of firms’ policies when shopping online in the last 12 months admitted to doing so in order to avoid paying full price. Furthermore, as the cost-of-living crisis has had a marked impact on shoppers’ relationships with retailers, nearly half (49%) of UK users buy more from retailers with lenient return policies due to several financial concerns. A quarter of those surveyed, representing 25% of them, also cited rising costs due to inflation as a motivator, with almost two-thirds (63%) of UK consumers relying on retailers’ promotions and free perks more now than in the past as well. At the moment, retailers and merchants face a delicate balancing act of maintaining customer loyalty without exposing their business to more risk. At the same time, the new research launched by Forter also reveals that overly restrictive policies can have serious unintended consequences for the business, as more consumers and clients are currently seeking convenience and affordability when shopping online. Free Headlines in your E-mail Every day we send out a free e-mail with the most important headlines of the last 24 hours.

Forter Frequently Asked Questions (FAQ)

When was Forter founded?

Forter was founded in 2013.

Where is Forter's headquarters?

Forter's headquarters is located at 575 Fifth Avenue, New York.

What is Forter's latest funding round?

Forter's latest funding round is Series F.

How much did Forter raise?

Forter raised a total of $525M.

Who are the investors of Forter?

Investors of Forter include Scale Venture Partners, March Capital, NewView Capital, Sequoia Capital, Bessemer Venture Partners and 17 more.

Who are Forter's competitors?

Competitors of Forter include Vesta, ClearSale, Resistant AI, DataVisor, Fraud.net and 7 more.

What products does Forter offer?

Forter's products include Forter Payment Protection and 4 more.

Who are Forter's customers?

Customers of Forter include TAG Heuer, SNIPES, Priceline, Delivery.com and Nordstrom.

Loading...

Compare Forter to Competitors

Sift operates in the fields of cybersecurity and financial technology. Its main offerings include a platform that uses machine learning and user identity verification to address fraud, including account takeover, payment fraud, and policy abuse. Sift serves sectors that require digital trust solutions, such as e-commerce, fintech, and online marketplaces. Sift was formerly known as Sift Science. It was founded in 2011 and is based in San Francisco, California.

Signifyd provides e-commerce fraud protection and prevention services. The company offers services, including revenue protection, abuse prevention, and payment compliance, all aimed at maximizing conversion and eliminating fraud and consumer abuse. Its services primarily cater to the e-commerce industry. Signifyd was founded in 2011 and is based in San Jose, California.

Shield is a device-first risk AI platform that specializes in fraud prevention and risk intelligence within the digital business sector. The company offers solutions to identify and eliminate fraudulent activities through global standard device identification and actionable risk intelligence. Shield primarily serves industries such as ride-hailing, social media, e-commerce, digital banking, and gaming. Shield was formerly known as CashShield. It was founded in 2008 and is based in Singapore.

Vesta specializes in fraud prevention and payment processing for the telecommunications sector. The company offers AI-driven fraud detection and prevention services, payment processing, and risk management solutions to telecoms. Vesta was formerly known as Carrier Services. It was founded in 1995 and is based in Lake Oswego, Oregon.

FUGU specializes in payment fraud prevention and operates within the financial technology sector. The company offers a suite of services that analyze transactions throughout the entire lifecycle, from pre-checkout to post-purchase, to identify and prevent various types of fraud, automate Know Your Customer (KYC) verifications, and manage chargebacks. FUGU's solutions are designed to reduce false declines, minimize operational costs, and provide a chargeback guarantee to online sellers and payment service providers. It was founded in 2017 and is based in Tel Aviv, Israel.

Accertify is a company that operates within the risk management and cybersecurity industry. Their services include fraud detection, chargeback management, and payment gateway solutions, utilizing artificial intelligence and machine learning to address financial fraud risks. Accertify serves sectors that require online transaction security and customer experience. It was founded in 2007 and is based in Itasca, Illinois.

Loading...