Bunq

Founded Year

2012Stage

Series B - III | AliveTotal Raised

$368.05MLast Raised

$31.41M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-23 points in the past 30 days

About Bunq

Bunq focuses on providing financial services. The company offers a range of banking products, including savings accounts, full bank accounts, and multi-currency banking, all accessible through a mobile application. Bunq primarily serves individual consumers and businesses looking for modern, hassle-free banking solutions. It was founded in 2012 and is based in Amsterdam, Netherlands.

Loading...

Bunq's Product Videos

Bunq's Products & Differentiators

bunq account in 5 minutes

Bank account that's ready to use in 5 minutes

Loading...

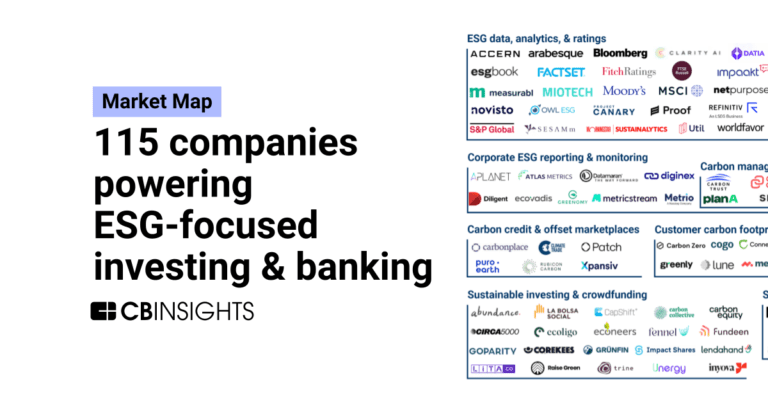

Research containing Bunq

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Bunq in 1 CB Insights research brief, most recently on May 24, 2023.

Expert Collections containing Bunq

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Bunq is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,277 items

Fintech

13,966 items

Excludes US-based companies

Digital Banking

1,150 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Fintech 100

100 items

Bunq Patents

Bunq has filed 3 patents.

The 3 most popular patent topics include:

- banking

- banking technology

- international taxation

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/18/2017 | 11/6/2018 | Windows Server System, Wireless networking, Cryptographic protocols, Network protocols, Remote desktop | Grant |

Application Date | 5/18/2017 |

|---|---|

Grant Date | 11/6/2018 |

Title | |

Related Topics | Windows Server System, Wireless networking, Cryptographic protocols, Network protocols, Remote desktop |

Status | Grant |

Latest Bunq News

Jun 21, 2025

Eduardo Álvarez | Freepik / bunq Si tienes dinero ahorrado, el contexto actual es bastante claro: los precios suben sin parar y toca sacarle rentabilidad a tus ahorros, una forma de amortiguar el impacto de la inflación. Eso hace que la carrera por encontrar el mejor depósito a plazo fijo o cuenta remunerada sea frenética. No obstante, son pocos los bancos o entidades que dan buena rentabilidad, y es que el Banco Central Europeo (BCE) no para de bajar los tipos de interés. Sí que hay varios neobancos que resisten por encima del 2% TAE anual, y uno de ellos es relativamente nuevo, bunq . Este banco online holandés opera ya en España, con IBAN de nuestro país y sin condición alguna, así que lo tiene todo para captar capital entre los ahorradores que prefieran la flexibilidad de una cuenta muy bien remunerada. Por encima del 2% se puede decir que es una buena opción, y en este caso se mantiene bastante por encima, aunque como todas las entidades, puede ir ajustando a la baja cuando lo considere. Un 2,26% y pagos semanales La cuenta de ahorros de bunq es indudablemente de las opciones más atractivas ahora mismo, sobre todo en el contexto de tipos actual. Para quienes buscan flexibilidad, rentabilidad y una gestión completamente online, bunq es un banco 100% digital y europeo. Una de sus ventajas es la sencillez: cualquier persona mayor de 18 años que resida en en la Unión Europea y pueda demostrarlo, puede abrir una cuenta en tan solo unos minutos desde su móvil, completando el registro y aportando la documentación necesaria. No se requiere domiciliar nómina, ni recibos, ni contratar productos adicionales o asumir compromisos de permanencia. La cuenta de ahorros de este neobanco destaca por ofrecer una remuneración competitiva desde el principio, incluso ahora que los tipos van bajando, y eso la convierte en una opción interesante frente a otras cuentas del mercado. Actualmente, la rentabilidad puede alcanzar hasta un 2,26% TAE, aunque este porcentaje puede variar según el plan contratado y la moneda en la que se mantenga el saldo. Los intereses se calculan diariamente sobre el saldo mínimo de la cuenta y se abonan semanalmente, lo que permite que los ahorros crezcan de manera más rápida gracias al efecto del interés compuesto. El saldo máximo sobre el que se pueden generar intereses es de 100.000 euros por usuario, sumando todas las cuentas remuneradas que tenga en bunq. Los fondos depositados en bunq están protegidos por el Sistema de Garantía de Depósitos Holandés (DGS), que cubre precisamente hasta 100.000 euros por titular en caso de insolvencia del banco. Online de principio a fin y con IBAN español La operativa de la cuenta es sencilla y completamente digital. El usuario puede añadir fondos en cualquier momento mediante transferencias bancarias, tarjetas de crédito o débito, y otros métodos como Apple Pay o Google Pay. Además, la cuenta permite realizar pagos y transferencias internacionales de forma eficiente y económica, gracias a la integración con Wise. Bunq también ofrece la posibilidad de crear subcuentas de ahorro dentro de la misma cuenta principal, lo que facilita la organización de los ahorros según diferentes objetivos, como vacaciones, emergencias o proyectos personales. Todas las gestiones se realizan desde la app, que proporciona un control total sobre los movimientos y el saldo disponible en tiempo real. Además, la cuenta incluye una tarjeta virtual gratuita. Es fundamental tener en cuenta que, aunque la cuenta bunq pueda tener un IBAN español, sigue considerándose a efectos legales como una cuenta bancaria neerlandesa. Esto implica que los intereses generados no están sujetos a retención automática de impuestos en España, a diferencia de lo que ocurre con los bancos nacionales. Por tanto, es responsabilidad del titular declarar los beneficios obtenidos en la cuenta de ahorros de bunq en la declaración de la renta como rendimientos del capital . En España, estos intereses tributan al 19% para los primeros 6.000 euros, al 21% para el tramo entre 6.000 y 50.000 euros, y al 23% para cantidades superiores. Conforme a los criterios de

Bunq Frequently Asked Questions (FAQ)

When was Bunq founded?

Bunq was founded in 2012.

Where is Bunq's headquarters?

Bunq's headquarters is located at Naritaweg 131-133, Amsterdam.

What is Bunq's latest funding round?

Bunq's latest funding round is Series B - III.

How much did Bunq raise?

Bunq raised a total of $368.05M.

Who are the investors of Bunq?

Investors of Bunq include Pollen Street Capital.

Who are Bunq's competitors?

Competitors of Bunq include Finom, Revolut, Monese, Allica Bank, Qonto and 7 more.

What products does Bunq offer?

Bunq's products include bunq account in 5 minutes and 4 more.

Loading...

Compare Bunq to Competitors

Black Banx offers a real-time money transfer system. The company's platform allows account opening in various currencies, provides digital banking solutions, and protects customers' funds with various security tools. Black Banx was formerly known as WB21. It was founded in 2014 and is based in Toronto, Canada.

Bitwala is a cryptocurrency investment platform operating within the fintech sector. The company offers services including buying, storing, and saving cryptocurrencies, instant euro transfers, biometric crypto storage, and payments with a Visa card. Bitwala serves individuals looking to incorporate cryptocurrency into their financial activities. Bitwala was formerly known as Nuri. It was founded in 2014 and is based in Berlin, Germany.

Qonto offers business banking solutions. The company provides an online business account that includes payment features, invoicing, bookkeeping, expense management, and financing options for businesses. Qonto serves self-employed individuals, freelancers, micro-businesses, small and medium-sized enterprises (SMEs), and associations. It was founded in 2016 and is based in Paris, France.

Allica Bank specializes in financial services for established businesses and focuses on banking solutions within the financial sector. The company offers a range of products including business current accounts, savings accounts, asset finance, commercial mortgages, and growth finance. It caters primarily to small and medium-sized enterprises with a suite of financial products designed to meet their banking needs. Allica Bank was formerly known as Civilised Bank. It was founded in 2019 and is based in London, United Kingdom.

Tide serves as a financial technology company that provides business banking services and financial management tools for small and medium-sized enterprises (SMEs). The company offers services including digital business accounts, invoicing, accounting, savings solutions, loans, and company registration services. Tide primarily serves the SME sector with various products. It was founded in 2015 and is based in London, United Kingdom.

Atom bank is a digital bank that provides financial services such as savings accounts, mortgages, and business loans. The company offers savings products with various interest rates, mortgage solutions, and business financing options, all managed through a mobile app. Atom bank serves individuals and small to medium-sized enterprises seeking banking solutions. It was founded in 2014 and is based in Durham, England.

Loading...