CoreWeave

Founded Year

2017Stage

IPO | IPOTotal Raised

$12.487BDate of IPO

3/28/2025Market Cap

81.60BStock Price

151.45Revenue

$0000About CoreWeave

CoreWeave specializes in graphics processing unit (GPU) cloud computing within the artificial intelligence sector. The company provides a cloud platform for AI workloads that includes GPU and CPU compute services, storage, and networking solutions for AI model training and inference. Its infrastructure focuses on scalability, reliability, and security, serving AI labs, platforms, and enterprises. CoreWeave was formerly known as Atlantic Crypto. It was founded in 2017 and is based in Livingston, New Jersey.

Loading...

ESPs containing CoreWeave

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The AI observability & evaluation market provides solutions that continuously monitor, test, and assess AI systems, offering real-time visibility into their behavior. AI performance can degrade when models encounter data different from training sets or operate in new contexts. These solutions identify issues by tracking prediction outliers, measuring accuracy, detecting bias, benchmarking performa…

CoreWeave named as Challenger among 15 other companies, including Databricks, IBM, and Arize.

Loading...

Research containing CoreWeave

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned CoreWeave in 9 CB Insights research briefs, most recently on Apr 3, 2025.

Apr 3, 2025 report

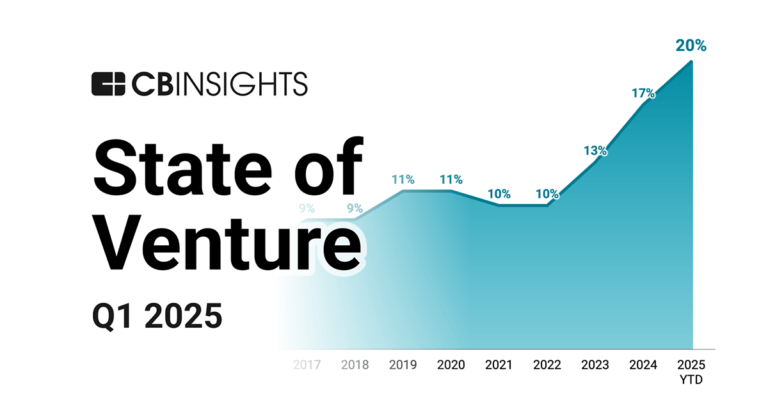

State of Venture Q1’25 Report

Oct 29, 2024 report

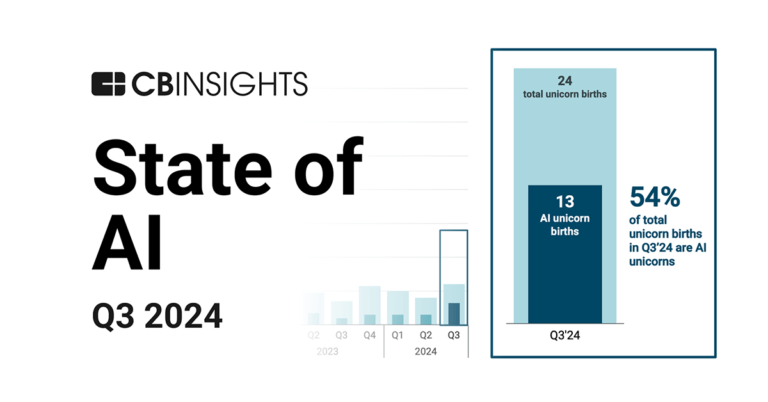

State of AI Q3’24 Report

Jul 30, 2024 report

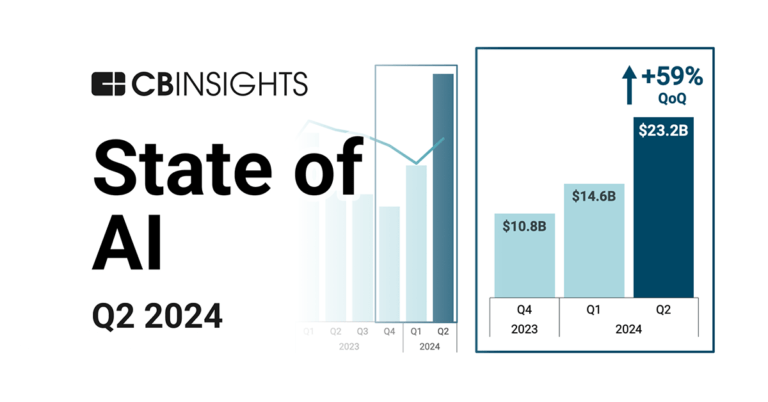

State of AI Q2’24 Report

Jul 3, 2024 report

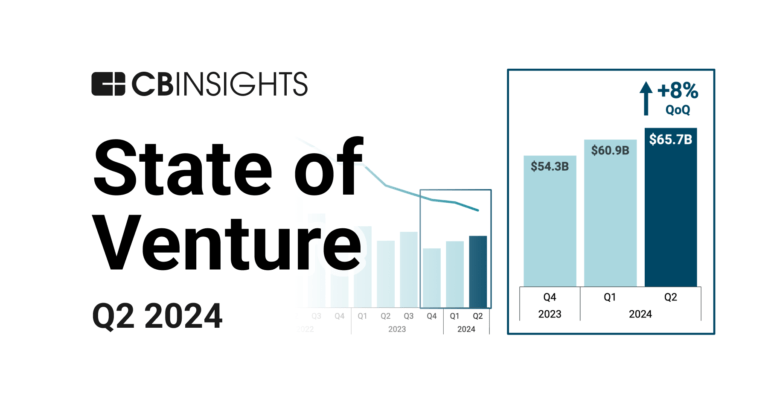

State of Venture Q2’24 Report

Jul 13, 2023 report

State of Venture Q2’23 ReportExpert Collections containing CoreWeave

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

CoreWeave is included in 2 Expert Collections, including Generative AI.

Generative AI

2,332 items

Companies working on generative AI applications and infrastructure.

Artificial Intelligence

10,050 items

Latest CoreWeave News

Jul 9, 2025

Check this box to indicate that a transaction was made pursuant to a contract, instruction or written plan that is intended to satisfy the affirmative defense conditions of Rule 10b5-1(c). See Instruction 10. UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940 OMB APPROVAL OMB Number: Estimated average burden hours per response... (Print or Type Responses) 1. Name and Address of Reporting Person Boone Karen 2. Issuer Name and Ticker or Trading Symbol CoreWeave, Inc. [CRWV] 5. Relationship of Reporting Person(s) to Issuer (Check all applicable) __X__ Director _____ 10% Owner _____ Officer (give title below) _____ Other (specify below) (Last) (First) (Middle) C/O COREWEAVE, INC., 290 WEST MT. PLEASANT AVENUE, SUITE 4100 3. Date of Earliest Transaction (Month/Day/Year) (Street) LIVINGSTON, NJ 07039 4. If Amendment, Date Original Filed (Month/Day/Year) 6. Individual or Joint/Group Filing (Check Applicable Line) _X_ Form filed by One Reporting Person ___ Form filed by More than One Reporting Person (City) (State) (Zip) Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned 1.Title of Security (Instr. 3) 2. Transaction Date (Month/Day/Year) 2A. Deemed Execution Date, if any (Month/Day/Year) 3. Transaction Code (Instr. 8) 4. Securities Acquired (A) or Disposed of (D) (Instr. 3, 4 and 5) 5. Amount of Securities Beneficially Owned Following Reported Transaction(s) (Instr. 3 and 4) 6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4) 7. Nature of Indirect Beneficial Ownership (Instr. 4) Code V Amount (A) or (D) Price Class A Common Stock M A D Class A Common Stock M A D Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly. Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. SEC 1474 (9-02) Table II - Derivative Securities Acquired, Disposed of, or Beneficially Owned e.g. , puts, calls, warrants, options, convertible securities) 1. Title of Derivative Security (Instr. 3) 2. Conversion or Exercise Price of Derivative Security 3. Transaction Date (Month/Day/Year) 3A. Deemed Execution Date, if any (Month/Day/Year) 4. Transaction Code (Instr. 8) 5. Number of Derivative Securities Acquired (A) or Disposed of (D) (Instr. 3, 4, and 5) 6. Date Exercisable and Expiration Date (Month/Day/Year) 7. Title and Amount of Underlying Securities (Instr. 3 and 4) 8. Price of Derivative Security (Instr. 5) 9. Number of Derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) 11. Nature of Indirect Beneficial Ownership (Instr. 4) Code V (A) (D) Date Exercisable Expiration Date Title Amount or Number of Shares Restricted Stock Units M Class A Common Stock D Restricted Stock Units M Class A Common Stock D Reporting Owners Reporting Owner Name / Address Relationships Director 10% Owner Officer Other Boone Karen C/O COREWEAVE, INC. 290 WEST MT. PLEASANT AVENUE, SUITE 4100 LIVINGSTON, NJ 07039 X Signatures /s/ Kristen McVeety, as Attorney-in-Fact Signature of Reporting Person Date Explanation of Responses: If the form is filed by more than one reporting person, see Instruction 4(b)(v). Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a). Each restricted stock unit represents a contingent right to receive one share of the Issuer's Class A Common Stock. The award vested or vests as to 1/12 of the total award on the sixth calendar day of April, July, October, and January, subject to the reporting person's continued service to the Issuer on each vesting date, with the first tranche vested on April 6, 2025. These restricted stock units do not expire; they either vest or are cancelled prior to the vesting date The award vested or vests as to 1/4 of the total award on the sixth calendar day of April, July, October, and January, subject to the reporting person's continued service to the Issuer on each vesting date, with the first tranche vested on April 6, 2025. Remarks: Due to an inadvertent error, it was previously reported on a Form 4 that Ms. Boone received 1,463 and 265 shares of Class A Common Stock on April 6, 2025 in respect of RSU vesting events, and thereupon directly owned 1,728 shares. It was subsequently determined that she vested on that date only as to 1,460 and 260 shares, for a total of 1,720. The totals reported in column 5 of Table I and column 9 of Table II of this Form 4 have been adjusted to reflect the reporting person's ownership after giving effect to that correction. Note: File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure. Potential persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB number. Attachments Original document Permalink Disclaimer CoreWeave Inc. published this content on July 08, 2025 , and is solely responsible for the information contained herein. Distributed via Public Technologies (PUBT) , unedited and unaltered, on July 09, 2025 at 01:33 UTC MoneyController also suggests

CoreWeave Frequently Asked Questions (FAQ)

When was CoreWeave founded?

CoreWeave was founded in 2017.

Where is CoreWeave's headquarters?

CoreWeave's headquarters is located at 290 West Mt Pleasant Avenue, Livingston.

What is CoreWeave's latest funding round?

CoreWeave's latest funding round is IPO.

How much did CoreWeave raise?

CoreWeave raised a total of $12.487B.

Who are the investors of CoreWeave?

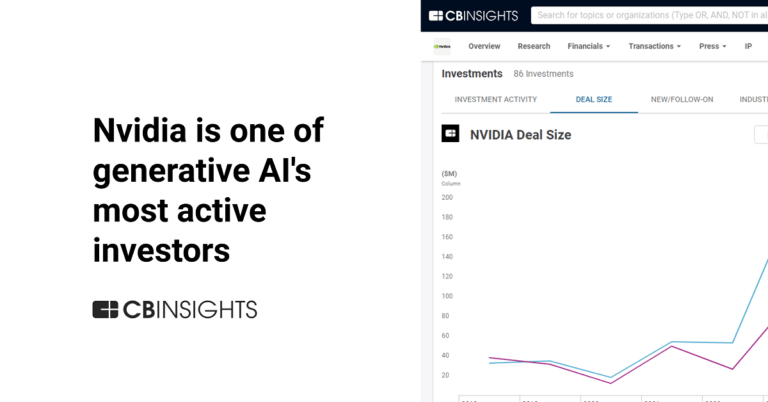

Investors of CoreWeave include OpenAI, Stack Capital, Magnetar Capital, Coatue, BlackRock and 40 more.

Who are CoreWeave's competitors?

Competitors of CoreWeave include Crusoe, United Compute, NexGen Cloud, Lambda, Enverge and 7 more.

Loading...

Compare CoreWeave to Competitors

RunPod engages as a cloud computing company that operates in the artificial intelligence (AI) and cloud computing sectors. The company has a platform for developing, training, and scaling AI models, including features like graphics processing unit (GPU) instances and application programming interface (API) endpoints for AI inference. RunPod serves clients such as startups, academic institutions, and enterprises requiring machine learning infrastructure. It was founded in 2022 and is based in Dover, Delaware.

Lambda provides graphics processing unit (GPU) compute for artificial intelligence within the cloud computing industry. The company offers GPU instances and clusters for AI training and inference, as well as GPU cloud infrastructure. Lambda also offers Kubernetes services, inference endpoints, and application programming interface, and NVIDIA GPU workstations and desktops for deep learning applications. Lambda was formerly known as Lambda Labs. It was founded in 2012 and is based in San Jose, California.

Aethir is a decentralized cloud computing infrastructure provider that offers access to GPUs for AI model training, fine-tuning, inference, and cloud gaming. The company primarily serves the artificial intelligence and gaming industries with its distributed cloud solutions. It was founded in 2021 and is based in Singapore, Singapore.

Foundry provides elastic graphics processing unit compute solutions for artificial intelligence (AI) developers across various sectors. It offers access to NVIDIA graphics processing unit (GPU) for AI training, fine-tuning, and inference. Its services cater to Artificial Intelligence (AI) engineers, researchers, and scientists. It was founded in 2022 and is based in Palo Alto, California.

Crusoe provides artificial intelligence (AI) cloud computing services in the tech industry. Its offerings include infrastructure for AI exploration, large-scale model training, and scalable AI inference. It's Crusoe Cloud is available for developers and enterprises looking for AI computing resources. It was founded in 2018 and is based in Denver, Colorado.

SQream focuses on GPU-accelerated data processing within the technology sector, with an emphasis on big data analytics and machine learning. The company provides tools for processing large datasets, including SQL on GPU for complex queries and machine learning model training. It serves sectors such as finance, telecommunications, manufacturing, advertising, retail, and healthcare. It was founded in 2010 and is based in New York, New York.

Loading...