Cohere

Founded Year

2019Stage

Series D - III | AliveTotal Raised

$1.437BValuation

$0000Last Raised

$500M | 2 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+212 points in the past 30 days

About Cohere

Cohere is an enterprise artificial intelligence (AI) company building foundation models and AI products across various sectors. The company offers a platform that provides multilingual models, retrieval systems, and agents to address business problems while ensuring data security and privacy. Cohere serves financial services, healthcare, manufacturing, energy, and the public sector. It was founded in 2019 and is based in Toronto, Canada.

Loading...

Cohere's Product Videos

ESPs containing Cohere

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The enterprise AI agents & copilots market consists of platforms that automate workflows and processes. These solutions can be customized to support various functions across a company, including IT, finance, operations, product, sales, marketing, and more. Many companies offer no-code platforms that allow users to build and train AI agents without coding knowledge. These solutions often integrate …

Cohere named as Leader among 15 other companies, including Salesforce, Zapier, and ClickUp.

Cohere's Products & Differentiators

Classify

Access massive language models that can understand text and take appropriate action — like highlight a post that violates your community guidelines, or trigger accurate chatbot responses. Classify uses cutting-edge machine learning to analyze and bucket text into specific categories. Build automated text classifiers into your application to do things like identify toxic language, automatically route customer queries, or detect breaking trends in product reviews.

Loading...

Research containing Cohere

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Cohere in 14 CB Insights research briefs, most recently on Mar 6, 2025.

Mar 6, 2025

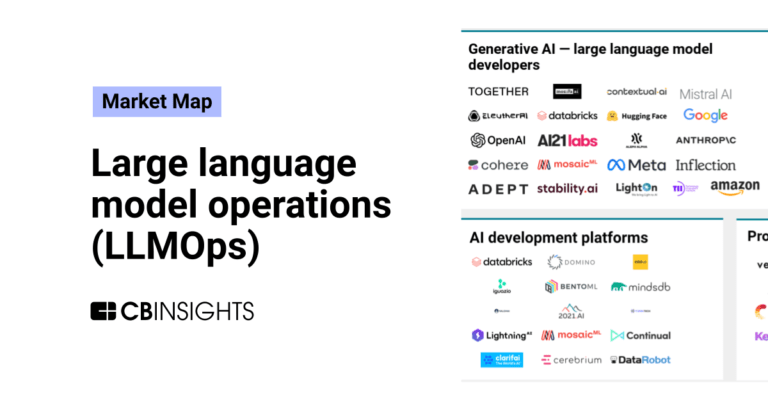

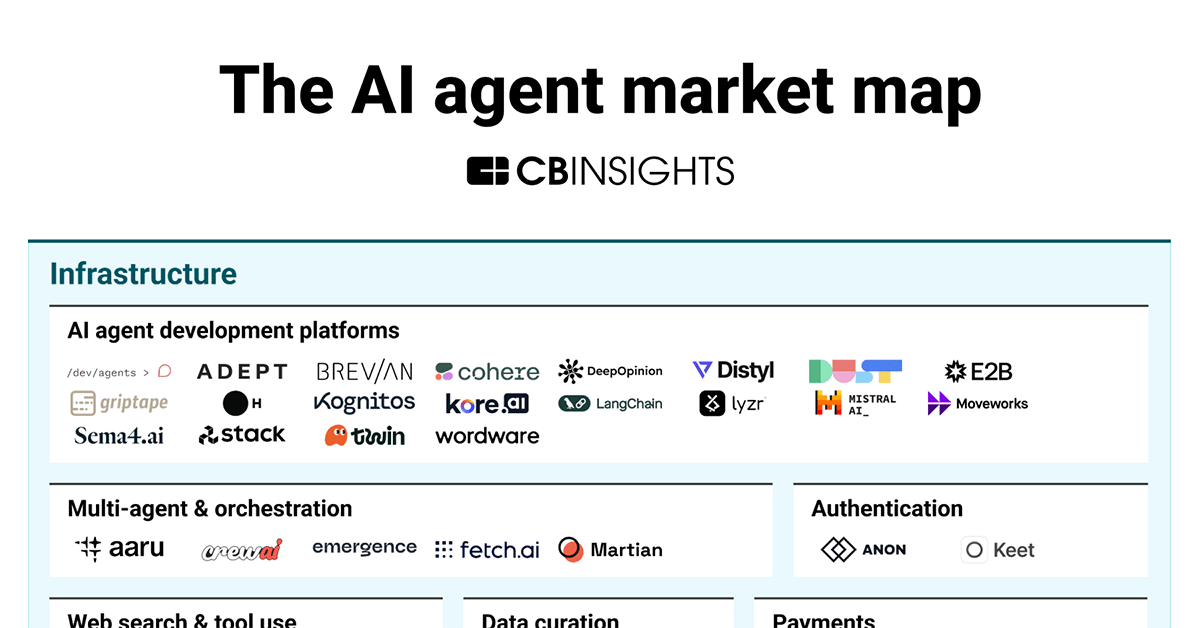

The AI agent market map

Feb 27, 2024

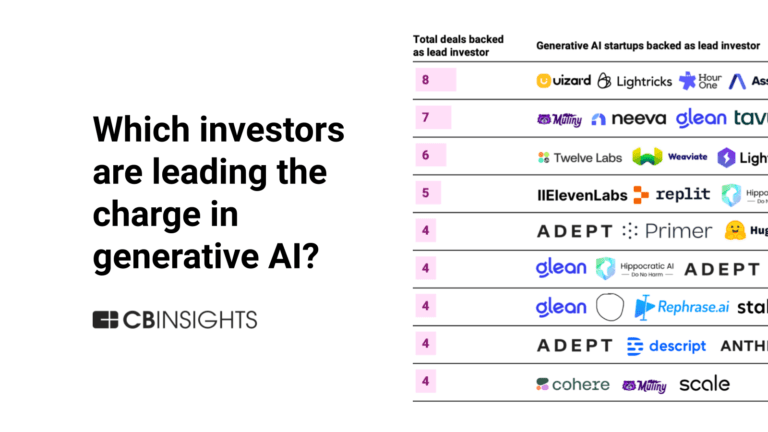

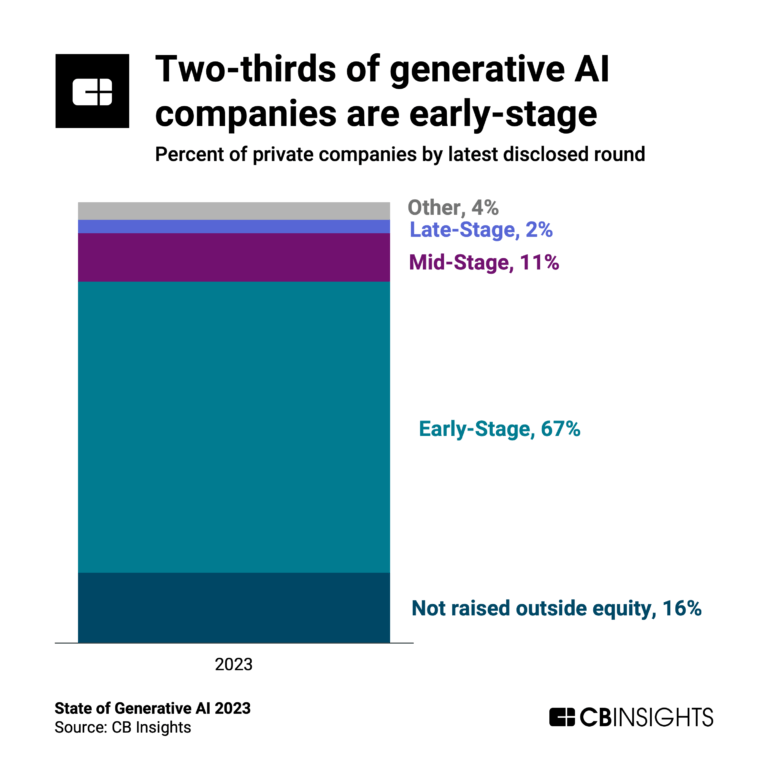

The generative AI boom in 6 charts

Aug 16, 2023 report

State of AI Q2’23 ReportExpert Collections containing Cohere

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Cohere is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Artificial Intelligence

12,322 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Digital Content & Synthetic Media

2,287 items

The Synthetic Media collection includes companies that use artificial intelligence to generate, edit, or enable digital content under all forms, including images, videos, audio, and text, among others.

AI 100 (All Winners 2018-2025)

200 items

Generative AI 50

50 items

CB Insights' list of the 50 most promising private generative AI companies across the globe.

Generative AI

2,314 items

Companies working on generative AI applications and infrastructure.

Cohere Patents

Cohere has filed 21 patents.

The 3 most popular patent topics include:

- wireless networking

- radio resource management

- channel access methods

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/2/2024 | 2/18/2025 | Wireless networking, Radio resource management, Information theory, Summary statistics, Channel access methods | Grant |

Application Date | 4/2/2024 |

|---|---|

Grant Date | 2/18/2025 |

Title | |

Related Topics | Wireless networking, Radio resource management, Information theory, Summary statistics, Channel access methods |

Status | Grant |

Latest Cohere News

Jul 7, 2025

估值3000亿美元的OpenAI,反而是“价值洼地”? 02 这两家公司不仅在构建支撑整个行业的核心AI模型、创造一个全新产业,还在效仿云巨头,利用其基础设施优势向应用领域扩张,建立起“根深蒂固的优势和护城河”。 03 当前,许多应用类初创公司(如Perplexity)的估值是基于其意图颠覆的行业规模,而非实际收入。 7月7日消息,The Information撰文称, 人工智能 领域,并无便宜可捡。最近,投资者向 OpenAI 前首席技术官米拉·穆拉蒂(Mira Murati)创办的AI 初创公司 Thinking Machines Lab投资了20亿美元,尽管这家公司成立才五个月,尚未推出任何产品,且收入几乎为零。 然而,如果仔细分析,价值依然可见。审视整个AI领域的估值、增长率和收入,便能在泡沫中分辨出合理的价值,并区分开那些有望成功的公司与那些可能难以满足投资者高企期望的企业。 其中的赢家,无疑是两家业内最知名的AI模型开发商——OpenAI与Anthropic。它们与众不同之处在于,二者都展现了惊人的增长速度。 根据The Information 2月的报道,Anthropic预计全年的收入将略低于40亿美元。而上周的最新消息显示,该公司已提前达成40亿美元的年化收入目标,其当前的增速几乎是年初的四倍。 OpenAI的情况也类似。根据4月末的报道,OpenAI预计今年的营收将达到120亿美元,而到6月初,该公司的年化收入已经突破100亿美元。 这两家公司都在构建支撑整个行业的核心AI模型,发展势头不可小觑。 作为对比,Altimeter投资人雅明·鲍尔(Jamin Ball)在其博客中分享的数据显示,包括Snowflake和ServiceNow在内的十大高估值上市软件公司,市销率的中位数也仅为15倍,而这十家公司未来一年的预期增长率中位数仅为11%。显然,OpenAI与Anthropic的增长速度远远超出了这些企业的平均水平。 在AI行业中,OpenAI与Anthropic的估值相对合理,尤其是与今年获得融资的应用类初创公司相比。例如,凭借AI搜索引擎实现快速增长的Perplexity,其融资估值对应的市销率高达116倍。同样,企业搜索公司Glean和为律师提供AI工具的Harvey,其估值也接近年化收入的70倍。 精品投行Aventis Advisors的董事菲利普·德拉兹多(Filip Drazdou)指出:“很多估值并非基于收入,而是基于这些公司所意图颠覆的行业规模和其中蕴含的机会。”他以Perplexity为例表示:“当Perplexity出现时,大家认为它会颠覆 谷歌 ,估值理应达到数十亿美元,所有投资者都想分一杯羹。现在看来,我感觉它的收入远未达到预期,因此估值过高。” Perplexity的增长确实令人瞩目:根据The Information 2024年3月的报道,该公司的年度经常性收入仅为1500万美元,而彭博社的数据则显示,到了今年,这一数字已飙升至1.2亿美元。然而,Perplexity的估值也迅速从去年4月的10亿美元跃升至最新融资时的140亿美元。Perplexity面临的一大问题是,它直接与ChatGPT以及另一个强大基础模型Gemini展开竞争。 作为AI领域最受欢迎的两家模型开发商,OpenAI与Anthropic不仅仅是在颠覆现有行业,它们本质上是在创造一个全新的产业。这意味着,它们与只在现有基础上构建应用的公司不同,理应拥有更高的溢价。 但与其他AI模型开发商相比,OpenAI与Anthropic的估值仍显得相对保守。例如,较小的竞争对手Cohere和Mistral AI去年融资时,估值都超过了年化收入的200倍。 公开交易基金SuRo Capital的投资人威利·李(Willy Lee)将OpenAI和Anthropic比作支付处理公司Stripe。他表示,在电子商务领域,Stripe创造了一个应用开发者可以依托的生态系统。“这是一种根深蒂固的优势和护城河。”SuRo Capital基金投资了包括OpenAI在内的多家高速增长的创投企业。 OpenAI和Anthropic的战略也在逐步向AI应用领域延伸,这与三大云计算公司(微软、谷歌、亚马逊)采用的策略相似:首先建立关键基础设施,形成分销网络,再利用这一网络向客户销售应用程序。例如,微软通过Azure云计算部门销售的商业智能应用Power BI,就与Snowflake和Databricks等公司形成了竞争关系。 SuRo Capital的李指出:“在大语言模型领域,谁能够深深嵌入到某些生态系统或应用中,谁就能占据巨大的优势。无论是Anthropic试图成为编程领域的专用模型,还是OpenAI想要成为‘万能模型’,他们的目标都指向这一点。” Anthropic收入激增的一个关键因素是其2月推出的编程助手工具Claude Code。OpenAI则预计,新产品和AI智能体将成为其收入的关键组成部分。目前,OpenAI的收入大多来源于ChatGPT。此外,OpenAI还在开发类似咨询服务的业务,这可能与Harvey等AI初-创公司形成直接竞争。 OpenAI的发展战略表明,AI智能体将是其未来的重要方向。这也意味着,像Sierra这样的AI客服智能体初创公司将面临来自OpenAI的直接威胁。Sierra去年秋季以45亿美元估值融资,根据路透社报道的数字计算,其当时的估值已超过其年化收入的200倍。 当然,在瞬息万变且充满不确定性的AI领域,没有任何事情是绝对的。OpenAI和Anthropic都在快速消耗现金,可能难以迅速实现盈利。而像DeepSeek等低成本竞争者,或是Meta Llama等开源替代品,都可能抢占市场份额,改变行业竞争格局。 另外,消费者和企业对AI技术价值的失望情绪,可能会拖慢整个行业的增长速度。但至少在目前看来,OpenAI和Anthropic仍是人工智能领域中最接近价值投资标的的初创公司。(小小) 本文来源:网易科技报道 责任编辑: 王凤枝_NT2541

Cohere Frequently Asked Questions (FAQ)

When was Cohere founded?

Cohere was founded in 2019.

Where is Cohere's headquarters?

Cohere's headquarters is located at 171 John Street, Toronto.

What is Cohere's latest funding round?

Cohere's latest funding round is Series D - III.

How much did Cohere raise?

Cohere raised a total of $1.437B.

Who are the investors of Cohere?

Investors of Cohere include Cisco, Fujitsu, AMD Ventures, Government of Canada, Salesforce Ventures and 35 more.

Who are Cohere's competitors?

Competitors of Cohere include Lyzr, OpenAI, Albert, CHAI AI, Dimension Labs and 7 more.

What products does Cohere offer?

Cohere's products include Classify and 2 more.

Loading...

Compare Cohere to Competitors

LlamaIndex specializes in building artificial intelligence knowledge assistants. The company provides a framework and cloud services for developing context-augmented AI agents, which can parse complex documents, configure retrieval-augmented generation (RAG) pipelines, and integrate with various data sources. Its solutions apply to sectors such as finance, manufacturing, and information technology by offering tools for deploying AI agents and managing knowledge. LlamaIndex was formerly known as GPT Index. It was founded in 2023 and is based in Mountain View, California.

LG AI Research conducts research in artificial intelligence within the technology sector. The company works on machine learning and the development of AI solutions that include language, vision, and multimodal processing, along with data and materials intelligence. It was founded in 2020 and is based in Seoul, South Korea.

AI21 Labs develops artificial intelligence systems and foundation models within the technology sector. The company offers generative AI solutions for enterprise workflows, including products like the engine for conversational AI and deployment options. It serves sectors that require AI integration, including financial technology, research, and business operations. It was founded in 2017 and is based in Tel-Aviv, Israel.

Anthropic operates a safety and research company focused on developing AI systems. The company's main offerings include Claude, an AI assistant for various tasks, and a suite of research initiatives aimed at AI safety and interpretability. It's research includes natural language processing, human feedback, reinforcement learning, and other areas. It was founded in 2021 and is based in San Francisco, California.

LangChain specializes in the development of large language model (LLM) applications and provides a suite of products that support developers throughout the application lifecycle. It offers a framework for building context-aware, reasoning applications, tools for debugging, testing, and monitoring application performance, and solutions for deploying application programming interfaces (APIs) with ease. It was founded in 2022 and is based in San Francisco, California.

Fireworks AI specializes in generative artificial intelligence platform services, focusing on inference and model fine-tuning within the artificial intelligence sector. The company offers an inference engine for building production-ready AI systems and provides a serverless deployment model for generative AI applications. It serves AI startups, digital-native companies, and Fortune 500 enterprises with its AI services. It was founded in 2022 and is based in Redwood City, California.

Loading...