Dune

Founded Year

2018Stage

Series B | AliveTotal Raised

$79.42MValuation

$0000Last Raised

$69.42M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+72 points in the past 30 days

About Dune

Dune provides a data platform for the cryptocurrency sector. It specializes in organizing, decoding, and presenting blockchain data in a human-readable format, making crypto data more accessible to users. It primarily serves the cryptocurrency analytics community. It was founded in 2018 and is based in Oslo, Norway.

Loading...

ESPs containing Dune

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital assets market data & insights market provides comprehensive data and analytics on blockchain networks, cryptocurrency and stablecoin markets, and decentralized finance. It includes solutions that offer historical and real-time on-chain and market data for research, trading, risk management, reporting, and compliance. Companies in this market aggregate fragmented data from multiple sour…

Dune named as Outperformer among 15 other companies, including Chainalysis, Kaiko, and Coin Metrics.

Loading...

Research containing Dune

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Dune in 3 CB Insights research briefs, most recently on Feb 23, 2023.

Dec 14, 2022

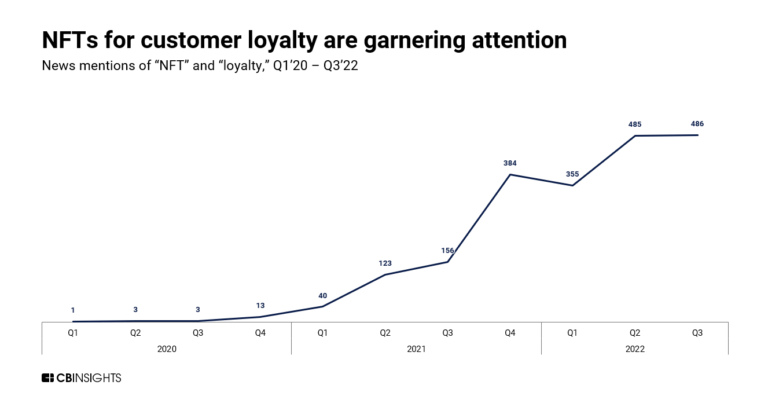

What L’Oréal, Nike, and LVMH are doing in Web3Expert Collections containing Dune

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Dune is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Blockchain

12,965 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

13,978 items

Excludes US-based companies

Blockchain 50

50 items

Stablecoin

433 items

Latest Dune News

Jul 2, 2025

Dune Analytics now supports XRP Ledger, revealing a massive surge in transactions, user growth, and DeFi activity Copied Dune Analytics, the leading blockchain data dashboards platform, has officially supported the XRP Ledger (XRPL). This is a significant milestone for XRP enthusiasts, developers. XRPL’s extensive on-chain data is now more accessible and actionable than ever before. With this integration, users can now observe real-time trends. This includes trends in transactions, accounts, decentralized trading, and user behavior, indicating XRPL’s increasing relevance in 2025. How Quickly Is XRPL Expanding in 2025? has been unprecedented. Since its establishment in 2012, the network has recorded more than 4 billion transactions. It started out and gained great renown, processing approximately 50,000 transactions daily back in 2013. Today, that number has surged to more than 2.2 million daily transactions. Account creation has followed a similar trend. XRPL now hosts more than 5.6 million accounts. 2,800+ new accounts created just yesterday. Daily signups have jumped from 1,000–2,000 in 2022 to highs of 8,000+ new users per day this year. Who’s Using XRPL, and How Often? Not only is the network user base increasing, but it’s also extremely active. More than 30,000 users engage with XRPL daily, and last week alone, it processed 14.1 million transactions from 78,000 individual senders. That means each average sender made roughly 180 transactions within a mere seven-day period, highlighting the steady usefulness of XRPL. Users have spent over 14 million What’s Driving XRPL’s Usage Beyond Payments? Payments are still XRPL’s most prevalent transaction type. Weekly volumes have doubled from 1.5 million in 2023 to 8 million in 2025. Even after this, they’re not the only use case driving activity. XRPL’s built-in decentralized exchange (DEX) is also performing well. It accommodates 2,300+ daily traders and more than 400 trading pairs, all without the use of smart contracts. The DEX has witnessed 384 million+ XRP in total volume due to its high liquidity and speedy order matching. Also Read: Is XRPL Becoming a DeFi Contender? Yes, and their own native Automated Market Makers (AMMs) are taking the reins. These intelligent liquidity pools are injected directly into the protocol. 20,000+ AMM pools are collectively processing over 350 million XRP in volume, and 2 million XRP is getting traded per day. What’s Next for XRPL and the Broader Ecosystem? With ready and fully flexible in use, the XRP Ledger has become another playground for transparency and accountability. In the new integration, developers and analysts get to watch from the front row. One of the longest-running success stories in blockchain is now being scaled faster than ever, and investors cannot wait for more.

Dune Frequently Asked Questions (FAQ)

When was Dune founded?

Dune was founded in 2018.

Where is Dune's headquarters?

Dune's headquarters is located at C/o Epicenter Edvard Storms gate 2, Oslo.

What is Dune's latest funding round?

Dune's latest funding round is Series B.

How much did Dune raise?

Dune raised a total of $79.42M.

Who are the investors of Dune?

Investors of Dune include Multicoin Capital, Dragonfly, Coatue, Redpoint Ventures, Union Square Ventures and 10 more.

Who are Dune's competitors?

Competitors of Dune include Kaiko and 8 more.

Loading...

Compare Dune to Competitors

Whalemap provides on-chain data for Bitcoin trading within the cryptocurrency market. The company offers tools to track whale activity, identify support and resistance levels, and analyze market trends for trading decisions. Whalemap's services cater to individuals and institutions looking to gain insights into Bitcoin's market movements based on whale transactions. It was founded in 2020 and is based in London, England.

Sun Zu Lab focuses on providing data solutions for the cryptocurrency ecosystem. The company offers services such as crypto market research, analytics, and in-depth articles, as well as a customizable dashboard for monitoring crypto markets. Sun Zu Lab primarily serves institutional investors, token foundations, and trading venues within the cryptocurrency industry. It was founded in 2020 and is based in Metz, France.

Coin Metrics provides crypto financial intelligence, focusing on network data, market data, and index solutions for the cryptoassets industry. The company offers products including aggregate network data metrics, historical and real-time market data, independent cryptoasset prices, and a suite of cryptoasset benchmarks. Coin Metrics serves institutions requiring crypto data. It was founded in 2017 and is based in Boston, Massachusetts.

Riskbloq is a company focused on providing professional risk analysis and scoring for digital assets within the cryptocurrency sector. Their main services include generating comprehensive risk profiles for over 3000 crypto assets by combining on-chain and off-chain data, aimed at aiding investors in making informed crypto investment decisions. The company primarily caters to individual and institutional investors looking for data-driven insights into the cryptocurrency market. It was founded in 2022 and is based in Johannesburg, South Africa.

DeepDAO lists, ranks, and analyzes top DAOs across multiple metrics, such as membership and assets under management (AUM). Its mission is to provide comprehensive discoverability for decentralized governance systems, analytics, and information gathering.

Chainalysis is a blockchain data platform that offers blockchain intelligence to assist in detecting crypto crime, ensuring regulatory compliance, and supporting financial institutions. The company serves law enforcement agencies, regulators, and centralized exchanges. It was founded in 2014 and is based in New York, New York.

Loading...