Dataminr

Founded Year

2009Stage

Convertible Note - II | AliveTotal Raised

$1.144BLast Raised

$100M | 3 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+124 points in the past 30 days

About Dataminr

Dataminr uses artificial intelligence for event and risk detection across various sectors. It's platform analyzes publicly available data to provide alerts on significant events and emerging risks, serving clients that include corporations, public sector agencies, newsrooms, and non-governmental organizations (NGOs). It's main offerings consist of solutions for corporate security and cyber risk management, and tools for journalists to find and report on news stories. It was founded in 2009 and is based in New York, New York.

Loading...

Loading...

Research containing Dataminr

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Dataminr in 2 CB Insights research briefs, most recently on Aug 21, 2023.

Aug 14, 2023

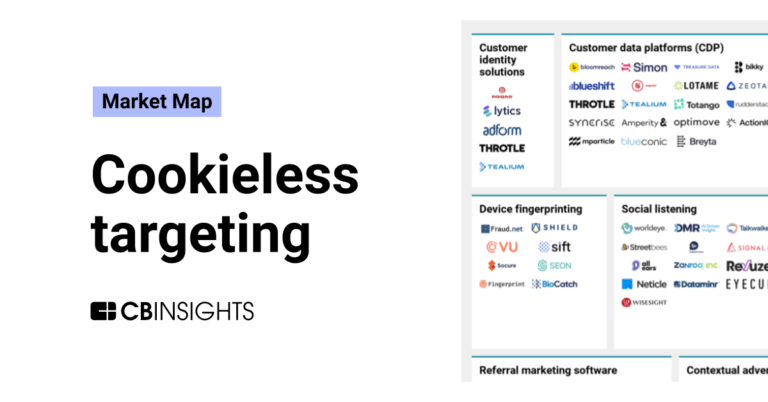

The cookieless targeting market mapExpert Collections containing Dataminr

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Dataminr is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

568 items

Market Research & Consumer Insights

734 items

This collection is comprised of companies using tech to better identify emerging trends and improve product development. It also includes companies helping brands and retailers conduct market research to learn about target shoppers, like their preferences, habits, and behaviors.

Artificial Intelligence

10,050 items

Latest Dataminr News

Jul 9, 2025

Sheryl Estrada Senior Writer and author of CFO Daily Sheryl Estrada is a senior writer at Fortune, where she covers the corporate finance industry, Wall Street, and corporate leadership. A longtime finance executive at cybersecurity company CrowdStrike is leaving for a new CFO role at a growing AI player. AI company Dataminr tapped Tiffany Buchanan to serve as its next CFO. Buchanan will begin her role as finance chief in early August. She succeeds interim CFO, Kiran Rao. At CrowdStrike, Buchanan served as SVP of finance and capital markets during a 13-year tenure that began as an accounting manager. She joined CrowdStrike when it was pre-revenue and played a key role in strategic finance from Series A-1 to its initial public offering (IPO) in 2019. The company quickly grew to more than $4 billion in annual recurring revenue. She also helped navigate the aftermath of the company’s global IT outage last year. “If I think back to high school, I loved watching my bank account, and I had my spreadsheets and my budget,” Buchanan said, reflecting on her path to CFO. After getting a job out of high school and putting herself through college, she landed a position at a CPA firm where she realized accounting was “always part of my DNA.” Buchanan is set to help lead Dataminr, a real-time AI platform, down the path to an IPO. The platform analyzes more than one million public data sources—including text, images, and video—to detect and inform users of emerging events, risks, and threats. The company—which counts NATO and OpenAI among its prominent and wide-ranging client pool—raised $100 million in funding from Fortress in April and $85 million in new funding in March, following a $475 million round in 2021 that valued Dataminr at $4.1 billion. Tiffany Buchanan, CFO of Dataminr. Courtesy of Dataminr Buchanan’s decision to join Dataminr was cemented after meeting founder and CEO Ted Bailey and experiencing the company’s mission-driven culture. “I really wanted to replicate that same feeling and excitement I felt many years ago with CrowdStrike, and I really feel as though I found that with Dataminr,” she said. Her immediate focus is initially on building out new routes to market, targeting new customer personas, and driving product innovation. And then with the eye on going public, she’s working to strength Dataminr’s systems, processes, and functions to prepare for a potential IPO. “It’s about making sure we can check all the boxes from a public reporting standpoint,” she explained, drawing on her experience guiding CrowdStrike from pre-revenue to a multibillion-dollar public company. Lessons from the IPO Journey Going public is “one of the most amazing experiences” an organization can have. However, the work isn’t done. “Oftentimes, the hardest part is after the IPO—getting to that predictability and public reporting cadence, being able to continuously tell the story you want to tell the public market,” she explained. Post-IPO, Buchanan stresses the importance of not sacrificing long-term success for short-term gains and ensuring that internal processes and external messaging are aligned. As Dataminr expands internationally, Buchanan sees robust risk management and compliance as top priorities. She emphasizes the importance of identifying risks—including financial, cybersecurity, and supply chain—in areas where Dataminr’s real-time intelligence platform provides early warnings. Bailey said in a statement that Buchanan has deep financial acumen, operational rigor, and high-growth experience, all “skills that will be instrumental.” Mentorship and giving back Buchanan’s preparation for the CFO seat began at CrowdStrike. She names Gregg Marston, the original CFO and cofounder of CrowdStrike, and current CFO Burt Podbere as her mentors. She believes in paying it forward. To that end, she recently joined the board of ASAPP, an AI company focused on transforming customer service. Outside of work, Buchanan is committed to supporting foster children and families in need. “I was in foster care from a very young age and, fortunately, adopted by my aunt and uncle and was raised within my family,” she said. Along with philanthropy, Buchanan enjoys running and spending time with her husband and children. Sheryl Estrada

Dataminr Frequently Asked Questions (FAQ)

When was Dataminr founded?

Dataminr was founded in 2009.

Where is Dataminr's headquarters?

Dataminr's headquarters is located at 6 East 32nd Street, New York.

What is Dataminr's latest funding round?

Dataminr's latest funding round is Convertible Note - II.

How much did Dataminr raise?

Dataminr raised a total of $1.144B.

Who are the investors of Dataminr?

Investors of Dataminr include Fortress Investment Group, NightDragon, HSBC, Fabrica Ventures, Institutional Venture Partners and 39 more.

Who are Dataminr's competitors?

Competitors of Dataminr include Logically, CloudMargin, Accern, Capitolis, NYSHEX and 7 more.

Loading...

Compare Dataminr to Competitors

Q4 provides capital markets access platforms, operating within the financial technology sector. The company offers products including IR website products, virtual event solutions, engagement analytics, investor relations CRM, shareholder and market analysis, surveillance, and ESG tools, designed to facilitate efficient communication and engagement between issuers, investors, and the sell-side. Q4 primarily serves public companies across various industries seeking to enhance their investor relations and capital market activities. It was founded in 2006 and is based in Toronto, Canada.

Capitolis is a technology provider specializing in the capital markets sector. The company offers solutions aimed at reducing financial risk and improving capital efficiency for global and regional banks and institutional investors. Capitolis primarily serves the financial services industry, focusing on banks and investment institutions. It was founded in 2016 and is based in New York, New York.

TradeIX offers an open platform for trade finance. The company offers tools to transform and rewire the global trade infrastructure. It was founded in 2016 and is based in Dublin, Ireland.

Symphony is a technology company that provides communication infrastructure for the financial services industry. The company offers products including messaging, voice communication, directory services, and analytics tailored for market participants. Symphony's solutions facilitate standardized and automated workflows, catering to the needs of institutions and professionals. It was founded in 2014 and is based in New York, New York.

CloudMargin is a cloud-based collateral management workflow tool. The firm's Software-as-a-Service model helps financial institutions, including exchanges, brokerage firms, banks, asset management firms, and insurance companies, meet regulatory deadlines and reduce costs associated with collateral requirements that are growing. CloudMargin enables clients to experience rapid implementation and access to robust and secure collateral management workflow software. It was founded in 2014 and is based in London, United Kingdom.

Trumid operates as a financial technology company. It offers an electronic trading platform and provides corporate bond market professionals with direct access to anonymous and counterparty-disclosed liquidity. It primarily serves the financial technology sector. The company was founded in 2014 and is based in New York, New York.

Loading...