Human Interest

Founded Year

2015Stage

Debt | AliveTotal Raised

$755.72MValuation

$0000Last Raised

$25M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+26 points in the past 30 days

About Human Interest

Human Interest provides 401(k) and 403(b) plans for the retirement savings industry, catering to small and medium-sized businesses. The company offers retirement savings plans without transaction fees, allowing businesses to help their employees invest for retirement. Human Interest provides technology solutions to manage the administrative and compliance aspects of retirement plans for its clients. Human Interest was formerly known as Captain401. It was founded in 2015 and is based in San Francisco, California.

Loading...

Human Interest's Product Videos

_Retirement_Plans_for_Nonprofits_thumbnail.png?w=3840)

Human Interest's Products & Differentiators

401(k)

Human Interest 401(k) is a full-service solution for businesses that want all the benefits of a modern 401(k) plan without the burdensome administrative responsibility.

Loading...

Research containing Human Interest

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Human Interest in 3 CB Insights research briefs, most recently on Oct 15, 2024.

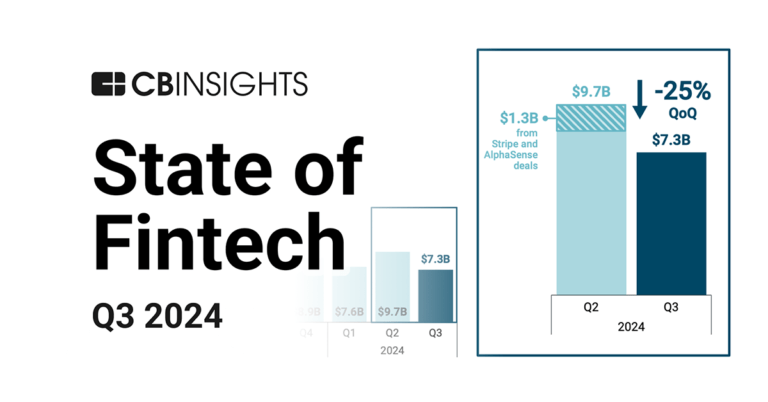

Oct 15, 2024 report

State of Fintech Q3’24 ReportExpert Collections containing Human Interest

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Human Interest is included in 7 Expert Collections, including HR Tech.

HR Tech

5,910 items

The HR tech collection includes software vendors that enable companies to develop, hire, manage, and pay their workforces. Focus areas include benefits, compensation, engagement, EORs & PEOs, HRIS & HRMS, learning & development, payroll, talent acquisition, and talent management.

Unicorns- Billion Dollar Startups

1,276 items

Wealth Tech

2,658 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

SMB Fintech

2,003 items

Fintech 100

750 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Financial Wellness

245 items

Track startups and capture company information and workflow.

Latest Human Interest News

Jul 7, 2025

News provided by Share this article Share toX MISSION, Kan., July 7, 2025 /PRNewswire/ -- (Family Features) A comfortable retirement is something most people aspire to, and there are many paths to plan for that phase of life. While many employers offer retirement savings plans as a workplace benefit, small business owners, whose time and resources are already at a premium, often face barriers – including hours of administrative work, additional costs and compliance liabilities – when setting up these plans for their employees. Photo courtesy of Shutterstock Today, many small business owners understand the power of offering a retirement plan, such as a 401(k), to attract and retain top talent and provide additional financial security for their employees. In fact, a retirement plan is the benefit most wanted by workers after health insurance, according to a survey commissioned by 401(k) provider Human Interest . Many states have passed or enacted laws requiring most employers to offer retirement plans for employees. Currently, 20 states have passed legislation for state-mandated retirement programs and 13 states have active programs. Legislation is currently being considered in an additional 28 states. Employers can opt out of state-mandated retirement programs by offering a 401(k) plan, simplifying compliance for business owners. Federal regulations, such as SECURE 2.0 , introduced incentives and requirements for business owners who offer 401(k)s, which make it easier for employees to save and access their funds. If you're a small business owner setting up a retirement plan, these considerations can simplify the process while helping employees save for retirement. Add Auto-Enroll to Your 401(k) Plan Many people intend to save for retirement, but don't take the necessary steps to enroll in a plan. Plans that include an automatic enrollment feature help overcome this inertia by automatically collecting deferrals from employees' compensation each pay period unless they opt out of participation. SECURE 2.0 mandates auto-enroll for most 401(k) plans established after Dec. 29, 2022. If your plan is not subject to the requirement, consider adding it voluntarily. Ultimately, auto-enroll can help contribute to a more financially secure workforce by encouraging consistent savings habits. Take Advantage of Match Contributions Programs While the primary benefit of a 401(k) plan is to help employees save for retirement, offering an employer match encourages employees to participate, as employees may consider the match "free" money. In addition, employers can take a tax deduction for their matching contributions, up to 25% of the total compensation paid to eligible employees for the year. SECURE 2.0 also introduced a tax credit for matching contributions for small employers with new plans. Employers should be aware the tax credit is an alternative to the deduction; the employer can't claim both in the same year. Pick a Platform Designed for Small Businesses The administrative burden of setting up retirement plans can be overwhelming for some business owners. Choosing a tech-enabled 401(k) platform like Human Interest – which offers a fast online setup in a few clicks; transparent pricing; and attentive, human support – can help employers navigate the shifting landscape of state-specific regulations and mandates. When choosing a provider, also consider the upfront fees you'll pay (both as an employer and for the employees participating in the plan ), if the platform integrates with your payroll provider , customer service response times and how the 401(k) provider can help answer questions about compliance from regulatory bodies to set your employees up for long-term success. Find additional information to help provide a more secure financial future for your employees at humaninterest.com . Michael French

Human Interest Frequently Asked Questions (FAQ)

When was Human Interest founded?

Human Interest was founded in 2015.

Where is Human Interest's headquarters?

Human Interest's headquarters is located at 655 Montgomery Street, San Francisco.

What is Human Interest's latest funding round?

Human Interest's latest funding round is Debt.

How much did Human Interest raise?

Human Interest raised a total of $755.72M.

Who are the investors of Human Interest?

Investors of Human Interest include Baillie Gifford, Marshall Wace Asset Management, U.S. Venture Partners, Battery Ventures, ACT Venture Capital and 41 more.

Who are Human Interest's competitors?

Competitors of Human Interest include Icon Savings Plan, Folio, Vestwell, Raisin, Blooom and 7 more.

What products does Human Interest offer?

Human Interest's products include 401(k) and 3 more.

Loading...

Compare Human Interest to Competitors

Wacai operates as a fintech company. It develops an online personal financial management platform that provides users with wealth management services and credit solutions. The company was founded in 2009 and is based in Hangzhou, China.

Betterment operates as a digital investment advisor that focuses on automated investing and savings services within the financial technology sector. The company offers a range of products, including automated portfolio management and tax-advantaged retirement accounts that aid personal finance management for individuals. Betterment provides diversified investment portfolios, tax loss harvesting, and financial planning tools to help clients achieve their financial goals. It was founded in 2008 and is based in New York, New York.

ForUsAll offers a platform that enables employers to provide a modern 401(k) plan. The company offers 401(k) plans for startups and small businesses, with features such as payroll integration, the ability to add cryptocurrency to the plan, and automated administration. It caters to the startup sector, small to medium-sized businesses, and blockchain and web3 companies. The company was founded in 2012 and is based in San Francisco, California.

SigFig focuses on digital wealth management solutions within the financial services industry. The company offers a suite of products that facilitate effortless and compliant account opening, client onboarding, investment management, and financial planning for various financial institutions. SigFig's solutions cater to banks, credit unions, wealth management firms, insurance companies, and individual investors. It was founded in 2006 and is based in San Francisco, California.

Raisin operates in the financial technology sector, connecting consumers with banks for savings and investment products. It provides interest rates for savings and investments and offers banks refinancing options. It serves the financial services industry, facilitating a marketplace for savings and investment products. It was founded in 2012 and is based in Berlin, Germany.

Wealthsimple is a financial services company that provides various investing products. The company offers services including managed investing, trading, and savings accounts, aimed at individual investors who want to grow their personal wealth through different investment options. It was founded in 2014 and is based in Toronto, Canada.

Loading...