BitGo

Founded Year

2013Stage

Option/Warrant - III | AliveTotal Raised

$186.14MLast Raised

$6.32M | 6 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-14 points in the past 30 days

About BitGo

BitGo provides digital asset custody and financial services within the cryptocurrency sector. It offers secure wallet solutions, qualified custody, and financial services including trading, financing, and wealth management. It serves institutional investors, trading firms, investment advisors, exchanges, retail platforms, and developers. It was founded in 2013 and is based in Palo Alto, California.

Loading...

ESPs containing BitGo

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The stablecoin settlement & payouts market refers to the use of stablecoins, which are cryptocurrencies designed to maintain a stable value, for settling transactions and making payouts. This market offers a fast and cost-effective way to move money across borders and provides access to financial services in emerging markets. Technology vendors in this market offer solutions for digital asset cust…

BitGo named as Leader among 12 other companies, including Circle, Coinbase, and Ripple.

BitGo's Products & Differentiators

Wallet Platform

BitGo’s wallet platform creates an ideal balance between security and accessibility—enabling clients to move assets seamlessly and reliably, protected by BitGo’s pioneering multi-key security, multi-user policy controls, and advanced security configurations. BitGo offers flexible wallet security and transaction policy features to address a range of business needs. Protect your wallet against any single point of failure with BitGo's multi-key security. Enforce controls and policies using whitelists, velocity limits, and administrative approvals.

Loading...

Research containing BitGo

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned BitGo in 6 CB Insights research briefs, most recently on May 29, 2025.

May 29, 2025

The stablecoin market map

May 23, 2025 report

Book of Scouting Reports: Stablecon 2025

Oct 18, 2023 report

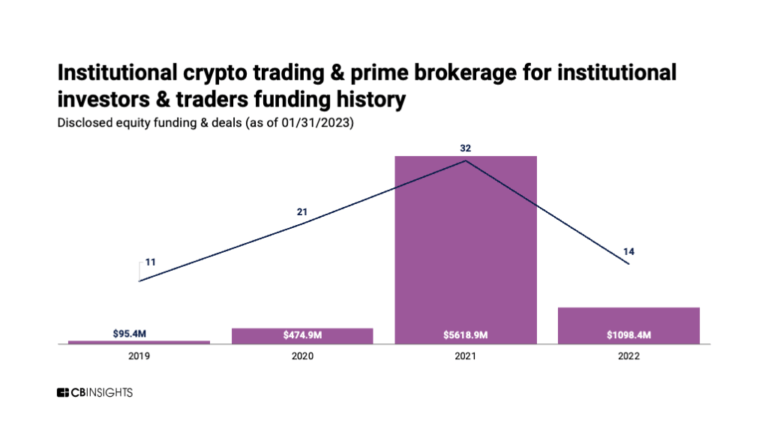

State of Fintech Q3’23 Report

Oct 15, 2022

What is institutional staking?Expert Collections containing BitGo

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

BitGo is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Blockchain

9,347 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Wealth Tech

2,424 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Digital Lending

2,464 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech 100

350 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

BitGo Patents

BitGo has filed 3 patents.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/14/2018 | 9/14/2021 | Cryptocurrencies, Cryptography, Alternative currencies, Key management, Bitcoin exchanges | Grant |

Application Date | 12/14/2018 |

|---|---|

Grant Date | 9/14/2021 |

Title | |

Related Topics | Cryptocurrencies, Cryptography, Alternative currencies, Key management, Bitcoin exchanges |

Status | Grant |

Latest BitGo News

Jul 3, 2025

Payments and stablecoin firm Ripple Labs Inc. and crypto custodian BitGo Inc. have applied for national bank charters, joining a crush of upstart financial services companies seeking such approval. Bloomberg BitGo, Ripple Join Wave of Firms Applying for US Bank Charters Payments and stablecoin firm Ripple Labs Inc. and crypto custodian BitGo Inc. have applied for national bank charters, joining a crush of upstart financial services companies seeking such approval. BitGo, which custodies billions of dollars in cryptoassets for clients, is weighing an initial public offering as soon as this year, Bloomberg News previously reported. The custodian’s corporate structure already includes two state-regulated trust companies, one in New York and one chartered in South Dakota. BitGo declined to comment on which of the two trust companies it had applied to the Office of the Comptroller of the Currency for approval to convert into a national bank. A spokesperson for the regulator confirmed receipt of a filing from BitGo, without providing further details. A Ripple spokesperson confirmed that the firm had applied to become a national bank in the US. The OCC declined to comment on Ripple’s petition beyond saying it “received a de novo charter application for Ripple National Trust Bank.” A de novo application, if approved, would see the creation of a brand new entity while a conversion would involve changing from one type of charter to another. Ripple also said it applied for a Federal Reserve master account, which would give it further access to the traditional US financial system. A Fed spokesperson didn’t immediately respond to a request for comment. The Ripple news was first reported Wednesday by the Wall Street Journal. Ripple and BitGo join the ranks of Circle Internet Group Inc. and Wise Plc, which have also recently applied for banking charters, spotting an opportunity to try their hand at obtaining the sought-after licenses now that the Biden administration’s closed-door policy seems to be changing under President Donald Trump. Ripple Chief Executive Officer Brad Garlinghouse said in a post on social-media platform X that the Fed master account, if approved, would allow the firm to hold its proprietary stablecoin reserves with the central bank directly and “provide an additional layer of security to future proof trust” in Ripple’s RLUSD stablecoin. “Ripple always has and will continue to build trusted, battle-tested and secure infrastructure,” Garlinghouse said in the post. “In a $250B market, RLUSD stands out for putting regulation first, setting the standard that institutions expect.” With assistance from Yizhu Wang. ©2025 Bloomberg L.P. This article was generated from an automated news agency feed without modifications to text. Business News Companies News BitGo, Ripple Join Wave of Firms Applying for US Bank Charters MoreLess Download App Trending Stories Popular Stocks Nifty 50 companies Latest Stories

BitGo Frequently Asked Questions (FAQ)

When was BitGo founded?

BitGo was founded in 2013.

Where is BitGo's headquarters?

BitGo's headquarters is located at 2443 Ash Street, Palo Alto.

What is BitGo's latest funding round?

BitGo's latest funding round is Option/Warrant - III.

How much did BitGo raise?

BitGo raised a total of $186.14M.

Who are the investors of BitGo?

Investors of BitGo include SK Telecom, Hana Financial Group, The Brink's Company, Redpoint Ventures, Valor Equity Partners and 17 more.

Who are BitGo's competitors?

Competitors of BitGo include Digital Securities, Circle, AZA Finance, Airwallex, Zepz and 7 more.

What products does BitGo offer?

BitGo's products include Wallet Platform and 4 more.

Who are BitGo's customers?

Customers of BitGo include Nike, BitcoinIRA, SoFi and Bullish.

Loading...

Compare BitGo to Competitors

Ledger involved in the security and management of digital assets in the cryptocurrency domain. The company offers hardware wallets for storing cryptocurrencies, as well as a companion application for managing and interacting with digital assets. Ledger's products are available for individual consumers and institutional investors, focusing on storage, transaction, and portfolio management. It was founded in 2014 and is based in Paris, France.

Ripple provides digital asset infrastructure for financial services, focusing on cross-border payments and digital asset management. The company offers solutions for payment settlement, liquidity management, and a global payout network, as well as services for storing and managing digital assets. Ripple was formerly known as OpenCoin. It was founded in 2012 and is based in San Francisco, California.

Zepz is a company in the financial technology sector that facilitates international payments. It provides digital solutions for sending money across borders, including options for bank deposits, cash collections, and mobile money services. Zepz serves the ecommerce industry by offering online money transfers. The company was formerly known as WorldRemit. It was founded in 2021 and is based in London, United Kingdom.

Lianlian Pay operates a network of agents in China where consumers can convert cash into mobile-phone minutes. It allows customers to purchase airline tickets, video gaming credits, and utility bills with its network. It was founded in 2003 and is based in Hangzhou, China.

Paga is a mobile money company that focuses on facilitating digital financial transactions. The company offers services that allow users to send and receive money, pay bills, and top up airtime and data. Paga primarily serves the financial technology sector by simplifying access to financial services for individuals. It was founded in 2009 and is based in Lagos, Nigeria.

Xapo Bank operates as a financial institution integrating traditional banking with cryptocurrency. The company offers banking services that allow customers to manage both US Dollar and Bitcoin accounts, providing a platform for transactions and wealth growth. The bank primarily serves individuals interested in blending traditional finance with the cryptocurrency economy. It was founded in 2014 and is based in Gibraltar, United Kingdom.

Loading...