Earnix

Founded Year

2001Stage

Secondary Market | AliveTotal Raised

$98.5MLast Raised

$120M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-61 points in the past 30 days

About Earnix

Earnix provides predictive analytics solutions for the financial services industry. It focuses on strategies, processes, and an evolving ecosystem of technologies to help insurers and banks operate. It helps in business operations, pricing and rating, customer engagement, product personalization, and more. It serves the telematics, health, and insurance industries. The company was founded in 2001 and is based in Ramat Gan, Israel.

Loading...

Earnix's Product Videos

ESPs containing Earnix

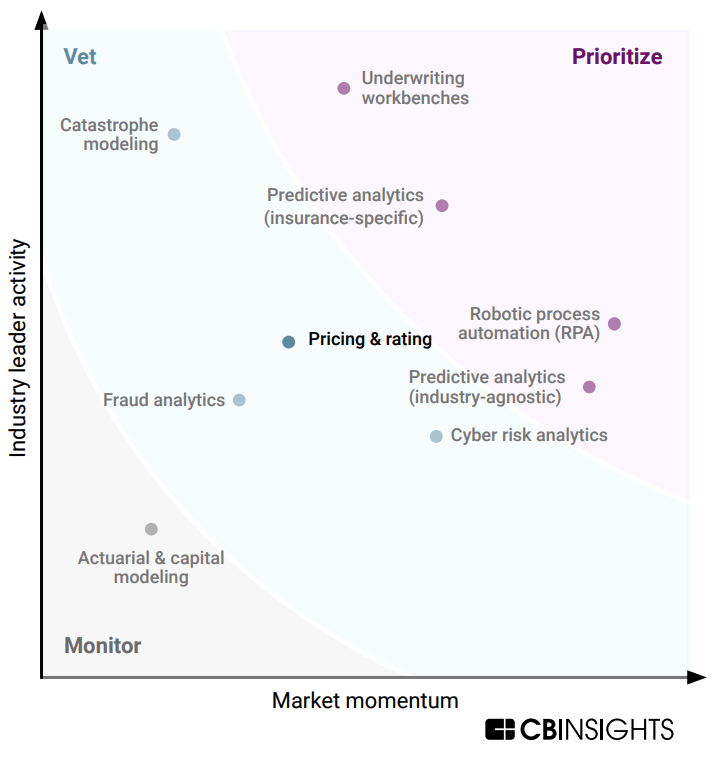

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

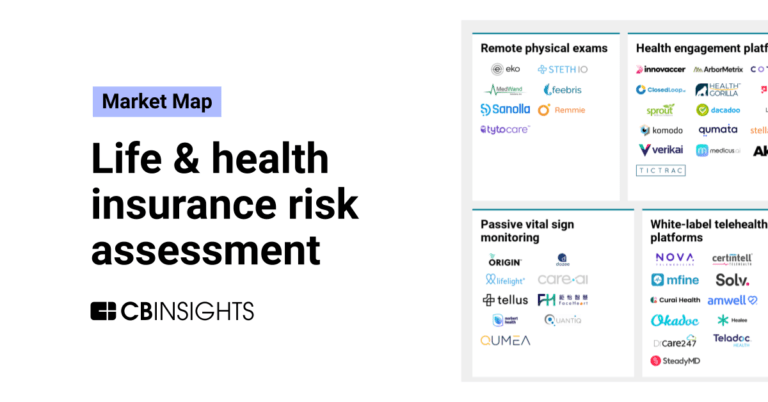

The underwriting data platforms market offers technology solutions for insurance companies to streamline their underwriting processes and improve risk assessment. These platforms provide tools for data analysis, automation, and continuous monitoring to enhance efficiency and accuracy in underwriting. The market includes solutions for health, life, and commercial insurance underwriting, with a focu…

Earnix named as Challenger among 15 other companies, including Guidewire, Sapiens, and Majesco.

Earnix's Products & Differentiators

Earnix Price-it

Earnix is the only end to end solution from pricing through rating, enabling speed to market, governance and full automation with open integration and management of any and all machine learning and always-on dynamic monitoring of business performance.

Loading...

Research containing Earnix

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Earnix in 4 CB Insights research briefs, most recently on Aug 9, 2023.

Expert Collections containing Earnix

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Earnix is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

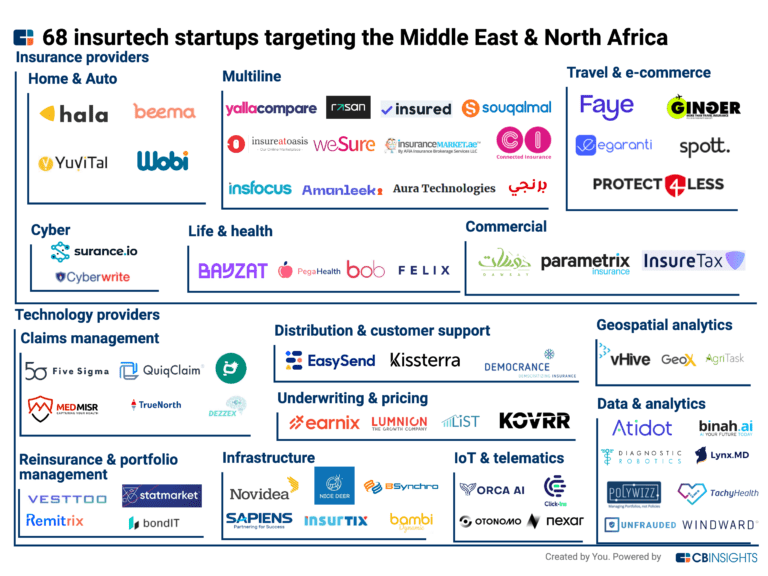

Insurtech

4,553 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence

12,322 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech 50

50 items

Digital Banking

908 items

Latest Earnix News

Jul 2, 2025

Earnix PolicyCenter v10 Product Now Available on Guidewire Marketplace The latest from Earnix for you; Earnix, the leading Dynamic-AI platform for insurance, today announced its new PolicyCenter v10 accelerator is now available to Guidewire PolicyCenter version 10 users in the Guidewire Marketplace . Like its PolicyCenter Cloud accelerator, Earnix’s new PolicyCenter version 10 integration helps insurers respond rapidly to market changes and improve profitability with a fully integrated intelligent pricing and rating solution. It creates a bi-directional flow of data to PolicyCenter, enabling streamlined loading of data from Guidewire to Earnix, Earnix Price-It quotes and rates stored in PolicyCenter. The Earnix for Guidewire PolicyCenter v10 accelerator enables insurers to: Improve profitability with more accurate rates and more responsive rate changes. Drive future product innovation and personalized offerings through better collective data and analytics. Efficiently transition to PolicyCenter on Guidewire Cloud without reimplementation. “We are pleased to strengthen our partnership with Guidewire through our suite of accelerators to help insurers optimize processes and data exchange throughout the insurance lifecycle,” said Robin Gilthorpe, CEO, Earnix. “Together we are offering solutions that help insurers respond rapidly to market changes and ultimately improve profitability.” “Congratulations to Earnix on the release of its new PolicyCenter integration,” said Will Murphy, Vice President, Marketplace and Technology Alliances, Guidewire. “The important bi-directional flow of data to PolicyCenter from Earnix helps insurers stay one step ahead by analyzing the impact their decisions and rates will have before the offer is added to the insurance marketplace.” Share this:

Earnix Frequently Asked Questions (FAQ)

When was Earnix founded?

Earnix was founded in 2001.

Where is Earnix's headquarters?

Earnix's headquarters is located at 2 Ze’ev Jabotinsky Street, Ramat Gan.

What is Earnix's latest funding round?

Earnix's latest funding round is Secondary Market.

How much did Earnix raise?

Earnix raised a total of $98.5M.

Who are the investors of Earnix?

Investors of Earnix include Jerusalem Venture Partners, Vintage Investment Partners, Israel Growth Partners, Insight Partners, PropertyCasualty360 Insurance Luminaries and 4 more.

Who are Earnix's competitors?

Competitors of Earnix include Soteris, Zesty AI, Zelros, Quantee, Federato and 7 more.

What products does Earnix offer?

Earnix's products include Earnix Price-it and 3 more.

Who are Earnix's customers?

Customers of Earnix include Gore Mutual and Suncorp.

Loading...

Compare Earnix to Competitors

Atidot provides AI and predictive analytics solutions for the life insurance sector. The company offers a cloud-based platform that combines internal data with external sources to support decision-making for insurers. Atidot's technology is utilized by various stakeholders in the life insurance industry, including executives, marketing teams, policy distributors, and actuaries, focusing on improving profitability, lead generation, policy accuracy, and risk analysis. It was founded in 2016 and is based in Palo Alto, California.

Akur8 provides pricing and reserving platforms for the insurance industry. The company offers a suite of software solutions that utilize machine learning and predictive analytics for actuarial pricing and reserving processes. Akur8's platforms aim to support insurance pricing and reserving for personal and commercial lines insurers, managing general agents, insurers, and health insurers. It was founded in 2019 and is based in Paris, France.

UnderwriteMe is a technology provider that offers underwriting solutions for the life insurance industry. The company provides products such as decision platforms, underwriting engines, and analytics tools that aim to facilitate the insurance application process and support decision-making. UnderwriteMe serves the life insurance sector by providing technology solutions to insurers and intermediaries. It was founded in 2012 and is based in London, United Kingdom.

KASKO is an InsurTech company providing technology solutions within the insurance sector. The company offers a modular no-/low-code platform that enables insurance providers to create and manage digital insurance programs efficiently. KASKO also provides services such as EU market access, technology consulting, and recruitment for the insurance industry. It was founded in 2015 and is based in London, United Kingdom.

Insurity provides cloud-based software solutions for the property and casualty (P&C) insurance industry. The company offers a suite of software products, including policy administration, billing, claims management, and analytics, aimed at improving operations and aiding decision-making for insurers. It primarily serves insurance carriers, brokers, managing general agents (MGAs), and other entities within the insurance sector. The company was founded in 1985 and is based in Hartford, Connecticut.

Zesty AI provides AI-powered risk assessment solutions for the property and casualty insurance industry. The company offers peril-specific risk models for natural disasters and environmental hazards, along with property insights to assist in underwriting and pricing decisions. Zesty AI's services are used by the insurance sector for risk management and decision-making. Zesty AI was formerly known as PowerScout. It was founded in 2015 and is based in San Francisco, California.

Loading...