Corvus Insurance

Founded Year

2017Stage

Acquired | AcquiredTotal Raised

$161MValuation

$0000About Corvus Insurance

Corvus Insurance is a company that specializes in the insurance industry, with a particular focus on cyber insurance solutions. The company offers insurance products that help manage cyber risks, including data-driven risk prevention tools and consultations with their Risk Advisory team. Their primary market is businesses seeking to mitigate their cyber risk exposure. It was founded in 2017 and is based in Boston, Massachusetts. In November 2023, Corvus Insurance was acquired by The Travelers Companies.

Loading...

Corvus Insurance's Product Videos

ESPs containing Corvus Insurance

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital cyber insurance providers market consists of companies that provide businesses and individuals with insurance that covers cyber risks. These companies include insurtech producers (e.g., agents and brokers), insurtech managing general agents (MGAs), and full-stack insurtech carriers with tech-centered operating models. Well-established insurers and intermediaries that have entered the c…

Corvus Insurance named as Leader among 15 other companies, including Coalition, Cowbell Cyber, and Newfront.

Corvus Insurance's Products & Differentiators

Smart Cyber Insurance

Data-informed coverage built for evolving threats. We combine our underwriting expertise with technology for personalized quotes, optimal pricing, and broad coverage.

Loading...

Research containing Corvus Insurance

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Corvus Insurance in 5 CB Insights research briefs, most recently on Feb 29, 2024.

Feb 9, 2024 report

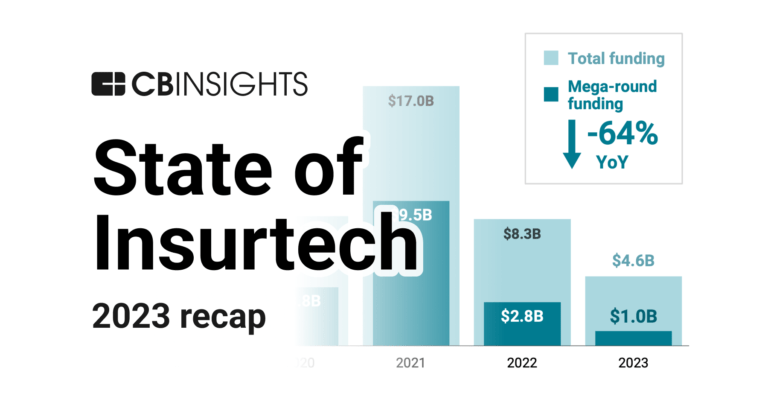

State of Insurtech 2023 Report

Feb 1, 2024 report

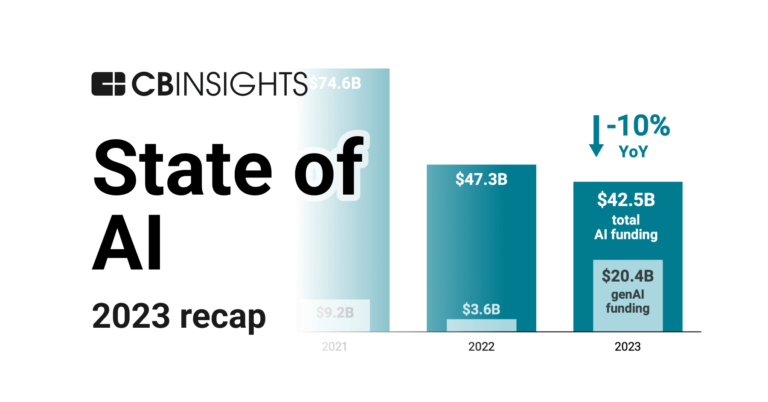

State of AI 2023 Report

Jan 18, 2024 report

State of Fintech 2023 ReportExpert Collections containing Corvus Insurance

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Corvus Insurance is included in 7 Expert Collections, including Insurtech.

Insurtech

4,553 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Cybersecurity

10,758 items

These companies protect organizations from digital threats.

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

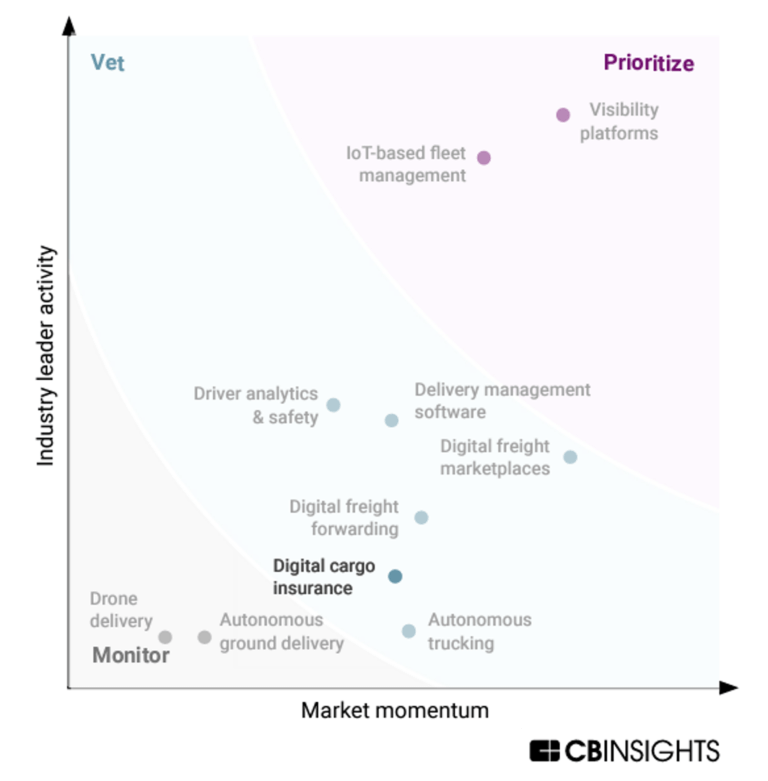

Supply Chain & Logistics Tech

347 items

Insurtech 50

50 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Latest Corvus Insurance News

Apr 28, 2025

Harsha - stock.adobe.com Global cyber risk insurance premium rates have been decreasing, leaving insurers in the space looking at risk pricing, underwriting and the frequency of claims as areas to address. LinkedIn "Rates continue to be under pressure, overall and in all revenue bands – SME, middle market and large accounts – but they have been leveling out for the past few quarters," said Jeff Kulikowski, EVP, Cyber & Professional Liability, Westfield Specialty, who spoke as part of an April 17 panel hosted by Insurtech Insights. "The reason behind the rate decrease is new capacity and expanded risk appetite amongst carriers is driving rates downward." Steven Schwartz, chief insurance officer, Safe, thinks the rates have hit a plateau. "Within the next year, we'll start to see rates increase, or at least get more validation that we are pricing the risk more effectively," he said. Steven Schwartz, chief insurance officer, Safe. Overall, cyber risk premiums grew 32% annually from 2017 to 2022, but did not grow as fast in 2023 and 2024 as rates were reduced, according to . New insurers, in the form of MGAs, have joined the cyber risk insurance space, because it has a lot of room for growth, according to Connor Brennan, a vice president at Arch Insurance Group specializing in cyber insurance. These new insurers, including Coalition, Cowbell, At-Bay and Corvus, are challenging major P&C carriers that had cyber insurance offerings for a while. Connor Brennan, vice president, Arch Insurance Group. LinkedIn Cyber risk insurance MGAs tend to focus more on distribution technology, according to Schwartz. "When you change the way you look at things, things you look at change," he said. "I'm seeing a few different underwriting methods and how that data is being captured with some of the newer SMB MGAs. It's also what we need to learn and bring back to the traditional, larger incumbents." projects another increase in cyber insurance premiums, to a total of $23 billion by 2026, at a 15% to 20% increase each year (for 2024 and 2025). While insurers have had a greater appetite for cyber risk, volatility in cyber risk claims seems to be returning, according to Kulikowski. Middle-market claims caused concern from 2019 through 2022, he explained, because of a rise in ransomware events. Now the concern is with large policyholders' claims, Kulikowski said. Arch Insurance's Brennan cautioned that more discipline is needed in what insurers are underwriting and brokers are providing. Increases in claims are being driven by ransomware as well as business interruption and third-party risks, according to Schwartz. Policyholders' use of third parties complicates claims handling, Kulikowski noted. "What happens if that vendor fails? What is your resiliency like? Do you have a backup internally? Is there a manual way to do things?" he said. "We're having to dig very deep into these kinds of dependency claims, because we've just seen that ripple effect. These aren't traditionally ransomware generated, either. It could be system failure generated."

Corvus Insurance Frequently Asked Questions (FAQ)

When was Corvus Insurance founded?

Corvus Insurance was founded in 2017.

Where is Corvus Insurance's headquarters?

Corvus Insurance's headquarters is located at 100 Summer Street, Boston.

What is Corvus Insurance's latest funding round?

Corvus Insurance's latest funding round is Acquired.

How much did Corvus Insurance raise?

Corvus Insurance raised a total of $161M.

Who are the investors of Corvus Insurance?

Investors of Corvus Insurance include Travelers, SiriusPoint, FinTLV, Aquiline Capital Partners, .406 Ventures and 8 more.

Who are Corvus Insurance's competitors?

Competitors of Corvus Insurance include Coalition and 7 more.

What products does Corvus Insurance offer?

Corvus Insurance's products include Smart Cyber Insurance and 2 more.

Loading...

Compare Corvus Insurance to Competitors

Cowbell Cyber provides adaptive cyber insurance coverage to small and medium-sized enterprises within the insurance sector. The company offers cyber insurance products that include continuous risk assessment and underwriting, using artificial intelligence (AI) to manage and mitigate cyber risks. Cowbell Cyber serves the insurance industry with a focus on Small and Medium-sized Enterprises (SMEs). It was founded in 2019 and is based in Pleasanton, California.

Resilience is a company that operates in the field of cybersecurity risk management and insurance within the financial services and technology sectors. Its offerings include cyber insurance policies, cyber risk quantification, and a risk operations center. Resilience provides solutions that include risk quantification software, cybersecurity expertise, and cyber insurance for middle and large organizations. It was founded in 2016 and is based in San Francisco, California.

Counterpart is a Managing General Underwriter (MGU) focused on management and professional liability insurance within the insurance industry. The company offers products such as directors and officers insurance, employment practices liability, fiduciary coverage, commercial crime insurance, and general liability insurance. Counterpart serves small businesses and insurance brokers with its Agentic Insurance platform, which includes risk mitigation, claims management, and underwriting services. It was founded in 2019 and is based in Covina, California.

Coalition serves as a provider of active Insurance in the cybersecurity domain. It offers cyber insurance products, including coverage for ransomware and email compromise, as well as cybersecurity tools and services. It serves a diverse range of sectors by providing insurance and security solutions to manage digital risks. It was founded in 2017 and is based in San Francisco, California.

Embroker offers digital insurance brokerage specializing in business insurance solutions across various industries. The company offers a range of commercial insurance packages, including professional liability, cybersecurity, and directors and officers insurance, tailored to meet the specific needs of businesses. It primarily serves sectors such as startups, law firms, tech companies, and financial services. It was founded in 2015 and is based in San Francisco, California.

Eye Security offers cybersecurity solutions, including threat detection and mitigation across various sectors. The company provides managed extended detection and response (XDR), incident response, security awareness training, and cyber insurance to support business operations. It serves small to medium-sized enterprises in sectors such as logistics, manufacturing, professional services, and healthcare. The company was founded in 2020 and is based in The Hague, Netherlands.

Loading...