Clari

Founded Year

2012Stage

Series F | AliveTotal Raised

$496MValuation

$0000Last Raised

$225M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-78 points in the past 30 days

About Clari

Clari focuses on improving efficiency, predictability, and growth in the revenue process, operating in the technology and business services sectors. The company offers a revenue platform that provides total visibility into businesses, driving process rigor, spotting risk and opportunity in the pipeline, increasing forecast accuracy, and enhancing overall efficiency. It primarily serves sales, marketing, and customer success teams across various industries. It was founded in 2012 and is based in Sunnyvale, California.

Loading...

Clari's Product Videos

ESPs containing Clari

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The conversation intelligence market offers solutions that analyze customer interactions across calls, emails, and other communication channels using AI and natural language processing (NLP) technologies. These platforms extract meaningful data from conversations to help businesses understand customer preferences, pain points, and sentiments. Key features include real-time transcription, sentiment…

Clari named as Outperformer among 15 other companies, including Salesforce, Zoom, and Gong.

Clari's Products & Differentiators

Clari Revenue Platform

The Clari Revenue Platform connects all revenue-critical employees, processes, and systems to drive revenue precision. At the core of Clari’s platform is the Clari Revenue Database (RevDB), the industry’s first AI-powered time-series database, purpose-built to optimize and amplify revenue processes. It automatically captures, stores, corrects, and analyzes revenue data across the growing ocean of fragmented revenue-critical applications - CRMs, Marketing Automation, Emails, Call Recordings, and Engagement Platforms to name a few. From the boardroom to the frontlines, teams have full visibility into their revenue for more accurate forecasting and a more trustworthy pipeline so they can answer the most important question in business: ‘Are we going to meet, beat, or miss on revenue?’

Loading...

Research containing Clari

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Clari in 4 CB Insights research briefs, most recently on May 2, 2023.

Expert Collections containing Clari

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Clari is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Tech IPO Pipeline

282 items

Track and capture company information and workflow.

AI 100 (All Winners 2018-2025)

100 items

Winners of CB Insights' 5th annual AI 100, a list of the 100 most promising private AI companies in the world.

Artificial Intelligence

10,047 items

Clari Patents

Clari has filed 41 patents.

The 3 most popular patent topics include:

- data management

- machine learning

- project management

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/22/2019 | 4/1/2025 | Machine learning, Natural language processing, Computer network security, Computer memory, Classification algorithms | Grant |

Application Date | 11/22/2019 |

|---|---|

Grant Date | 4/1/2025 |

Title | |

Related Topics | Machine learning, Natural language processing, Computer network security, Computer memory, Classification algorithms |

Status | Grant |

Latest Clari News

Jul 4, 2025

The choice is clear: embrace the mesh—or get outmaneuvered by those who already have A buyer moves swiftly from awareness to consideration to the final purchase in a traditional sales pipeline. But today, the movement of B2B buyers in a sales pipeline is everything but linear. They research independently, involve multiple stakeholders, skip steps, and circle back before deciding. Yet, many sales teams still rely on CRM pipelines and single-threaded forecast models built on outdated assumptions. Such behavior signals a transformation in the sales pipelines from linear to a revenue mesh, which is a dynamic, interconnected network of buyer-seller interactions. And the shift isn’t just a theory; it is practically happening with the help of modern salestech tools designed to manage complexity rather than oversimplify it. The flaw of current sales funnels Imagine selling large enterprise software where a deal engages with IT, Finance, Procurement, CPO, and even the Legal team. Today’s deal is not a linear progression but a multi-threaded web of relationships, conversations, and dependencies. Yet many CRMs still force deals into single pipelines and provide hard-and-fast forecast stages. The result? Blind spots in deal health, inaccurate forecasting, and lost opportunities to influence unseen stakeholders. Understanding the modern revenue mesh A revenue mesh is a mental model and increasingly, a technologic framework, that views enterprise opportunities as interconnected nodes between multiple buyers and sellers. With this concept, sales pipelines are no longer just stages, each node represents a critical micro-conversion point: a meeting with Finance, stakeholder advocacy from marketing, technical validation from IT, and so on. The modern revenue mesh reflects reality: deals aren’t linear, they are a series of concurrent, interwoven paths. To win big-ticket B2B deals, teams must understand, track, and influence across threads, not just within a staged pipeline. Greater Deal Visibility: Understanding the revenue mesh spot emerging roadblocks, such as lack of CMO buy-in, before they stall the process. Stronger Forecasting: Smarter Resource Allocation: Teams can deploy presales engineers or executives to precisely the right threads and not just a deal stage. Faster Deals: How salestech powers revenue meshes Modern salestech tools are being re-engineered to support this nonlinear revenue reality: Thread Insights: Platforms like Gong and Clari analyze email and meeting notes to surface which stakeholders are engaged or absent in real time. Artificial Intelligence: Tools such as Aviso can predict which thread or role has the power to move the deal by applying deal intelligence and pattern recognition. Account-Based Orchestration: 6sense, Demandbase, and Terminus enable teams to target content while tracking shifts and signals across account roles and buying motions. Cross-Thread Workflow Automation: Salestech solutions like Salesforce Revenue Intelligence can trigger playbooks when a new buying committee member enters or when procurement data lags. These tools turn a tangled deal into a visible, actionable revenue mesh helping your team understand every thread as a measurement and optimization point. Revenue mesh and its implications on sales leaders and RevOps From process re-design to team structure and reporting overhaul, the entry of revenue mesh will transform everything. Let us understand how: Process redesign: Team structure: A new team structure is needed to be set, for example an assigned individual as a thread owner – an executive sponsor for legal, a data expert for security, and so on. Playbook Evolution: Reporting Overhaul: Shift to thread-aware quota planning, weighted by thread progress rather than deal size alone. B2B sales is changing, and for good. While the straight-line funnel is dead, we have revenue meshes that makes closing the deal more interesting. Yes, it is challenging to understand every thread of the mesh but developing deep insight into every thread and conceptualizing sales tactics according to the prospect’s preferences will lead to less friction and more closed deals. The time has come when we accept that the revenue mesh mindset is not just a jargon, it is a shift in how revenue teams measure, forecast, and accelerate complex deals. It requires new tech, new playbooks, and new organizational alignment, but the payoff is high: Fewer blind spots More accurate and accelerated deal cycles. Let’s embrace the revenue meshes and improve our sales outcome.

Clari Frequently Asked Questions (FAQ)

When was Clari founded?

Clari was founded in 2012.

Where is Clari's headquarters?

Clari's headquarters is located at 1154 Sonora Court, Sunnyvale.

What is Clari's latest funding round?

Clari's latest funding round is Series F.

How much did Clari raise?

Clari raised a total of $496M.

Who are the investors of Clari?

Investors of Clari include Sequoia Capital, Bain Capital Ventures, Tenaya Capital, Northgate Capital, Sapphire Ventures and 12 more.

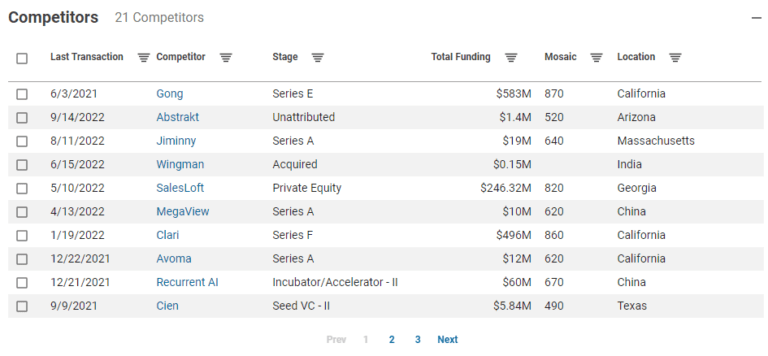

Who are Clari's competitors?

Competitors of Clari include Collective[i], SalesLoft, Pepsales, Clientell, SetSail and 7 more.

What products does Clari offer?

Clari's products include Clari Revenue Platform and 3 more.

Who are Clari's customers?

Customers of Clari include Okta and Fortinet.

Loading...

Compare Clari to Competitors

People.ai is a company that provides an AI data platform for go-to-market teams. The company offers products for sales activities such as account planning, deal inspection, content generation, account enablement, and forecasting, utilizing a data foundation and generative AI capabilities. People.ai serves sectors that require sales and revenue operations solutions, utilizing AI technology to enhance sales processes. It was founded in 2016 and is based in San Francisco, California.

Salesloft provides revenue growth and efficiency solutions within the sales technology sector. Its main offering is a Revenue Orchestration Platform that helps sales teams prioritize and act on buyer signals, manage pipelines, and forecast sales outcomes. The platform is used by revenue operations, sales leaders, and customer success teams, and includes tools for technology and workflow optimization, team productivity, and customer engagement. It was founded in 2011 and is based in Atlanta, Georgia.

Highspot provides a sales enablement platform. The platform includes managing sales content, executing sales plays and playbooks, engaging buyers, onboarding and training sales representatives, and providing sales coaching, supported by analytics and AI technology. Highspot serves sectors, including financial services, manufacturing, healthcare, life sciences, and technology. It was founded in 2012 and is based in Seattle, Washington.

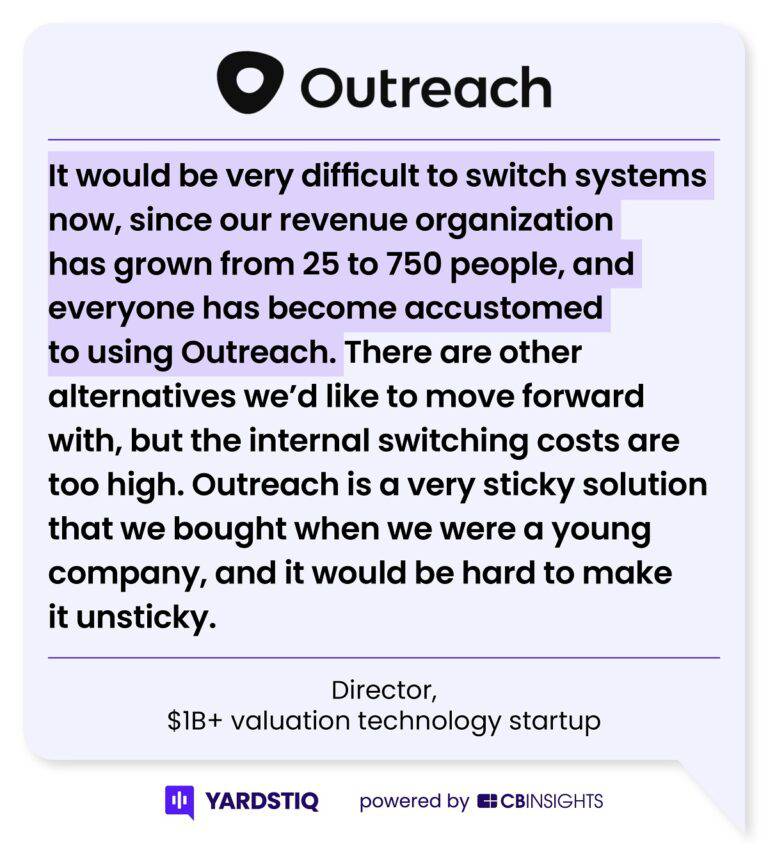

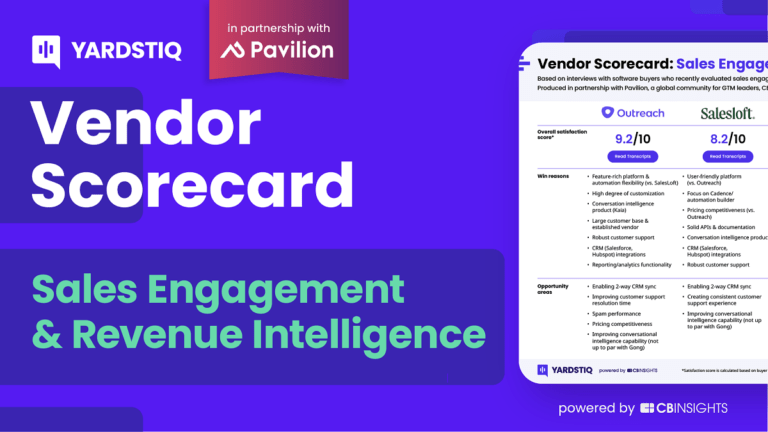

Outreach provides tools for prospecting, deal management, and sales forecasting, intended for use by revenue teams across various business sectors. The company serves sales, customer success, and revenue operations leaders across different industries. Outreach was formerly known as GroupTalent. It was founded in 2014 and is based in Seattle, Washington.

Aviso provides a revenue operating system that focuses on sales activities within the sales sector. It offers tools for sales forecasting, pipeline management, and deal guidance to assist go-to-market (GTM) teams in their sales processes. Aviso's platform is used by enterprise and high-growth companies to manage revenue operations. The company was founded in 2012 and is based in Redwood City, California.

Addvocate specializes in providing sales strategies through the integration of artificial intelligence (AI) and customer feedback within the sales technology sector. The company offers AI-driven tools that provide personalized sales insights and strategies. Addvocate's solutions are designed to cater to the needs of sales professionals seeking to optimize their sales cycles and strategies. It was founded in 2024 and is based in Paris, France.

Loading...