Carta

Founded Year

2012Stage

Valuation Change | AliveTotal Raised

$1.158BValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-19 points in the past 30 days

About Carta

Carta provides tools for private equity and venture capital within the financial services industry. The company offers a fund administration platform that includes services such as capitalization table management, valuations, tax compliance, and equity program management for private businesses. Carta serves the private capital market, including investors, limited partners, and portfolio companies. Carta was formerly known as eShares. It was founded in 2012 and is based in San Francisco, California.

Loading...

ESPs containing Carta

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The equity management market provides platforms that help private companies, startups, and investors track, manage, and administer equity ownership through digital cap table solutions. These platforms offer tools for equity plan administration, capitalization table management, stock option tracking, valuation services, and shareholder communication. Companies in this market solve challenges relate…

Carta named as Leader among 10 other companies, including Morgan Stanley, AngelList, and Pulley.

Loading...

Research containing Carta

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Carta in 3 CB Insights research briefs, most recently on Jan 3, 2024.

Jan 3, 2024

2024 prediction: Rippling acquires Pulley

Dec 22, 2022 report

The top 50 angel investing groupsExpert Collections containing Carta

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

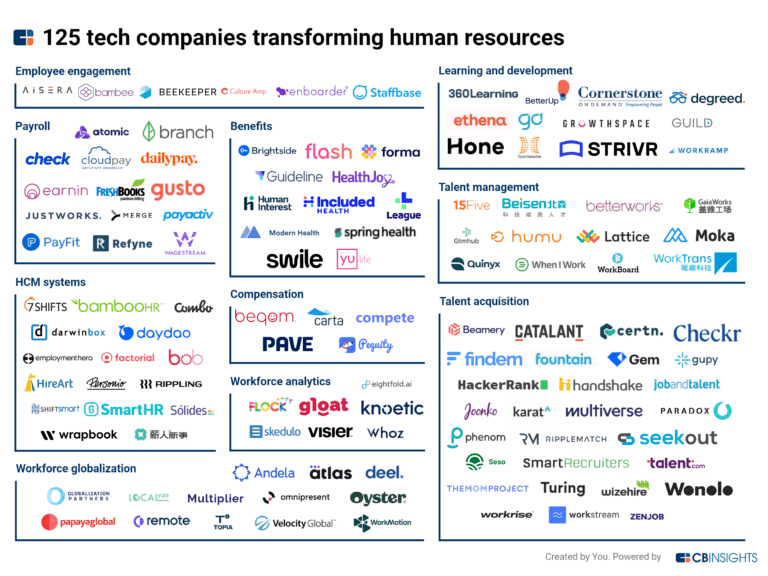

Carta is included in 8 Expert Collections, including HR Tech.

HR Tech

5,910 items

The HR tech collection includes software vendors that enable companies to develop, hire, manage, and pay their workforces. Focus areas include benefits, compensation, engagement, EORs & PEOs, HRIS & HRMS, learning & development, payroll, talent acquisition, and talent management.

Unicorns- Billion Dollar Startups

1,276 items

Fintech 100

997 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Capital Markets Tech

1,170 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

SMB Fintech

1,231 items

Tech IPO Pipeline

568 items

Carta Patents

Carta has filed 2 patents.

The 3 most popular patent topics include:

- 3d computer graphics

- 3d imaging

- automotive safety technologies

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/5/2021 | 2/20/2024 | 3D imaging, 3D computer graphics, Computer vision, Earth observation satellites, Cluster analysis algorithms | Grant |

Application Date | 3/5/2021 |

|---|---|

Grant Date | 2/20/2024 |

Title | |

Related Topics | 3D imaging, 3D computer graphics, Computer vision, Earth observation satellites, Cluster analysis algorithms |

Status | Grant |

Latest Carta News

Jul 9, 2025

From AI Billions to Sales Struggles: The Top 10 SaaStr Posts of The First Half of 2025 Like Read Time: min The first half of 2025 has been a whirlwind for the SaaS industry, with AI continuing to reshape everything from sales processes to customer expectations. Looking at the most-read SaaStr posts from January through June 2025, several clear themes emerge: AI’s impact on SaaS, the ongoing challenges in the sales and funding landscape, and the critical importance of execution fundamentals. Here are the top 10 posts that captured the SaaS community’s attention: 1. The Top 10 SaaStr Learnings from Mary Meeker’s Latest Report on AI Mary Meeker’s influence on the tech industry remains unmatched, and her latest AI-focused report provided crucial insights for SaaS leaders. This post distilled her key findings into actionable takeaways, covering everything from AI adoption curves to investment patterns that will shape the next wave of SaaS innovation. Read the full post → 2. OpenAI to Hit $12.7 Billion in Revenue This Year. But Won’t Be Profitable Until $125 Billion in Revenue The staggering numbers behind OpenAI’s growth trajectory sparked intense discussion about AI business models and the path to profitability. For SaaS founders, this post offered sobering insights into the capital requirements and scale needed to build sustainable AI-powered businesses. Read the full post → 3. It’s 2025 And Even Salesforce’s Sales Team is Kind of Phoning It In (At Least Some Of It) A candid look at how even the gold standard of SaaS sales organizations faces challenges in the current market environment. This post resonated with sales leaders struggling with decreased win rates and longer sales cycles, showing that these issues affect companies at every scale. Read the full post → 4. The #1 Thing That Makes Enterprise Customers See Value: A Great Dashboard In an era of feature bloat and complex SaaS products, this post reminded readers that sometimes the most impactful improvements are the simplest. Great dashboards remain the primary way enterprise customers perceive and demonstrate value from their SaaS investments. Read the full post → 5. 10 Brutal Truths From Coatue About AI and Who Gets Left Behind: The Great Separation Coatue’s stark assessment of the AI landscape highlighted which companies and business models will thrive versus those at risk of being disrupted. This post served as a wake-up call for SaaS leaders about the urgency of AI integration. Read the full post → 6. The Deadly “AI Slow Roll” in SaaS: It May Cost You Everything While everyone talks about AI adoption, this post warned about the opposite problem: implementing AI too slowly or tentatively. The “slow roll” phenomenon has become a significant competitive risk for established SaaS companies. Read the full post → 7. Egnyte Sells to Private Equity for $1.5 Billion after 18 Years. Slightly Slower and Steady Wins Not every SaaS story is about hypergrowth and unicorn valuations. Egnyte’s successful exit after 18 years provided a compelling case study for sustainable, profitable growth that ultimately delivers strong returns for all stakeholders. Read the full post → 8. Carta: The Actual, Real Dilution from Series A, B, C and D Rounds With funding rounds becoming more challenging, understanding dilution has never been more critical. This data-driven post from Carta’s real transaction data helped founders make more informed decisions about fundraising and equity management. Read the full post → 9. SaaS Is Still Slowing Down, Unfortunately: What Q1 2025 Numbers Reveal About the Cloud The continued deceleration in SaaS growth rates dominated industry conversations in early 2025. This post provided hard data on market trends and helped leaders set realistic expectations for their planning cycles. Read the full post → 10. 70% of Pipeline from Marketing Comes From Just 4 Things In a world of countless marketing channels and tactics, this post cut through the noise to identify the core activities that actually drive pipeline. For resource-constrained SaaS companies, focusing on these four areas can dramatically improve marketing ROI. Read the full post → Several clear patterns emerge from these top posts: AI Integration is Make-or-Break: Multiple posts in the top 10 focus on AI, from OpenAI’s massive scale to the risks of slow AI adoption. The message is clear: AI isn’t optional anymore. Back to Fundamentals: Despite all the AI hype, posts about dashboards, sales execution, and marketing focus remind us that business fundamentals still matter most. Market Reality Check: The continued focus on slowing growth, difficult fundraising, and sales challenges reflects the ongoing market correction that began in 2022. Long-term Thinking: Success stories like Egnyte’s 18-year journey to a $1.5B exit show that sustainable growth often trumps hypergrowth. The Top 10 SaaStr Learnings from Mary Meeker’s Latest Report on AI

Carta Frequently Asked Questions (FAQ)

When was Carta founded?

Carta was founded in 2012.

Where is Carta's headquarters?

Carta's headquarters is located at 333 Bush Street, San Francisco.

What is Carta's latest funding round?

Carta's latest funding round is Valuation Change.

How much did Carta raise?

Carta raised a total of $1.158B.

Who are the investors of Carta?

Investors of Carta include Silver Lake, Alumni Ventures, Fabrica Ventures, Premji Invest, SierraMaya360 and 79 more.

Who are Carta's competitors?

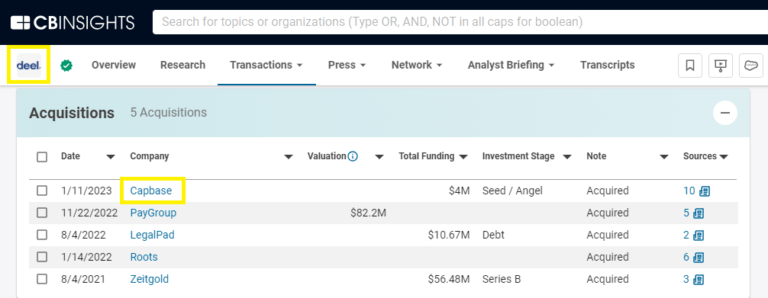

Competitors of Carta include Qapita, Aption, Nasdaq Private Market, Capbase, Shoobx and 7 more.

Loading...

Compare Carta to Competitors

Shareworks is a company that focuses on providing workplace financial solutions, operating within the financial services industry. The company offers a range of services including equity plan administration, retirement readiness programs, deferred compensation plan services, and executive services, all designed to help employees achieve their financial goals and companies to grow. The company primarily serves sectors such as private companies, public companies, and strategic partners. It was founded in 1999 and is based in New York, New York.

Pulley operates as an equity management platform for fundraising. The company offers solutions including cap table management, fundraising modeling, crypto and tokens, a communications hub, and more. It primarily serves the financial services sector. The company was founded in 2019 and is based in Oakland, California.

Upstock specializes in equity management solutions within the financial technology sector. It offers RSU-based equity plans and a platform for real-time tracking and management of worker equity, designed to empower founders and team members to align and achieve collective success. Upstock primarily serves startups, legal experts, contractors, and companies looking to integrate equity into their compensation and culture. It was founded in 2019 and is based in Wilmington, Delaware.

Ledgy is a company specializing in equity management software within the financial technology sector. The company offers a platform that includes financial reporting, cap table management, and compliance for equity plans. Ledgy serves private and public companies, providing tools for equity management and related services. It was founded in 2017 and is based in Zurich, Switzerland.

Aption specializes in equity pooling solutions within the financial services sector. The company offers services that allow individuals to leverage their equity positions to access investment opportunities in other startups. Aption was formerly known as Apeiros. It was founded in 2022 and is based in Scottsdale, Arizona.

EquityZen develops an investment platform. It connects shareholders of private companies with investors seeking alternative investments. It enables clients to provide the opportunity to invest in large private firms and address liquidity and risk concerns. It was founded in 2013 and is based in New York, New York.

Loading...