EBANX

Founded Year

2012Stage

Series C | AliveTotal Raised

$460MLast Raised

$430M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-36 points in the past 30 days

About EBANX

EBANX is a payment solutions provider that facilitates cross-border transactions in emerging markets. The company provides a platform for payments in different currencies and methods, including digital wallets and mobile money, for global brands entering these markets. EBANX serves sectors such as electronic commerce (e-commerce), Software as a Service (SaaS), gaming, and digital advertising, offering solutions for each industry's payment processing. It was founded in 2012 and is based in Curitiba, Brazil.

Loading...

Loading...

Research containing EBANX

Get data-driven expert analysis from the CB Insights Intelligence Unit.

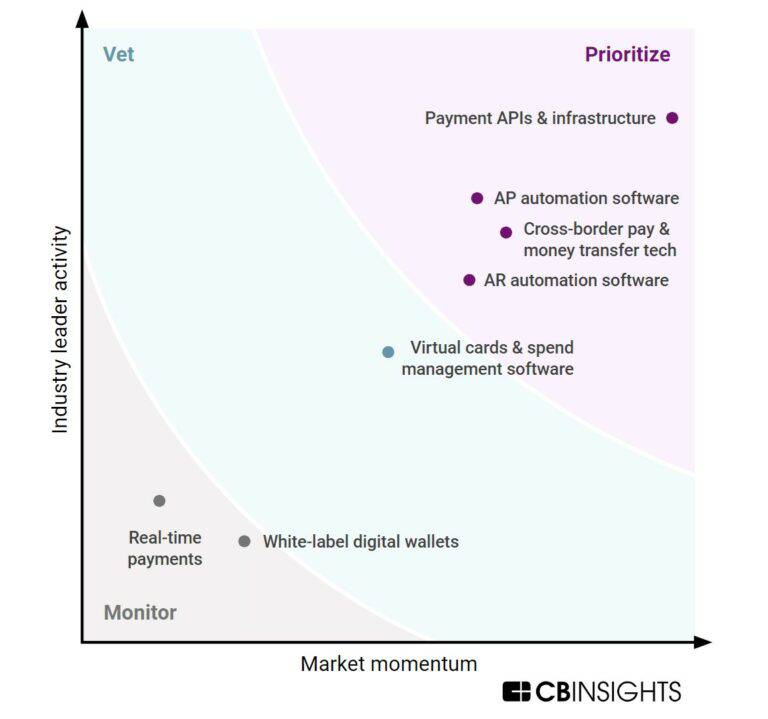

CB Insights Intelligence Analysts have mentioned EBANX in 7 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

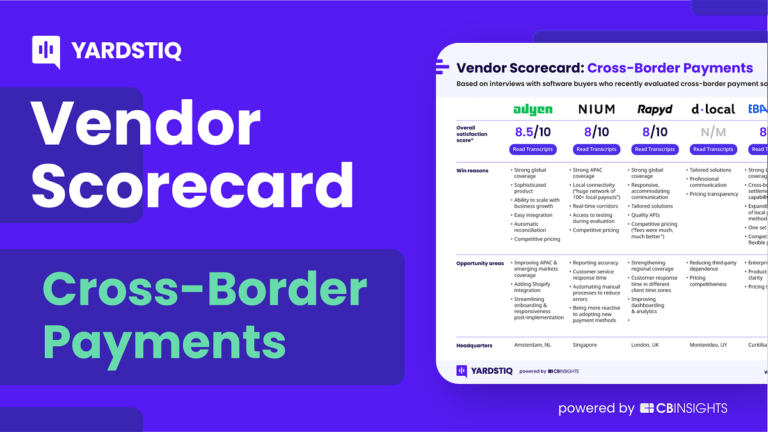

Dec 14, 2023

Cross-border payments market map

Jan 23, 2023 report

Top cross-border payments companies — and why customers chose them

Nov 28, 2022

The Transcript from Yardstiq: Feel the churn

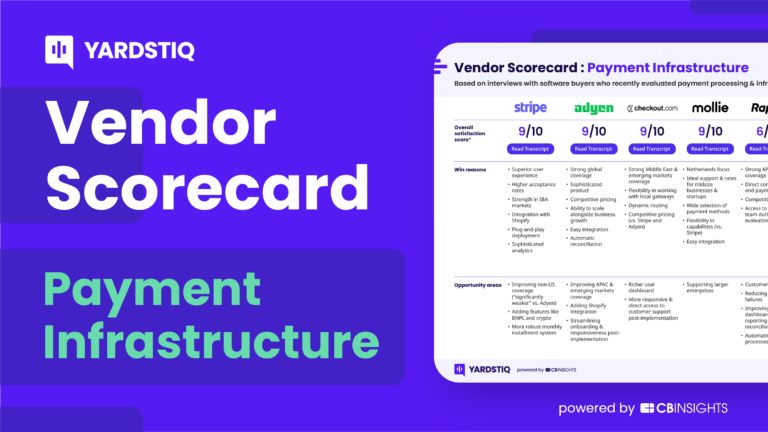

Sep 21, 2022 report

Top payment infrastructure companies — and why customers chose themExpert Collections containing EBANX

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

EBANX is included in 5 Expert Collections, including E-Commerce.

E-Commerce

11,558 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,276 items

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,978 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest EBANX News

Jul 7, 2025

monday.com: How EBANX Has Enabled it to Tap Into Brazilian Payment Market Through Local Preferences Like Read Time: min Since its expansion into Brazil in 2022, monday.com, a global software firm for businesses, has been utilising global payment tech service provider, EBANX‘s local payment solutions to power Brazilian businesses. Over the past three years, monday.com has experienced an average annual growth of 41 per cent in total payment volume (TPV) through EBANX. With support from the paytech and utilising a strategy focused on local solutions, monday.com has elevated the average ticket in the country to above $9,000. This is only the beginning, though, as according to Payments and Commerce Market Intelligence, Latin America’s (LatAm’s) SaaS market is projected to expand by 20 per cent annually until 2027. The payment method mix includes credit card instalments, a cultural phenomenon in Brazil, and cash payments like Boleto Bancário, a popular bank slip that can be paid either online or offline. Mauricio Prado Silva, VP of LatAm at monday.com “Our collaboration with EBANX has been transformative for supporting the payment process for our customers in Brazil, ensuring they have an intuitive and localised experience from start to finish,” says Mauricio Prado Silva, VP of LatAm at monday.com. “Leveraging EBANX’s industry expertise, combined with their flexible payment solutions, ensures that we are meeting our customers where they are by removing payment barriers to adoption, and enabling businesses of all sizes to benefit from our platform.” Understanding the Brazilian market The widespread use of instalments in Brazil is deeply tied to the country’s experience with high inflation in the 1980s and early 1990s. Additionally, Boleto Bancário has long served as a tool for financial inclusion, particularly relevant given that 60 million people in Brazil don’t own a credit card. With both payment options available, businesses can take full advantage of monday.com’s work management platform, enabling teams to perform at their best across all areas. Local payment methods are crucial for cross-border e-commerce in Latin America, for both large enterprise companies to small and medium-sized (SMBs) ones. For SMBs, particularly, local payment options like cash-based vouchers and account-based transfers provide them with more accessible and flexible ways to engage in international commerce. Offering instalments has enabled the company to cater to a Brazilian preference and habit of splitting payments — for both consumers and businesses — and overcome challenges related to lower purchasing power in emerging markets compared with more developed economies. This method accounts for 35 per cent of the total volume transacted in Brazil for monday.com through EBANX over 12 months. Beyond instalments While instalments make up a big part of the Brazilian payments ecosystem, another major factor is cash payments, like Boleto Bancário. With support from EBANX, monday.com has also been able to tap into this avenue and expand its consumer base, with cash payments representing 52 per cent of all the company’s transactions in the country, followed by credit cards, which account for 47 per cent. EBANX’s study Beyond Borders 2025 reports that 25 per cent of B2B (business-to-business) e-commerce purchases in the country are made with Boleto, compared to 10 per cent in P2B (person-to-business) sales in digital commerce. Cash payments like Boleto Bancário have become key to supporting monday.com’s growing customer base in Brazil, representing 52 per cent of all the company’s transactions in the country, followed by credit cards, which account for 47%. Robert-Jan Lieben, vice-president of commercial in Europe at EBANX Commenting on the impact of cash payments, Robert-Jan Lieben, vice-president of commercial in Europe at EBANX, said: “The share of Boleto in monday.com’s business is double the average. This performance further reinforces the value in partnering with a payment specialist for success in emerging countries.” Discussing the impact of the partnership on a grander scale, Lieben added: “Our collaboration with monday.com highlights how deeply understanding local payment preferences can significantly transform business outcomes in emerging markets. By offering methods that local consumers trust and use every day, businesses are not just facilitating transactions; they are expanding and democratizing access to their products and services across different economic segments.” Francis is a journalist and our lead LatAm correspondent, with a BA in Classical Civilization, he has a specialist interest in North and South America. View all posts

EBANX Frequently Asked Questions (FAQ)

When was EBANX founded?

EBANX was founded in 2012.

Where is EBANX's headquarters?

EBANX's headquarters is located at Marechal Deodoro, 630, Curitiba.

What is EBANX's latest funding round?

EBANX's latest funding round is Series C.

How much did EBANX raise?

EBANX raised a total of $460M.

Who are the investors of EBANX?

Investors of EBANX include Advent International, FTV Capital, Endeavor, Bossa Invest and Endeavor Outliers.

Who are EBANX's competitors?

Competitors of EBANX include CloudWalk, Payall, Belvo, Bamboo Payment Systems, Pismo and 7 more.

Loading...

Compare EBANX to Competitors

Nium operates within the financial technology sector and provides services including multi-currency accounts, global card issuance, and solutions for sending payouts to over 190 countries, facilitated through their API and platform. Nium serves financial institutions, money transfer operators, and enterprises across sectors such as payroll, marketplaces, spend management, the creator economy, and travel. Nium was formerly known as InstaReM Pte. Ltd.. It was founded in 2014 and is based in Singapore, Singapore.

PayU is a company in global payments and fintech, focusing on enabling local and cross-border payments as well as providing financial services. The company offers a payment platform that facilitates online payment processing and payment gateway services. PayU primarily serves sectors such as e-commerce, hospitality, and marketplace solutions. It was founded in 2002 and is based in Hoofddorp, Netherlands. PayU operates as a subsidiary of Naspers.

Rapyd focused on global payment processing and financial services infrastructure. The company provides products including online payment acceptance, in-store payment solutions, and financial services for businesses, such as global accounts and multi-currency management. Rapyd's platform supports e-commerce transactions, lending, remittances, and offers compliance and risk management solutions. It was founded in 2016 and is based in Essex, United Kingdom.

Hash operates a financial technology platform. It enables companies to create and test payment and other financial solutions. It provides non-financial business-to-business (B2B) enterprises wishing to offer banking services with payment infrastructure. The company was founded in 2017 and is based in Sao Paulo, Brazil.

Float operates as a financial technology company that specializes in global payment solutions. The company offers a platform for businesses to make domestic and international payments using various methods such as card, automated clearing house (ACH), wire, society for worldwide interbank financial telecommunication (SWIFT), and local payments, as well as features for managing invoices, collections, and vendor relationships. It primarily serves the financial service sector. Float was formerly known as Swipe Technologies. It was founded in 2020 and is based in San Francisco, California.

BlueSnap provides flexible payment solutions and delivers a customizable platform to global online businesses such as software publishers, web hosting companies, and online retailers. BlueSnap builds and manages online businesses for software publishers, web hosting companies, and online retailers. A business can choose the BlueSnap hosted application that spans the entire e-commerce lifecycle, or it can deploy the BlueSnap API, which allows retailers to integrate the technology with existing solutions. Using BlueSnap software, retailers can deliver newsletters to customers, coupons and promotions, real-time reporting, and live chat, amongst other features. It was formerly known as Plimus. It was founded in 2001 and is based in Waltham, Massachusetts.

Loading...