Circle

Founded Year

2013Stage

IPO | IPOTotal Raised

$1.199BDate of IPO

6/5/2025Market Cap

23.29BStock Price

177.97About Circle

Circle operates as a financial technology firm involved in the issuance and management of regulated stablecoins and a platform for digital currency transactions. The company provides services including stablecoin issuance (USDC and EURC), a tokenized money market fund (USYC), and developer services such as secure wallet integration, smart contract management, and cross-chain transfer solutions. Circle serves sectors that require digital currency payments, trading, and liquidity services. It was founded in 2013 and is based in New York, New York.

Loading...

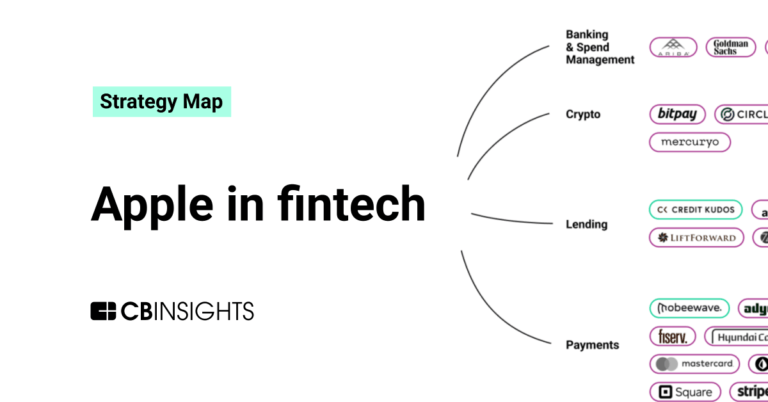

ESPs containing Circle

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The stablecoin settlement & payouts market refers to the use of stablecoins, which are cryptocurrencies designed to maintain a stable value, for settling transactions and making payouts. This market offers a fast and cost-effective way to move money across borders and provides access to financial services in emerging markets. Technology vendors in this market offer solutions for digital asset cust…

Circle named as Leader among 12 other companies, including Coinbase, Ripple, and BitGo.

Circle's Products & Differentiators

Circle Account

The Circle Account is a full stack solution that replaces a fractured system for business banking. Securely custody funds, send and receive payments globally and streamline treasury operations all connected through USD Coin (USDC) and integrated with a suite of APIs.

Loading...

Research containing Circle

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Circle in 14 CB Insights research briefs, most recently on May 29, 2025.

May 29, 2025

The stablecoin market map

May 23, 2025 report

Book of Scouting Reports: Stablecon 2025

Aug 23, 2024

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market map

Dec 14, 2023

Cross-border payments market map

Expert Collections containing Circle

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Circle is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Blockchain

13,713 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech 100

498 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

286 items

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Circle Patents

Circle has filed 70 patents.

The 3 most popular patent topics include:

- cryptocurrencies

- blockchains

- alternative currencies

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/25/2021 | 4/8/2025 | Parasites of fish, Monopisthocotylea, Geoplanidae, Animal equipment, Dog training and behavior | Grant |

Application Date | 10/25/2021 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Parasites of fish, Monopisthocotylea, Geoplanidae, Animal equipment, Dog training and behavior |

Status | Grant |

Latest Circle News

Jul 3, 2025

Ripple follows Circle on wanting bank charter Ripple’s decision to get a banking license came just two days after Circle, which issues the second-largest stablecoin USDC ( USDC ), applied to the OCC to create a national trust bank that would oversee its stablecoin reserves. The move by both firms comes as the US Senate passed a stablecoin regulating bill called the GENIUS Act , which lays out standards for offering the US dollar-pegged tokens, including that the OCC will oversee larger stablecoin issuers. Circle co-founder and CEO Jeremy Allaire said the company was taking “proactive steps” to “align with emerging US regulation for the issuance and operation of dollar-denominated payment stablecoins.” Anchorage Digital is the only crypto firm that holds a national bank charter. Ripple bids for Fed master account Ripple’s Garlinghouse added that the company also applied for a Master Account with the Federal Reserve, which would give it access to the US central banking system. “This access would allow us to hold $RLUSD reserves directly with the Fed and provide an additional layer of security to future proof trust in RLUSD,” Garlinghouse said. “Congress is working towards clear rules and regulations, and banks (in a far cry from the years of Operation Chokepoint 2.0) are leaning in,” he added, mentioning the conspiracy that the Biden administration sought to cut off crypto from the financial system. Ripple applied for the account through Standard Custody, a crypto custody firm it acquired in February 2024. XRP gains over 3% on Ripple’s bank charter application XRP ( XRP ), the token of the XRP Ledger blockchain that Ripple Labs uses for its products, has risen 3.2% over the past day to trade at $2.24, according to CoinGecko. The token began to climb late on Wednesday before hitting a 24-hour peak of $2.27 around the time of Garlinghouse’s post before slightly cooling from its rally.

Circle Frequently Asked Questions (FAQ)

When was Circle founded?

Circle was founded in 2013.

Where is Circle's headquarters?

Circle's headquarters is located at 1 World Trade Center, New York.

What is Circle's latest funding round?

Circle's latest funding round is IPO.

How much did Circle raise?

Circle raised a total of $1.199B.

Who are the investors of Circle?

Investors of Circle include Coinbase, Fidelity Investments, Marshall Wace Asset Management, BlackRock, Fin Capital and 42 more.

Who are Circle's competitors?

Competitors of Circle include Zepz, Revolut, Binance, BitGo, Bitstamp and 7 more.

What products does Circle offer?

Circle's products include Circle Account and 3 more.

Who are Circle's customers?

Customers of Circle include FTX and CMS.

Loading...

Compare Circle to Competitors

BurjX provides cryptocurrency trading exchange and broker-dealer solutions. It develops a platform for trading digital assets, managing digital asset wallets, and facilitating financial transactions. It was founded in 2022 and is based in New York, New York.

CoinDCX is a cryptocurrency investment platform that operates in the financial technology sector. The company offers a crypto exchange with a focus on user experience and security, providing access to a variety of crypto-based financial products and services. CoinDCX caters to the needs of the Indian crypto community by offering solutions for crypto investing, trading, and literacy. It was founded in 2018 and is based in Mumbai, India.

Kraken focuses on digital currency exchange. The company provides a platform for trading various digital currencies, including bitcoin, offering a secure and efficient service for its users. Kraken primarily serves the financial technology industry. It was founded in 2011 and is based in San Francisco, California.

Crypto.com is a cryptocurrency trading platform and financial services provider in the fintech sector. The company provides services for buying, selling, and trading Bitcoin, Ethereum, and over 350 other cryptocurrencies, as well as decentralized finance services like staking and various crypto financial products. Crypto.com serves individuals and businesses involved in cryptocurrency transactions and investments. Crypto.com was formerly known as Monaco. It was founded in 2016 and is based in Singapore.

CoinZoom is a fintech company that provides a cryptocurrency debit card enabling users to spend their crypto and cash, buy, sell, and trade cryptocurrencies. The company serves individuals interested in incorporating cryptocurrency into their financial transactions. It was founded in 2018 and is based in Salt Lake City, Utah.

Metallicus works as a company building a digital asset banking network using blockchain technology. Its offerings include digital asset banking services, a stablecoin index treasury called Metal Dollar and a proprietary blockchain named Proton that allows for payment solutions. Metallicus serves individual users, corporations, and banks seeking integration with digital assets and blockchain. It was founded in 2016 and is based in San Francisco, California.

Loading...