Investments

61Portfolio Exits

3About Decibel Partners

Decibel is an independent venture capital firm created in partnership with Cisco to push the conventional boundaries of early-stage investing. Decibel combines the speed, agility, and independent risk-taking traditionally found in venture firms while offering differentiated access to the scale, entrepreneurial talent, and deep customer relationships found in one of the largest tech companies in the world.

Research containing Decibel Partners

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Decibel Partners in 1 CB Insights research brief, most recently on Apr 24, 2025.

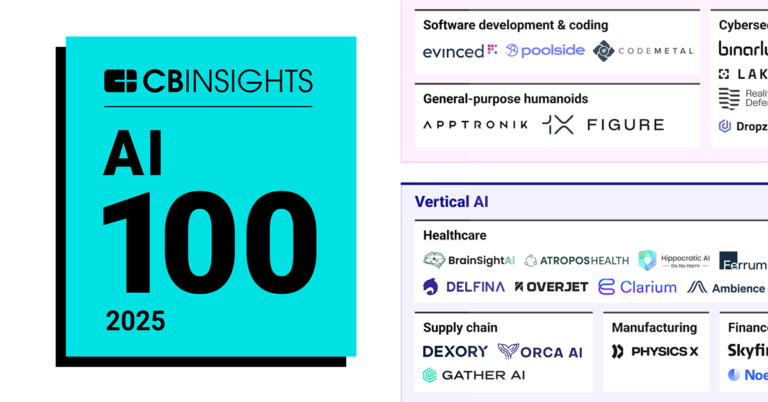

Apr 24, 2025 report

AI 100: The most promising artificial intelligence startups of 2025Latest Decibel Partners News

Jun 12, 2025

NEW YORK–( BUSINESS WIRE )–Veris AI, a platform that lets companies safely train and test AI agents through novel high-fidelity simulated experiences, emerged from stealth today and announced it has raised $8.5M in seed funding. The round was led by Decibel Ventures and Acrew Capital , with participation from angel investors Ian Livingstone The House Fund Rocket Money 's Idris Mokhtarzada Dorothy Chang , and others. We are building Veris to unlock the potential of agentic AI for enterprises – both by solving existing problems and improving the speed and quality in which new agents can come into production. Share Within the next three years, 80% of companies are expected to integrate AI agents into their core operations, a trend that will enable massive productivity gains through automation. Yet, today, most agents lack the accuracy, consistency and governance required for enterprise use, exposing organizations to significant risk. Veris exists to eliminate these roadblocks by allowing developers to train agents using experience rather than prompt engineering and human-generated data, as is common practice today. In doing so, Veris accelerates development speed in a way that is purpose-built for quality, compliance, and continuous improvement. “We started Veris after observing that the traditional ways we train machine learning models just don't work for AI agents. Similar to how self-driving cars needed simulated cities to become production-ready, AI agents need real experience” said Mehdi Jamei, CEO and co-founder of Veris. “There's a paradigm shift taking place right now in which AI learns by interacting with the world directly, rather than solely relying on human-generated data. We are building Veris to unlock the potential of agentic AI for enterprises – both by solving existing problems and improving the speed and quality in which new agents can come into production.” Veris' founders combine deep technical expertise with real-world enterprise experience. Chief Executive Officer Mehdi Jamei holds a Ph.D. in electrical engineering and computer science from University of California at Berkeley and formerly led agentic AI at System and Workmate . Chief Technology Officer Andi Partovi earned a Ph.D. in brain-computer interfaces from the University of Melbourne and was previously a Solutions Architect at Google and Founder/CTO at KeyLead Health “As founders, Mehdi and Andi have a rare combination of academic, technical and enterprise customer experience that makes them well-positioned to deliver on this new paradigm,” said Alessio Fanelli, Partner and CTO at Decibel Ventures. “We've been looking to make an investment in this space for quite some time and Veris is the only platform we found that is building the environment layer that enterprise AI has been missing.” The company is currently working with a select group of early customers across financial services, enterprise productivity, and manufacturing. Early use cases include: A consumer fintech company is using Veris to deploy compliant, trustworthy chatbots, unlocking new channels of user engagement without injecting new regulatory risk. The company is able to simulate user conversations, sensitive information disclosures, regulatory violations and edge cases. An HR tech company is using Veris to train executive assistant AI agents on simulated, complex scenarios involving calendaring and confidential information sharing to ensure the AI assistants behave reliably, professionally, and securely. A leading manufacturer is using Veris to train a supply chain AI agent on simulated real-world sourcing tasks, like supplier research, RFP generation, email conversations, negotiation, and risk evaluation, to prevent mistakes that could cause financial loss, brand damage, or even legal issues. “Veris is ahead of the curve in approaching agent training through experience rather than evaluation,” said Asad Khaliq, Founding Partner at Acrew Capital. “Their simulation-first approach is exactly what enterprises need to confidently deploy AI agents in production. We believe Veris is defining a new and dynamic category in enterprise AI — and expect the rest of the industry to quickly follow their lead.” The seed funding will be used to hire a lean, high-impact team of engineers and data scientists and open the waitlist to additional enterprise customers Interested parties can sign up for the waitlist at veris.ai About Veris AI Veris AI provides an experiential training ground for AI agents to learn through real-world experience. Veris' dynamic, realistic, simulated environments gives enterprises a safe space for reinforcement learning and continuous improvement, ultimately helping them deploy and scale more accurate AI agents. Backed by top investors, including Decibel Ventures and Acrew Capital, Veris is addressing the gap between advancements in underlying AI models and accurate, high-quality AI agents. For more information, visit veris.ai About Decibel Ventures Decibel is a venture capital firm, based in Silicon Valley that backs technical founders and helps them find product-market fit. Decibel invests in early-stage enterprise software companies, with a special focus on developer platforms and tools, data and AI engineering products, cybersecurity, and autonomous software and services. For more information visit www.decibel.vc About Acrew Capital Acrew Capital is a thesis led and values driven venture capital firm, investing from inception to inflection stage growth across three key sectors: Data and Security, Fintech, and Health. Acrew's investments include At-Bay, Bilt, Cato Networks, Chime, Ditto, Protect AI, and Vanta among many others. For more information visit www.acrewcapital.com Contacts Meg Sinclair meg@am.partners (c)2025 Business Wire, Inc., All rights reserved.

Decibel Partners Investments

61 Investments

Decibel Partners has made 61 investments. Their latest investment was in Botpress as part of their Series B on June 23, 2025.

Decibel Partners Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

6/23/2025 | Series B | Botpress | $25M | No | Deloitte Ventures, Framework Venture Partners, HubSpot Ventures, Inovia Capital, and Undisclosed Investors | 5 |

6/3/2025 | Seed VC | Veris AI | $8.5M | Yes | Acrew Capital, Dorothy Chang, Ian Livingstone, Idris Mokhtarzada, The House Fund, and Undisclosed Angel Investors | 5 |

5/22/2025 | Seed VC | Pixee | $15M | No | Alex Rice, Brian Chess, Prime Set, TEDCO, Undisclosed Angel Investors, Wing Venture Capital, and Zach Holman | 2 |

4/24/2025 | Series B | |||||

4/2/2025 | Seed VC - II |

Date | 6/23/2025 | 6/3/2025 | 5/22/2025 | 4/24/2025 | 4/2/2025 |

|---|---|---|---|---|---|

Round | Series B | Seed VC | Seed VC | Series B | Seed VC - II |

Company | Botpress | Veris AI | Pixee | ||

Amount | $25M | $8.5M | $15M | ||

New? | No | Yes | No | ||

Co-Investors | Deloitte Ventures, Framework Venture Partners, HubSpot Ventures, Inovia Capital, and Undisclosed Investors | Acrew Capital, Dorothy Chang, Ian Livingstone, Idris Mokhtarzada, The House Fund, and Undisclosed Angel Investors | Alex Rice, Brian Chess, Prime Set, TEDCO, Undisclosed Angel Investors, Wing Venture Capital, and Zach Holman | ||

Sources | 5 | 5 | 2 |

Decibel Partners Portfolio Exits

3 Portfolio Exits

Decibel Partners has 3 portfolio exits. Their latest portfolio exit was Blameless on August 21, 2024.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

8/21/2024 | Acquired | 4 | |||

Date | 8/21/2024 | ||

|---|---|---|---|

Exit | Acquired | ||

Companies | |||

Valuation | |||

Acquirer | |||

Sources | 4 |

Decibel Partners Team

2 Team Members

Decibel Partners has 2 team members, including , .

Name | Work History | Title | Status |

|---|---|---|---|

Jon Sakoda | Founder | Current | |

Name | Jon Sakoda | |

|---|---|---|

Work History | ||

Title | Founder | |

Status | Current |

Loading...