FINNY AI

Founded Year

2023Stage

Angel | AliveTotal Raised

$4.8MAbout FINNY AI

FINNY AI provides tools for financial advisors to assist in their prospecting efforts within the financial services industry. The company offers services that include identifying potential prospects, prioritizing them based on a compatibility score, and automating outreach processes to support advisor-client connections. Its platform aims to improve the prospecting process, allowing financial advisors to focus on building relationships and developing their businesses. The company was founded in 2023 and is based in New York, New York.

Loading...

ESPs containing FINNY AI

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The wealth management prospecting and lead generation platforms market provides technology solutions that enable financial advisors to segment, prioritize, and engage with potential clients. These platforms leverage AI, data analytics, and client profiling to identify high-potential leads, offer insights into client behavior, and optimize engagement strategies. Key features include relationship ma…

FINNY AI named as Highflier among 12 other companies, including HubSpot, Seismic, and Nitrogen.

Loading...

Research containing FINNY AI

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned FINNY AI in 2 CB Insights research briefs, most recently on Mar 6, 2025.

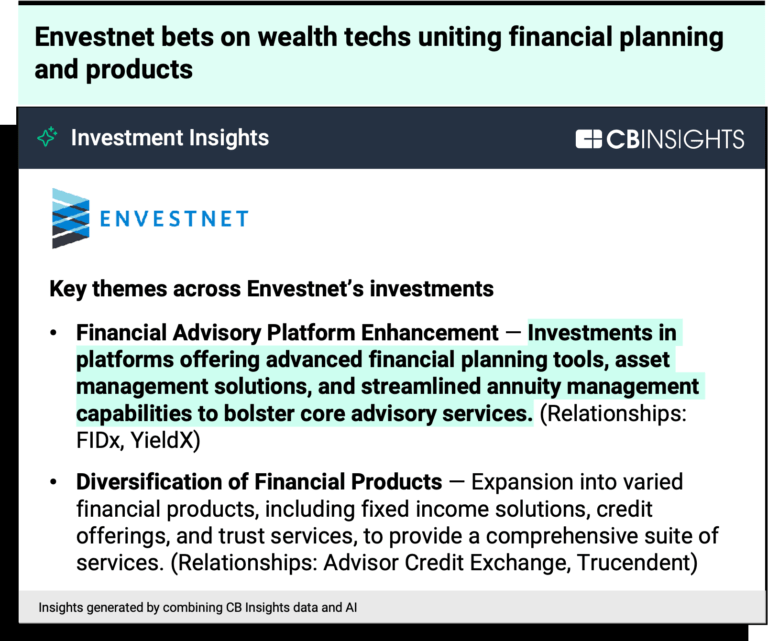

Mar 6, 2025

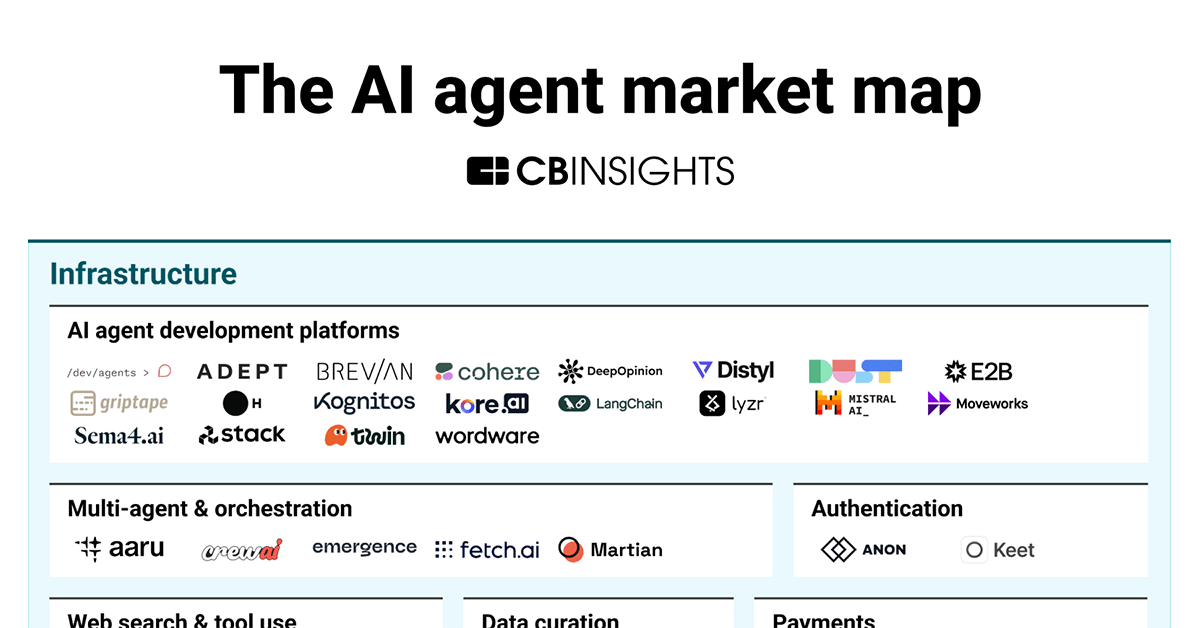

The AI agent market mapExpert Collections containing FINNY AI

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

FINNY AI is included in 5 Expert Collections, including Artificial Intelligence.

Artificial Intelligence

10,049 items

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Wealth Tech

2,424 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

AI agents

374 items

Companies developing AI agent applications and agent-specific infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy. Not exhaustive.

Generative AI

2,330 items

Companies working on generative AI applications and infrastructure.

Latest FINNY AI News

Jun 9, 2025

FINNY AI Inc. (“FINNY”), the AI-powered prospecting and marketing platform built specifically for financial advisors, today announced the launch of Intent Search, a feature that allows advisors to identify and engage with prospects actively seeking financial guidance. This release also includes Prospect Enrichment and AI Voicemails, two additional capabilities that equip advisors with faster, smarter tools to drive organic growth through FINNY's all-in-one prospecting solution. The Intent Search feature represents a breakthrough in precision prospecting. Powered by 1.8 billion proprietary intent signals that are updated daily, it enables advisors to surface high-intent prospects based on real-time online behavior. Advisors can select keywords related to their services – like “401k rollovers”, “business succession planning”, “charitable giving” and more. FINNY identifies prospects who have recently researched those topics, pinpointing what they're interested in and when they were actively searching. This allows for timely, targeted outreach based on actual behavior rather than guesswork. Searches are fully customizable, giving advisors the flexibility to layer in as much or as little criteria as needed to align with their prospecting strategy. “Organic growth in wealth management has been stagnant for years—not because advisors aren't working hard, but because the tools they've been given aren't built for how clients make decisions today,” said Eden Ovadia , co-founder and CEO . “With our proprietary intent data, advisors can finally break the cold outbound cycle. Now they know what prospects are actively searching for so they can reach out when interest is highest and the prospect is ready to connect. With this update, we're affirming our commitment to helping advisors scale efficiently by leaning into what makes them most effective: relevance, empathy and timing.” Alongside Intent Search, FINNY has released its Prospect Enrichment and AI Voicemails features. Prospect Enrichment enables advisors to upload external contacts and automatically matches them to FINNY's database. Each contact is enriched with key information like estimated net worth, interests or money-in-motion events, and assigned a predictive F-Score to prioritize high-potential leads and add them to personalized campaign lists. Meanwhile, AI Voicemails allow advisors to deliver ringless, personalized voicemails at scale. They can select from multiple voice options to suit their preferences, and messages are able to circumvent spam filters. Each voicemail can be paired with a follow-up email to create efficient outreach that retains a human touch. Developed in direct response to advisor feedback, these new features address evolving marketing needs and help advisors focus on high-intent prospects. Previously, users were limited to outbound email campaigns targeting only FINNY-sourced leads. With these enhancements, prospecting is now more expansive, data-rich and efficient, reflecting FINNY's commitment to helping advisors scale prospecting through advanced automation powered by data. The introduction of Intent Search, Prospect Enrichment and AI Voicemails further strengthens the platform's capabilities and solidifies FINNY's position as the go-to prospecting solution for advisory firms looking to break through today's stalled organic growth. FINNY has seen strong engagement with its newly launched features and impressive platform growth in recent months. Since its launch, the Prospect Enrichment feature has already led to the upload and enrichment of more than 8,000 prospects, signaling strong demand and immediate value. Overall platform usage is accelerating, with average weekly users increasing eightfold from February to May. Nearly 800 campaigns have been launched through FINNY so far this year – reflecting 133% month-over-month growth – and over 26,000 prospect searches have been performed, growing at a rate of 122% month-over-month. “Intent signals aren't just another feature — they're the engine behind truly effective outbound. Our advisors wanted a smarter way to know who to reach out to and when, and we delivered,” said Victoria Toli , co-founder and president . “By feeding this data into our prioritization model, the F-Score, we've significantly enhanced its predictive power – making cold outreach warmer and more accurate. With the launch of prospect enrichment and AI-powered voicemails, we're giving advisors richer context and new ways to connect across various channels. The goal is simple: make outreach multi-modal, hyper-targeted and impossible to ignore.” This announcement builds on FINNY's recent momentum, following its 4.3 million seed round and the appointment of Josh Brown – CEO of Ritholtz Wealth Management and a prominent financial commentator – to its advisory board. As both an investor and advisor, Brown is playing an active role in shaping the platform's product roadmap to meet the evolving prospecting and marketing needs of advisors. For more information about FINNY or to book a demo, visit www.finnyai.com . Attendees of WealthManagement.com EDGE in Boca Raton can catch Toli speaking about these features on the panel “AI Lead Generation: The Future of New Business Development” on June 10 at 1:30pm ET. About FINNY FINNY is the AI-powered prospecting and marketing platform built exclusively for financial advisors. By leveraging advanced data intelligence and automation, FINNY helps advisors identify, prioritize and engage high-intent prospects effortlessly—removing the guesswork from client acquisition. With a proprietary database of millions of records, a predictive F-Score matching engine and automated outreach tools, FINNY helps ensure that prospecting is targeted, scalable and seamlessly integrated into an advisor's workflow. Backed by top fintech investors and recognized as Best of Show at the 2024 Morningstar Annual Fintech Showcase, FINNY is redefining organic growth for financial advisors. Visit www.finnyai.com to learn more. View source version on businesswire.com: https://www.businesswire.com/news/home/20250609899894/en/ Contacts Media Contacts: StreetCred PR Lexie Brazil lexie@streetcredpr.com Jimmy Moock jimmy@streetcredpr.com

FINNY AI Frequently Asked Questions (FAQ)

When was FINNY AI founded?

FINNY AI was founded in 2023.

Where is FINNY AI's headquarters?

FINNY AI's headquarters is located at 153 Mercer Street, New York.

What is FINNY AI's latest funding round?

FINNY AI's latest funding round is Angel.

How much did FINNY AI raise?

FINNY AI raised a total of $4.8M.

Who are the investors of FINNY AI?

Investors of FINNY AI include Josh Brown, Y Combinator, Maple VC, Dan Westgarth, Liquid 2 Ventures and 7 more.

Who are FINNY AI's competitors?

Competitors of FINNY AI include Conquest Planning, Addepar, Envestnet, Canoe Intelligence, BridgeFT and 7 more.

Loading...

Compare FINNY AI to Competitors

Addepar focuses on investment portfolio management within the financial services industry. The company provides a system that consolidates and evaluates data related to market and clients, aiding investment professionals in decision-making. Addepar's services are relevant to wealth managers, family offices, private banks, and institutions, offering functionalities for trading, rebalancing, scenario modeling, and billing. It was founded in 2009 and is based in Mountain View, California.

Metaframe Technology Solutions provides financial technology solutions that focus on asset management and investment firms. The company offers services that include intelligent agents through its DashHub AI platform, which automates financial operations and reporting. Metaframe also provides ITSM solutions, technology leadership, and compliance automation to support IT infrastructure and regulatory adherence for financial services. It was founded in 2010 and is based in New York, New York.

Powder provides artificial intelligence (AI) solutions for the wealth management sector, focusing on document analysis. The company offers AI agents that automate the parsing and analysis of financial documents, which reduces the time required for these tasks and allows wealth management professionals to engage with clients and perform other activities. Powder's AI technology aims to improve client service by increasing productivity, ensuring compliance, and providing data security. It was founded in 2023 and is based in Los Altos, California.

Nitrogen operates as an inclusive client engagement platform. It focuses on wealth management firms and financial advisors. The company offers a suite of tools designed to facilitate risk tolerance assessment, investment research, portfolio analytics, and client acquisition and retention. Nitrogen primarily serves financial advisors, wealth management firms, banks, and insurance companies. Nitrogen was formerly known as Riskalyze. It was founded in 2011 and is based in Auburn, California.

InvestCloud focuses on transforming the financial industry's approach to digital and operates within the financial technology sector. The company offers a no-code software platform for digital and commerce enablement, providing cloud-native, multi-tenanted solutions that help banks, wealth managers, and asset managers overcome technology debt and meet the needs of their clients. The company primarily serves the financial industry. It was founded in 2010 and is based in West Hollywood, California.

Orion Advisor Technology specializes in providing comprehensive software solutions for financial advisors within the wealth management sector. The company offers a suite of products that facilitate portfolio accounting, client relationship management, and trading, as well as tools for risk assessment, regulatory compliance, and financial planning. Orion Advisor Technology was formerly known as Orion Advisor Services. It was founded in 1999 and is based in Omaha, Nebraska. Orion Advisor Technology operates as a subsidiary of Orion.

Loading...