Cover Genius

Founded Year

2014Stage

Series E | AliveTotal Raised

$240.5MLast Raised

$80M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-18 points in the past 30 days

About Cover Genius

Cover Genius specializes in embedded protection for various industries. Its main offerings include a global distribution platform, XCover, which provides seamless insurance and protection services, and an API that enables claims payments. It primarily serves sectors such as retail, fintech, logistics, mobility and auto, gig economy, travel, property, and live event ticketing. It was founded in 2014 and is based in New York, New York.

Loading...

ESPs containing Cover Genius

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The embedded insurance infrastructure market consists of tech vendors that offer products to enable insurance sales on third-party platforms via APIs (application programming interfaces). These companies sell their products to insurance providers or third-party platforms. Some embedded insurance infrastructure providers may also provide insurance (as a licensed carrier, managing general agent, or …

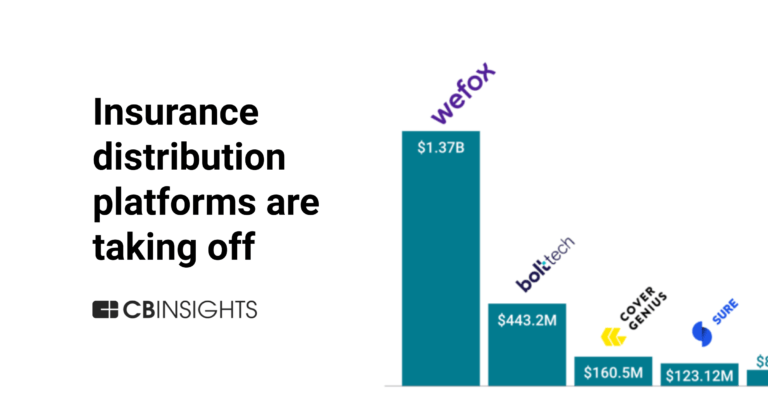

Cover Genius named as Highflier among 15 other companies, including Bolttech, Igloo, and Qover.

Cover Genius's Products & Differentiators

XCover

XCover is Cover Genius’ award-winning global distribution platform. It protects the customers of the world’s largest digital companies with seamless, end-to-end experiences. Licensed or authorized in over 60 countries and all 50 US States, XCover enables merchants to embed and sell multiple lines of insurance and other types of protection, backed by an industry-leading post-claims Net Promoter Score (NPS).

Loading...

Research containing Cover Genius

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Cover Genius in 7 CB Insights research briefs, most recently on Aug 28, 2024.

Aug 28, 2024 report

Insurtech 50: The most promising insurtech startups of 2024

Dec 18, 2023

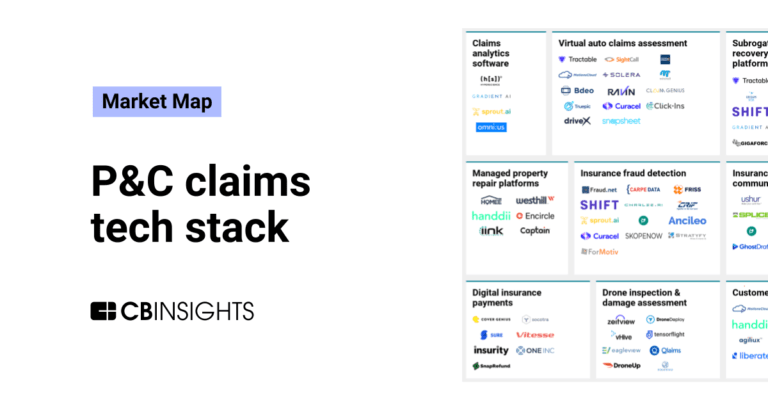

The P&C claims tech stack market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Cover Genius

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Cover Genius is included in 7 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

4,573 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Insurtech

4,553 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50

150 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Fintech 100

100 items

Insurtech 50 (2024)

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Cover Genius Patents

Cover Genius has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

7/15/2016 | Social networking services, User interfaces, Usability, Virtual communities, Pricing | Application |

Application Date | 7/15/2016 |

|---|---|

Grant Date | |

Title | |

Related Topics | Social networking services, User interfaces, Usability, Virtual communities, Pricing |

Status | Application |

Latest Cover Genius News

Jun 20, 2025

The product offers flexible digital cover with no underwriting or paperwork Share Millions of Australian workers with little to no access to life insurance may soon find it easier to get cover, thanks to a new digital product launched by TAL and insurtech firm Cover Genius. The offering, called backd, embeds life, income, and illness insurance directly into payroll and HR platforms, allowing employers to provide protection without the need for medical underwriting or paperwork. The product is designed with flexibility and simplicity in mind, particularly for part-time workers, contractors, and casual staff, which are segments often excluded from traditional insurance models. Workers can sign up entirely online, and claims are handled digitally from start to finish. According to Cover Genius CEO and co-founder Angus McDonald, embedded insurance could be a key strategy to bridge the protection gap in Australia’s workforce. “Many people do not have life insurance either because they feel they cannot afford it, have not been offered it or think the process will be too complex. backd overcomes these issues by giving employers a simple way to offer their employees easily accessible protection that suits their income and financial needs,” McDonald said. backd offers income protection benefits of $100 to $300 per day and life insurance cover of up to $150,000. It is tailored for people who may not qualify for superannuation-linked group cover or find retail insurance options unaffordable.

Cover Genius Frequently Asked Questions (FAQ)

When was Cover Genius founded?

Cover Genius was founded in 2014.

Where is Cover Genius's headquarters?

Cover Genius's headquarters is located at 11 West 42nd Street, New York.

What is Cover Genius's latest funding round?

Cover Genius's latest funding round is Series E.

How much did Cover Genius raise?

Cover Genius raised a total of $240.5M.

Who are the investors of Cover Genius?

Investors of Cover Genius include King River Capital, G Squared, Dawn Capital, Spark Capital, Atlas Merchant Capital and 8 more.

Who are Cover Genius's competitors?

Competitors of Cover Genius include Assurely, Seel, Pattern, Bolttech, Insuritas and 7 more.

What products does Cover Genius offer?

Cover Genius's products include XCover and 4 more.

Who are Cover Genius's customers?

Customers of Cover Genius include https://www.priceline.com.

Loading...

Compare Cover Genius to Competitors

Galaxy Finco operates as a special-purpose entity. The Company was formed for the purpose of issuing debt securities, repaying existing credit facilities, refinancing indebtedness, and for acquisition purposes. The company was founded in 2013 and is based in Jersey, United Kingdom.

Qover specializes in insurance orchestration within the insurance sector. The company offers a platform as a service to enable businesses to integrate insurance services into their digital experiences, including claims management and customer support. Qover primarily serves sectors that require integrated insurance solutions, such as fintech, automotive, retail, and the gig economy. It was founded in 2016 and is based in Brussels, Belgium.

Bolttech is an international insurtech company that provides services in the areas of protection and insurance. The company connects insurers, distributors, and customers to facilitate the buying and selling of insurance and protection products. Bolttech serves the insurance industry and aims to improve the processes involved in insurance transactions. Bolttech was formerly known as AmTrust Mobile Solutions Singapore. It was founded in 2020 and is based in Singapore.

Ancileo is a provider of insurance technology solutions, specializing in the digital distribution of insurance products and services. The company offers a suite of enterprise solutions including API integration, white label services, agent portal management, AI-driven claims automation, policy management, and localized premium billing, all designed to enhance the operations of insurers, re-insurers, brokers, and affinity partners. Ancileo's technology is tailored to support the insurance industry, with a focus on travel insurance portfolios. It was founded in 2016 and is based in Singapore, Singapore.

Boost focuses on providing digital insurance solutions in the insurance technology sector. It offers a digital insurance platform that provides compliance, capital, and technology infrastructure for insurance technology companies, MGAs, and embedded insurance. It primarily sells to the insurance technology industry, as well as to MGAs, brokers, agents, and embedded insurance platforms. The company was founded in 2017 and is based in New York, New York.

Bsurance operates in the insurance technology sector, offering a platform for the creation and distribution of insurance products. The company provides services including platform solutions, expert services, and a range of insurance solutions for insurers, banks, retailers, and MGAs. Bsurance's technology allows partners to launch, manage, and scale insurance offerings with a focus on embedded insurance and digital product integration. It was founded in 2017 and is based in Vienna, Austria.

Loading...