Chainalysis

Founded Year

2014Stage

Unattributed VC | AliveTotal Raised

$536.72MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+20 points in the past 30 days

About Chainalysis

Chainalysis is a blockchain data platform that offers blockchain intelligence to assist in detecting crypto crime, ensuring regulatory compliance, and supporting financial institutions. The company serves law enforcement agencies, regulators, and centralized exchanges. It was founded in 2014 and is based in New York, New York.

Loading...

Chainalysis's Product Videos

ESPs containing Chainalysis

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The anti-money laundering (AML) software market helps detect, prevent, and mitigate the risks associated with money laundering and financial crimes. Solutions in this market analyze large volumes of data and identify suspicious activity for further investigation. This allows financial institutions and other regulated entities to monitor transactions, screen customers and counterparties, and conduc…

Chainalysis named as Outperformer among 15 other companies, including Microsoft, Oracle, and BAE Systems.

Chainalysis's Products & Differentiators

Chainalysis KYT

Chainalysis KYT (Know Your Transaction) combines industry-leading blockchain intelligence, an easy-to-use interface, and a real-time API. It helps organizations reduce manual workflows, stay compliant with local and global regulations, and safely interact with emerging technologies such as DeFi.

Loading...

Research containing Chainalysis

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Chainalysis in 7 CB Insights research briefs, most recently on May 29, 2025.

Expert Collections containing Chainalysis

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Chainalysis is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Regtech

1,921 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Blockchain

9,347 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Chainalysis Patents

Chainalysis has filed 12 patents.

The 3 most popular patent topics include:

- graphical control elements

- graphical user interface elements

- graphical user interface testing

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/11/2023 | 10/22/2024 | Grant |

Application Date | 1/11/2023 |

|---|---|

Grant Date | 10/22/2024 |

Title | |

Related Topics | |

Status | Grant |

Latest Chainalysis News

Jul 9, 2025

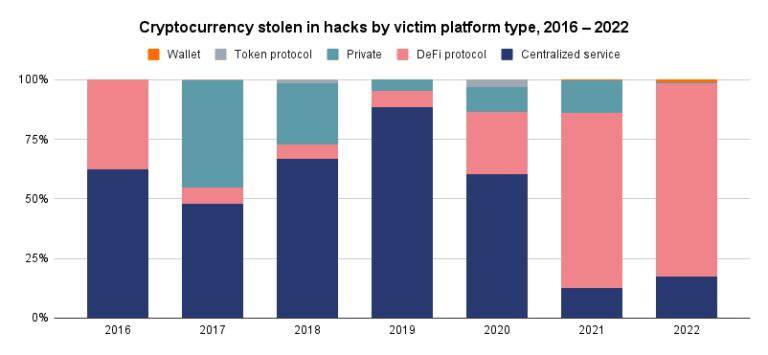

Treasury Department serves as a stark reminder of this reality, highlighting the persistent threat posed by state-sponsored cyber criminals. This time, the focus is squarely on North Korea and its audacious attempts to fund its illicit programs through digital means. US Sanctions North Korea: A Direct Response to Digital Threats In a significant move to counter global cybercrime and illicit finance, the U.S. Treasury has taken decisive action, imposing US sanctions North Korea . Specifically, the sanctions target North Korean national Song Kum Hyok. His alleged role? Orchestrating the placement of DPRK (Democratic People's Republic of Korea) IT workers into unsuspecting foreign companies. But these weren't just any IT workers; they were reportedly covert operatives, leveraging their positions for cyber espionage and, crucially, for massive cryptocurrency thefts. This action underscores the U.S. government's commitment to disrupting North Korea's ability to generate revenue through illegal cyber activities, which directly funds its weapons of mass destruction (WMD) and ballistic missile programs. The Treasury's statement made it clear: Song Kum Hyok facilitated the deployment of these workers, who then exploited their access to company networks. This isn't just about financial theft; it's about national security. The funds generated are then funneled back to the regime, fueling its dangerous ambitions. This sanction serves as a warning to companies worldwide to enhance their due diligence, especially when hiring remote IT personnel, as the threat of infiltration is real and carries severe consequences. Unmasking North Korean IT Workers and Their Global Reach How do these North Korean IT workers operate, and why are they so effective? It's a sophisticated scheme. These individuals often present themselves as freelance developers or employees of legitimate-looking front companies. They leverage their technical skills to gain employment in various sectors, from IT services to software development and even finance. Once embedded, they can engage in a range of malicious activities: Intellectual Property Theft: Stealing sensitive company data, designs, or proprietary software. Network Exploitation: Gaining unauthorized access to internal systems for future attacks or data exfiltration. Financial Fraud: Directly participating in or facilitating cryptocurrency thefts and other financial crimes. These workers are often highly skilled and operate under strict instructions from the DPRK government. Their primary goal is to generate hard currency, bypassing international sanctions that restrict North Korea's access to traditional financial systems. The anonymity and speed offered by cryptocurrency make it an attractive target for these state-sponsored operatives, allowing them to move large sums of money across borders with relative ease. The Alarming Rise of Crypto Cyber Activity by DPRK: What's the Impact? The DPRK's reliance on crypto cyber activity has surged in recent years, becoming a cornerstone of its illicit fundraising strategy. These activities range from direct hacks of cryptocurrency exchanges and decentralized finance (DeFi) protocols to sophisticated phishing campaigns targeting individual crypto holders. The sheer scale of these operations is staggering, with estimates suggesting billions of dollars stolen over the past few years. But what does this mean for the average crypto user or investor? The impact is multifaceted: Erosion of Trust: High-profile hacks undermine confidence in the security of the crypto ecosystem. Financial Losses: Individuals and companies suffer direct financial losses from stolen assets. Regulatory Scrutiny: Increased illicit activity leads to greater regulatory oversight, potentially impacting innovation and accessibility. Reputational Damage: Projects and platforms that are successfully attacked face significant reputational harm. It's a constant cat-and-mouse game between cybersecurity experts, law enforcement, and these persistent threat actors. Every successful theft not only enriches the regime but also provides valuable intelligence and techniques for future attacks. The Shadowy Operations of the Lazarus Group: Who Are They? When discussing North Korea's cyber capabilities, it's impossible to ignore the notorious Lazarus Group . This state-sponsored hacking collective is widely recognized as one of the most prolific and dangerous cyber threat actors globally. Active since at least 2009, the Lazarus Group has been implicated in a string of high-profile cyberattacks, including the 2014 Sony Pictures hack, the 2017 WannaCry ransomware attack, and numerous cryptocurrency heists. Their methods are diverse, employing everything from sophisticated social engineering to zero-day exploits. Their connection to the North Korean government is well-documented by intelligence agencies worldwide. They serve as a vital arm of the regime, tasked with generating funds and conducting espionage. In the crypto space, their exploits are particularly infamous: Ronin Bridge Hack (2022): One of the largest crypto heists in history, with over $600 million stolen from Axie Infinity's Ronin Network. Harmony Horizon Bridge Hack (2022): Another significant breach, resulting in over $100 million in stolen crypto. Numerous Exchange Hacks: Throughout the years, many centralized exchanges have fallen victim to Lazarus Group's sophisticated attacks. Their operations are characterized by meticulous planning, advanced technical skills, and a relentless pursuit of financial gain for their benefactors. Understanding their tactics is crucial for anyone involved in the digital asset space. Tracing and Combatting Illicit Crypto Funds: A Global Challenge Once stolen, these illicit crypto funds don't just disappear. They enter a complex web of laundering techniques designed to obscure their origins and make them usable by the North Korean regime. This is where the global fight against financial crime truly comes into play. Tracing these funds requires sophisticated blockchain analytics tools and international cooperation. Common laundering methods include: Mixers/Tumblers: Services that pool and mix cryptocurrencies from various sources to obscure transaction trails. Chain Hopping: Converting one cryptocurrency to another multiple times across different blockchains. Decentralized Exchanges (DEXs) and Cross-Chain Bridges: Leveraging these platforms to move funds rapidly and anonymously. Shell Companies and Sanctioned Entities: Using front companies or sanctioned individuals to facilitate transfers through traditional financial systems once crypto is converted to fiat. The challenge lies in the decentralized nature of blockchain and the speed at which transactions occur. However, significant progress is being made. Blockchain analytics firms like Chainalysis and Elliptic work closely with law enforcement agencies to trace these funds, often identifying patterns and ultimately leading to seizures or arrests. International bodies like the Financial Action Task Force (FATF) also play a critical role in setting global standards for anti-money laundering (AML) and countering the financing of terrorism (CFT) in the crypto space. What Can You Do? Actionable Insights for Security While governments and law enforcement work to combat these large-scale threats, individual crypto users and businesses also have a role to play. Here are some actionable insights: Strong Security Practices: Always use strong, unique passwords and enable two-factor authentication (2FA) on all your crypto accounts and email. Be Wary of Phishing: Double-check URLs, email senders, and never click on suspicious links. Scammers often impersonate legitimate entities. Hardware Wallets: For significant holdings, consider using a hardware wallet, which keeps your private keys offline. Software Updates: Keep all your software, operating systems, and antivirus programs updated to patch known vulnerabilities. Due Diligence for Hiring: Companies, especially those in tech, must implement robust background checks and verification processes for remote hires to prevent infiltration by malicious actors like the North Korean IT workers. Stay Informed: Keep abreast of the latest cybersecurity threats and best practices in the crypto space. A Resilient Stand Against Digital Malice The U.S. Treasury's sanction against Song Kum Hyok is more than just a punitive measure; it's a clear signal that the international community is intensifying its efforts to dismantle North Korea's illicit financial networks. The convergence of state-sponsored cyber warfare and cryptocurrency presents a formidable challenge, but one that is being met with increasing sophistication and collaboration. As the digital landscape continues to evolve, so too must our defenses. Vigilance, strong security protocols, and global cooperation are our strongest weapons in ensuring the integrity of the crypto ecosystem and preventing it from being exploited by those who seek to sow chaos and fund dangerous agendas. To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin's price action and institutional adoption. Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions. Source: https://bitcoinworld.co.in/us-sanctions-north-korea-crypto/

Chainalysis Frequently Asked Questions (FAQ)

When was Chainalysis founded?

Chainalysis was founded in 2014.

Where is Chainalysis's headquarters?

Chainalysis's headquarters is located at 114 5th Avenue, New York.

What is Chainalysis's latest funding round?

Chainalysis's latest funding round is Unattributed VC.

How much did Chainalysis raise?

Chainalysis raised a total of $536.72M.

Who are the investors of Chainalysis?

Investors of Chainalysis include Haun Ventures, Plug and Play Crypto & Digital Assets, Accel, FundersClub, Dragoneer Investment Group and 31 more.

Who are Chainalysis's competitors?

Competitors of Chainalysis include AnChain.AI, Elliptic, Allium, Gray Wolf, Four Pillars and 7 more.

What products does Chainalysis offer?

Chainalysis's products include Chainalysis KYT and 4 more.

Loading...

Compare Chainalysis to Competitors

Elliptic provides blockchain analytics and crypto compliance solutions in the financial crime risk management and regulatory compliance sectors. The company offers products including crypto transaction monitoring, wallet screening, and investigations to support compliance with anti-money laundering (AML) regulations and address financial crime. Elliptic's services are utilized by financial institutions, centralized exchanges, law enforcement agencies, and regulators. Elliptic was formerly known as Bitxchange. It was founded in 2013 and is based in London, United Kingdom.

TRM Labs detects and investigates crypto-related financial crime and fraud within the financial sector. The company provides services such as forensics, tactical investigations, compliance solutions like transaction monitoring and wallet screening, and incident response. TRM Labs serves government agencies, financial institutions, and crypto businesses, equipping them with tools to address crypto-facilitated crime and ensure regulatory compliance. It was founded in 2018 and is based in San Francisco, California.

Merkle Science is a predictive cryptocurrency risk and intelligence platform that operates in the financial technology sector. The company provides tools for detecting, investigating, and preventing illegal activities involving cryptocurrencies, with services that include transaction monitoring, compliance training, and forensic analysis. Its offerings cater to crypto businesses, DeFi participants, financial institutions, government agencies, and insurers. It was founded in 2018 and is based in Manhattan, New York.

Glassnode is a blockchain data and intelligence platform that provides on-chain market insights for the digital assets sector. The company offers analytics tools that allow users to analyze blockchain data, market trends, and financial metrics to support trading and investment decisions. Glassnode serves the digital asset market, including traders, investors, researchers, and content creators. It was founded in 2017 and is based in Baar, Switzerland.

Solidus Labs focuses on security and compliance within the digital asset lifecycle, operating in the financial technology sector. The company offers solutions including trade surveillance to monitor market activities, transaction monitoring to identify suspicious behavior, and staking guard services for Ethereum validators. Solidus Labs serves the cryptocurrency market, providing tools for market integrity and regulatory compliance. It was founded in 2018 and is based in New York, New York.

Messari is a cryptocurrency research startup that provides data services and market intelligence in the blockchain and cryptocurrency sectors. The company offers data ingestion and analysis services to support token projects, exchanges, and information service providers. Messari's market intelligence services are designed to monitor cryptocurrency circulation and provide insights into the crypto economy. It was founded in 2017 and is based in New York, New York.

Loading...